R2 se niche vwap se niche aya ek baar bhi uske upar nahi gaya ek baar vwap ke upar aya par R1 ke upar nahi tika simple

More from itrade(DJ)

More from Optionslearnings

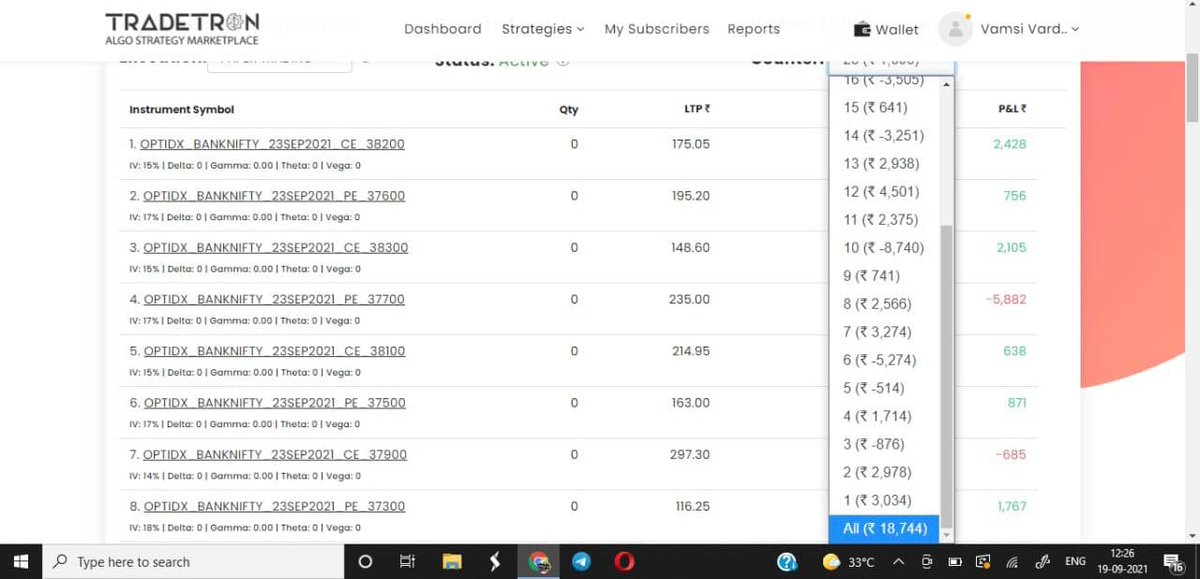

If we buy hedges, Margin will reduce & ROI increases.

More strategies will be shared going forward.

All u need is execute with Discipline & sticking with system when in DD.

(1/n) https://t.co/3KH9v0tgsb

A simple INTRADAY strategy with decent BACKTEST report of more than 3-5% returns on Monthly basis.

— OptionSeller(Vardhan) (@CaVardhanCa) August 15, 2021

Will be sharing live report on daily basis for a month.

& will conduct FREE webinar to discuss about the results in coming weeks.

Sharing all rules below.

(1/n) https://t.co/VMlxNtX90s pic.twitter.com/cJaa9axRss

to learn more about Algo Trading (in both directional & non directional) , you can visit my Telegram channel especially created for Algo Strategies.

Will be updating Daily Performance of our Algos in below

Great video with points helpful for beginners.

Made 4 threads on DJ Sir with the help of @niki_poojary

1. Selecting strikes to trade in with risk management.

2. How he took some aggressive trades.

3. Multiple charts analysis for intraday trading.

4. Trade Setup

https://t.co/Ngoc5bh906 Thank Mahek bhai for making this video basis my set up which i have been following since past 2 yr I\u2019m not promoting this software, neither I 'll gain any referral if anyone subscribes for this software ,Purpose is to share help fellow traders!\U0001f60a

— itrade(DJ) (@ITRADE191) September 5, 2021

Attaching all threads made on DJ Sir. After watching the video you can refer to this tweet for notes about his strategy and learn a few other ideas.

Compiling these together for easy access to his knowledge.

1. Selecting strikes and risk

5. A THREAD on . . . .

— Aditya Todmal (@AdityaTodmal) July 11, 2021

How @ITRADE191 selects strikes to trade in and how he follows risk management.

Short thread explained via pictures with the help of @niki_poojary.https://t.co/YiYYaIReNS

2. Going aggressive with help of data and

6. Thread on how @ITRADE191 made 3 lakhs in 2 days.

— Aditya Todmal (@AdityaTodmal) July 11, 2021

You will need:

1. Pivots

2. Vwap

3. PDL/PDH (Previous day high/low)

4. Advance/Decline Ratio.https://t.co/o9tLOaLpEh

3. Intraday

7. DJ @ITRADE191 multiple chart analysis for INTRADAY TRADING.

— Aditya Todmal (@AdityaTodmal) July 11, 2021

1. Core setup

2. Pivot points trades

3. PDH/PDL trades

4. Open interest addictions combined with rejections on charts.

5. Website to confirm biashttps://t.co/qZQCWOSisa