Let us decode this metric.

Layman’s explanation to PE Ratio and how it works.

A long thread! Do Bookmark this for patient reading.

#investing #investors #PEratio

Let us decode this metric.

•How to decide what to buy?

oCase A: Case A: Fresh Apple vs Stale Apple

oCase B: Costlier Fresh Apple v/s Cheaper Fresh Apple

oCase C: Apple vs Orange

•How to read PE ratio

•How is PE Ratio misunderstood?

•When will PE Ratio not work?

Apple ‘A’ is fresh and juicy. Apple ‘B’ is clearly stale. Apple ‘A’ costs you ₹.20 while Apple ‘B’ costs you only ₹.10.

The answer would clearly differ from person to person. This decision is subjective. Different things have different utilities.

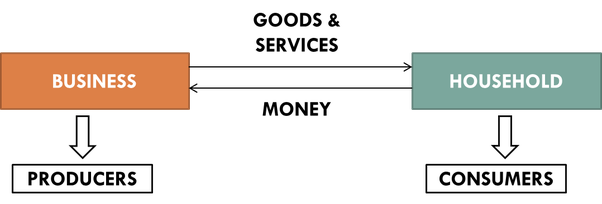

This is so relatable in stock market. Companies making different products and belonging to different industries can not be compared.

All the above cases so discussed can be linked to PE ratio.

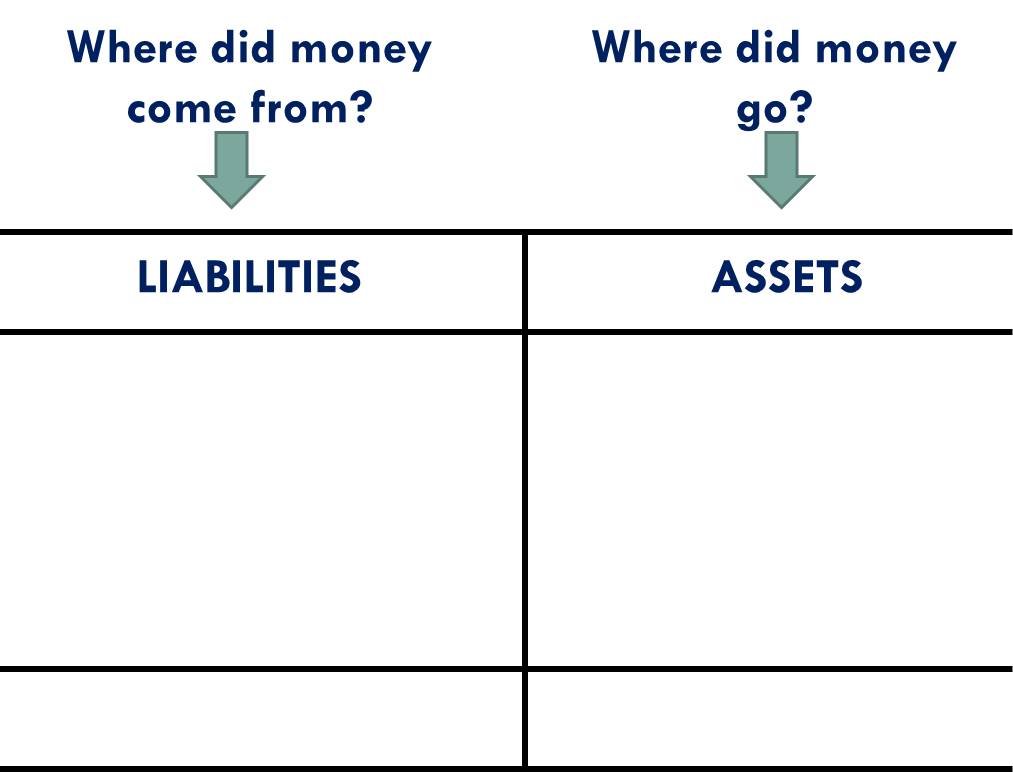

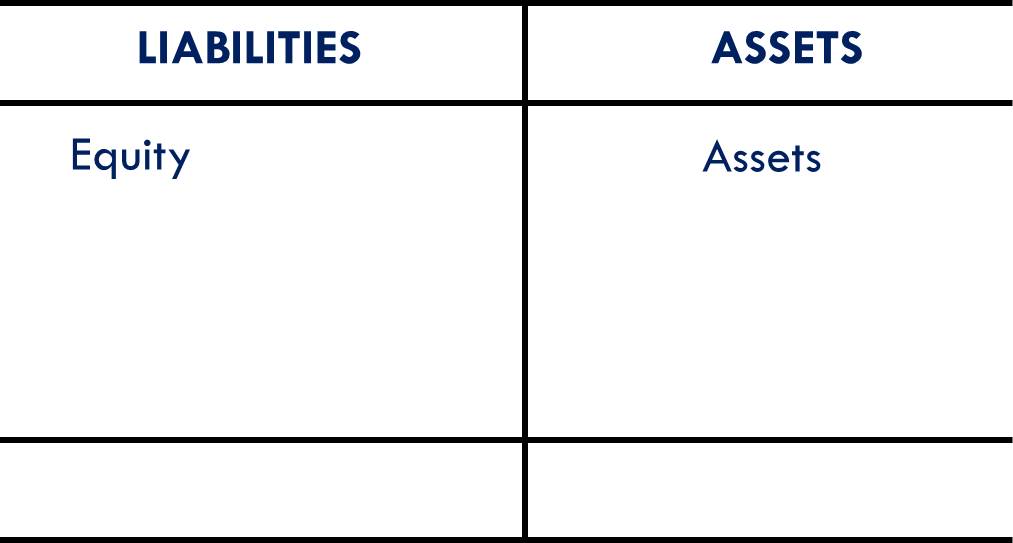

PE ratio= Market Price/ Earnings Per Share (EPS)

In other words, it is nothing but the market price one is ready to pay for every rupee earned by the company per share every year.

A ‘Nestle’ must not be compared with an ‘Asian Paints’! The reason is what we discussed in ‘Case C’. ‘Apples’ and ‘Oranges’ are not comparable!

Investors can be misled if they use this metric in case of cyclical or seasonal stocks.

More from swapnilkabra

More from Finance

1/ My Mission: To Spread Financial Wellness (thread)

Here’s what "financial wellness" means to me

⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️

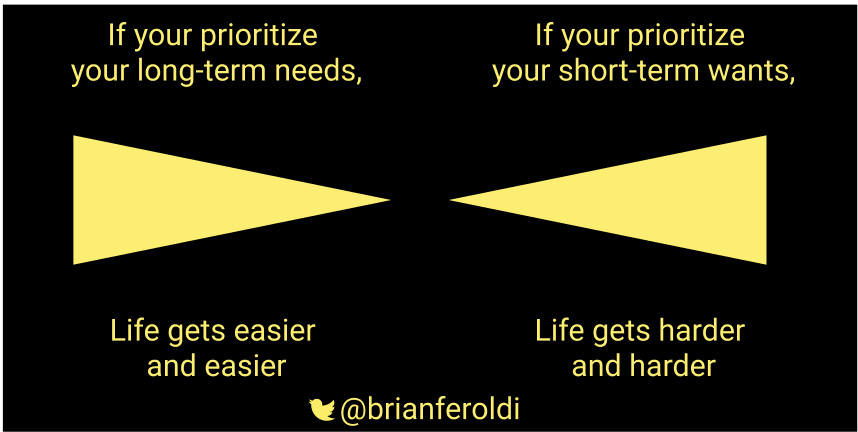

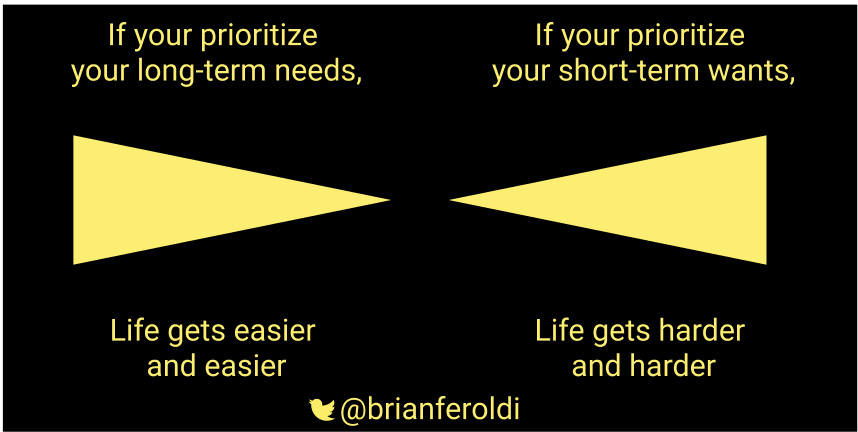

2/ Mindset

Humans are programmed to think short-term

Evolutionary, thinking short-term makes sense. It helps with survival.

Financial wellness is all about training yourself to develop a long-term mindset

Not easy -- it takes practice

3/ Mindset

If you join the right tribes, you can’t help but improve

My favs:

@AffordAnything

@ChooseFiFI

FinTwit

@MicroCapClub

@themotleyfoolFool

@visualizevalue

Twitter / Podcasts / Blogs / YouTube -- when used correctly -- are amazing

4/ Mindset

Educate yourself - constantly!

Especially about:

1⃣Money

2⃣Relationships

3⃣Health

These 3 categories have an outsized influence on all areas of your life

Books

5/ Career

In the beginning, focus on growing your income

Do more than what is expected

Become a lynchpin

Find a career that you ENJOY (<- important!) that also has high-income potential

Start a side hustle (<- important!)

Build your talent

Here’s what "financial wellness" means to me

⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️

2/ Mindset

Humans are programmed to think short-term

Evolutionary, thinking short-term makes sense. It helps with survival.

Financial wellness is all about training yourself to develop a long-term mindset

Not easy -- it takes practice

3/ Mindset

If you join the right tribes, you can’t help but improve

My favs:

@AffordAnything

@ChooseFiFI

FinTwit

@MicroCapClub

@themotleyfoolFool

@visualizevalue

Twitter / Podcasts / Blogs / YouTube -- when used correctly -- are amazing

1/ YouTube is an AMAZING resource when used properly (Thread)

— Brian Feroldi (@BrianFeroldi) November 7, 2020

Here are my favorite YouTube channels:

Top 5:

Mark Rober - @MarkRober

Real Engineering

Smarter Every Day - @smartereveryday

Stuff Made Here - @stuffmadehere

Wintegartan - @wintergatan

More \U0001f447\U0001f447\U0001f447\U0001f447\U0001f447

4/ Mindset

Educate yourself - constantly!

Especially about:

1⃣Money

2⃣Relationships

3⃣Health

These 3 categories have an outsized influence on all areas of your life

Books

1/ Book recommendations (thread)

— Brian Feroldi (@BrianFeroldi) November 20, 2020

Start Here:

Choose FI

Richest Man in Babylon

Millionaire Next Door

Rich Dad, Poor Dad

The Wealthy Barber

\u2b07\ufe0f\u2b07\ufe0f\u2b07\ufe0f\u2b07\ufe0f\u2b07\ufe0f

5/ Career

In the beginning, focus on growing your income

Do more than what is expected

Become a lynchpin

Find a career that you ENJOY (<- important!) that also has high-income potential

Start a side hustle (<- important!)

Build your talent

Boosting your salary is a great way to turbo-charge wealth building

— Brian Feroldi (@BrianFeroldi) November 1, 2020

Here's the good news: Your salary is negotiable!@themotleyfool and @ChooseFi have some AMAZING free resources for scoring a big raise:

Use them!

\U0001f447\U0001f447\U0001f447