Back with another #FreeLoveFriday. Last time, we covered how Mastercoin/@Omni_Layer pioneered digital asset issuance on blockchains. Today, let’s discuss @Chainlink and the vital role it plays in connecting blockchains to the real world.

Back with another #FreeLoveFriday. My first thread focused on what I love about Bitcoin, and features we borrowed for @AvalancheAVAX. Today, let's focus on @Omni_Layer, or as OGs knew it, Mastercoin https://t.co/fXFgmaeUEz

— Emin G\xfcn Sirer (@el33th4xor) January 15, 2021

More from Crypto

The vast majority of its success was fueled by #DeFi.

Here's what happened in 5 Tweets 🔽

1) Governance Tokens 🪙

Projects gave complete ownership of billion dollar protocols to their users, often using retroactive airdrops.

Early adopters earned tokens for past usage, and token-based voting now dictates all technical

It pays to be a web3 power user.

— Coopahtroopa \U0001f525_\U0001f525 (@Cooopahtroopa) December 9, 2020

Five networks that issued retroactive airdrops to value added actors \U0001f4dd

2) Liquidity Mining ⛏️

Power users were the first to earn on-going distribution by providing liquidity.

$COMP sparked the wave, with $BAL coining the term a few weeks

BAL is live!

— Balancer Labs (@BalancerLabs) June 23, 2020

The 435k BAL for liquidity providers of the first three weeks of liquidity mining (145k per week) have just been sent out to the wallets used to provide liquidity on Balancer.https://t.co/pkXFzwzPVC

3) Yield Faming 🌾

Projects coupled liquidity mining and governance tokens to boost 'yields' by combining lending rates with an incentive layer.

APYs peaked as high as 1M% during 'DeFi summer', leading to a 'food coin' craze like $YAM and

Check out @Cooopahtroopa's latest post for all the #DeFi farmers out there \U0001f468\u200d\U0001f33e

— Zerion \U0001f3e6 (@zerion_io) June 26, 2020

Turns out @synthetix_io & @CurveFinance were ploughing the fields long before $COMP & $BAL came along.

Learn how to put your #crypto to work with this #yieldfarming 101 \U0001f4b8

\U0001f449 https://t.co/zYUKtqx3BK

4) Fair Launches ✅

Who needs investment when you can launch using yield farming?

@iearnfinance debuted $YFI with no formal funding, seeding a community treasury for self-sustainability.

The notion of a core team and community became one and the

2/ What is a Fair Launch?

— fair launch capital (@fairlaunchcap) August 26, 2020

A FL enables founders to bootstrap new crypto networks that are earned, owned, and governed by their community from the outset.

In this dynamic, everyone participates on equal footing\u2014there is no early access, pre-mine, or allocation of tokens.

You May Also Like

🗓 Release date: October 30, 2018

📝 New Emojis: 158

https://t.co/bx8XjhiCiB

New in iOS 12.1: 🥰 Smiling Face With 3 Hearts https://t.co/6eajdvueip

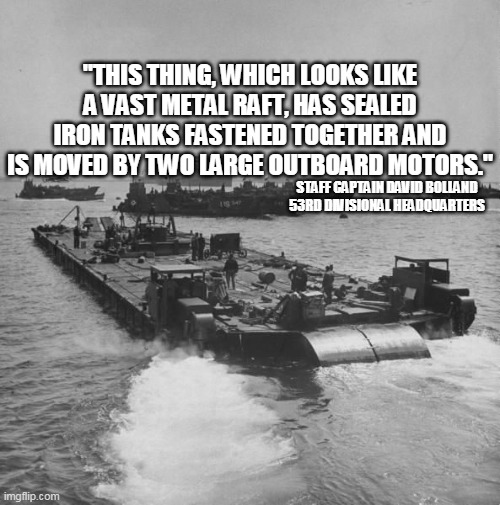

New in iOS 12.1: 🥵 Hot Face https://t.co/jhTv1elltB

New in iOS 12.1: 🥶 Cold Face https://t.co/EIjyl6yZrF

New in iOS 12.1: 🥳 Partying Face https://t.co/p8FDNEQ3LJ

Five billionaires share their top lessons on startups, life and entrepreneurship (1/10)

I interviewed 5 billionaires this week

— GREG ISENBERG (@gregisenberg) January 23, 2021

I asked them to share their lessons learned on startups, life and entrepreneurship:

Here's what they told me:

10 competitive advantages that will trump talent (2/10)

To outperform, you need serious competitive advantages.

— Sahil Bloom (@SahilBloom) March 20, 2021

But contrary to what you have been told, most of them don't require talent.

10 competitive advantages that you can start developing today:

Some harsh truths you probably don’t want to hear (3/10)

I\u2019ve gotten a lot of bad advice in my career and I see even more of it here on Twitter.

— Nick Huber (@sweatystartup) January 3, 2021

Time for a stiff drink and some truth you probably dont want to hear.

\U0001f447\U0001f447

10 significant lies you’re told about the world (4/10)

THREAD: 10 significant lies you're told about the world.

— Julian Shapiro (@Julian) January 9, 2021

On startups, writing, and your career: