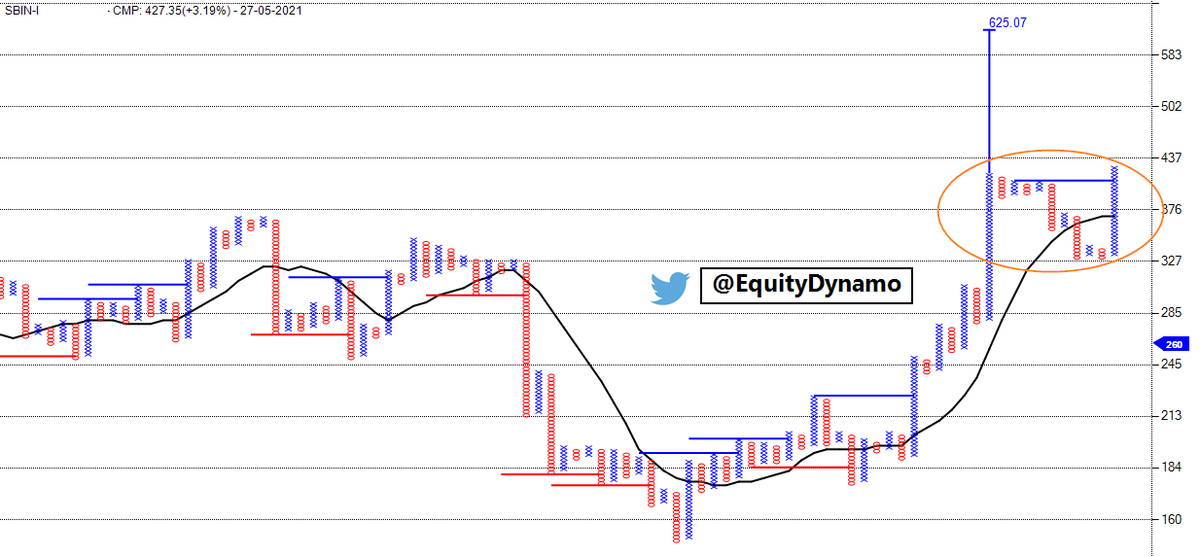

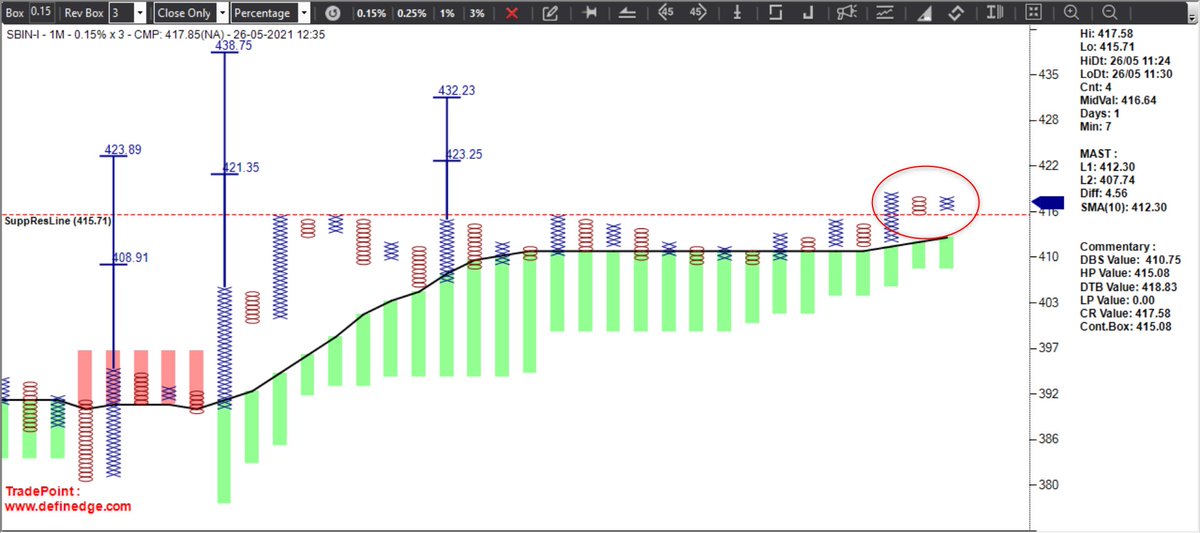

#SBIN

Daya is on the way

Can be a good trade

419 with stop 408 (L2)

Targets 432 / 438

Breakout retest and follow through

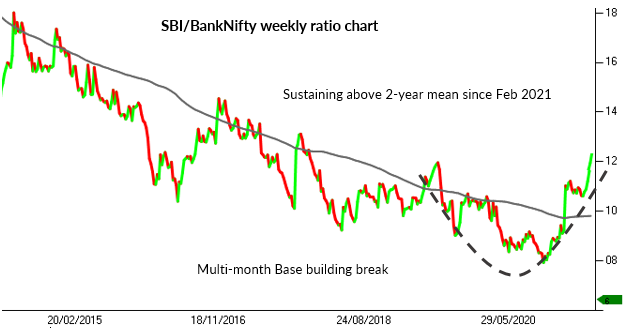

Relative Strength chart Bullish https://t.co/jCdu2V50us

SBI Nakabandi at 420

— AP (@ap_pune) May 26, 2021

Daya ko bulao pic.twitter.com/hATk1t8pzo

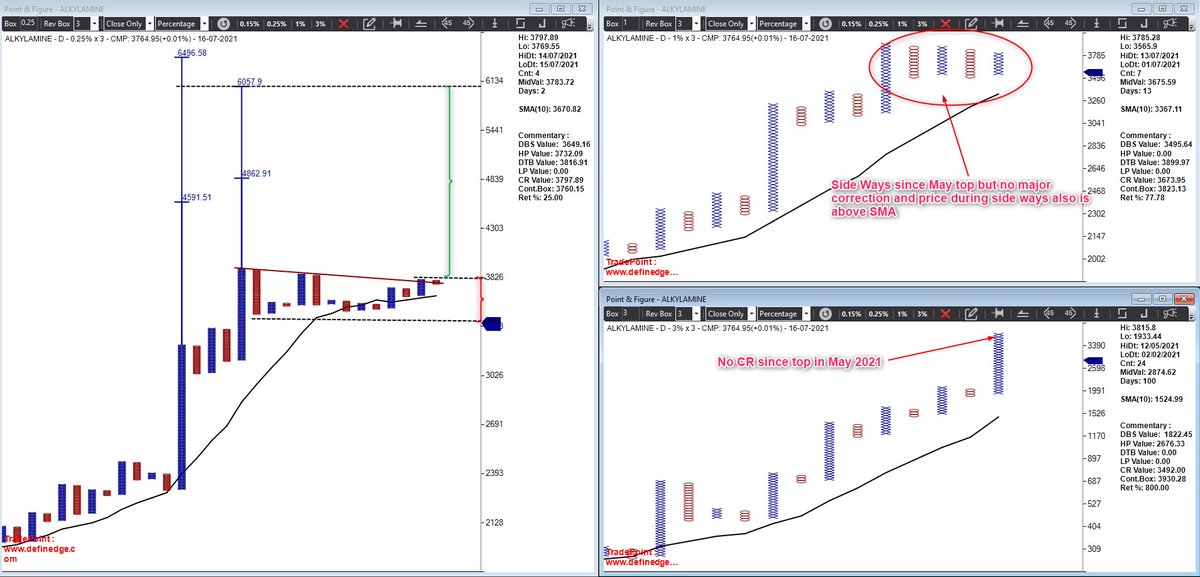

More from Vithal

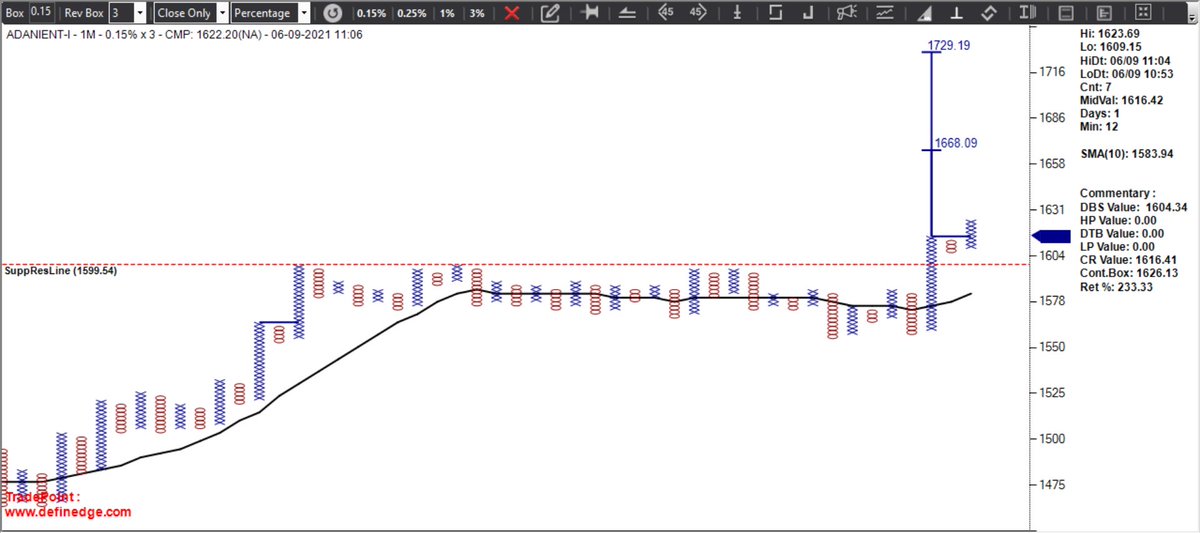

#AsianPaint Low Pole and later Double top buy above SMA after a bear trap. the earlier low pole and immediate DTB has negated the bearish anchor column. upside counts are active https://t.co/MvfHWK1IKx

#AsianPaint

— \U0001f1ee\U0001f1f3 \U0001d4d0\U0001d4f6\U0001d4f2\U0001d4fd \U0001d4e2\U0001d4ee\U0001d4fd\U0001d4f1 (@MaverickAmit01) May 23, 2022

Is it an Out of Box Idea \U0001f914 pic.twitter.com/Lg6m0AfVXB

More from Sbin

@rohanshah619 Looks excellent. Reversal from primary trendline as well

#FnOstock #SBIN has completed a 9 month time correction towards the primary trend line & is all set to head higher from here.

— Trendline Investor (@dmdsplyinvestor) July 11, 2022

This could also be a #SIP stock considering it broke out from a decade long consolidation in Feb'21.

Might continue to outperform #Nifty & #Banknifty pic.twitter.com/mYk4exvOn7

You May Also Like

I’m torn on how to approach the idea of luck. I’m the first to admit that I am one of the luckiest people on the planet. To be born into a prosperous American family in 1960 with smart parents is to start life on third base. The odds against my very existence are astronomical.

I’ve always felt that the luckiest people I know had a talent for recognizing circumstances, not of their own making, that were conducive to a favorable outcome and their ability to quickly take advantage of them.

In other words, dumb luck was just that, it required no awareness on the person’s part, whereas “smart” luck involved awareness followed by action before the circumstances changed.

So, was I “lucky” to be born when I was—nothing I had any control over—and that I came of age just as huge databases and computers were advancing to the point where I could use those tools to write “What Works on Wall Street?” Absolutely.

Was I lucky to start my stock market investments near the peak of interest rates which allowed me to spend the majority of my adult life in a falling rate environment? Yup.

Ironies of Luck https://t.co/5BPWGbAxFi

— Morgan Housel (@morganhousel) March 14, 2018

"Luck is the flip side of risk. They are mirrored cousins, driven by the same thing: You are one person in a 7 billion player game, and the accidental impact of other people\u2019s actions can be more consequential than your own."

I’ve always felt that the luckiest people I know had a talent for recognizing circumstances, not of their own making, that were conducive to a favorable outcome and their ability to quickly take advantage of them.

In other words, dumb luck was just that, it required no awareness on the person’s part, whereas “smart” luck involved awareness followed by action before the circumstances changed.

So, was I “lucky” to be born when I was—nothing I had any control over—and that I came of age just as huge databases and computers were advancing to the point where I could use those tools to write “What Works on Wall Street?” Absolutely.

Was I lucky to start my stock market investments near the peak of interest rates which allowed me to spend the majority of my adult life in a falling rate environment? Yup.