2/ Platform:

Otonomo is standardizing data using its patent-pending technology from its 16 OEM partners including Ford, GM, and BMW who provide data on 40M connected cars (4.3B data points daily), to make it easily usable by consumers and developers who can access it via API.

3/ Similar to other aggregators like $ROKU or $TTD, one of their biggest advantages is their neutrality. Many mobility services can’t operate well without data from multiple OEMs but individual OEMs lack the incentive to share their data with competitors.

4/ Otonomo is collecting over 150 data parameters per vehicle such as engine status, temperature, speed, location, fuel or battery levels, or seatbelt status. This is then normalized across OEMs and car models, anonymized, cleansed, and enriched through AI/ML.

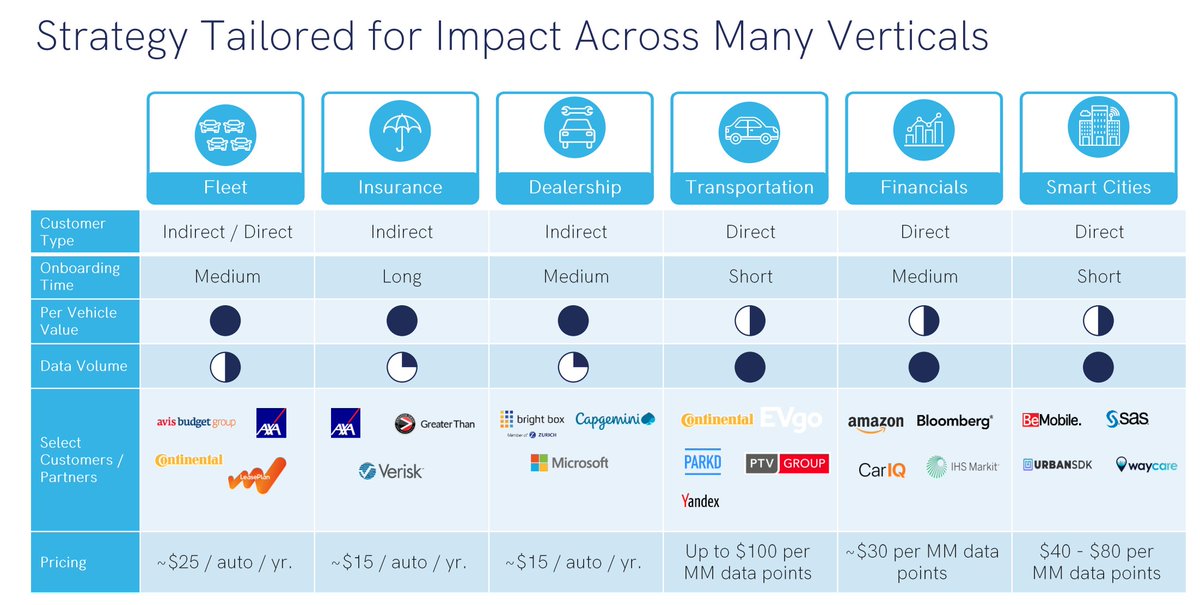

5/ There are hundreds of use cases that range from helping drivers to find parking to helping rental companies monitor their fleets in real-time or insurance companies offer usage-based insurance and better claims processing. Otonomo charges usage-based fees based on use-case.

6/ Otonomo is the clear leader in this space, their OEM partners represent 80% of the market. They project a TAM of over $70B by 2030 and see a large opportunity to increase transaction volume/customer. 90% of new cars sold last year in the EU and US were connected.

7/ All current revenue is coming from their marketplace offering but they expect half to come from their SaaS offering by 2025

Here, they offer vertical-specific modules like an IoT Hub or Data Blurring Engine that enable both sides of the marketplace to better manage their data

8/ Revenue is projected to grow from $3M in 2021 to $574M by 2025, at which point they’ll achieve 60% gross margins. They expect to be EBITDA-positive by '24

At $11 they are trading at a $1.24B EV or ~2.2x '25 rev. It should provide a great return if they come close to estimates

9/ Customers don't want to work with dozens of OEMs and the more vehicle data Otamono gets, the more bargaining power they have over OEMs and expect to raise prices.

Because supply-side is so fragmented, any single OEM won’t be able to offer as much data and as the marketplace.

10/ Again, the key is that Otonomo’s patent-pending technology standardizes vehicle data across both car models and OEMs.

Customers don’t want to do that themselves, yet they need aggregated data across all OEMs to make use-cases like traffic management work.

11/ It’s important to note that OEMs still retain control of their data and get to determine which services can access it

However, Otonomo has a unique value proposition by aggregating and standardizing the data, such that any single OEM isn't able to match it by going it alone.

12/ The primary risk is that the use-cases here are so nascent and the market needs to be educated. Usage-based insurance is the biggest near-term one, but fleet management is another large opportunity such as their current contract with Avis Budget Group.

13/ Multi-tenanting (OEMs using multiple neutral marketplaces) is another risk, but if customers know they are getting the best data by using Otonomo, then why would they want to use competitors? They can price shop but if they only get an incomplete dataset, it won’t make sense.

14/ Otonomo also appears to be sticky as they have gained the trust of OEMs. In fact, they say they have become the outsourced data enablement department for many of them since it’s not in their DNA. The fact they have partnered with all the major ones this early is telling.

15/ Although estimates are very aggressive with no direct comparables, the space is massive and growing fast, they are dominant, and their flywheel has just started spinning.

I like the R/R here with shares trading just 8% above NAV. I have a spec-size position and so does Luca.