1/x The market continues to try & shake out weak hands from overextended positioning by both HF & Retail...After a strong Vanna run up overnight, as expected, retail exuberance exploded on the open in the form of retail call buying, this fragility, paired w/a)Mean reverting flows

More from Cem Karsan 🥐

\U0001f4faOn December 13, 1982, Vanna White joined @WheelofFortune pic.twitter.com/rzrPcBTI59

— RetroNewsNow (@RetroNewsNow) December 13, 2020

2/x by both HF & Retail, but ultimately these moves are no match for our fair lady’s charming flows during this window, & should continue to support this market through 12/16 w/ qrtrly Vixperation & the Fed upon us....As I highlighted Fri, the minor correction in price/time that

3/x we got down to the 20 day, w/precise technical support at that level, paired w/ increasingly positive Dark Pool (DIX) demand was a textbook buy signal, given the timing...Despite all of this, the real story is not these positive flows nearly as much as the continued reflexive

4/x IVol compression...This is the holiday gift that keeps on giving. Along w/ continued targeted short Vol, massive calendar expansion & dispersion opportunities continue to print $ with VRP >94th % of occurrences & post 1/8 Vol still at a floor... This $ train doesn’t show any

5/x sign of stopping yet, as I expect Ivol oversupply should continue to be the dominant force through at least 12/16 & once we get through 12/21 without incident, likely beyond...W/ lots of imbedded potential energy still in the VRP to fuel more vanna/charm flows in the month to

1/x Well you can\u2019t say I didn\u2019t warn you... We\u2019ve been eying that 3770.5 level and the 1/5-1/13 window for many weeks. To get it a day early, @ the lowest edge of the upper range, tells me that there\u2019s understandable concern over the impending outcome of the runoff. As I\u2019ve said https://t.co/BxG2DzdXqt pic.twitter.com/ki4sYprwIH

— Cem Karsan \U0001f950 (@jam_croissant) January 5, 2021

2/x for this year, but for the economic trajectory of America & likely the macroeconomic regime of the developed world for the coming decade. That said, contrary to popular belief, the market does not move based on news in the short term if the positioning doesn’t allow it to.

3/x & our old friend Gary the 🦍 & his sidekick Vanna are positioned to have this market pinned through 1/11. So, as explained ad nauseam, the election news, though fundamentally important, won’t matter to the index itself in the ST. As predicted, the largest moves from the GA

4/x runoff INITIALLY have come from factor rotation. This should continue to be the case, as the street is oversupplied IVol & the index is pinned. This not only allows for idiosyncratic risk moves in constituents, but it actually FORCES extreme noncorrelation & rotation, as we

5/x have witnessed now for the past 2 days. This Vol compression will be increasingly difficult to break free from until 1/11-1/15, but the window of weakness is coming...soon the final hedges from the ‘election hump’ in Nov will expire with the Jan monthly options. Once the

More from Economy

(Article Thread)

All in one convenient location to access.

https://t.co/TuyltZTyW0

True State of the Nation

— Secret SoSHHiety (@SouledOutWorld) December 19, 2020

You think you know what's coming... but you don't...https://t.co/MVoIuxgaWX pic.twitter.com/DtF2Q53HrT

https://t.co/XJJRvpLRQE

Truth About Antarctica

— Secret SoSHHiety (@SouledOutWorld) December 19, 2020

Why? Scalar EM Antennas are kept at Antarctica; Scalar EM weaponry is the anonymous weapon to be used by the White Horse of Rev 6.https://t.co/7CDzmQfLSX pic.twitter.com/0400oCN8io

https://t.co/NeeFCfMkP2

The Finger (fuck you/fuck the world)

— Secret SoSHHiety (@SouledOutWorld) December 18, 2020

The middle finger is the Saturn finger.https://t.co/BsrsBE3f5h pic.twitter.com/ZJqZll8lU1

https://t.co/yFtbIgqzzm

Bread and Circuses

— Secret SoSHHiety (@SouledOutWorld) December 18, 2020

Bring in the clowns & the fast food...https://t.co/SZAlfkqTI3 pic.twitter.com/gLys0mNMIq

You May Also Like

This New York Times feature shows China with a Gini Index of less than 30, which would make it more equal than Canada, France, or the Netherlands. https://t.co/g3Sv6DZTDE

That's weird. Income inequality in China is legendary.

Let's check this number.

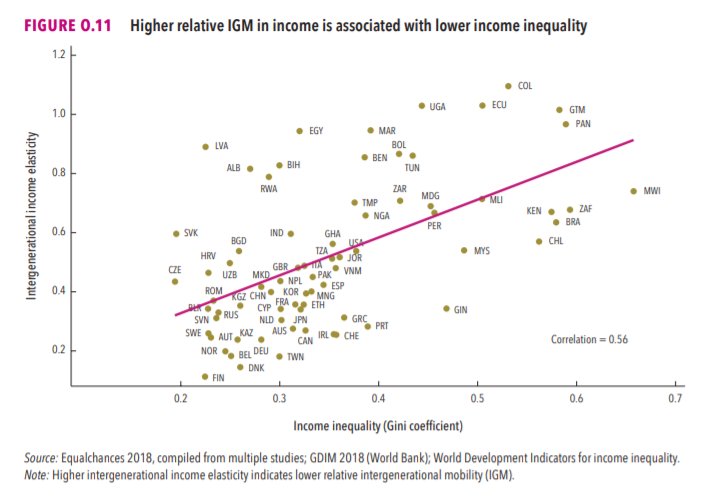

2/The New York Times cites the World Bank's recent report, "Fair Progress? Economic Mobility across Generations Around the World".

The report is available here:

3/The World Bank report has a graph in which it appears to show the same value for China's Gini - under 0.3.

The graph cites the World Development Indicators as its source for the income inequality data.

4/The World Development Indicators are available at the World Bank's website.

Here's the Gini index: https://t.co/MvylQzpX6A

It looks as if the latest estimate for China's Gini is 42.2.

That estimate is from 2012.

5/A Gini of 42.2 would put China in the same neighborhood as the U.S., whose Gini was estimated at 41 in 2013.

I can't find the <30 number anywhere. The only other estimate in the tables for China is from 2008, when it was estimated at 42.8.

To me, the most important aspect of the 2018 midterms wasn't even about partisan control, but about democracy and voting rights. That's the real battle.

2/The good news: It's now an issue that everyone's talking about, and that everyone cares about.

3/More good news: Florida's proposition to give felons voting rights won. But it didn't just win - it won with substantial support from Republican voters.

That suggests there is still SOME grassroots support for democracy that transcends

4/Yet more good news: Michigan made it easier to vote. Again, by plebiscite, showing broad support for voting rights as an

5/OK, now the bad news.

We seem to have accepted electoral dysfunction in Florida as a permanent thing. The 2000 election has never really

Bad ballot design led to a lot of undervotes for Bill Nelson in Broward Co., possibly even enough to cost him his Senate seat. They do appear to be real undervotes, though, instead of tabulation errors. He doesn't really seem to have a path to victory. https://t.co/utUhY2KTaR

— Nate Silver (@NateSilver538) November 16, 2018