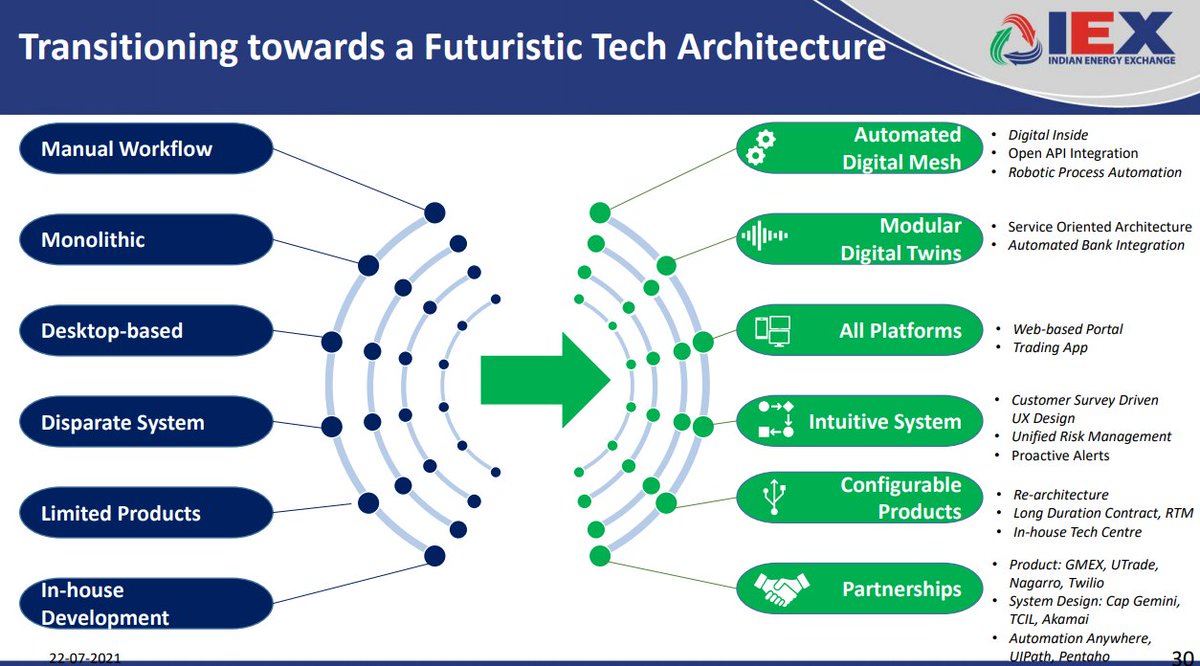

To see the bull case for #IEX one needs a bit of imagination on their side :)

Market always moves to the cheaper alternative, slowly at first, then all of a sudden.

As more and more companies look towards the ESG factors, IEX would be a potential beneficiary.

— Kharanshu Parikh (@Kharanshu) August 7, 2021

Source: Suven Pharma\u2019s Annual Report

\u2066@itsTarH\u2069 pic.twitter.com/sRdMIAMaVP

More from Tar ⚡

ROCE 1 Yr: 32.7%

ROCE 3 Yr: 24.8%

ROE: 27.4%

ROE 3 Yr: 19%

Op Margin: 28.4%

Reserves: 32% of Current Market Cap

Debt: Nil

Profit CAGR 3Yrs: 54%

Debtor Days: 15

Inventory Turnover > 5

CFO YoY Increase : 160%

Some of you got it correct. Its Anjali Portland.

The company just acquired another cement company that will double the total sales immediately.

https://t.co/2xVnpJapPy

The acquisition was financed by adding debt, so interest costs from next quarter will go up but still great!

For a company that operates in a cyclical sector like cement!

What I liked is that the company was able to maintain the balance sheet and margins even in a down cycle.

With real estate sector reviving, this can be a great bet from here.

No recommendations, just an observation.

Market started re-rating the stock as soon as they announced acquisition.

Someone did some work on details of acquisition, sharing the thread

@drprashantmish6 @Investor_Mohit

— Arun Choudhary FCA (@YOUNGBRUJ) July 9, 2021

1) Information on cement sector in India

India at 550 MTPA is the 2nd largest cement producer globally. Expected to move to 650 MTPA by 2025E pic.twitter.com/GqtcSk03TU

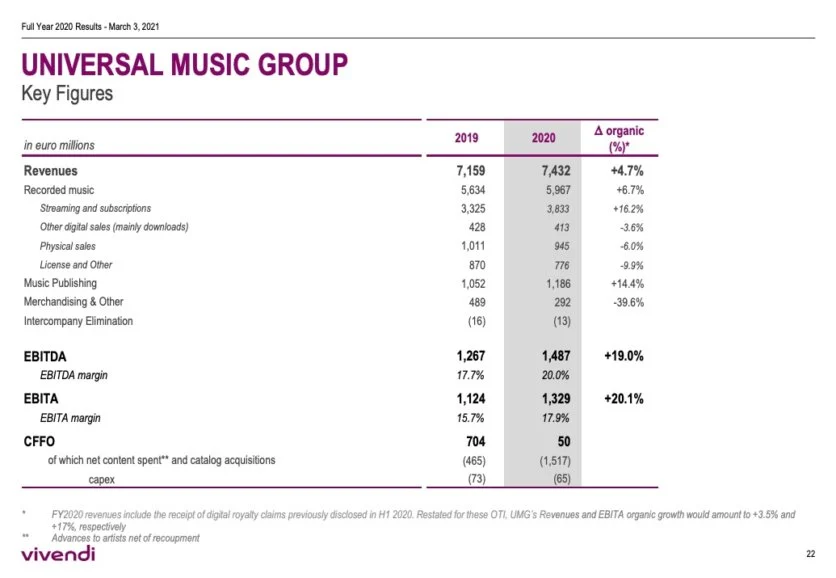

A business like Universal which controls more than 1/3rd of all published music globally is selling for less than 6x FY20 Sales.

Why are Indian businesses like Saregama / Tips selling for 11x, 20x their sales?

If I include all of the revenue generated by entire firm, its selling for ~4.5x FY20 Sales

Universal Listing Market Cap ~ 40 Billion USD

FY 20 Revenues ~ 8.87 B USD or 7.4B EUR

Catalogue of Music includes every international artist you can possibly name

Either Universal is grossly undervalued or Saregama/Tips are grossly overvalued.

https://t.co/aHzWSYtcUt

Homework for all the interested participants here:

— Intrinsic Compounding (@soicfinance) June 27, 2021

Q1.Why 20% and not 50%+ Margins for UMG

Q2. Differences in dynamics between Western&Indian cos?

Q3. Trends in West vs Trends in India in the industry.

Research and find the answers. My job is done \U0001f601\U0001f64f

https://t.co/v0EMoCuYKX

If you see the ebitda of universal music its low 20% compared to our saregama 30% or tips 50%. So when you compare earnings saregama is 40x and tips is 30x and universal music is 30x. Also these type of companies are less( low or no capex with excellent and growinh cashflows)

— Srikanth V (@mynameisnani75) June 27, 2021

More from Iex

You May Also Like

1) UCAS School of physical sciences Professor

https://t.co/9X8OheIvRw

2) UCAS School of mathematical sciences Professor

3) UCAS School of nuclear sciences and technology

https://t.co/nQH8JnewcJ

4) UCAS School of astronomy and space sciences

https://t.co/7Ikc6CuKHZ

5) UCAS School of engineering

6) Geotechnical Engineering Teaching and Research Office

https://t.co/jBCJW7UKlQ

7) Multi-scale Mechanics Teaching and Research Section

https://t.co/eqfQnX1LEQ

😎 Microgravity Science Teaching and Research

9) High temperature gas dynamics teaching and research section

https://t.co/tVIdKgTPl3

10) Department of Biomechanics and Medical Engineering

https://t.co/ubW4xhZY2R

11) Ocean Engineering Teaching and Research

12) Department of Dynamics and Advanced Manufacturing

https://t.co/42BKXEugGv

13) Refrigeration and Cryogenic Engineering Teaching and Research Office

https://t.co/pZdUXFTvw3

14) Power Machinery and Engineering Teaching and Research