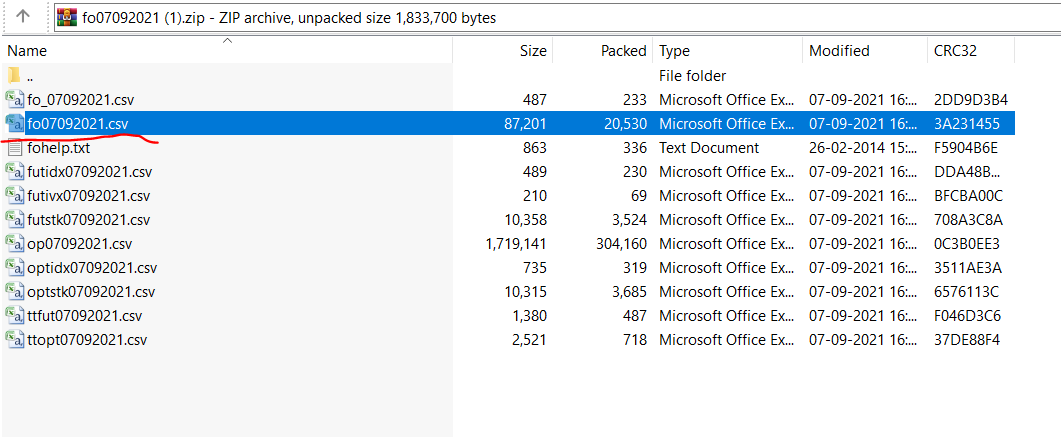

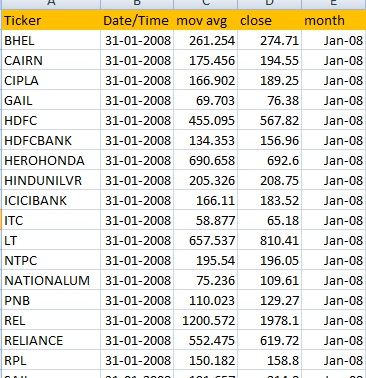

Most beginners when building a trading strategy simply use current info and test with it, they don't know How to Get Historical Stock Futures lot size, list of stocks that are part of index like Nifty 50, Nifty 500 historically, I will share all such info in this thread

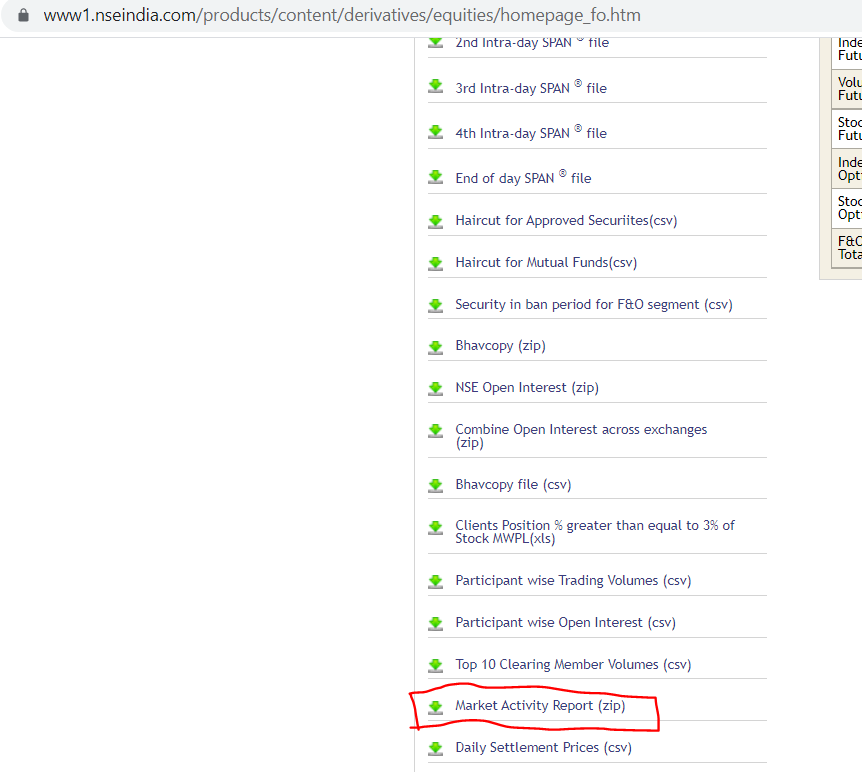

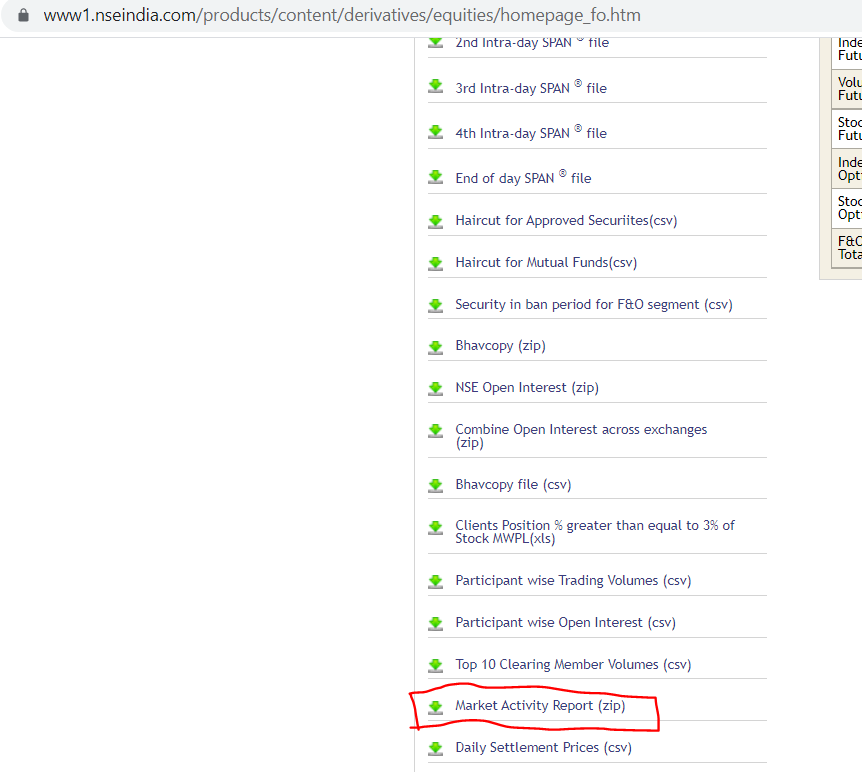

https://t.co/xIBXsPpIVt For an example, to get the historical stock futures lot size data for Sep 2016, use https://t.co/Criu7S3Fi5

https://t.co/MVN1wrKt4z

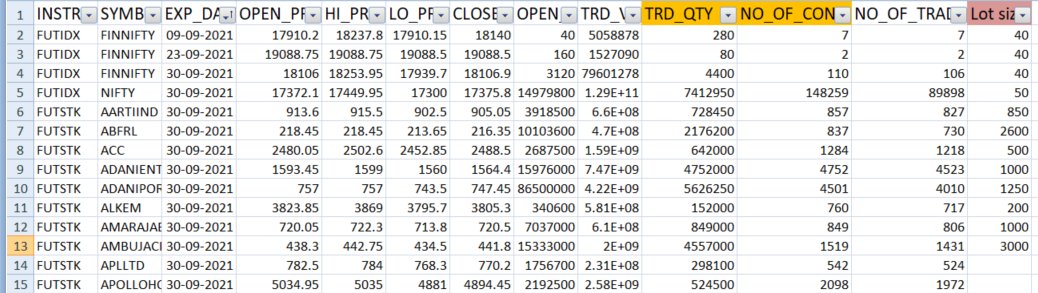

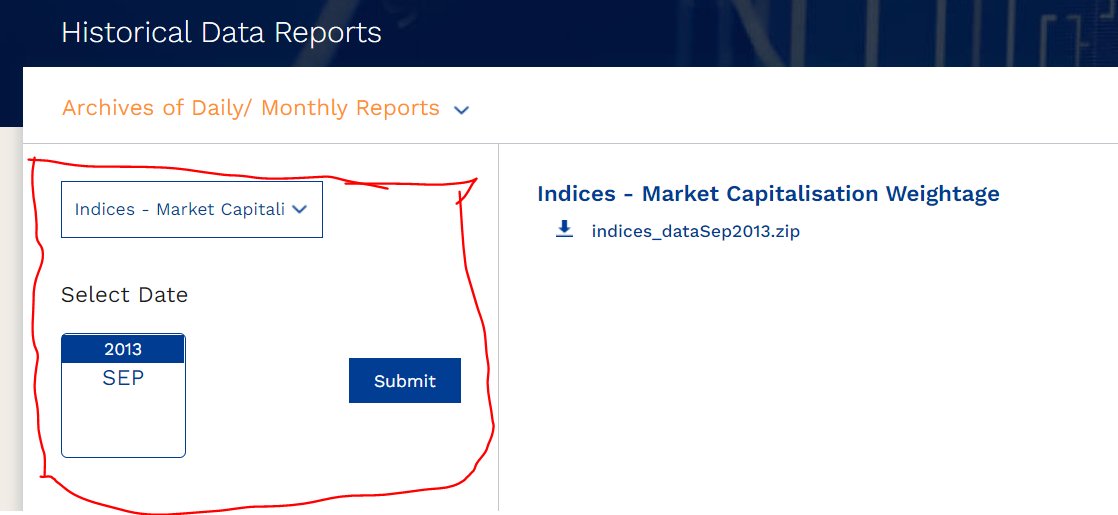

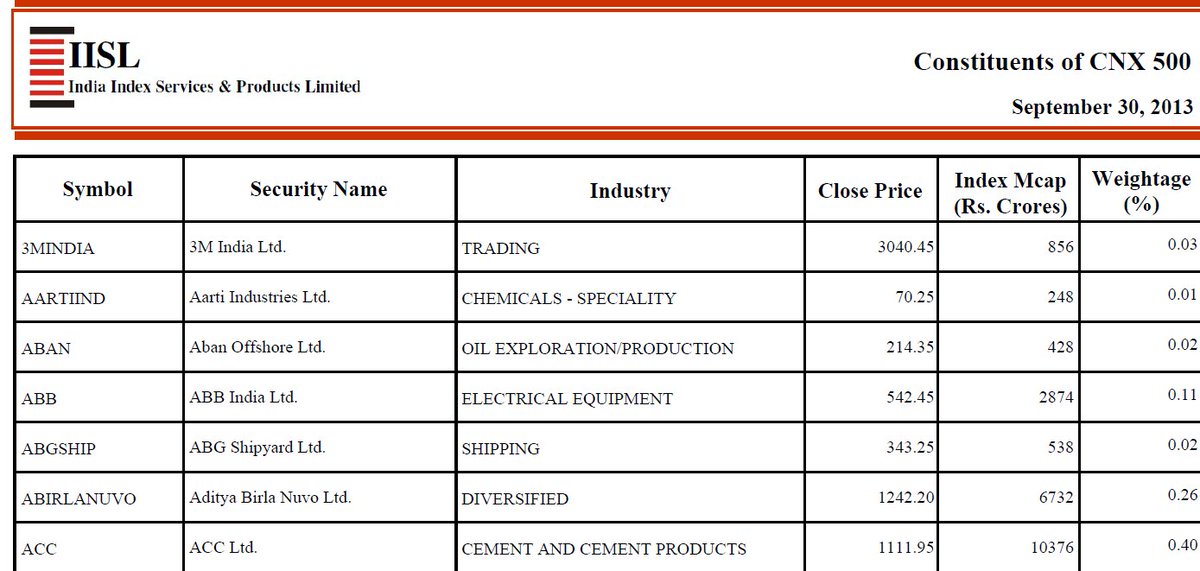

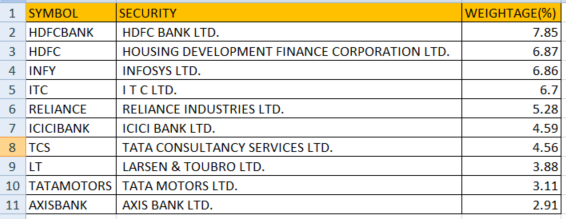

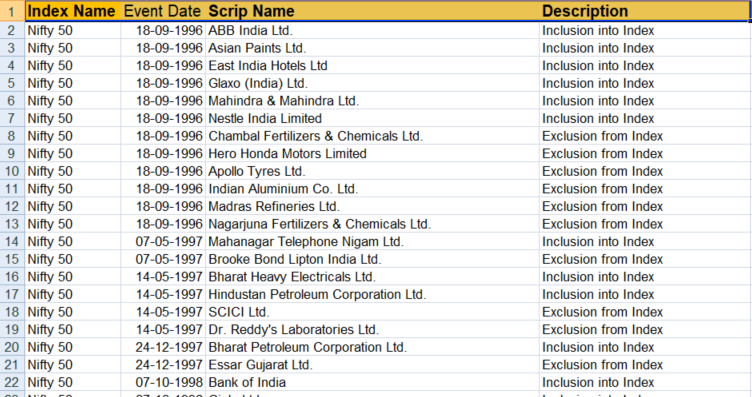

For an example, to get the historical constituents of all index for Aug 2013, i will use https://t.co/k79hR372dW

https://t.co/bNMunOr74B

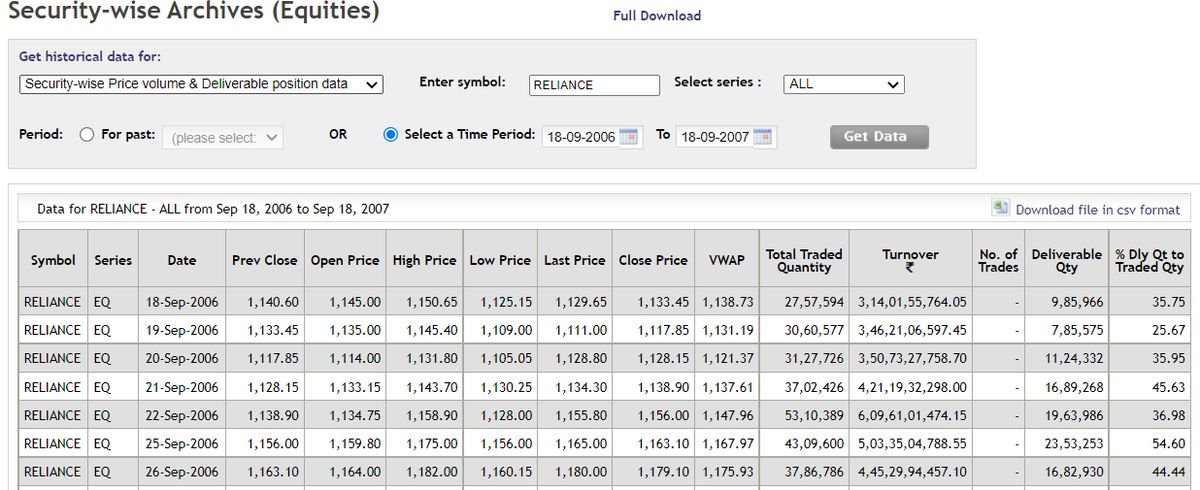

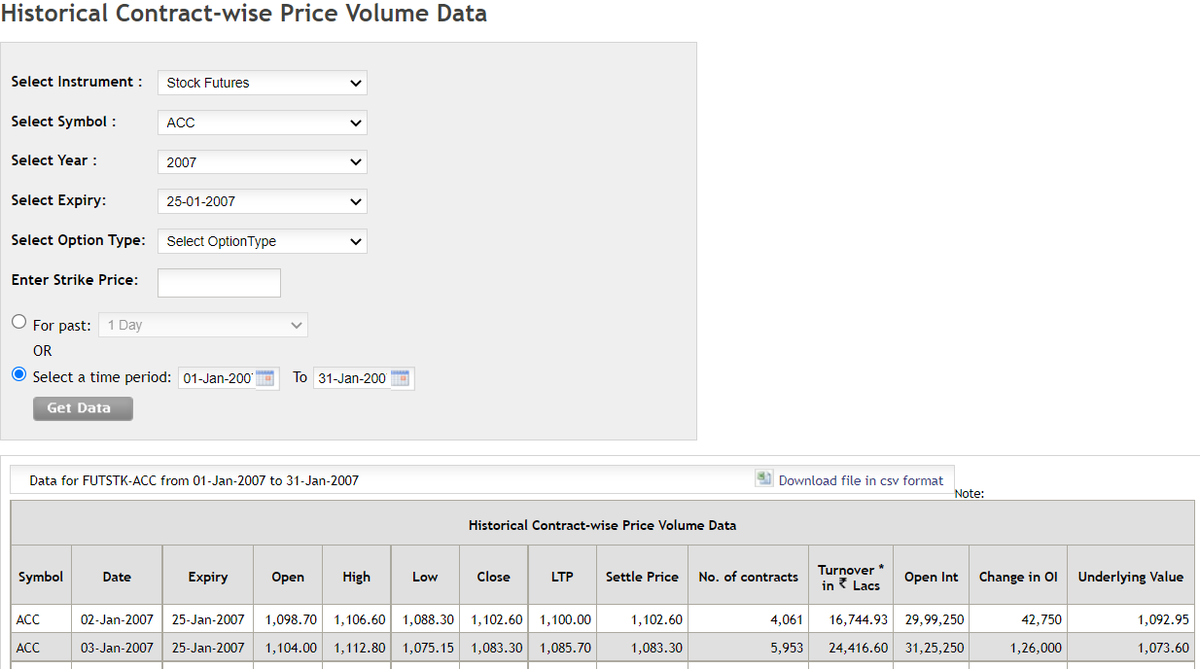

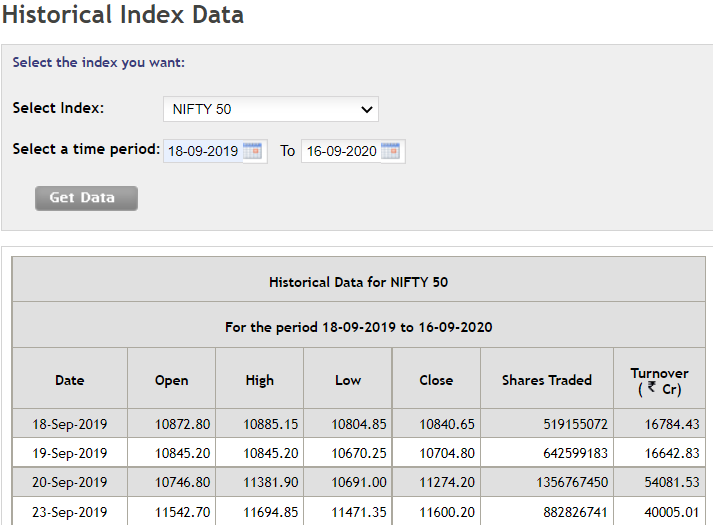

enter the stock symbol and date criteria for which you want to download the data

https://t.co/hjyUDNVwZ2

https://t.co/Ny8T1X8Xee

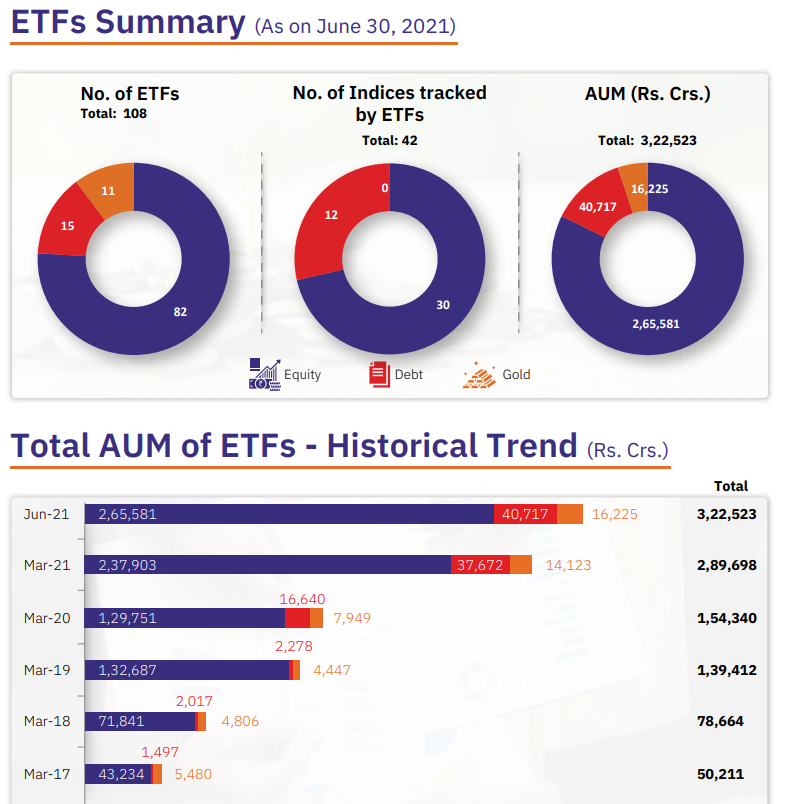

To get the list of all Exchange Traded funds listed in NSE, just go this link https://t.co/XSqmXhmxJN

https://t.co/0Dn036xifc

More from Kirubakaran Rajendran

You May Also Like

Great article from @AsheSchow. I lived thru the 'Satanic Panic' of the 1980's/early 1990's asking myself "Has eveyrbody lost their GODDAMN MINDS?!"

The 3 big things that made the 1980's/early 1990's surreal for me.

1) Satanic Panic - satanism in the day cares ahhhh!

2) "Repressed memory" syndrome

3) Facilitated Communication [FC]

All 3 led to massive abuse.

"Therapists" -and I use the term to describe these quacks loosely - would hypnotize people & convince they they were 'reliving' past memories of Mom & Dad killing babies in Satanic rituals in the basement while they were growing up.

Other 'therapists' would badger kids until they invented stories about watching alligators eat babies dropped into a lake from a hot air balloon. Kids would deny anything happened for hours until the therapist 'broke through' and 'found' the 'truth'.

FC was a movement that started with the claim severely handicapped individuals were able to 'type' legible sentences & communicate if a 'helper' guided their hands over a keyboard.

For three years I have wanted to write an article on moral panics. I have collected anecdotes and similarities between today\u2019s moral panic and those of the past - particularly the Satanic Panic of the 80s.

— Ashe Schow (@AsheSchow) September 29, 2018

This is my finished product: https://t.co/otcM1uuUDk

The 3 big things that made the 1980's/early 1990's surreal for me.

1) Satanic Panic - satanism in the day cares ahhhh!

2) "Repressed memory" syndrome

3) Facilitated Communication [FC]

All 3 led to massive abuse.

"Therapists" -and I use the term to describe these quacks loosely - would hypnotize people & convince they they were 'reliving' past memories of Mom & Dad killing babies in Satanic rituals in the basement while they were growing up.

Other 'therapists' would badger kids until they invented stories about watching alligators eat babies dropped into a lake from a hot air balloon. Kids would deny anything happened for hours until the therapist 'broke through' and 'found' the 'truth'.

FC was a movement that started with the claim severely handicapped individuals were able to 'type' legible sentences & communicate if a 'helper' guided their hands over a keyboard.