Authors Kirubakaran Rajendran

https://t.co/gjTHTKyyb2

It Ain\u2019t What You Don\u2019t Know That Gets You Into Trouble. It\u2019s What You Know for Sure That Just Ain\u2019t So. Watching #TheBigShort

— Kirubakaran Rajendran (@kirubaakaran) March 14, 2020

Perfect movie for this weekend in current market scenario. pic.twitter.com/OuW1ERAztx

https://t.co/ZCNxllFLB0

When U think of Cars, if #FastAndFurious what comes to your mind, then this movie is not for you. Instead if #Rush movie comes to your mind, then definitely #FordVsFerrai is for you. What an amazing movie, Matt & Bale performance was top notch. Must watch movie. pic.twitter.com/KTGAEhLu9V

— Kirubakaran Rajendran (@kirubaakaran) November 19, 2019

https://t.co/uqlAlXdFga

If you haven\u2019t watched this movie, check it out. The China Hustle. Fantastic documentary that covers about how bogus Chinese firms made millions with IPO, how they tackled these satellite tracking. https://t.co/nC3MTxFpZo pic.twitter.com/3iuhFpOA45

— Kirubakaran Rajendran (@kirubaakaran) April 3, 2020

https://t.co/wMf9Q0G6uY

#SooraraiPottru Entrepreneurship is living a few years of your life like most people won\u2019t, so that you can spend the rest of your life like most people can\u2019t.\u201d No business is inferior to one another. Most inspiring Tamil movie in recent times, Vera level \U0001f44c Chancey ila pic.twitter.com/f307TqIE3X

— Kirubakaran Rajendran (@kirubaakaran) November 12, 2020

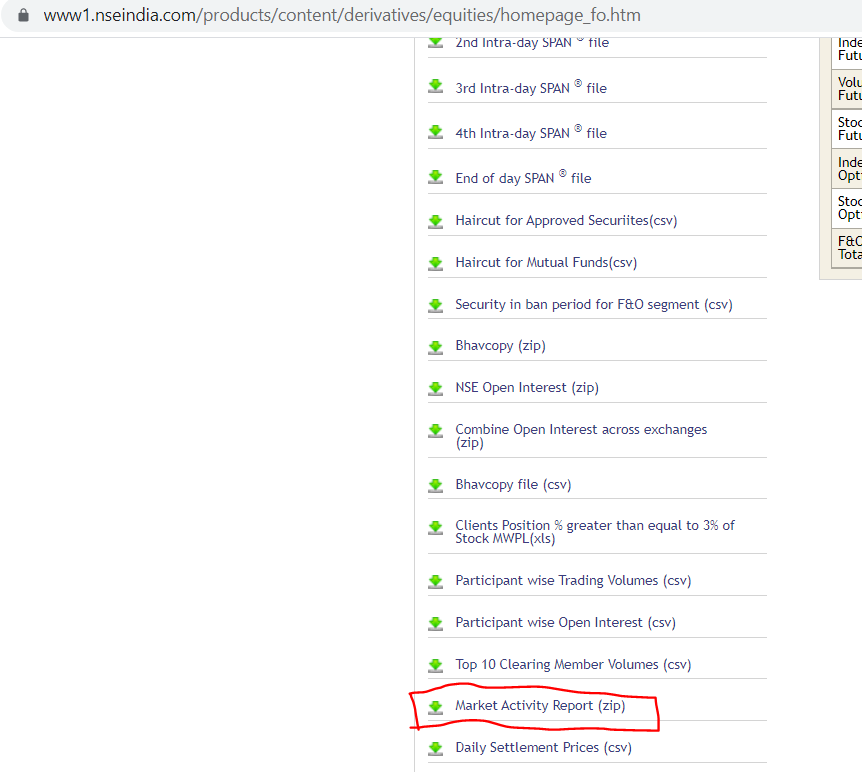

Please note that there is no way to get the historical lot size of stocks futures, NSE don't publish it directly, so we need to do some calculated steps to get that data. Download Market Activity report https://t.co/HKLkSVtXEI

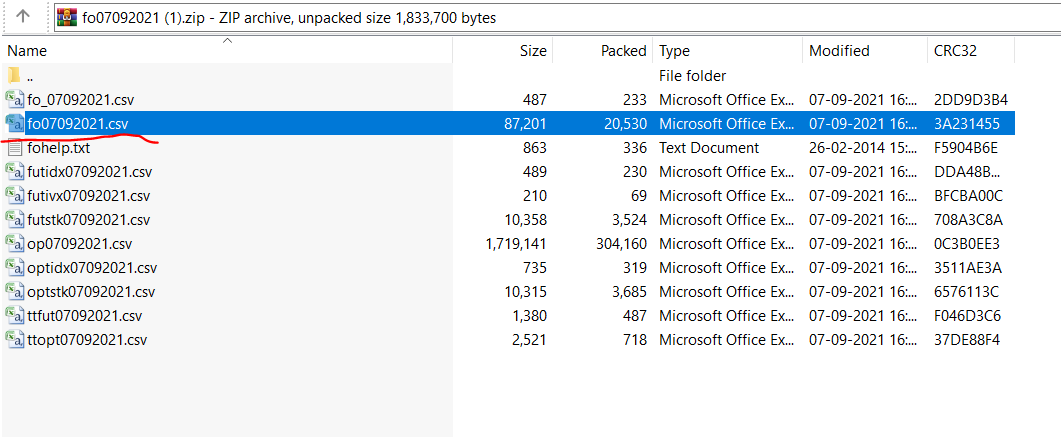

The zip file contains multiple files, open the second file.

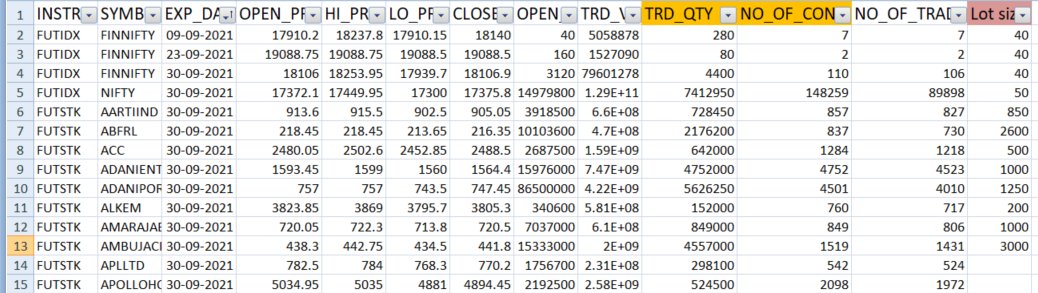

The file will contain stock symbol, expiry date, OHLC data, along with that you get traded quantity and No of contracts traded, using this data we can calculate the lot size of every stock symbol. Simply divide Traded QTY / NO of contracts gives you the lot size.

So to get the historical stock futures data, all you need to do is change the date in the below link

https://t.co/xIBXsPpIVt For an example, to get the historical stock futures lot size data for Sep 2016, use https://t.co/Criu7S3Fi5

During Trading hours, Your maximum time is spent on? Are you spending more time on analyzing your trades before placing the order or after placing the order?

— Kirubakaran Rajendran (@kirubaakaran) December 14, 2020

We do not like people or information that contradicts our thoughts. We like them when they confirm what we think. Hence, we tend to place more weight on information that confirms our trade position. Example- You think market is bullish & wanted to go on a long position,

Next a new bullish bar prints on the chart. You would think "Yes, my bullish proposition is still valid" (even though this bullish bar is smaller range)

A bearish bar prints. But you think "this bar lacks momentum" (because you already have firm belief that market is bullish)

One more bearish bar follows, pushing against a support level. But you would think "the support level is holding" Bullishness confirmed. Buy more! (even though this bar closed below the support level with clear momentum.)

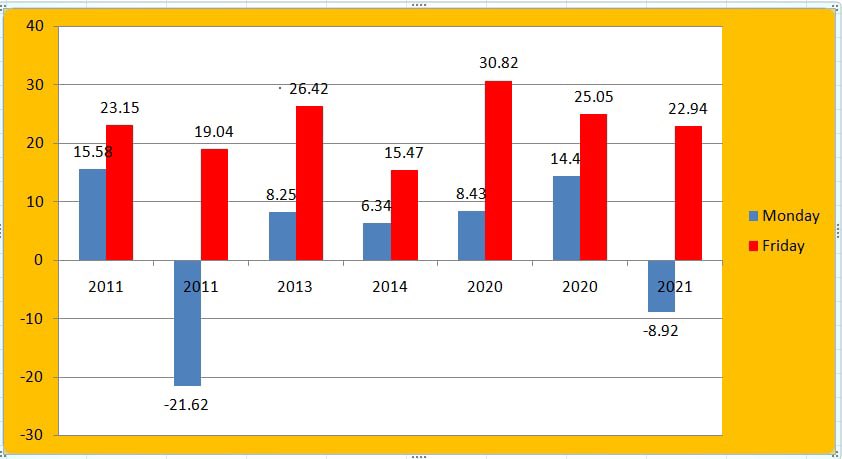

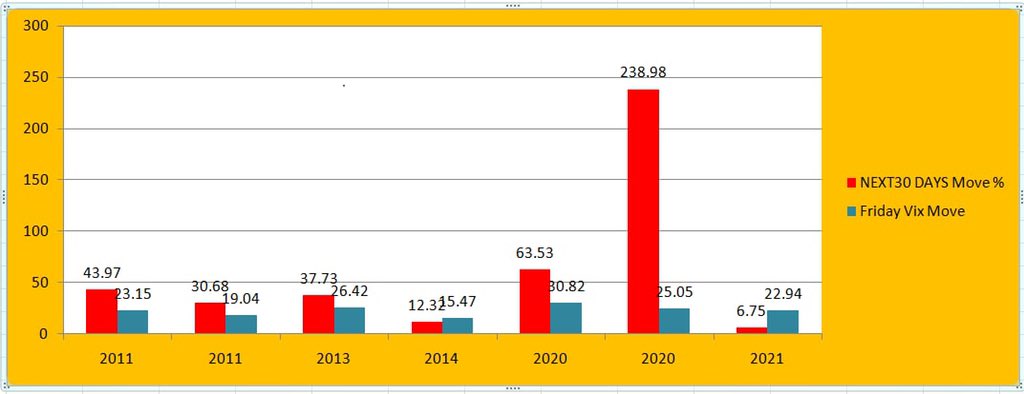

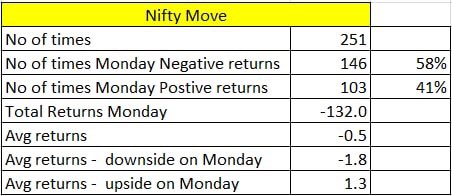

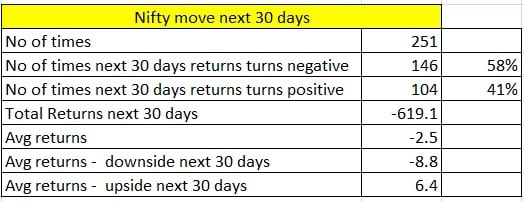

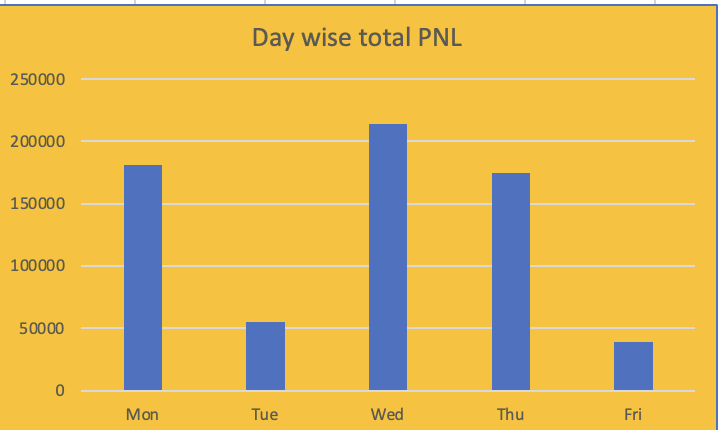

Here's day wise total profits, Wednesday are the days it has generated highest profits compared to all other days and Friday being the least profitable day.

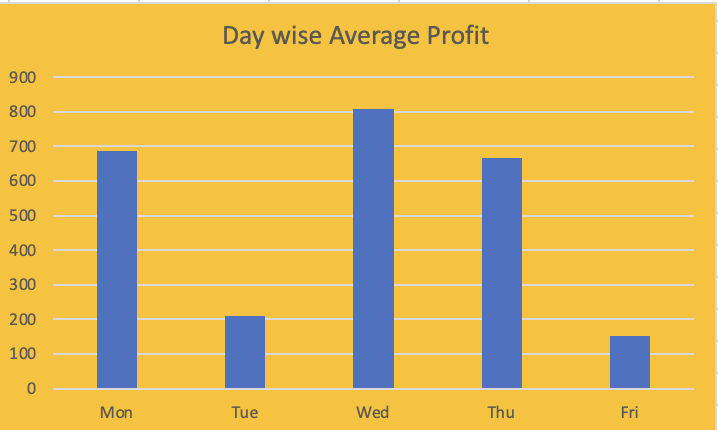

Here's day wise average profits, obviously Wednesday are the days it has generated highest average profits compared to all other days and Friday being the least profitable day.

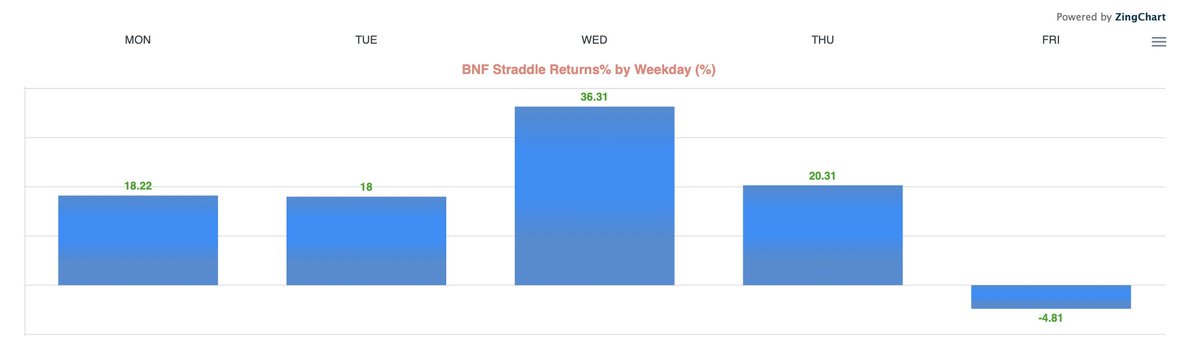

Even the live profits after all charges generated through 920 straddle trading bots at https://t.co/AKj4vqky6X also reflected Fridays are not profitable when you incur all charges. Wednesday being the most profitable day. Live profits are shown here https://t.co/3hgti23lRB

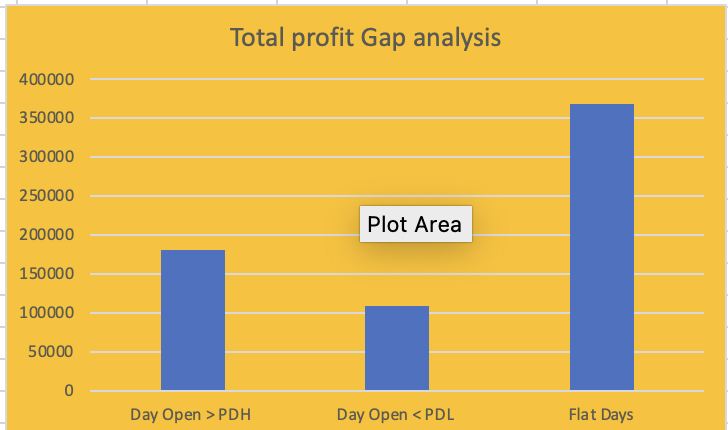

Here's total profits made during gaps, when day open is greater than previous day high, Day open < Prev day low and flat days. Irrespective of gaps, its able to generate profits over all. Even the avg profits denotes the same

https://t.co/pc1jr1xBlI

Am sharing my journey on how I started trading 15 years before when there was very limited resource. If you are a beginner who is looking to get started with Stock Market, this thread would be helpful.\U0001f9f5

— Kirubakaran Rajendran (@kirubaakaran) April 26, 2022

https://t.co/KZJ1FKCXSp

Many of my friends who work at Corporate culture are fed up with their work life, one question they keep asking me is how much money do I need to retire and live comfortably? Here\u2019s a short thread \U0001f9f5 pic.twitter.com/gNEOFOChlh

— Kirubakaran Rajendran (@kirubaakaran) May 24, 2022

https://t.co/pTnbkjVpr0

Year 2022 has been disastrous for many asset classes, the world economy is at 40 year high inflation. Are we headed for another stock market crash? Here's a detailed analysis. \U0001f9f5 pic.twitter.com/ZYch9yBHEq

— Kirubakaran Rajendran (@kirubaakaran) May 19, 2022

https://t.co/3QXmND1x6Y

I have closely observed FinNifty for couple of weeks and then started trading live since last 4 expiry. If you are looking to start trading with FinNifty weekly option then this thread might be of great help to you. \U0001f9f5

— Kirubakaran Rajendran (@kirubaakaran) July 12, 2022