I got many requests to create a screener to shortlist the breakout stocks.

Well, here is one!

Finally, my friend created a "screener" to shortlist the breakout stocks.

It saves over 95% efforts & it is FREE!

Read the article to download it &

More from Indrazith Shantharaj

More from Screeners

So friends here is the thread on the recommended pathway for new entrants in the stock market.

Here I will share what I believe are essentials for anybody who is interested in stock markets and the resources to learn them, its from my experience and by no means exhaustive..

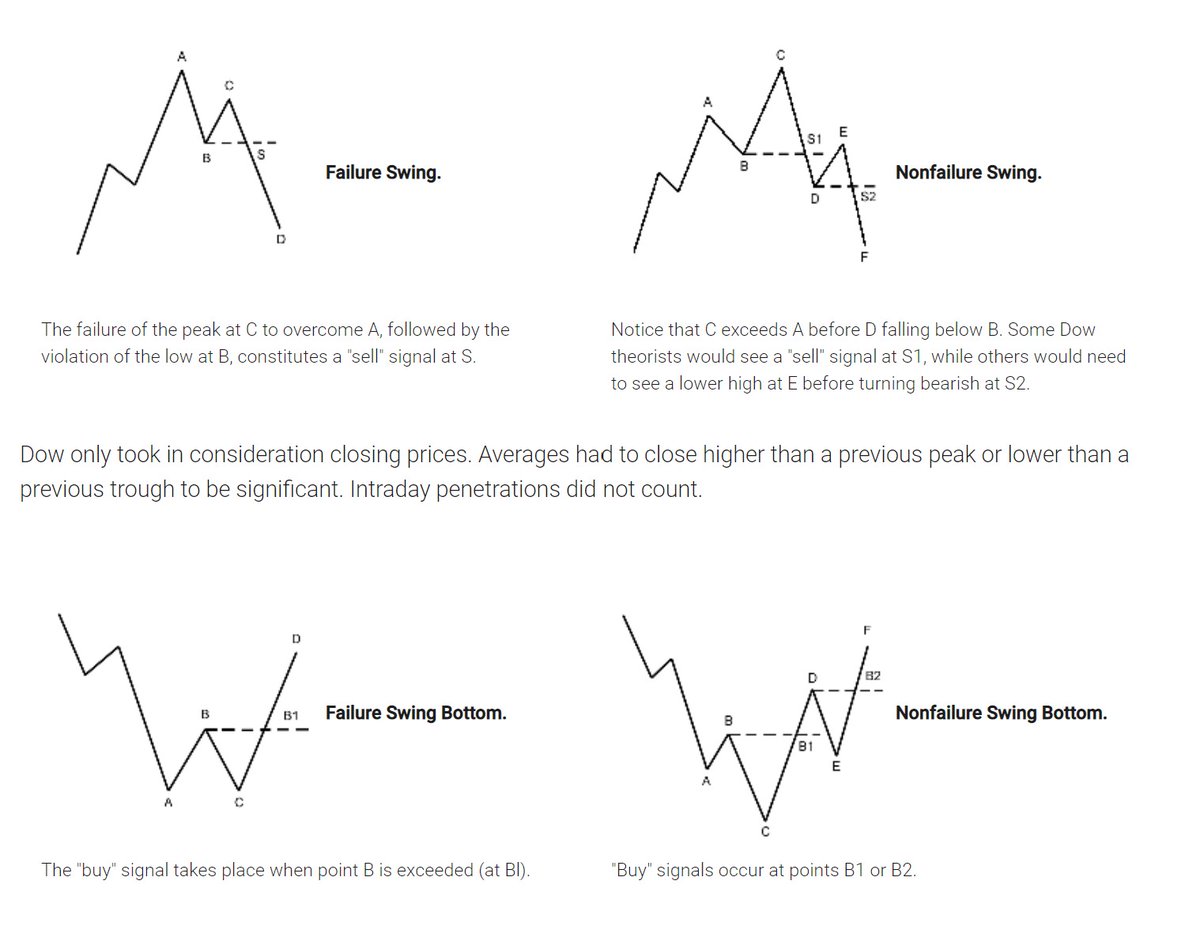

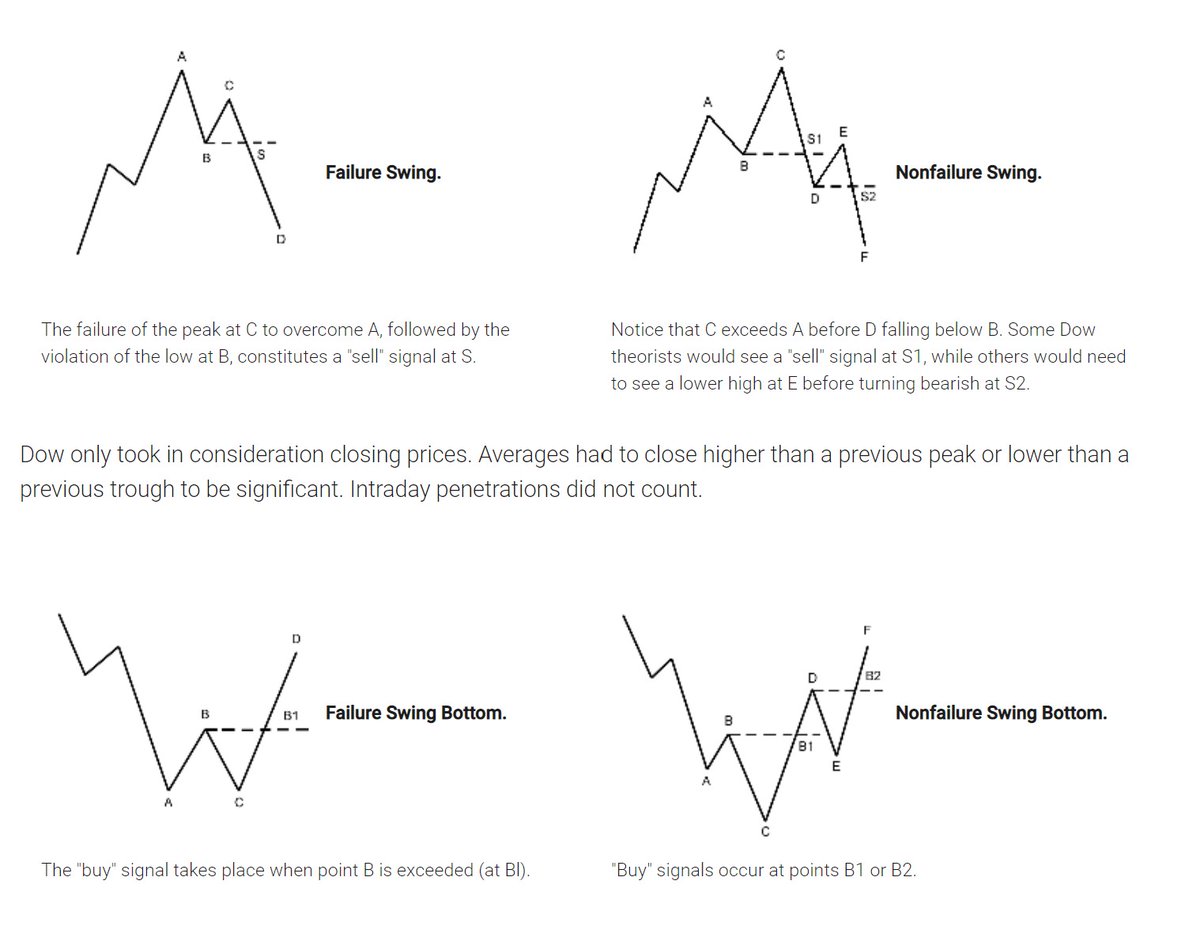

First the very basic : The Dow theory, Everybody must have basic understanding of it and must learn to observe High Highs, Higher Lows, Lower Highs and Lowers lows on charts and their

Even those who are more inclined towards fundamental side can also benefit from Dow theory, as it can hint start & end of Bull/Bear runs thereby indication entry and exits.

Next basic is Wyckoff's Theory. It tells how accumulation and distribution happens with regularity and how the market actually

Dow theory is old but

Here I will share what I believe are essentials for anybody who is interested in stock markets and the resources to learn them, its from my experience and by no means exhaustive..

First the very basic : The Dow theory, Everybody must have basic understanding of it and must learn to observe High Highs, Higher Lows, Lower Highs and Lowers lows on charts and their

Even those who are more inclined towards fundamental side can also benefit from Dow theory, as it can hint start & end of Bull/Bear runs thereby indication entry and exits.

Next basic is Wyckoff's Theory. It tells how accumulation and distribution happens with regularity and how the market actually

Dow theory is old but

Old is Gold....

— Professor (@DillikiBiili) January 23, 2020

this Bharti Airtel chart is a true copy of the Wyckoff Pattern propounded in 1931....... pic.twitter.com/tQ1PNebq7d

Most of the indices are entering oversold territories

Take small cap index for example

Whenever Monthly RSI is below or around 40, the index bottoms out

We are getting there.

If I had 50% cash, I would have deployed some in beaten down stocks where earnings growth is intact. https://t.co/t5WwgH1V5o

Take small cap index for example

Whenever Monthly RSI is below or around 40, the index bottoms out

We are getting there.

If I had 50% cash, I would have deployed some in beaten down stocks where earnings growth is intact. https://t.co/t5WwgH1V5o

I have more than 50% cash but still worried if this is a good time. Will invest 20% by EoY

— Tamil Metaverse (@TamilMetaverse) June 21, 2022