And you can also join our Telegram channel for regular updates – https://t.co/Ekz6I8pDGt (2/n)

Personal Finance 101 – My learning’s about investing

This topic is for everyone, whether you manage your money yourself or through your advisor, it will go a long way in managing your finances.

Do re-tweet & help us educate retail investors (1/n)

And you can also join our Telegram channel for regular updates – https://t.co/Ekz6I8pDGt (2/n)

Term Insurance is the best way to take an insurance cover & probably the only product to buy in life insurance. Make sure u disclose all the necessary information before taking the insurance. Smoking, Alcohol, any pre-existing deceases etc(3/n)

But there are variants of term insurance that you should avoid (4/n)

For a non-smoker born on the 1st Jan 1985 & policy term 39 years (till age 75), the regular premium for a 1-cr term insurance is 22,157 (inclusive of GST) but with returns of premium is 42670 (inclusive of GST). An increase of 20,513 (5/n)

(i) Without GST premium = 42670/118% = 36161

(ii) Premium returned at policy end if nothing happens = 36161*39 = 14,10,280 (7/n)

(iv) In other terms, the policy is only paying u 2.77% on the additional premium u r paying over the regular premium(8/n)

They will advertise it saying instead of paying 22,157 for 39 years (total 8,64,123), pay 48,830 for 10 years (Total 4,88,300 and save 43% premium, but, the trick here is time value of money. (9/n)

(i) If u calculate the present value of both stream of cash flows @ same rate of 6%, Present Value of regular pay (39 years) is 3,51,100 & 4 limited pay (10 years) is 3,80,957. In today’s term, u r paying 29,857 more in limited premium plans(10/n)

Which is why, in most cases you can ignore ULIP’s as well. (20/n)

- Make sure you mention all the necessary information while applying for the cover and not hide any material fact. Smoking, Alcohol, Pre-existing deceases etc. This is a major reason why most claims get rejected. (21/n)

- In case of a claim, Mediclaim will nt settle 100% of the bill amount; there may be items, which the insurance is nt covering, & the same needs 2b paid by u. Have some medical fund in place 4 such contingencies (22/n)

- Make sure you have atleast 6-12 months of your monthly expenses, including you EMIs, kept aside in an liquid fund for any unforeseen eventuality (23/n)

- Always have a goal in mind and define it in money terms, only then you can plan for it. Ex. Buying a house worth 2cr. in March 2030.

- Having a goal also brings in discipline in your investing (24/n)

- Keep you goals realistic (25/n)

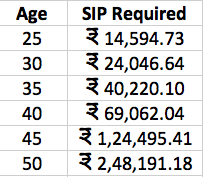

-If u want to accumulate 5 cr. at retirement at 60, below is the SIP u will have 2do depending on when u start, assuming 10% returns

-Starting 10 years later will require u to do 40,000 instead of 14,500 to reach the same goal (26/n)

-Investing golden rule 30:30:30:10. Maximum 30% of ur income as EMI, 30% household expense, 30% Savings & 10% liquid

-Always maintain an Asset Allocation. Don’t invest most of what u have in 1 asset (27/n)

-There is no get rich over night investing strategy. You will have to give it time

-Avoid looking at your portfolio value daily

-Save more (28/n)

- If you don’t understand stock picking, stick to MFs

- Equity is a long-term asset, invest for long term

- Avoid F&O if you don’t understand it

- Investing creates wealth not trading (29/n)

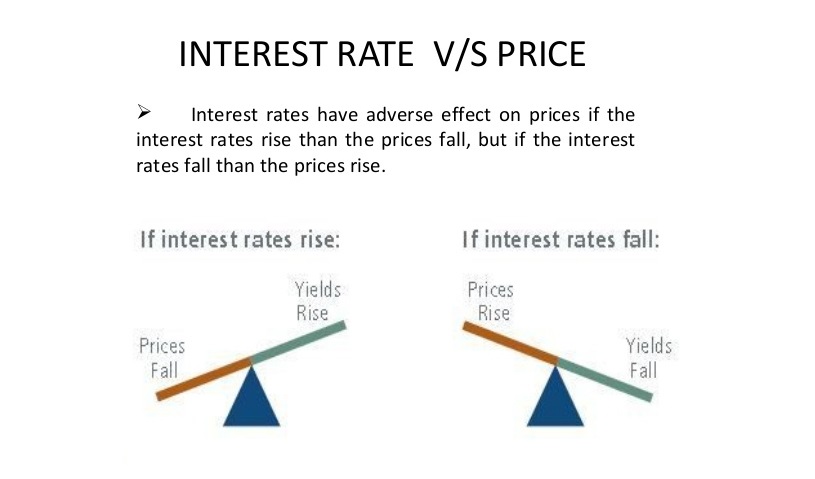

-Debt mutual funds are better over FD’s if you can avoid looking at the daily NAV and give it the 3-5 years you normally give your FDs

-Higher the interest rate offered, higher is the risk

-Fixed income is risk free is a misconception (30/n)

Fixed Income investment strategies (Thread)

— Kirtan A Shah (@KirtanShahCFP) November 20, 2020

Do 're-tweet' & help us reach & benefit investors

It\u2019s a misconception that FD, RBI Bond, PPF etc have no risk. The reason we don\u2019t see the risk in them is because for us, risk ONLY means loss of capital. (1/n)

-Don’t consider the real estate u stay in as a portfolio investment, u will rarely b able 2 use it 2 convert 2 cash when u want it

-RE investments r extremely illiquid

-Rent you receive on housing RE investment is 2% vs 6-7% on commercial real estate (32/n)

-Interesting way to invest in RE - https://t.co/7doPyKWe7D (33/n)

(Thread) With Kotak launching its International REIT Fund of Fund NFO, it is worth revisiting our old thread on Real Estate Investment Trust (#REIT). The Idea is to educate readers on REIT & share our view on the Kotak #NFO

— Kirtan A Shah (@KirtanShahCFP) December 12, 2020

Do \u2018re-tweet\u2019 & help us educate more investors (1/n)

-Don’t consider the Gold jewellery at home as investment if you are not going to sell it when the price increases. Its your emergency fund

-Investments in gold should be in bars and not jewellery. Why spend on making charges? (34/n)

-Best way to invest in Gold is through Gold ETFs & SGB

-More about gold investing - https://t.co/HubxI58OMZ (35/n)

What better day to discuss Gold, isn\u2019t it?

— Kirtan A Shah (@KirtanShahCFP) November 13, 2020

Topic - Physical Gold v/s Digital Gold v/s Gold ETF v/s Sovereign Gold Bond (SGB)

(Thread) \u2013 DO RE-TWEET FOR A LARGER REACH :)

(1/n)

- Always try and utilize your 80C limits to the fullest. If you are in the 30% tax bracket, you directly save 1,50,000 * 30% = 45,000 of tax.

- 80C is no reason to invest in Insurance & 5 years bank FDs.

PPF, ELSS are much better options (36/n)

- Cash that u generate by avoiding tax gets spent & does nt help u grow ur wealth. Its better 2 pay tax & invest the rest. Calculations show that in 3 years of investing, u recover the tax u paid & the investment can then keep growing(37/n)

A thread on National Pension Scheme (NPS)

— Kirtan A Shah (@KirtanShahCFP) November 25, 2020

This is the simplest yet the most comprehensive piece around. Do \u2018re-tweet\u2019 and help us reach more investors \u263a

(1/n)

- It’s a blessing to be debt free

- Home loan, working capital loan kind of loans are okay but strictly avoid personal & credit card loans

- Don’t take loans & invest

& finally, have a will! (39/n)

Link - https://t.co/sr86RDqq0N (40/n)

- Sector Analysis

- Macro Economics

- Debt Markets

- Real Estate

- Equity Markets etc.

You can find them all in the link below. Do hit the re-tweet & help us reach a larger audience

https://t.co/UrRt87xaU7 (**END**)

Here\u2019s a compilation of Personal Finance threads I have written so far. Thank you for motivating me to do it.

— Kirtan A Shah (@KirtanShahCFP) December 13, 2020

Hit the 're-tweet' and help us educated more investors

More from Kirtan A Shah

More from Genericlearnings

• Stocks to buy & hold forever

• Companies which will always be in business

• How to 10x money in 10 years?

• Feedback of company employees

• MWPL & F&O ban list explained

• Tradingview free version tricks

Stocks one can buy and hold

8 - Stocks For Buy And Hold Forever:

— Pankaj Parekh (@DhanValue) September 22, 2021

1. Asian Paints

2. Pidilite

3. HUL

4. Colgate

5. Nestle

6. Abbott

7. Honeywell

8. PGHH

NB: ITC is not included here due to its tobacco business.

Discl: Have a check and satisfy yourself before investing.

These companies will always keep running, no matter if recessions come or not.

26% CAGR makes your money 10x in 10

\u26a1\ufe0fIf you are making 26% CAGR then Rs 10,000 invested at 23 has the same value as:

— Soumya Malani (@insharebazaar) September 19, 2021

Investing Rs 1 Lakh at 33

Investing Rs 10 Lakh at 43

At 26% CAGR, your money grows 10 times in 10 years.

Young earners should realize this power and start early.

No amount is too small to start.

Some life

Old Life Lessons:

— R.K. (@ipo_mantra) September 19, 2021

-Mind your Thoughts: If u are Alone

-Mind your Tongue: If u are with Friends

-Mind your Temper: If u are Angry

-Mind your Behavior: if u are in a Group

-Mind your Emotions: If u are in Trouble

-Mind your Ego: If God showers His Blessing

Do u want to add more ?

Here is the

Glad that many could guess/ know the candle stick pattern and mainly know how to use it.

— The Chartians (@chartians) July 24, 2021

The one shown in the image was bullish Harami

The word Harami comes from an old Japanese word meaning pregnant.. pic.twitter.com/4qBDCyY2Pq

You May Also Like

The story doesn\u2019t say you were told not to... it says you did so without approval and they tried to obfuscate what you found. Is that true?

— Sarah Frier (@sarahfrier) November 15, 2018

In the spring and summer of 2016, as reported by the Times, activity we traced to GRU was reported to the FBI. This was the standard model of interaction companies used for nation-state attacks against likely US targeted.

In the Spring of 2017, after a deep dive into the Fake News phenomena, the security team wanted to publish an update that covered what we had learned. At this point, we didn’t have any advertising content or the big IRA cluster, but we did know about the GRU model.

This report when through dozens of edits as different equities were represented. I did not have any meetings with Sheryl on the paper, but I can’t speak to whether she was in the loop with my higher-ups.

In the end, the difficult question of attribution was settled by us pointing to the DNI report instead of saying Russia or GRU directly. In my pre-briefs with members of Congress, I made it clear that we believed this action was GRU.