Zerodha Varsity from @Nithin0dha's team & the @tastytrade financial network.

Links:

https://t.co/iYpilaaaoV

https://t.co/iooGW9CrCZ

15 Learnings from Power of Stocks: \U0001f9f5

— Aditya Todmal (@AdityaTodmal) January 23, 2022

Collaborated with @niki_poojary

The best traders have a trading plan.

— Aditya Todmal (@AdityaTodmal) February 13, 2022

But 98.8% of the new traders, don't know how to make one.

I analyzed @niki_poojary's account, to learn how we can create a plan on our own.

Here's the simple 8-step process:\U0001f9f5

@MiteshFan @Mitesh_Engr @Abhishekkar_ MY TRADING SETUP .... I've been using it for a long time .. result good try it \U0001f607 pic.twitter.com/XThUD0ftbl

— itrade(DJ) (@ITRADE191) June 13, 2020

Volume Should always be above 20 pic.twitter.com/CPgxLgpPKF

— itrade(DJ) (@ITRADE191) June 13, 2020

— itrade(DJ) (@ITRADE191) August 25, 2020

— itrade(DJ) (@ITRADE191) October 20, 2020

A thread about STBT options selling,

— Jig's Patel (@jigspatel1988) July 17, 2021

The purpose is simple to capture overnight theta decay,

Generally, ppl sell ATM straddle with hedge or sell naked options,

But I am using Today\u2019s price action for selling options in STBT,

(1/n)

Thread on

— Jig's Patel (@jigspatel1988) July 4, 2021

"Intraday Banknifty Strangle based on OI data"

(System already shared, today just share few examples)

(1/n)

#OpenDrive#intradaySetup

— Pathik (@Pathik_Trader) April 16, 2019

Sharing one high probability trending setup for intraday.

Few conditions needs to be met

1. Opening should be above/below previous day high/low for buy/sell setup.

2. Open=low (for buy)

Open=high (for sell)

(1/n)

https://t.co/Ngoc5bh906 Thank Mahek bhai for making this video basis my set up which i have been following since past 2 yr I\u2019m not promoting this software, neither I 'll gain any referral if anyone subscribes for this software ,Purpose is to share help fellow traders!\U0001f60a

— itrade(DJ) (@ITRADE191) September 5, 2021

5. A THREAD on . . . .

— Aditya Todmal (@AdityaTodmal) July 11, 2021

How @ITRADE191 selects strikes to trade in and how he follows risk management.

Short thread explained via pictures with the help of @niki_poojary.https://t.co/YiYYaIReNS

6. Thread on how @ITRADE191 made 3 lakhs in 2 days.

— Aditya Todmal (@AdityaTodmal) July 11, 2021

You will need:

1. Pivots

2. Vwap

3. PDL/PDH (Previous day high/low)

4. Advance/Decline Ratio.https://t.co/o9tLOaLpEh

7. DJ @ITRADE191 multiple chart analysis for INTRADAY TRADING.

— Aditya Todmal (@AdityaTodmal) July 11, 2021

1. Core setup

2. Pivot points trades

3. PDH/PDL trades

4. Open interest addictions combined with rejections on charts.

5. Website to confirm biashttps://t.co/qZQCWOSisa

Tik Tok pic.twitter.com/8X3oMxvncP

— Scotty Mar10 (@Allenma15086871) December 29, 2020

HOW LIFE EVOLVED IN THIS UNIVERSE AS PER OUR SCRIPTURES.

— Anshul Pandey (@Anshulspiritual) August 29, 2020

Well maximum of Living being are the Vansaj of Rishi Kashyap. I have tried to give stories from different-different Puran. So lets start.... pic.twitter.com/MrrTS4xORk

Thread on NARK(HELL) / \u0928\u0930\u094d\u0915

— Anshul Pandey (@Anshulspiritual) August 11, 2020

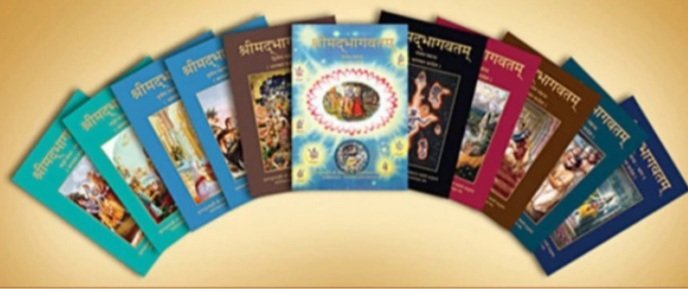

Well today i will take you to a journey where nobody wants to go i.e Nark. Hence beware of doing Adharma/Evil things. There are various mentions in Puranas about Nark, But my Thread is only as per Bhagwat puran(SS attached in below Thread)

1/8 pic.twitter.com/raHYWtB53Q

#THREAD

— Anshul Pandey (@Anshulspiritual) August 12, 2020

WHY PARENTS CHOOSE RELIGIOUS OR PARAMATMA'S NAMES FOR THEIR CHILDREN AND WHICH ARE THE EASIEST WAY TO WASH AWAY YOUR SINS.

Yesterday I had described the types of Naraka's and the Sin or Adharma for a person to be there.

1/8 pic.twitter.com/XjPB2hfnUC