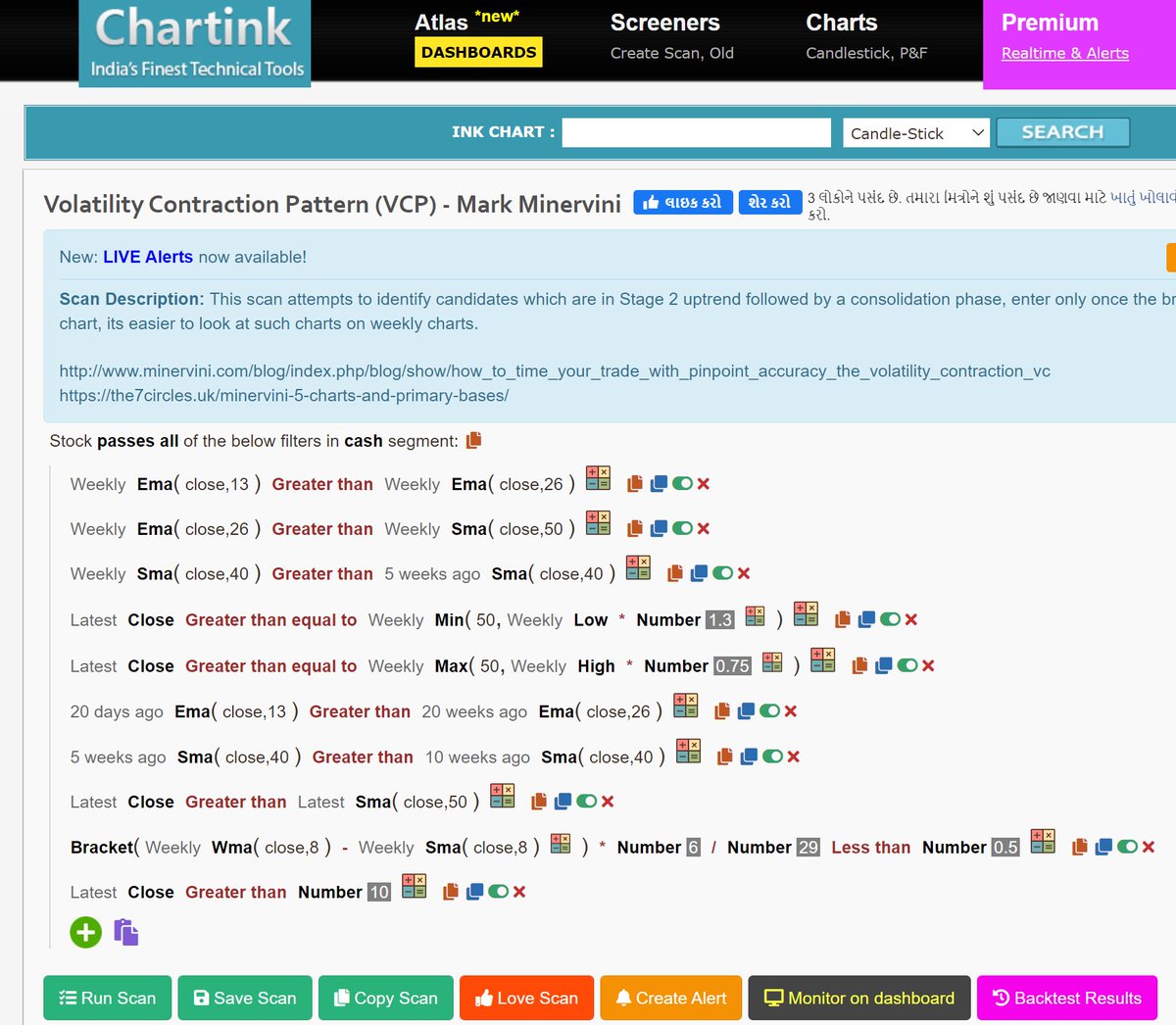

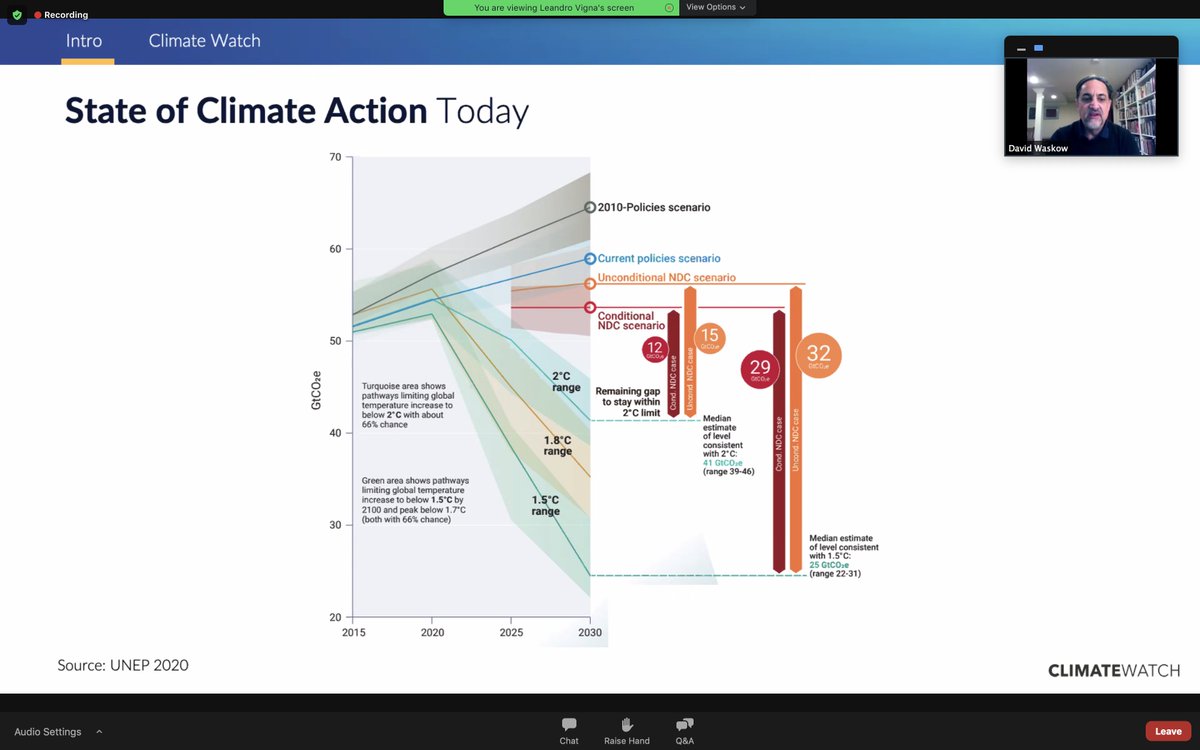

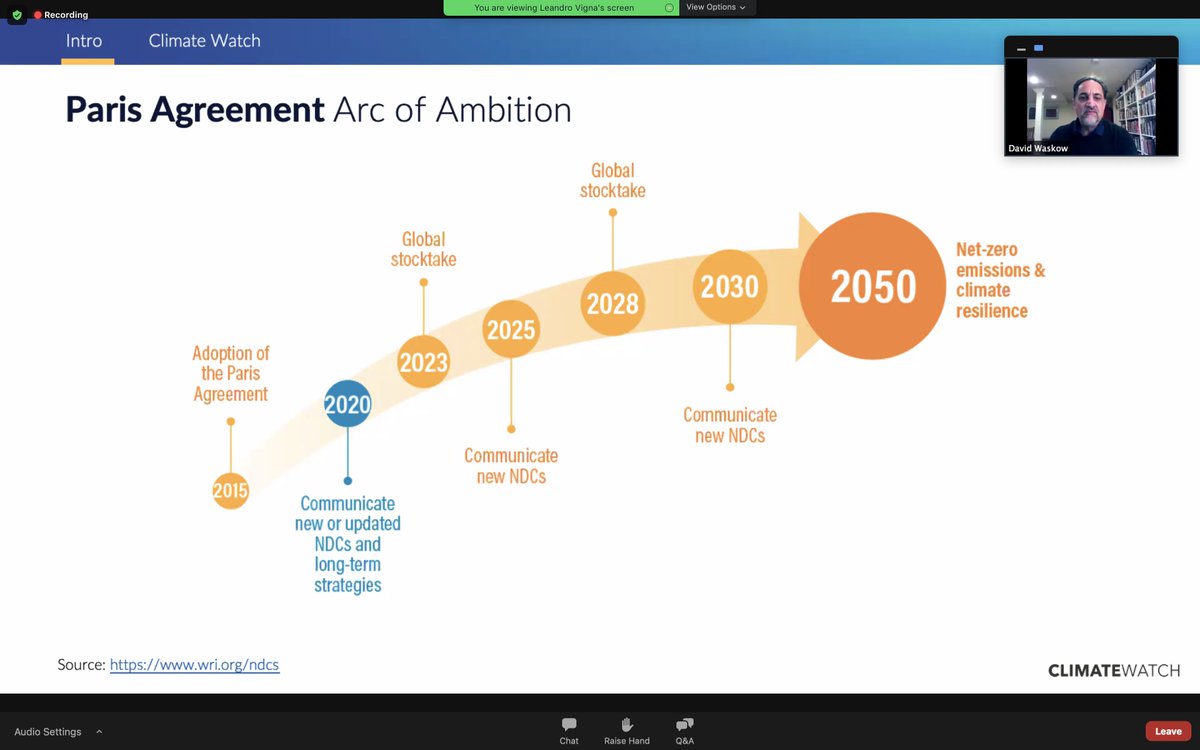

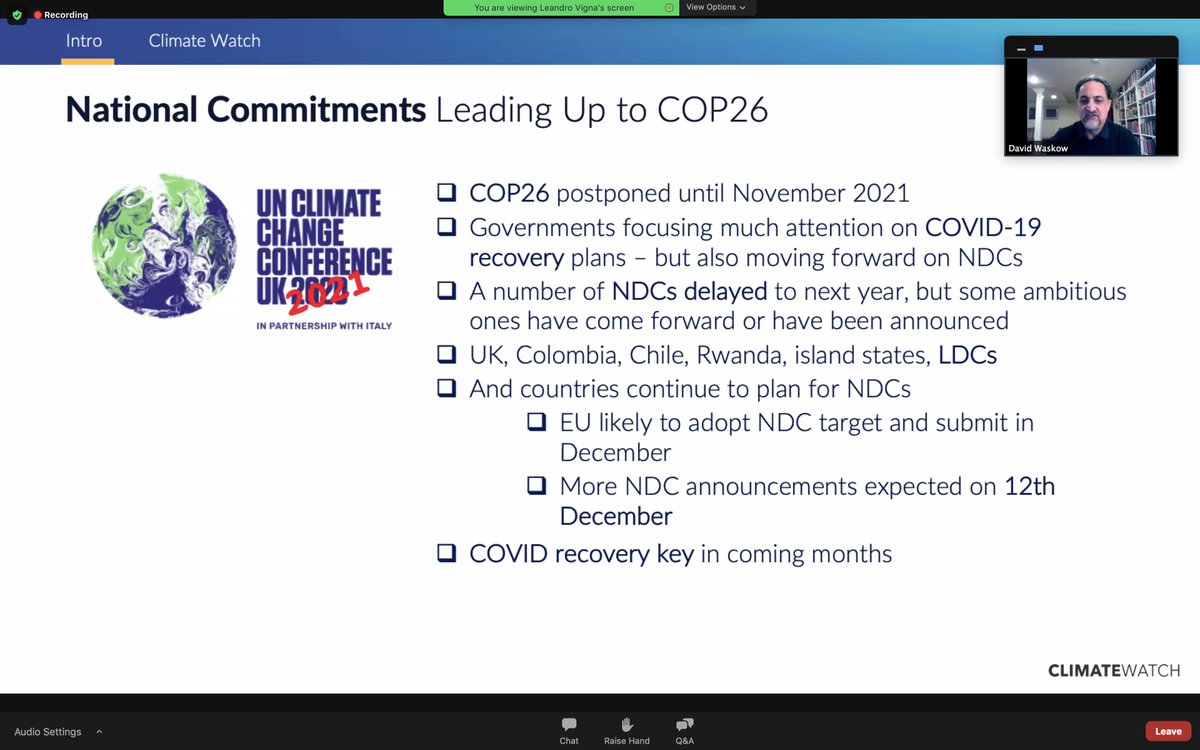

Webinar on tools for assessing national #climate pledges (NDCs) by @WRIClimate. @davidwaskow reminds: #ParisAgreement is meant to work thru an iterative process of increasing ambition (faster emission reductions), leading to #netzero emissions by 2050. (Thread 1/n)

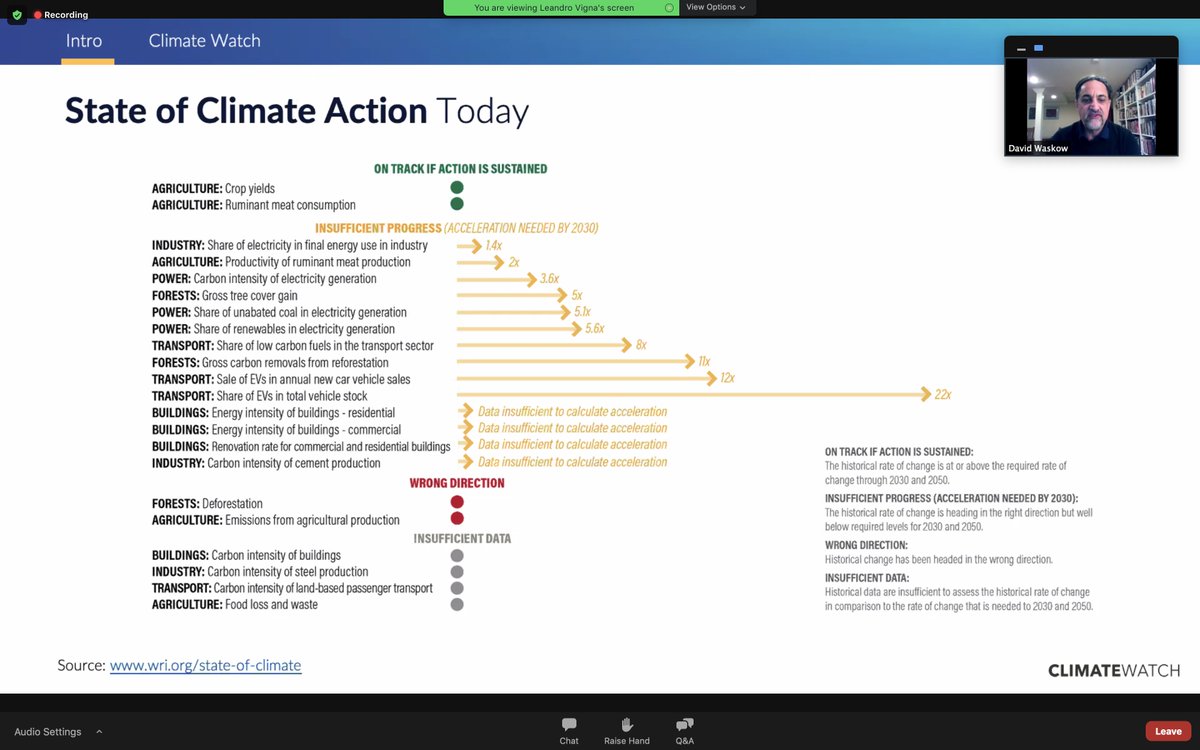

2 are on track (e.g., crop yields)

13 right direction but too slow (e.g., need electric vehicle sales to be 22x faster than now)

2 in wrong direction: forests, ag emissions

@davidwaskow from @climateactiontr, @WRIClimate et al 3/n

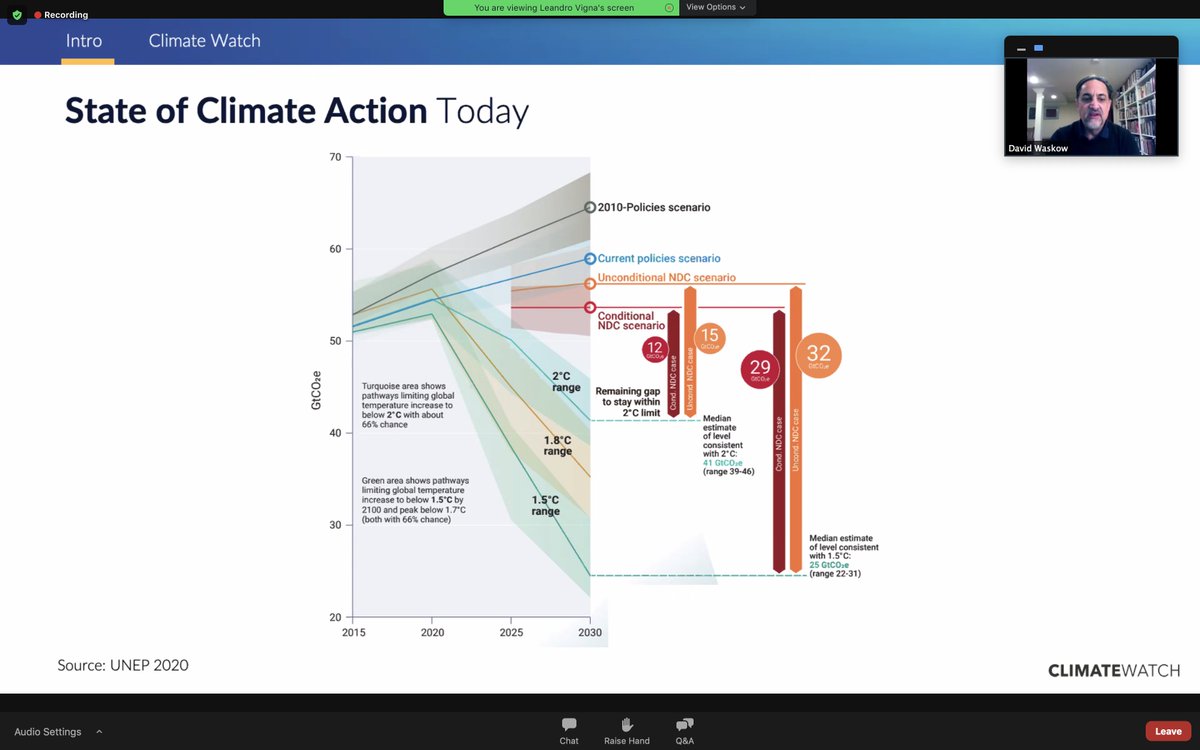

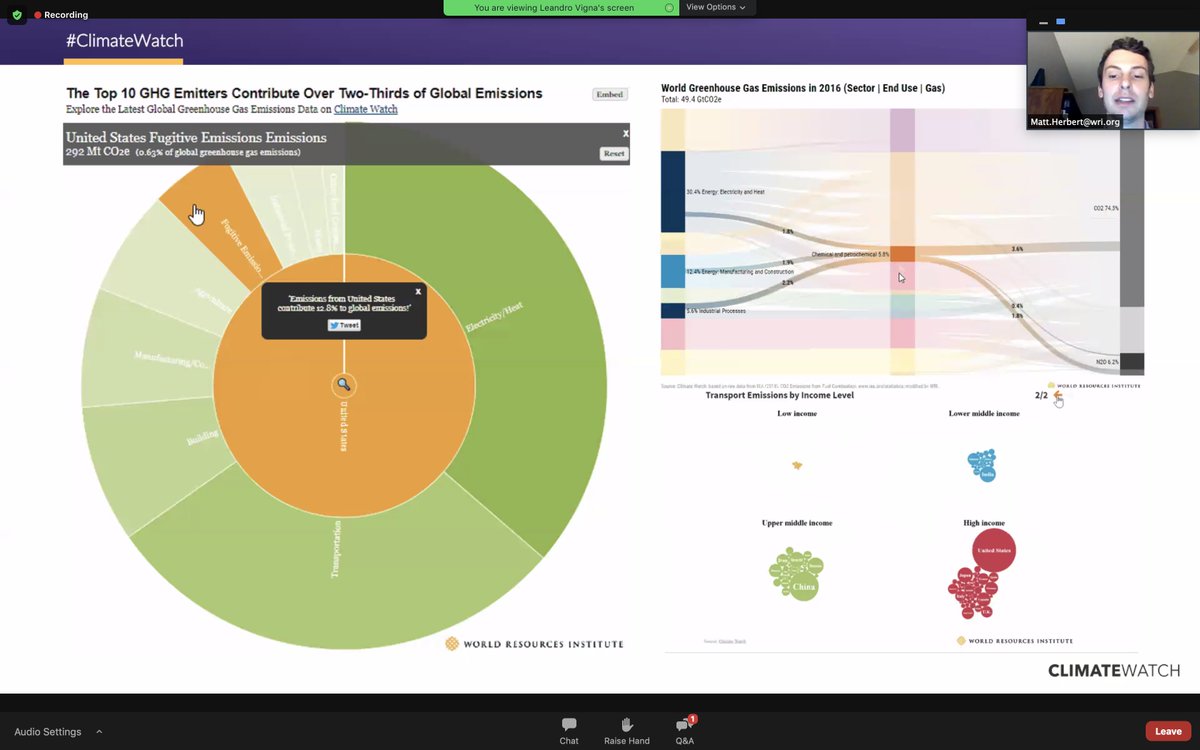

100s of credible datasets,

100,000s of data points

to assess #climate trends, targets, bring transparency to inform + drive #ClimateAction.

For govts, biz, researchers, NGOs

Run by @JohannesFried.

(See also other forest, energy, ... tools) 5/n

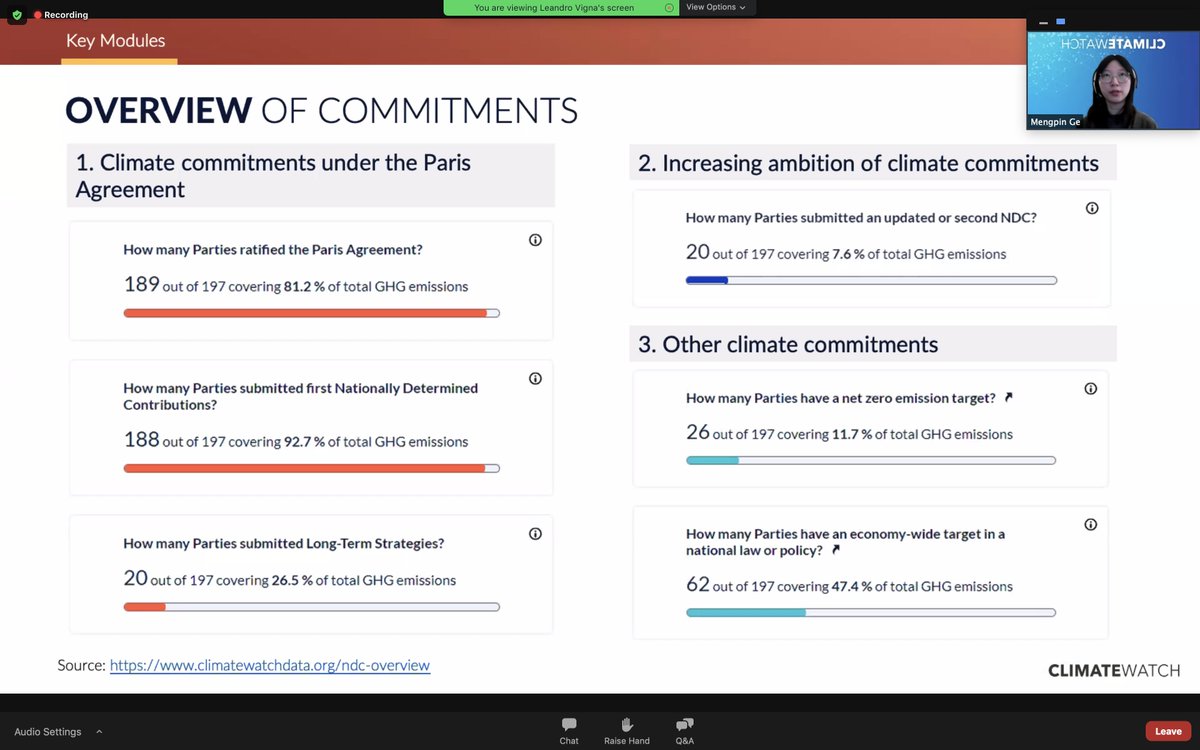

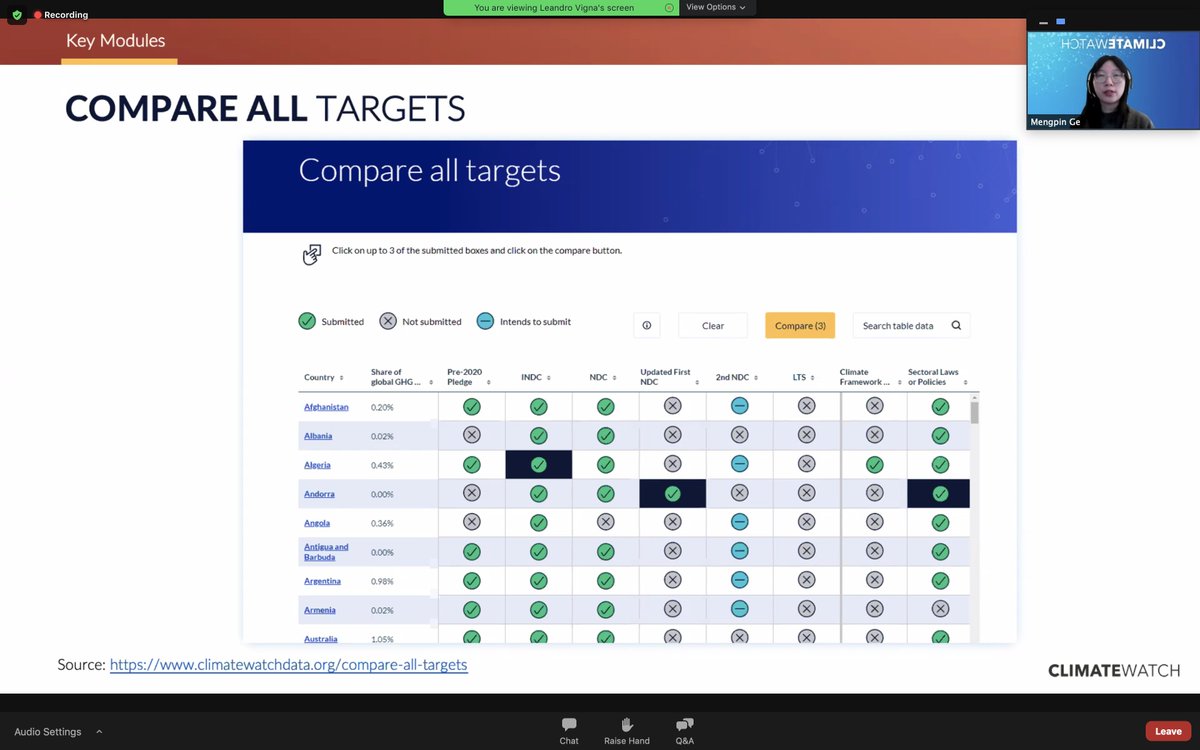

Only 20 countries have long-term #climate strategies

Only 20 have submitted updated, more ambitious pledges (NDCs)

26 have net zero targets

62 have economy wide #climate policy

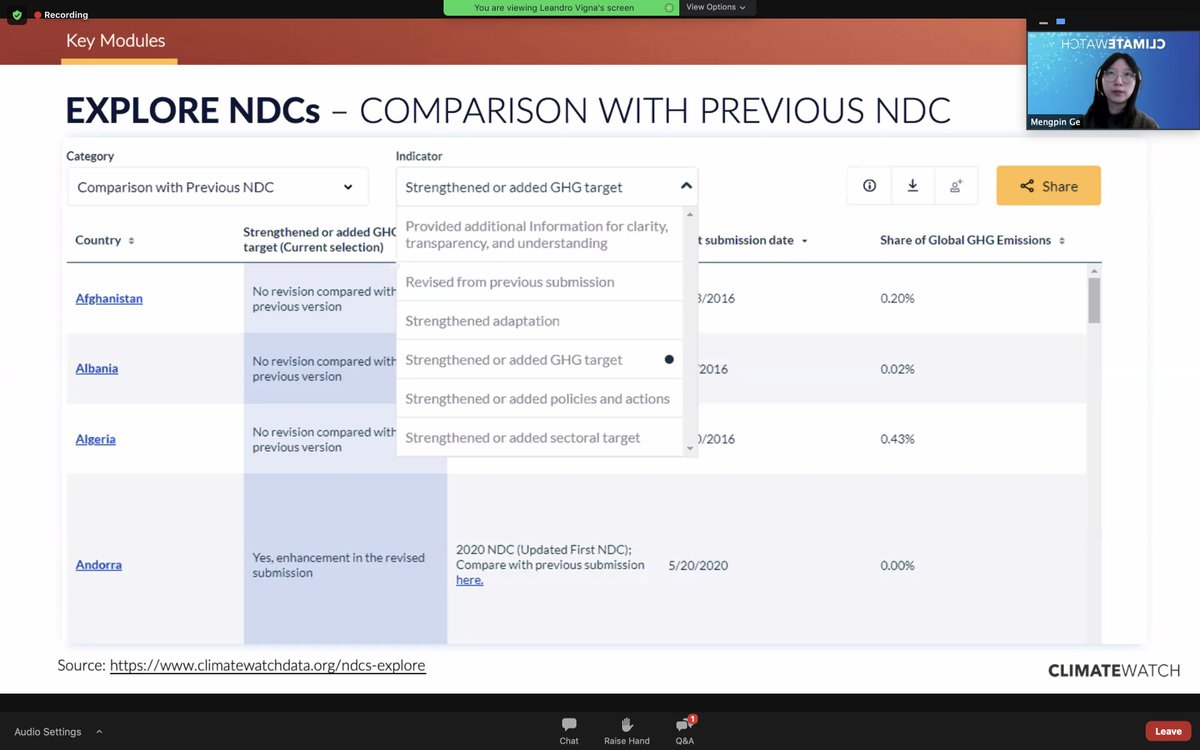

@MengpinGe (7/n)

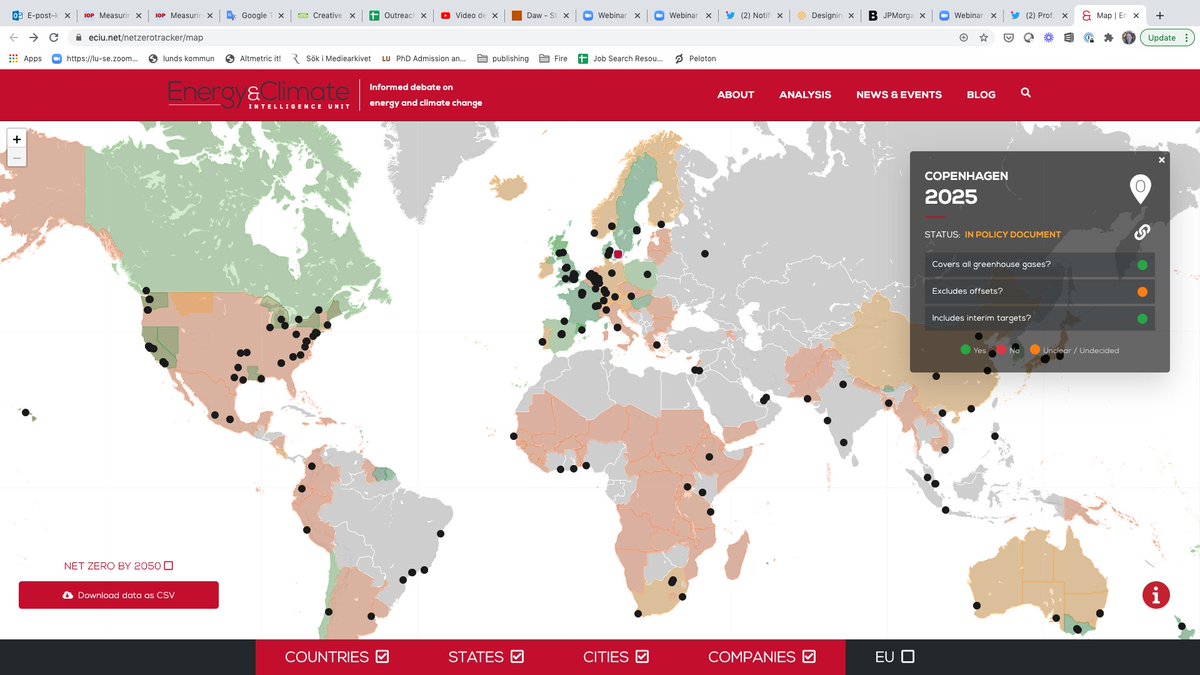

Coming soon: #NetZero tracker (see report:https://t.co/Kb5JB2VgMu).

@MengpinGe (9/n)

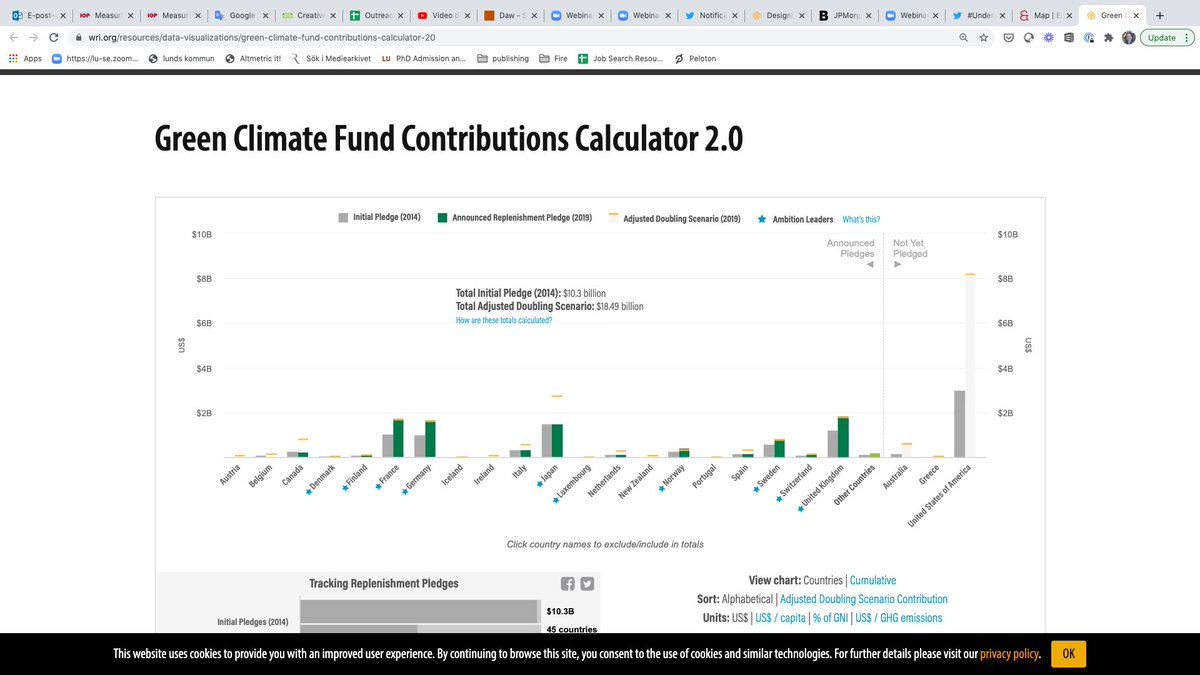

OECD 2018 found $78.9 bn/yr (78% public $), of $100 bn/yr promised in Paris, per @davidwaskow (12/12)

More from Economy

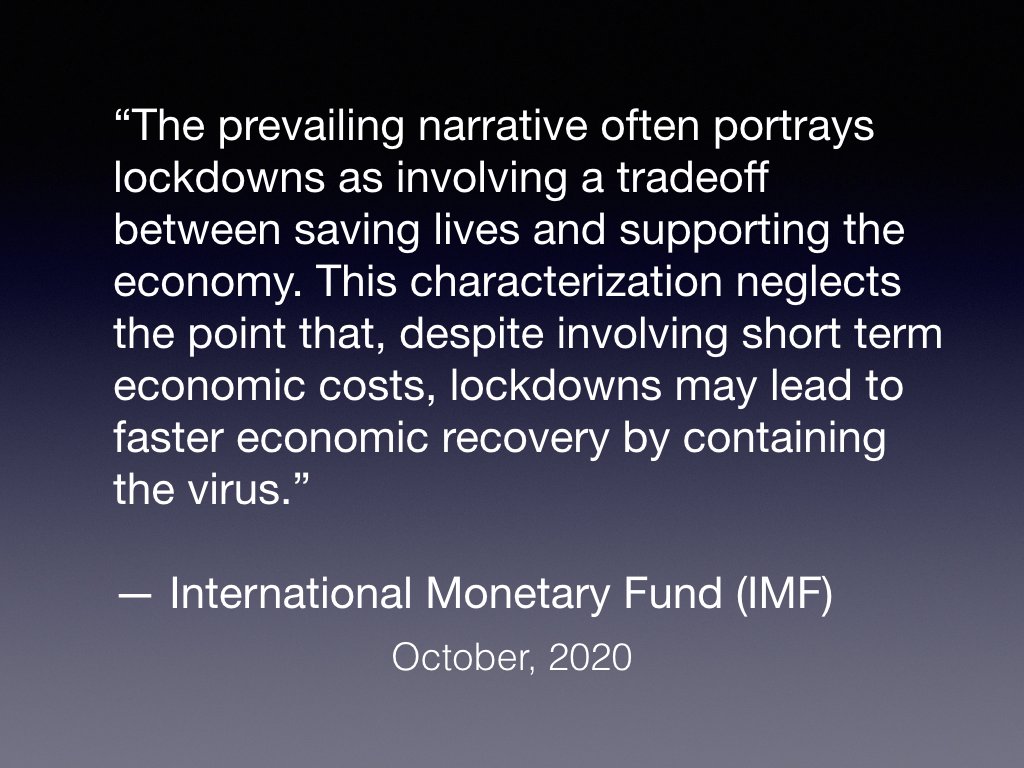

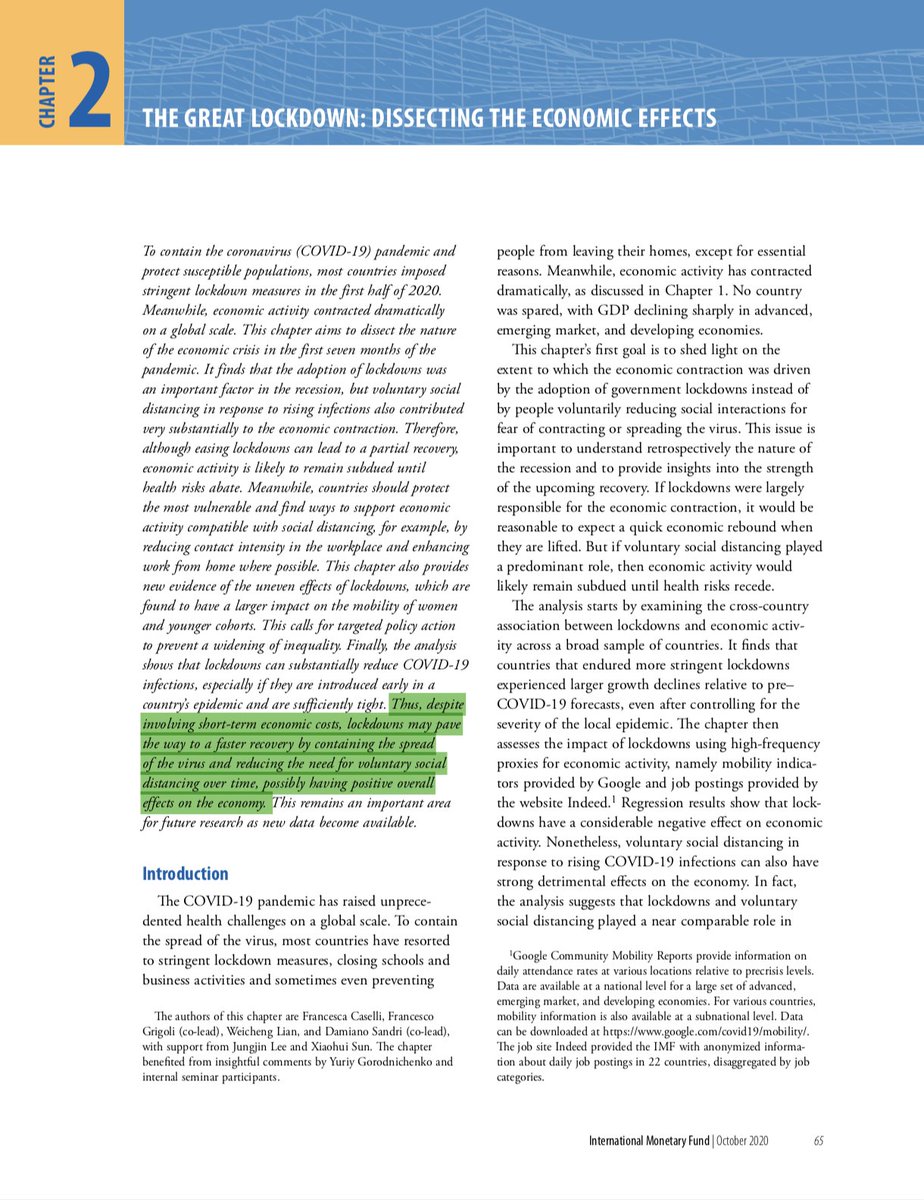

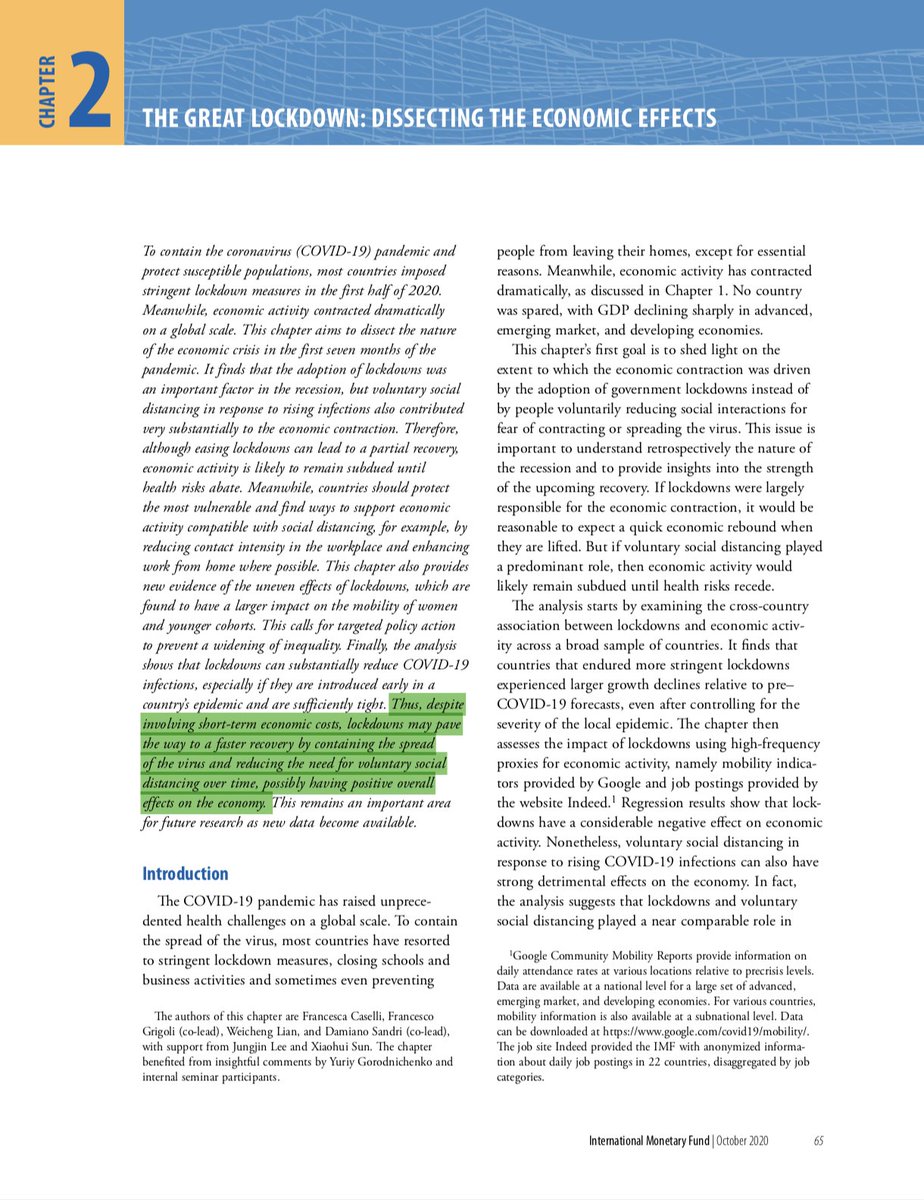

The International Monetary Fund (IMF) is analyzing damage due to COVID and projecting further severe consequences if current policies persist. They state “despite involving short term economic costs, lockdowns may lead to faster economic recovery by containing the virus”

1/

Note: This report doesn’t do a dynamic analysis that makes things much clearer, but it does a thoughtful statistical analysis based upon increasingly available data.

https://t.co/5Xmt8y7lCL

A few more quotes:

2/

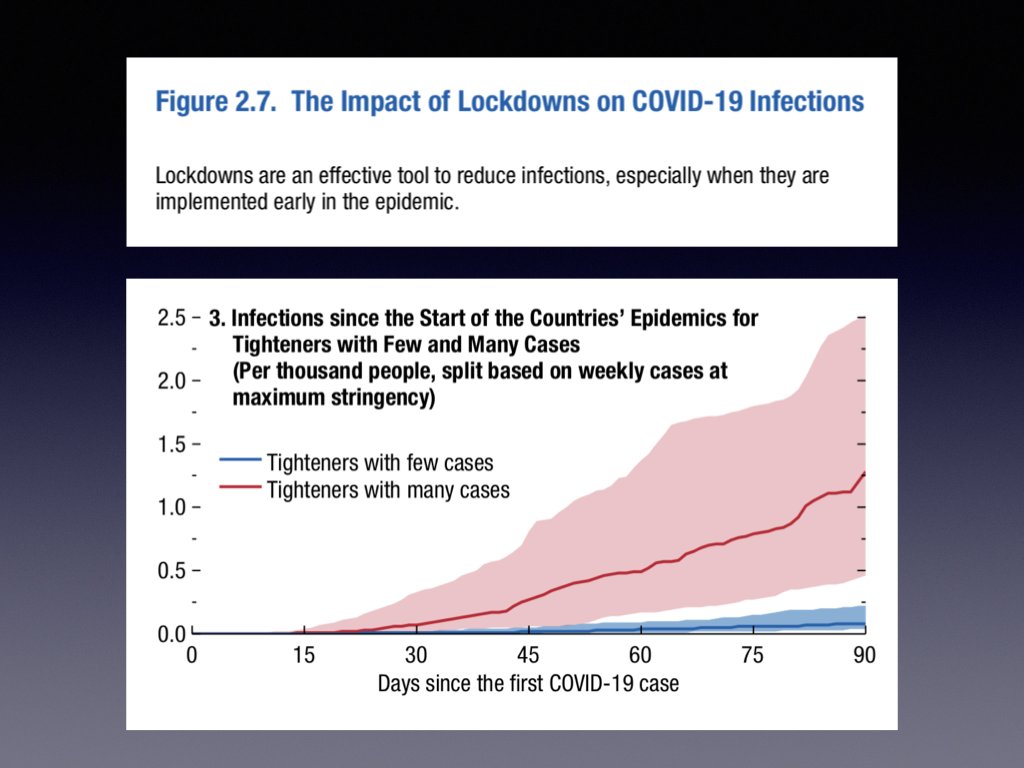

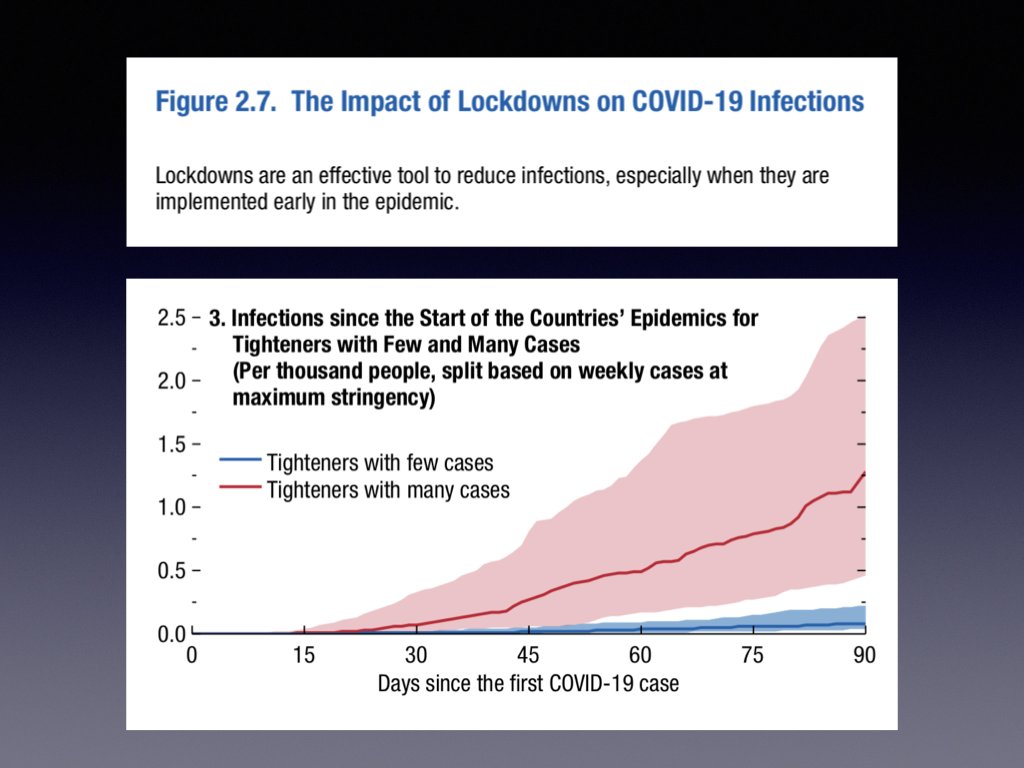

“The analysis also finds that lockdowns are powerful instruments to reduce infections, especially when they are introduced early in a country’s epidemic and when they are sufficiently stringent.”

3/

“lockdowns become progressively more effective in reducing COVID-19 cases when they become sufficiently stringent. Mild lockdowns appear instead ineffective at curbing infections.”

4/

“The results suggest that to achieve a given reduction in infections, policymakers may want to opt for stringent lockdowns over a shorter period rather than prolonged mild lockdowns...

5/

1/

Note: This report doesn’t do a dynamic analysis that makes things much clearer, but it does a thoughtful statistical analysis based upon increasingly available data.

https://t.co/5Xmt8y7lCL

A few more quotes:

2/

“The analysis also finds that lockdowns are powerful instruments to reduce infections, especially when they are introduced early in a country’s epidemic and when they are sufficiently stringent.”

3/

“lockdowns become progressively more effective in reducing COVID-19 cases when they become sufficiently stringent. Mild lockdowns appear instead ineffective at curbing infections.”

4/

“The results suggest that to achieve a given reduction in infections, policymakers may want to opt for stringent lockdowns over a shorter period rather than prolonged mild lockdowns...

5/

You May Also Like

Ivor Cummins has been wrong (or lying) almost entirely throughout this pandemic and got paid handsomly for it.

He has been wrong (or lying) so often that it will be nearly impossible for me to track every grift, lie, deceit, manipulation he has pulled. I will use...

... other sources who have been trying to shine on light on this grifter (as I have tried to do, time and again:

Example #1: "Still not seeing Sweden signal versus Denmark really"... There it was (Images attached).

19 to 80 is an over 300% difference.

Tweet: https://t.co/36FnYnsRT9

Example #2 - "Yes, I'm comparing the Noridcs / No, you cannot compare the Nordics."

I wonder why...

Tweets: https://t.co/XLfoX4rpck / https://t.co/vjE1ctLU5x

Example #3 - "I'm only looking at what makes the data fit in my favour" a.k.a moving the goalposts.

Tweets: https://t.co/vcDpTu3qyj / https://t.co/CA3N6hC2Lq

He has been wrong (or lying) so often that it will be nearly impossible for me to track every grift, lie, deceit, manipulation he has pulled. I will use...

... other sources who have been trying to shine on light on this grifter (as I have tried to do, time and again:

Ivor Cummins BE (Chem) is a former R&D Manager at HP (sourcre: https://t.co/Wbf5scf7gn), turned Content Creator/Podcast Host/YouTube personality. (Call it what you will.)

— Steve (@braidedmanga) November 17, 2020

Example #1: "Still not seeing Sweden signal versus Denmark really"... There it was (Images attached).

19 to 80 is an over 300% difference.

Tweet: https://t.co/36FnYnsRT9

Example #2 - "Yes, I'm comparing the Noridcs / No, you cannot compare the Nordics."

I wonder why...

Tweets: https://t.co/XLfoX4rpck / https://t.co/vjE1ctLU5x

Example #3 - "I'm only looking at what makes the data fit in my favour" a.k.a moving the goalposts.

Tweets: https://t.co/vcDpTu3qyj / https://t.co/CA3N6hC2Lq