More from Investment Books (Dhaval)

40 Investing Books Recommendations from 20 Legendary Investors

Including Warren Buffett, Charlie Munger, Joel Greenblatt, Mohnish Pabrai, Guy Spier, Li Lu.......

Worth More than $100 Billion!

1. Warren Buffett

The Most Important Thing - https://t.co/9noBa9TIYk

The Outsider -

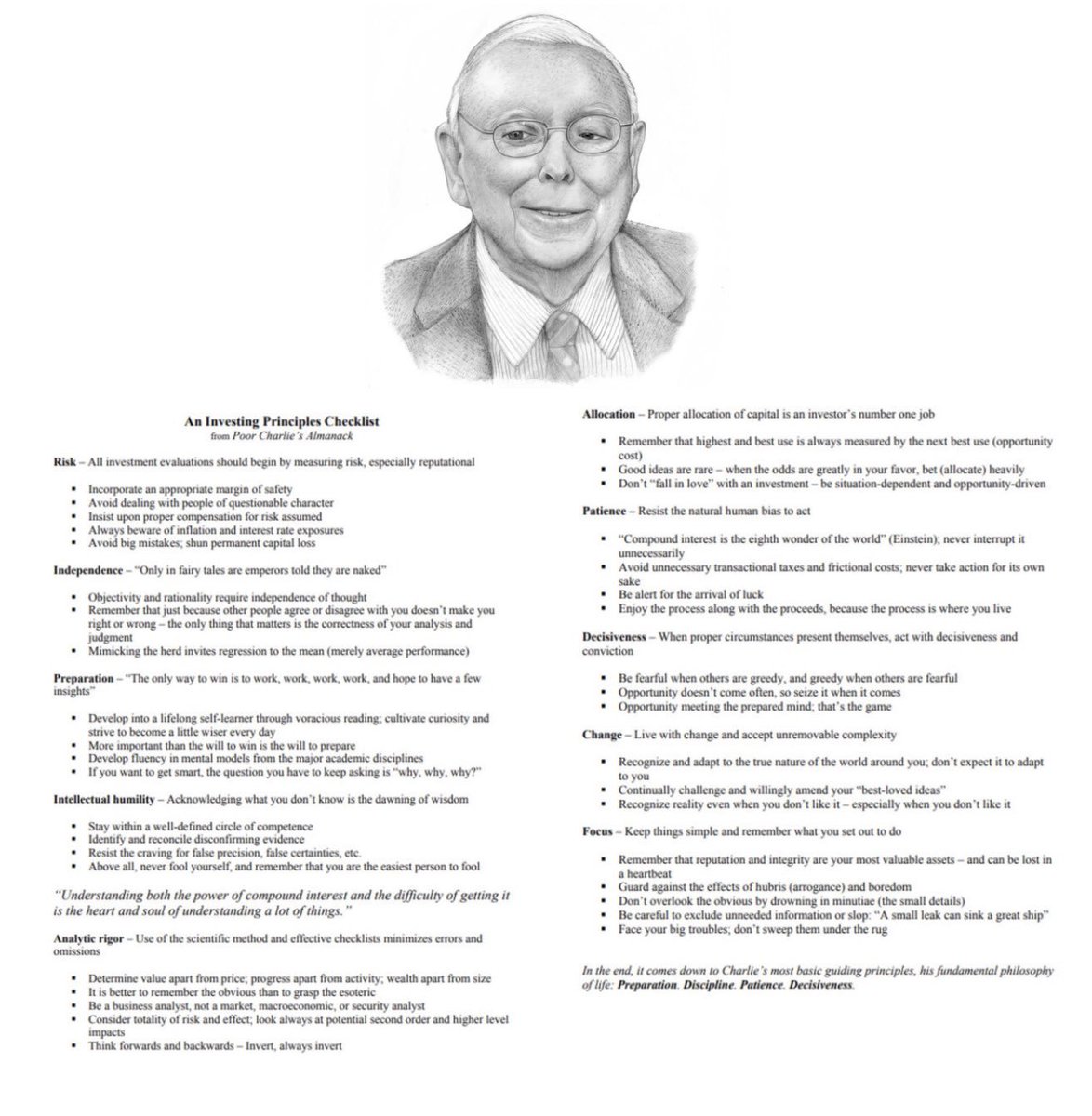

2. Charlie Munger

Influence: The Psychology of Persuasion - https://t.co/UnBFJ90J9o

The Warren Buffett Portfolio -

3. Mohnish Pabrai

100 Baggers - https://t.co/CrIt3kJlaF

A Gift to My Children: A Father’s Lessons for Life and Investing -

4. Chris Mayer

The Little Book That Beats the Market. - https://t.co/7NEKHgNCSD

100 to 1 in the Stock Market by Thomas Phelps -

Including Warren Buffett, Charlie Munger, Joel Greenblatt, Mohnish Pabrai, Guy Spier, Li Lu.......

Worth More than $100 Billion!

1. Warren Buffett

The Most Important Thing - https://t.co/9noBa9TIYk

The Outsider -

2. Charlie Munger

Influence: The Psychology of Persuasion - https://t.co/UnBFJ90J9o

The Warren Buffett Portfolio -

3. Mohnish Pabrai

100 Baggers - https://t.co/CrIt3kJlaF

A Gift to My Children: A Father’s Lessons for Life and Investing -

4. Chris Mayer

The Little Book That Beats the Market. - https://t.co/7NEKHgNCSD

100 to 1 in the Stock Market by Thomas Phelps -

More from Finance

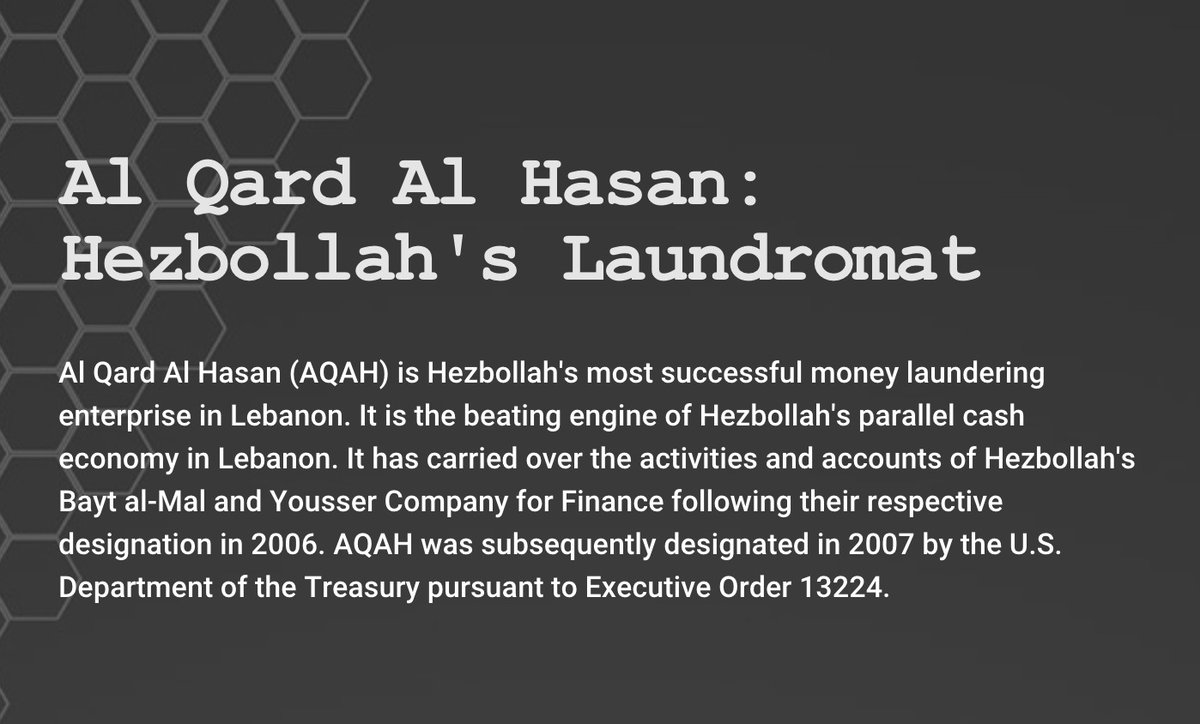

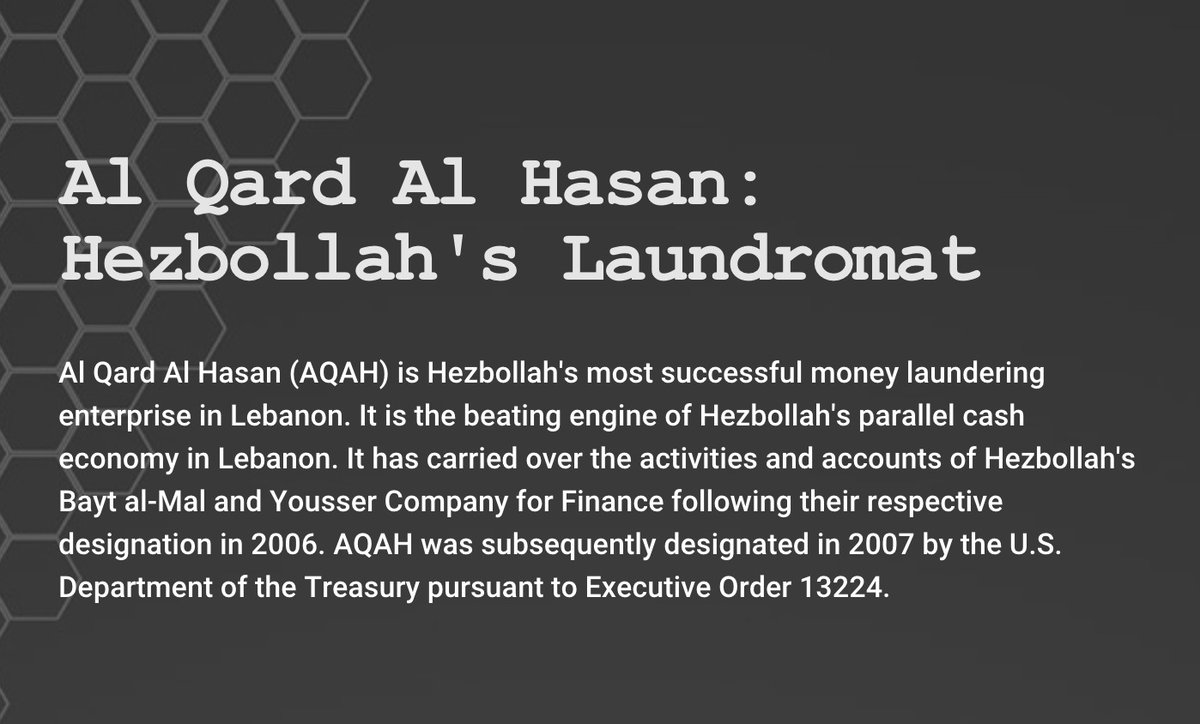

Last week Hizbollah's finance institution Al Qard el Hasan was hacked by Spiderz. A group of people took that Data and tried to make sense out of it. Below are the findings

https://t.co/eGLqvb28o5

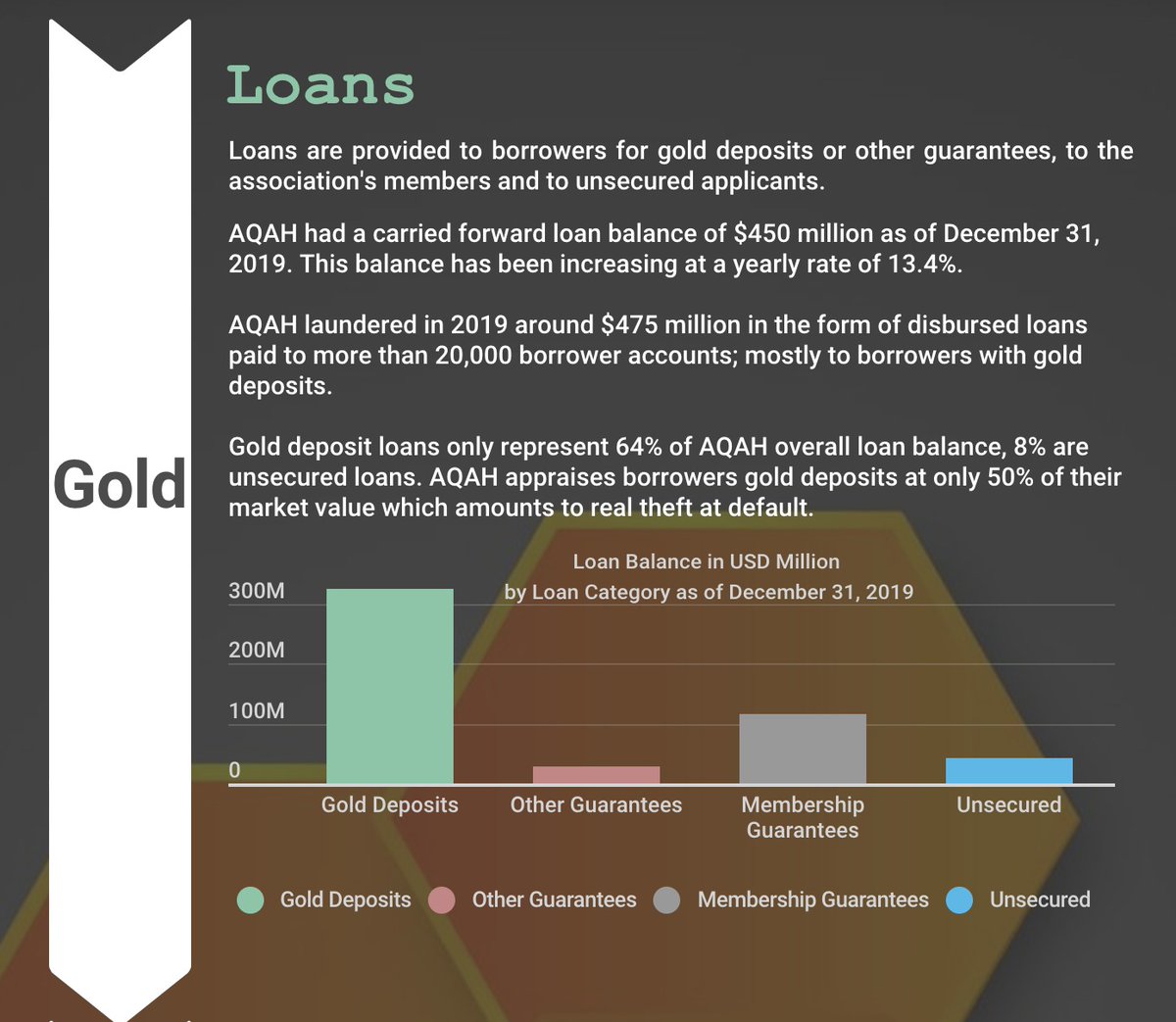

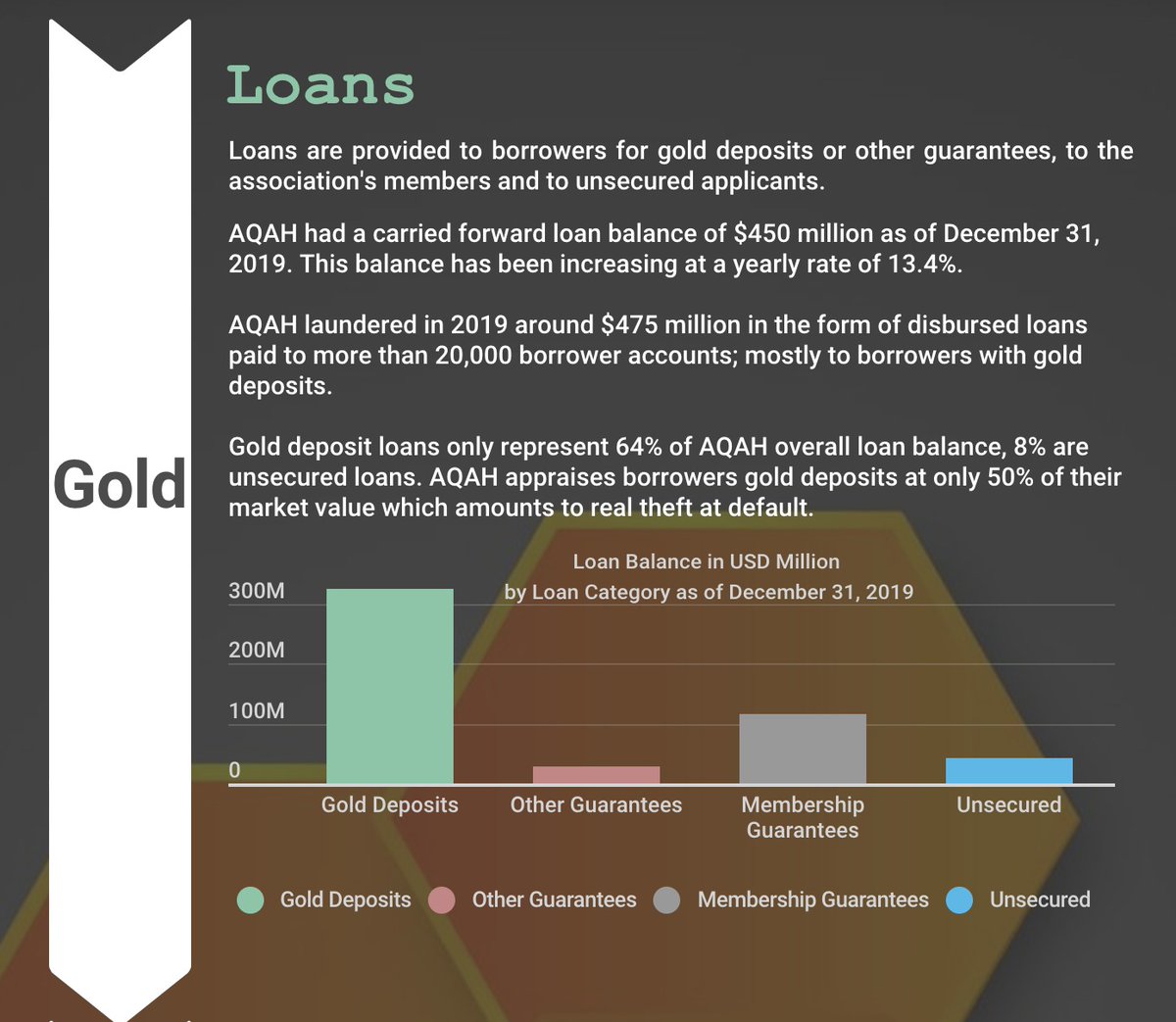

Loans are provided to borrowers for gold deposits or other guarantees, to the association's members and to unsecured applicants.

AQAH had a carried forward loan balance of $450 million as of December 31, 2019. This balance has been increasing at a yearly rate of 13.4%.

AQAH laundered around $475 million in 2019 in the form of disbursed loans paid to more than 20,000 borrower accounts; mostly to borrowers with gold deposits.

Deposits accounts have been offered to 307,000 members of the association, 83,000 contributors as well as to 600 companies. AQAH closed 2019 with an overall depositors accounts balance of around $500 million.

https://t.co/eGLqvb28o5

Loans are provided to borrowers for gold deposits or other guarantees, to the association's members and to unsecured applicants.

AQAH had a carried forward loan balance of $450 million as of December 31, 2019. This balance has been increasing at a yearly rate of 13.4%.

AQAH laundered around $475 million in 2019 in the form of disbursed loans paid to more than 20,000 borrower accounts; mostly to borrowers with gold deposits.

Deposits accounts have been offered to 307,000 members of the association, 83,000 contributors as well as to 600 companies. AQAH closed 2019 with an overall depositors accounts balance of around $500 million.

THREAD: Who are the rising stars of Chinese elite politics in the central Party-State bureaucracy?

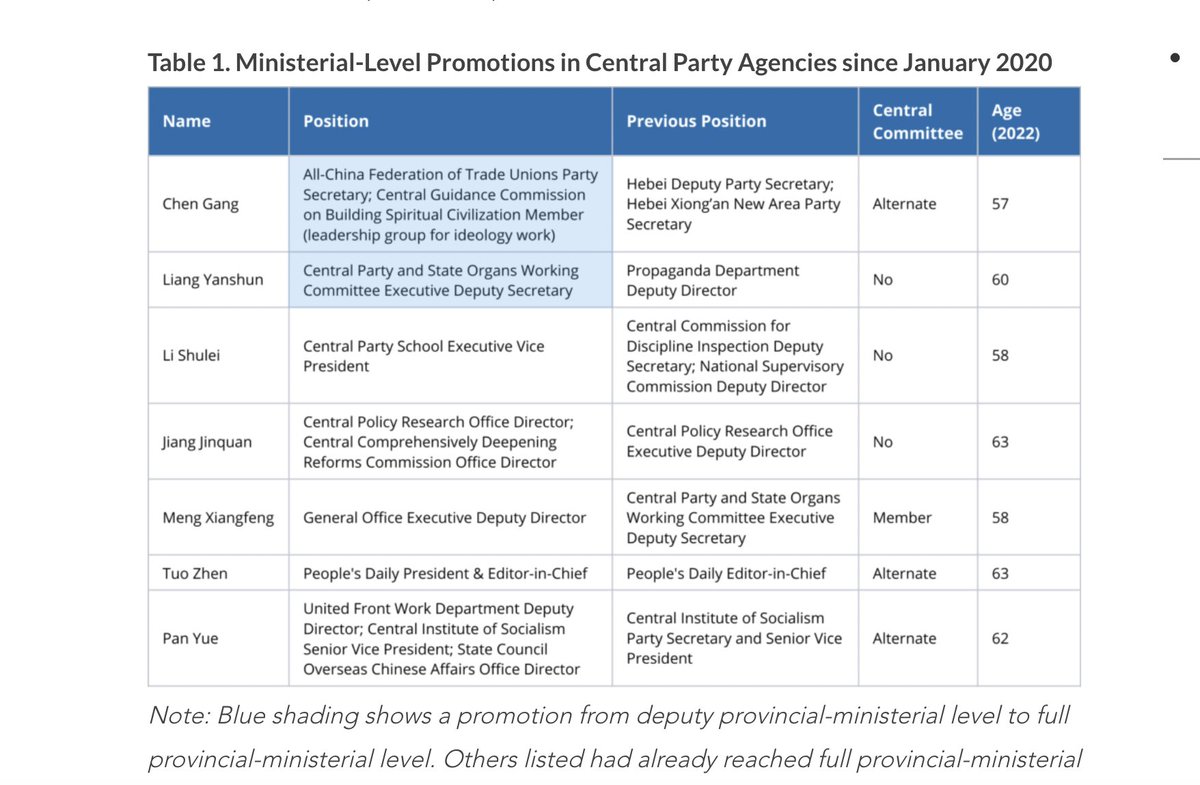

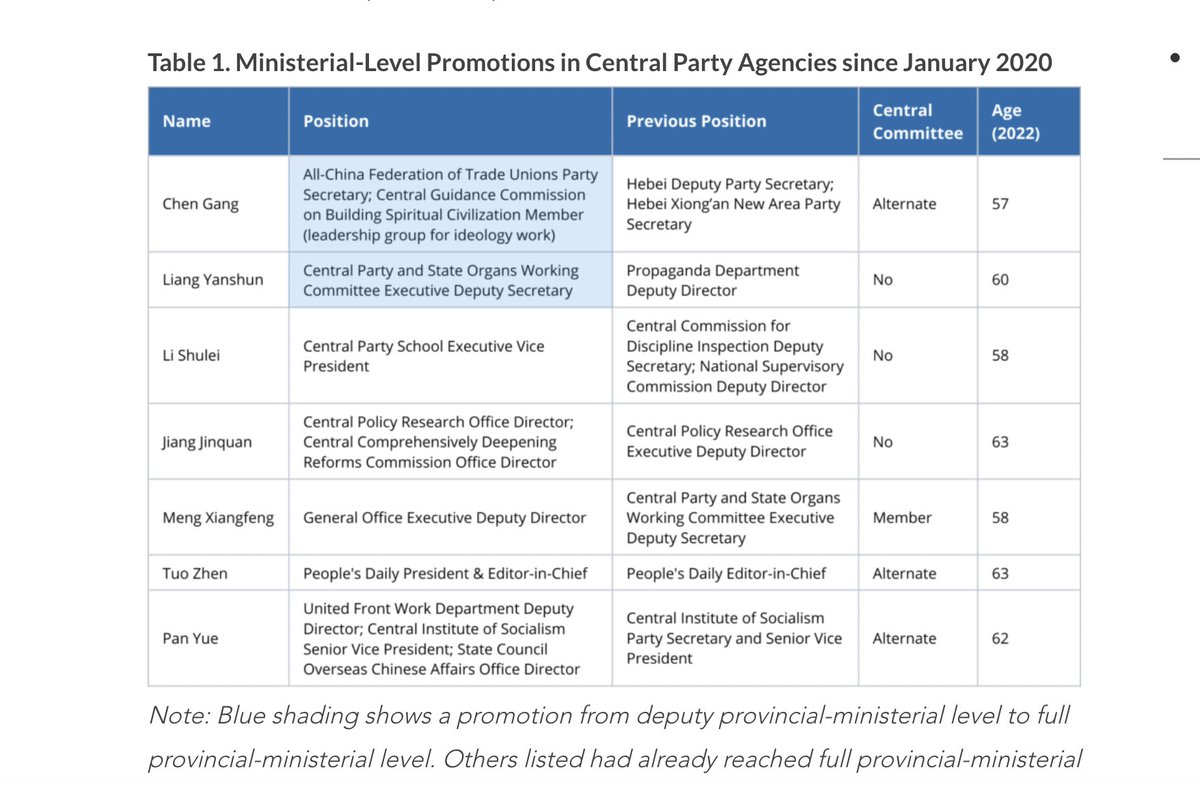

For @MacroPoloChina I analyzed last year's ministerial-level promotions to posts in Beijing

TLDR: Ties to Xi Jinping—or a Xi ally—are very helpful! (1/14)

https://t.co/kO2A0Efyq2

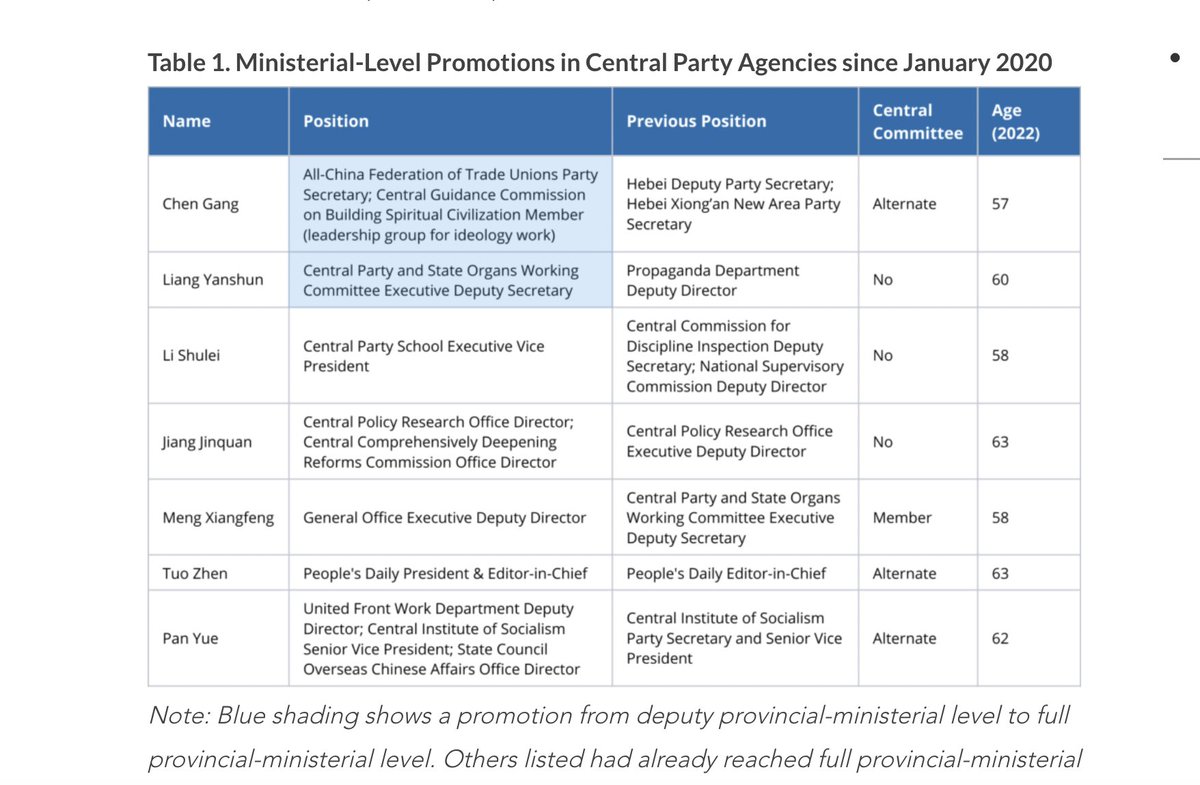

Seven politicians were promoted to ministerial-level positions in central Party agencies last year

All are likely to feature on the next Central Committee selected at the 2022 Party Congress

Some could make the CCP's elite 25-person Politburo (2/14)

https://t.co/kO2A0Efyq2

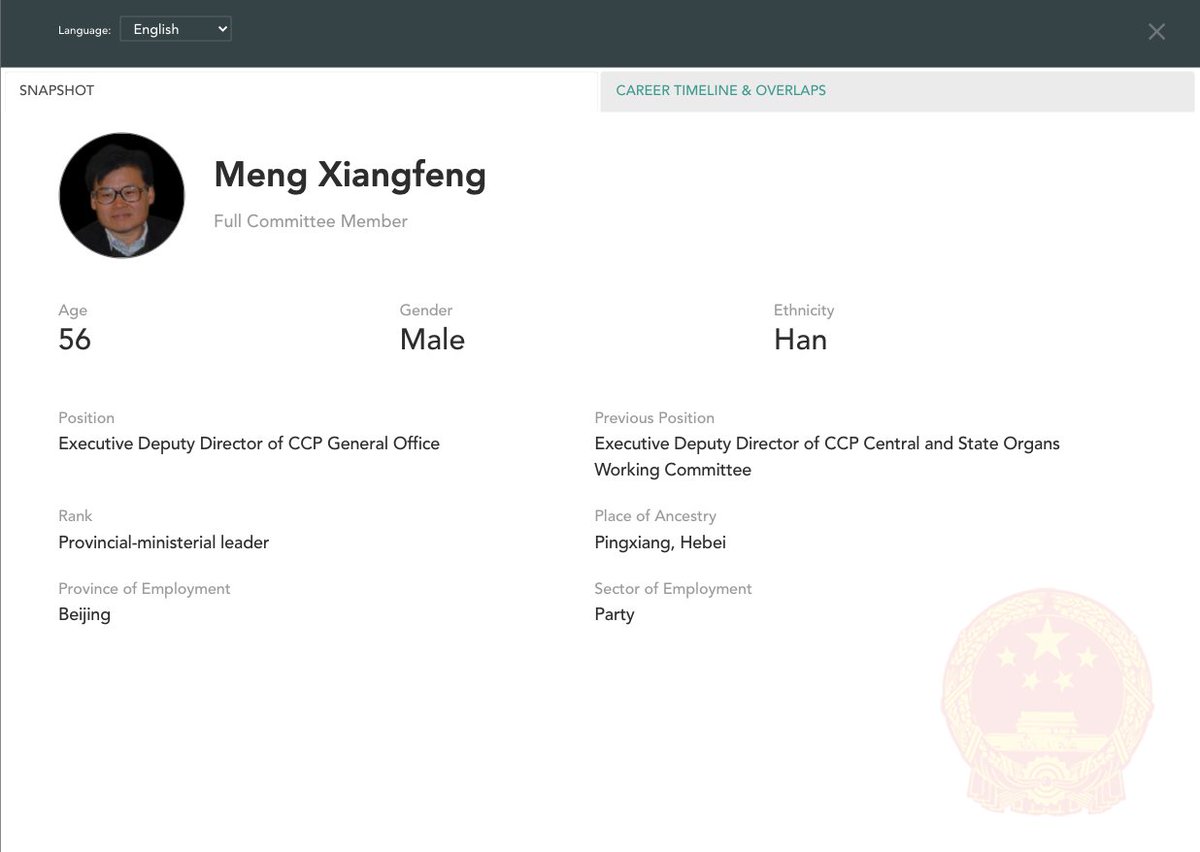

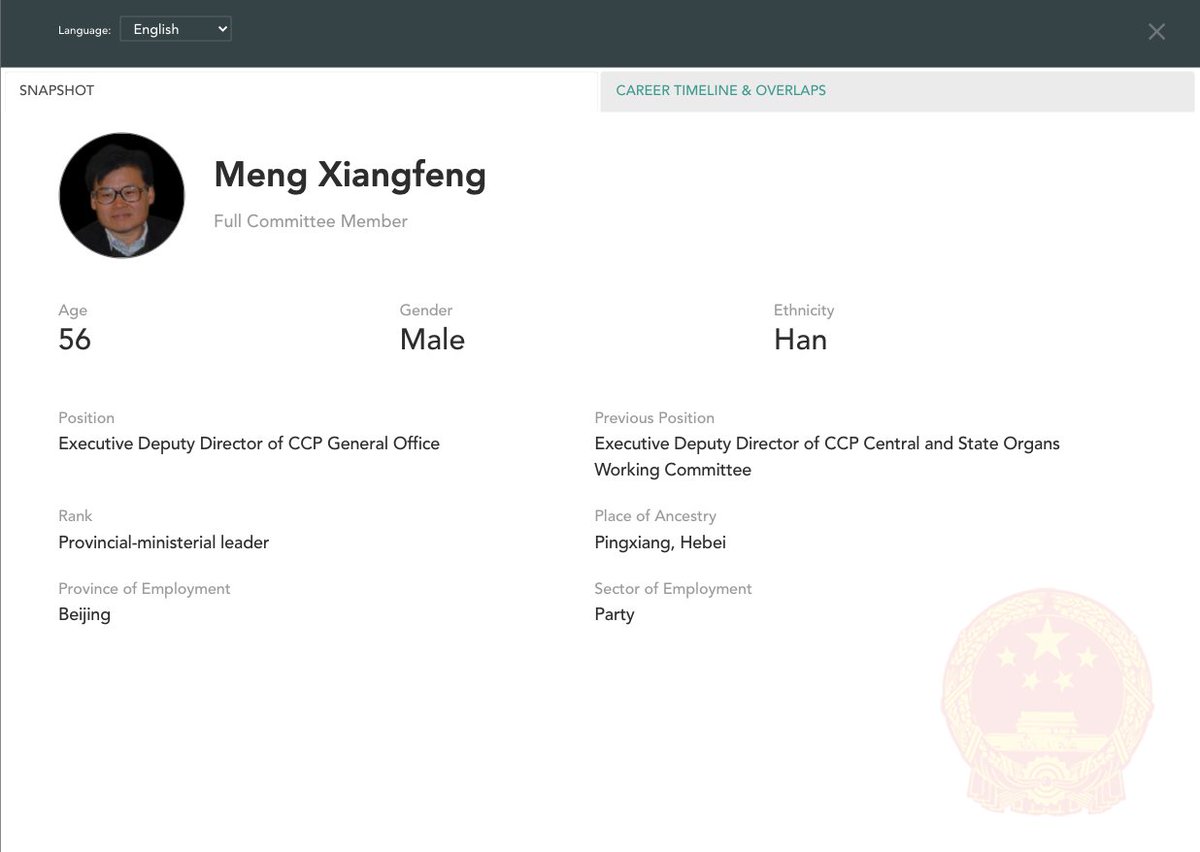

Likeliest for the Politburo is Meng Xiangfeng, new Executive Deputy Director of the CCP General Office

He would replace Xi ally Ding Xuexiang as CCP chief-of-staff if Ding is promoted further in 2022

Meng worked under Xi allies Cai Qi in Hangzhou and Chen Xi in Liaoning (3/14)

Less likely for the Politburo but still important is Jiang Jinquan, new Director of the CCP Policy Research Office

He replaces 5th-ranked leader Wang Huning who led the Party's brains trust for 18 years

Wang remains prominent and will be <68 in 2022, so he'll stay around (4/14)

Other notable central Party promotions include Li Shulei and Liang Yanshun, who both assisted Xi when he led the Central Party School from 2007-2012

Li is a political conservative who is said to be quite close with Xi, even drafting his 2014 speech on culture and art (5/14)

For @MacroPoloChina I analyzed last year's ministerial-level promotions to posts in Beijing

TLDR: Ties to Xi Jinping—or a Xi ally—are very helpful! (1/14)

https://t.co/kO2A0Efyq2

Seven politicians were promoted to ministerial-level positions in central Party agencies last year

All are likely to feature on the next Central Committee selected at the 2022 Party Congress

Some could make the CCP's elite 25-person Politburo (2/14)

https://t.co/kO2A0Efyq2

Likeliest for the Politburo is Meng Xiangfeng, new Executive Deputy Director of the CCP General Office

He would replace Xi ally Ding Xuexiang as CCP chief-of-staff if Ding is promoted further in 2022

Meng worked under Xi allies Cai Qi in Hangzhou and Chen Xi in Liaoning (3/14)

Less likely for the Politburo but still important is Jiang Jinquan, new Director of the CCP Policy Research Office

He replaces 5th-ranked leader Wang Huning who led the Party's brains trust for 18 years

Wang remains prominent and will be <68 in 2022, so he'll stay around (4/14)

Other notable central Party promotions include Li Shulei and Liang Yanshun, who both assisted Xi when he led the Central Party School from 2007-2012

Li is a political conservative who is said to be quite close with Xi, even drafting his 2014 speech on culture and art (5/14)