I am not of the belief that this is going to be the "final cycle" where BTC soaks up the world's wealth, goes to $1 million and rewrites financial history. I do not think...

For the sake of a public record, I would like to lay out my prediction for how this next #Bitcoin #BTC #Crypto bull market plays out...

@RaoulGMI @PrestonPysh @AriDavidPaul

I am not of the belief that this is going to be the "final cycle" where BTC soaks up the world's wealth, goes to $1 million and rewrites financial history. I do not think...

The macro narrative is taking shape that BTC is a hedge against inflation, however...

In order to get secular, painful, obvious inflation I think that several things need to happen. We need a more accommodating government (MMT) which we don't...

At this point we don't have the system necessary to fire the fiscal bazookas fast enough to overcome the forces of deflation.

I think that we'll get a MMT government eventually, but it could take several years...

The Obama administration spent $400 million on a website that didn't work, how fast do we really believe the United States government is going to be able to create a 99.99999% reliable...

Who the hell knows, but it sure as hell isn't coming in 2021, 2022, or probably even 2023. A full rollout might not even happen till 2025 or 2026.

So without a...

Yet...

By that time the situation may be very, very different. Central bank printing will be off the charts, more than anyone imagines. There is MMT, UBI...

There may even be a pilot version of a CBDC, or at the very least the government has figured out how to quickly distribute $$$ to the people without using dead trees.

Against this macro backdrop I think BTC will...

Ironically, we've all heard the maxim that markets love to dole out maximum pain...

Those investors may be hesitant to buy BTC next cycle, since inflation never happened before...

More from Crypto

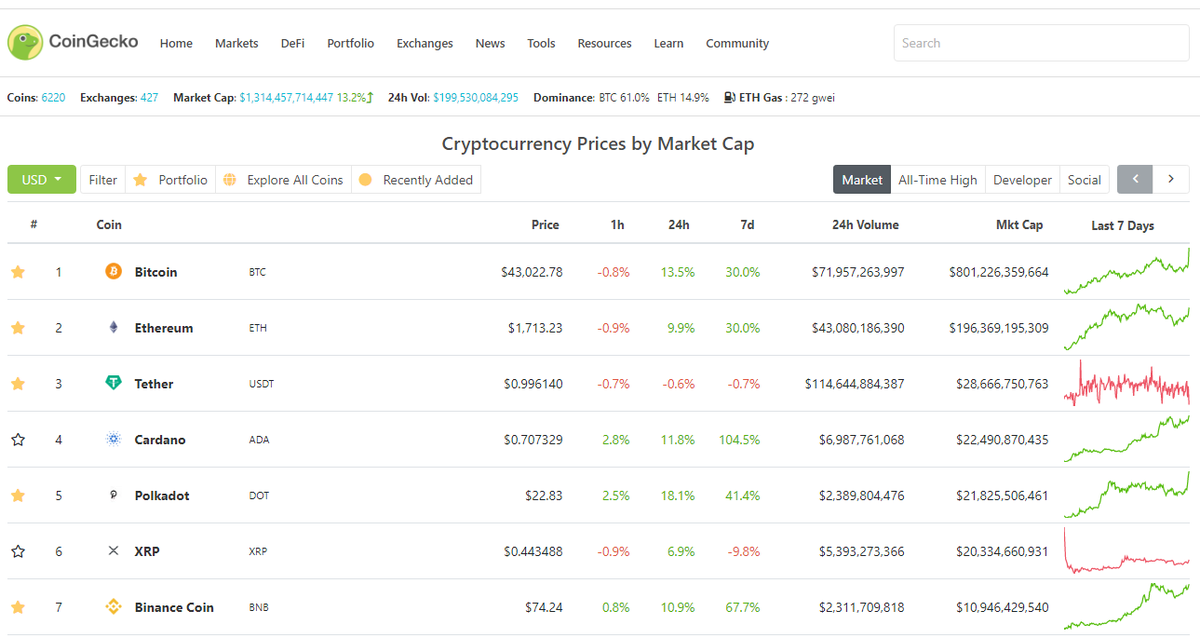

A primer on how to use @coingecko for your crypto data/research/trading needs.

Share it with a friend who needs it!

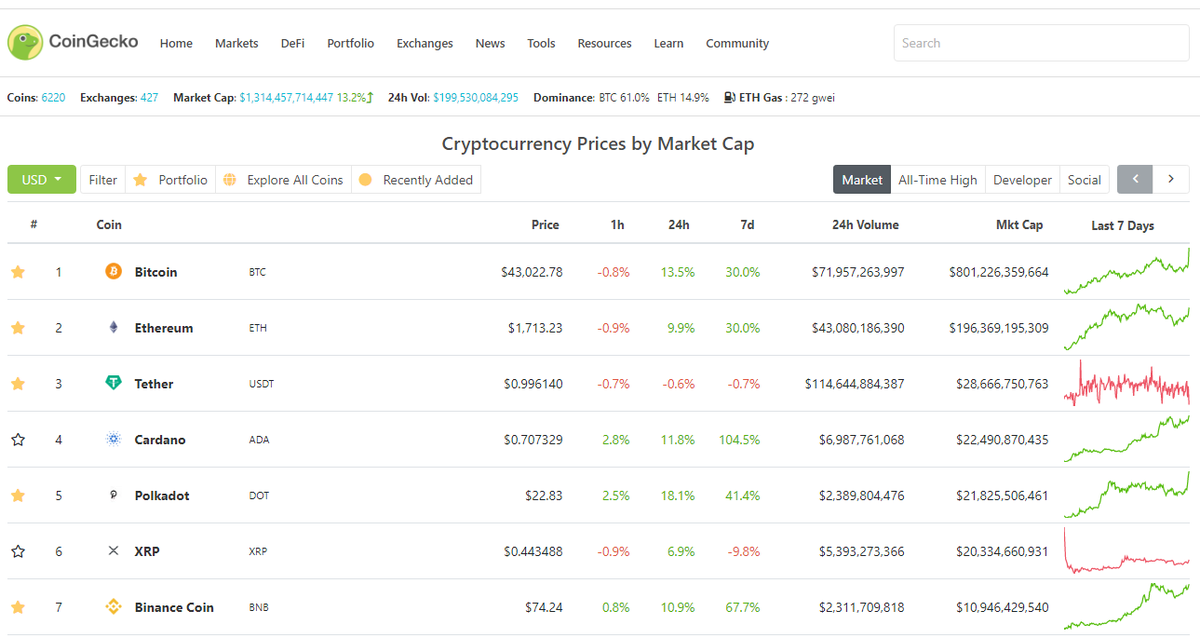

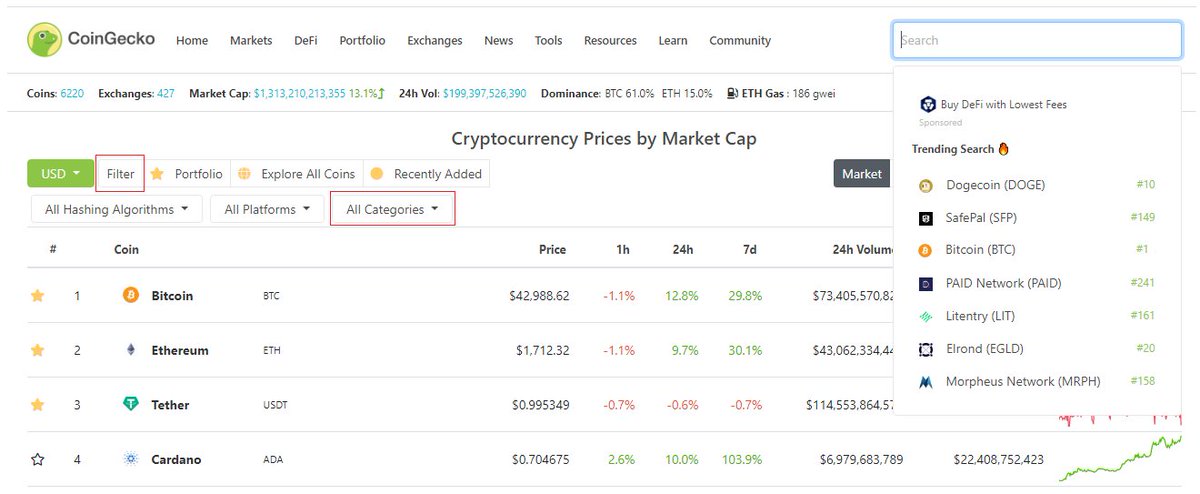

1/ Getting started with crypto and want to check prices/projects? https://t.co/LFnk4vukxj has info on just about every crypto you'll need :)

2/ Search over 6000+ cryptocurrencies available on the market. You can see what's trending in the space as well.

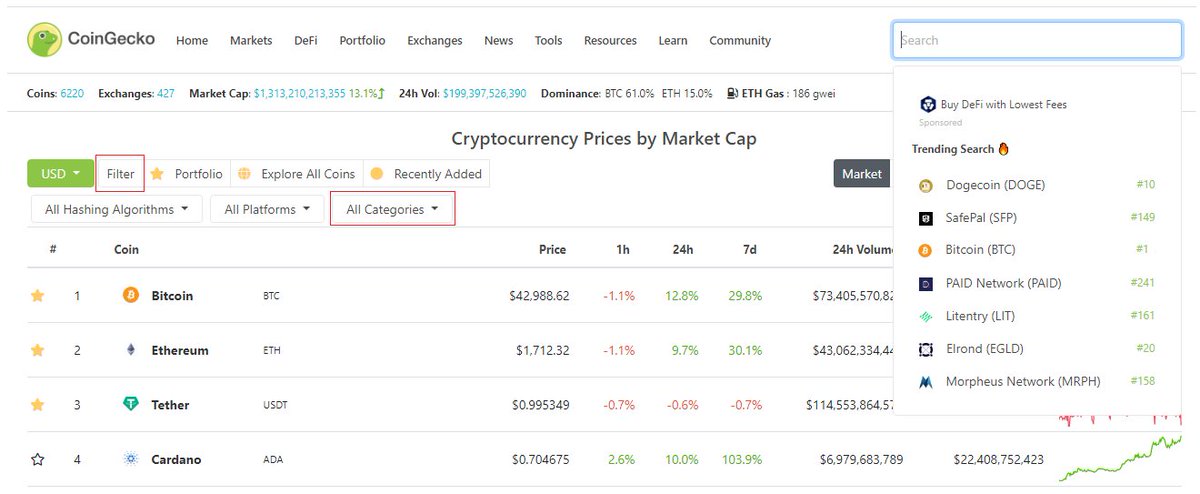

Researching by categories? Filter (left side) -> Select categories -> DeFi, DOT ecosystem, Exchange-based tokens, NFTs - anything!

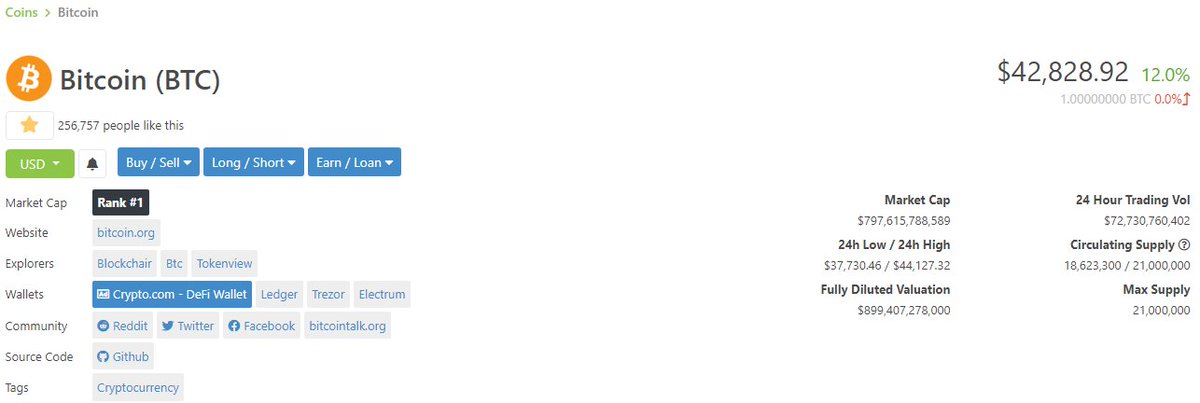

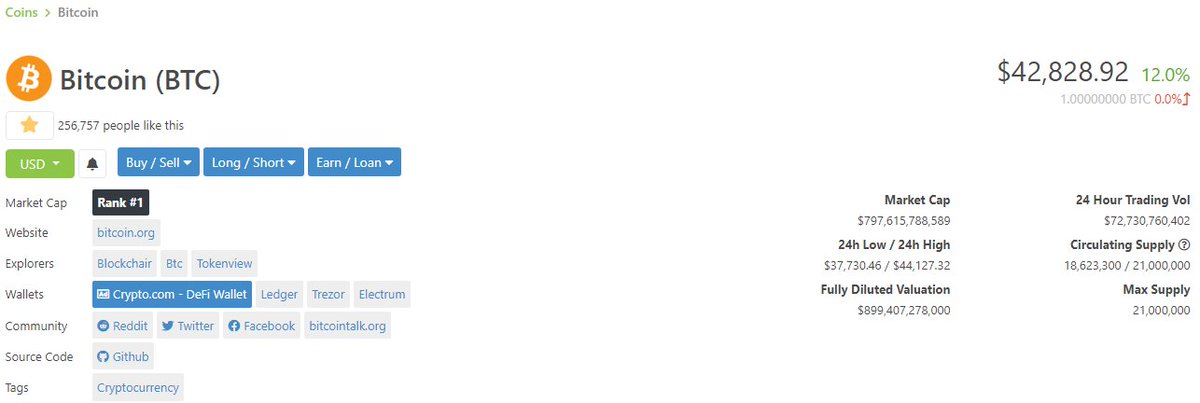

3/ Lets say you're looking at #Bitcoin https://t.co/g205lj03pG

At a glance you get:

- Price

- Mkt Capitalization (valuation)

- Circulating/Total supply

- 24h trading volume

- Links to websites, social media, block explorers

- Calculator

Next - check valuation?

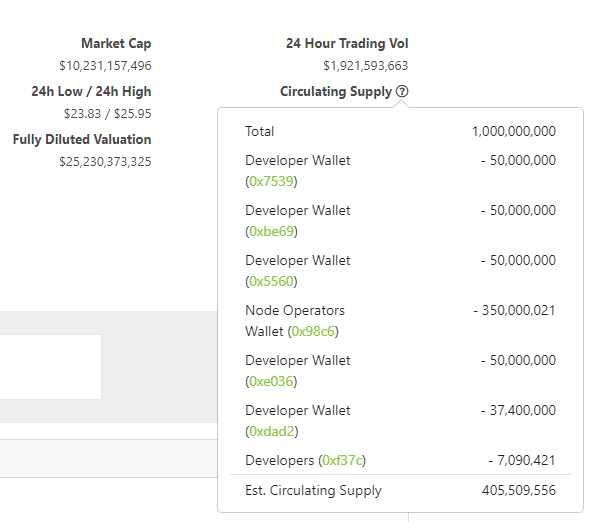

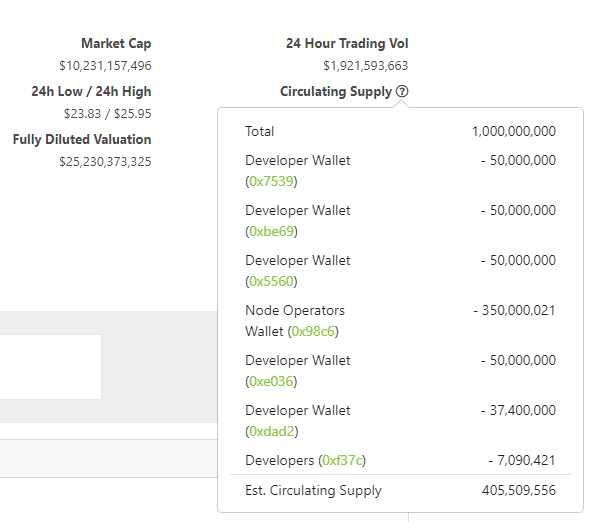

4/ Market cap is used to rank coins, and we'll show you how its calculated - Hover over Circulating Supply (?) for breakdown.

Note: used @chainlink as example here - https://t.co/Jc46fe79Ag

While MC is important also consider product fit, narrative, team, community etc.

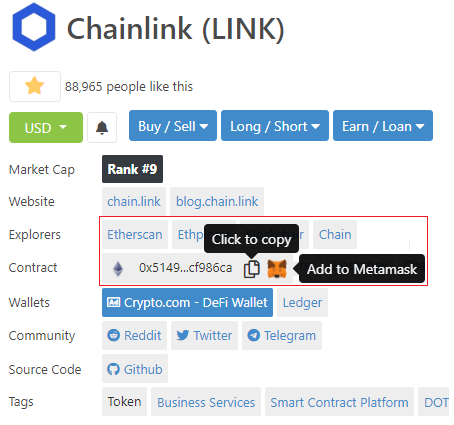

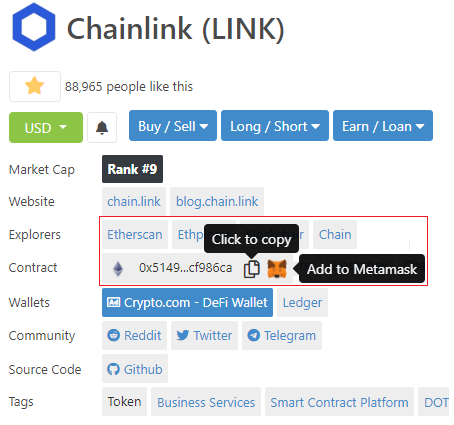

5/ If you're trading on AMMs like @Uniswap or @SushiSwap, you can copy the contract address directly to your clipboard.

Using @metamask_io? Add the token directly so it shows as one of the "Assets" that you own in the wallet.

See: https://t.co/94XihMf5oz

Share it with a friend who needs it!

1/ Getting started with crypto and want to check prices/projects? https://t.co/LFnk4vukxj has info on just about every crypto you'll need :)

2/ Search over 6000+ cryptocurrencies available on the market. You can see what's trending in the space as well.

Researching by categories? Filter (left side) -> Select categories -> DeFi, DOT ecosystem, Exchange-based tokens, NFTs - anything!

3/ Lets say you're looking at #Bitcoin https://t.co/g205lj03pG

At a glance you get:

- Price

- Mkt Capitalization (valuation)

- Circulating/Total supply

- 24h trading volume

- Links to websites, social media, block explorers

- Calculator

Next - check valuation?

4/ Market cap is used to rank coins, and we'll show you how its calculated - Hover over Circulating Supply (?) for breakdown.

Note: used @chainlink as example here - https://t.co/Jc46fe79Ag

While MC is important also consider product fit, narrative, team, community etc.

5/ If you're trading on AMMs like @Uniswap or @SushiSwap, you can copy the contract address directly to your clipboard.

Using @metamask_io? Add the token directly so it shows as one of the "Assets" that you own in the wallet.

See: https://t.co/94XihMf5oz

Introducing an effortless way to add tokens to your @metamask_io wallet \U0001f4e5

— CoinGecko (@coingecko) February 8, 2021

Skip the hassle of copying/pasting contract addresses to your wallet. Add an asset and it'll appear in your wallet with just a click - tap the \U0001f98a and try it out for yourself! pic.twitter.com/u26BA29ubs

"Blockchain technology is energy-intensive..." => No, it doesn't have to be.

Let's look at Proof-Of-Stake, an alternative to the energy-intensive Proof-Of-Work algorithm.

🧵🔽

1️⃣ A Quick Recap On Proof-Of-Work

A Proof-Of-Work algorithm requires miners to do a certain amount of work that is compute-intensive to gain access to a service or the right to do something. This algorithm, by design, also requires that the work done shall not ...

... be reusable for anything else than what it was performed for. This lies at the core of the security concept of a blockchain. To gain the right to append a new block to a chain and to get some currency as a reward, there is work to be done, and this work must be verifyable.

That work is a race between different miners. Many miners try to compete and to be the first to find the answer to a problem presented to them. This implies that a lot of energy is wasted as only the first correct solution is accepted.

You can find a more detailed thread on Proof-Of-Work

Let's look at Proof-Of-Stake, an alternative to the energy-intensive Proof-Of-Work algorithm.

🧵🔽

1️⃣ A Quick Recap On Proof-Of-Work

A Proof-Of-Work algorithm requires miners to do a certain amount of work that is compute-intensive to gain access to a service or the right to do something. This algorithm, by design, also requires that the work done shall not ...

... be reusable for anything else than what it was performed for. This lies at the core of the security concept of a blockchain. To gain the right to append a new block to a chain and to get some currency as a reward, there is work to be done, and this work must be verifyable.

That work is a race between different miners. Many miners try to compete and to be the first to find the answer to a problem presented to them. This implies that a lot of energy is wasted as only the first correct solution is accepted.

You can find a more detailed thread on Proof-Of-Work

Proof-Of-Work is the name of a cryptographic algorithm that is used for some blockchains when new blocks are to be appended to the chain.

— Oliver Jumpertz (@oliverjumpertz) April 3, 2021

Let's take a higher-level look at how this one works, shall we?

\U0001f9f5\U0001f53d

You May Also Like

“We don’t negotiate salaries” is a negotiation tactic.

Always. No, your company is not an exception.

A tactic I don’t appreciate at all because of how unfairly it penalizes low-leverage, junior employees, and those loyal enough not to question it, but that’s negotiation for you after all. Weaponized information asymmetry.

Listen to Aditya

And by the way, you should never be worried that an offer would be withdrawn if you politely negotiate.

I have seen this happen *extremely* rarely, mostly to women, and anyway is a giant red flag. It suggests you probably didn’t want to work there.

You wish there was no negotiating so it would all be more fair? I feel you, but it’s not happening.

Instead, negotiate hard, use your privilege, and then go and share numbers with your underrepresented and underpaid colleagues. […]

Always. No, your company is not an exception.

A tactic I don’t appreciate at all because of how unfairly it penalizes low-leverage, junior employees, and those loyal enough not to question it, but that’s negotiation for you after all. Weaponized information asymmetry.

Listen to Aditya

"we don't negotiate salaries" really means "we'd prefer to negotiate massive signing bonuses and equity grants, but we'll negotiate salary if you REALLY insist" https://t.co/80k7nWAMoK

— Aditya Mukerjee, the Otterrific \U0001f3f3\ufe0f\u200d\U0001f308 (@chimeracoder) December 4, 2018

And by the way, you should never be worried that an offer would be withdrawn if you politely negotiate.

I have seen this happen *extremely* rarely, mostly to women, and anyway is a giant red flag. It suggests you probably didn’t want to work there.

You wish there was no negotiating so it would all be more fair? I feel you, but it’s not happening.

Instead, negotiate hard, use your privilege, and then go and share numbers with your underrepresented and underpaid colleagues. […]

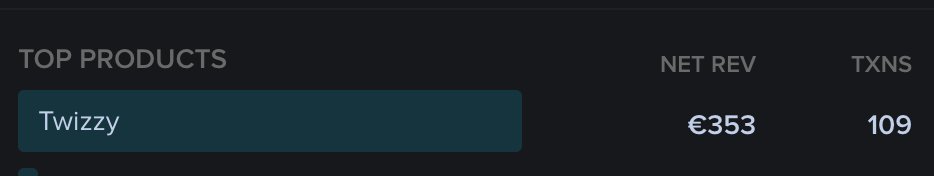

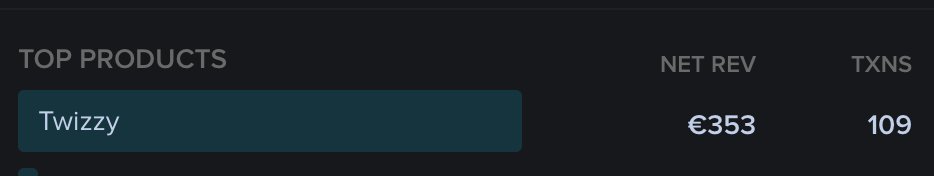

To people who are under the impression that you can get rich quickly by working on an app, here are the stats for https://t.co/az8F12pf02

📈 ~12000 vistis

☑️ 109 transactions

💰 353€ profit (285 after tax)

I have spent 1.5 months on this app. You can make more $ in 2 days.

🤷♂️

I'm still happy that I launched a paid app bcs it involved extra work:

- backend for processing payments (+ permissions, webhooks, etc)

- integration with payment processor

- UI for license activation in Electron

- machine activation limit

- autoupdates

- mailgun emails

etc.

These things seemed super scary at first. I always thought it was way too much work and something would break. But I'm glad I persisted. So far the only problem I have is that mailgun is not delivering the license keys to certain domains like https://t.co/6Bqn0FUYXo etc. 👌

omg I just realized that me . com is an Apple domain, of course something wouldn't work with these dicks

📈 ~12000 vistis

☑️ 109 transactions

💰 353€ profit (285 after tax)

I have spent 1.5 months on this app. You can make more $ in 2 days.

🤷♂️

I'm still happy that I launched a paid app bcs it involved extra work:

- backend for processing payments (+ permissions, webhooks, etc)

- integration with payment processor

- UI for license activation in Electron

- machine activation limit

- autoupdates

- mailgun emails

etc.

These things seemed super scary at first. I always thought it was way too much work and something would break. But I'm glad I persisted. So far the only problem I have is that mailgun is not delivering the license keys to certain domains like https://t.co/6Bqn0FUYXo etc. 👌

omg I just realized that me . com is an Apple domain, of course something wouldn't work with these dicks

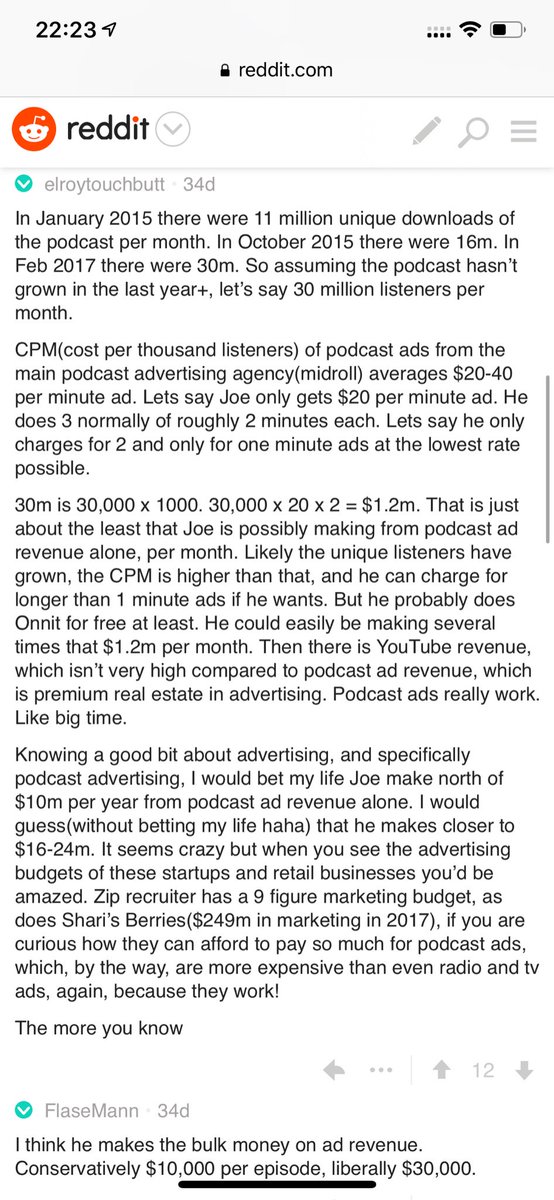

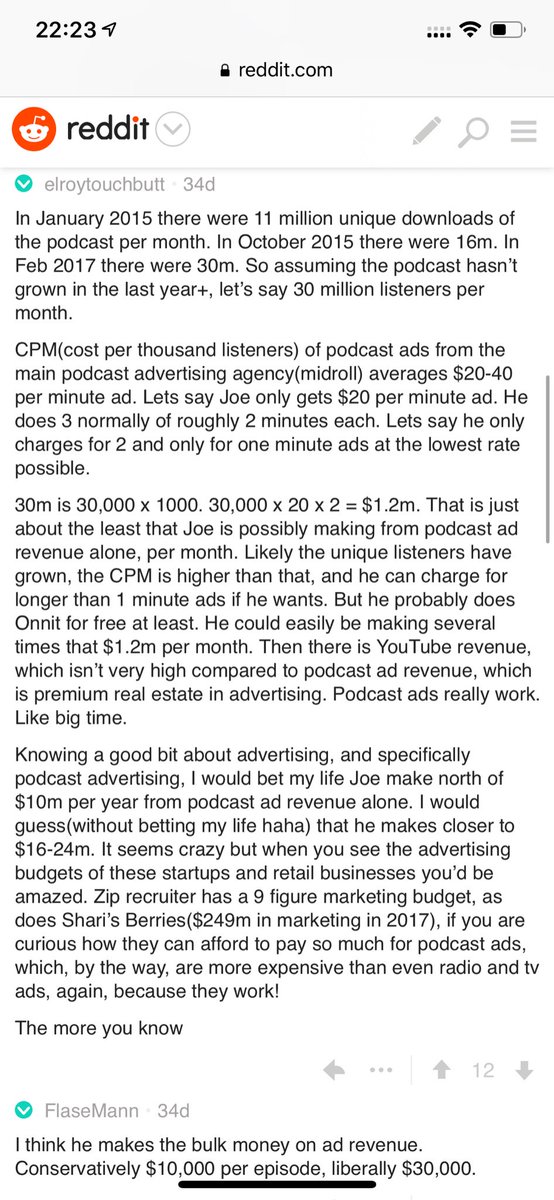

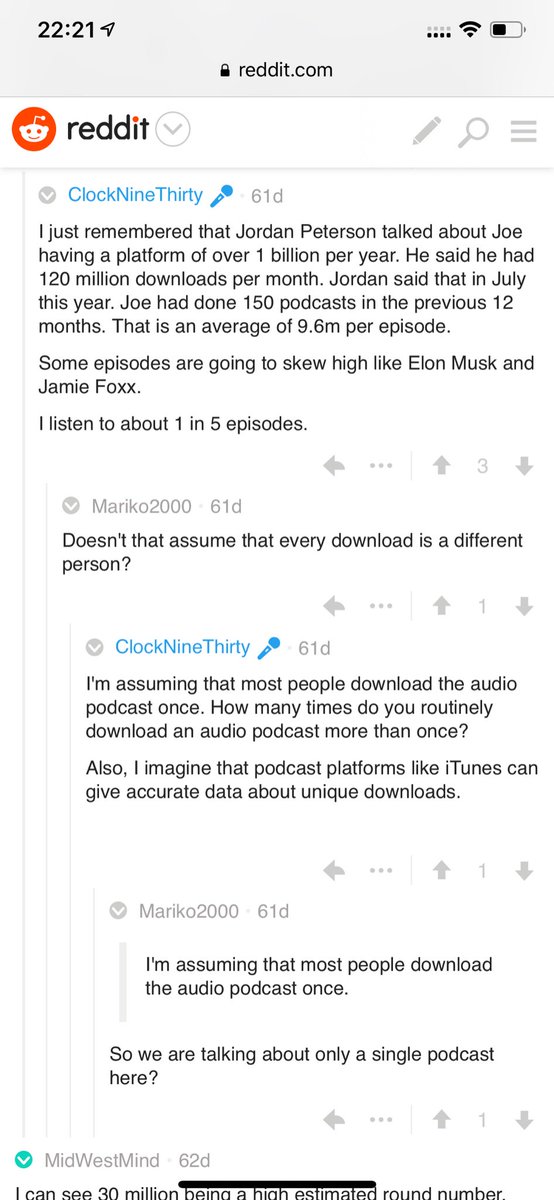

Joe Rogan's podcast is now is listened to 1.5+ billion times per year at around $50-100M/year revenue.

Independent and 100% owned by Joe, no networks, no middle men and a 100M+ people audience.

👏

https://t.co/RywAiBxA3s

Joe is the #1 / #2 podcast (depends per week) of all podcasts

120 million plays per month source https://t.co/k7L1LfDdcM

https://t.co/aGcYnVDpMu

Independent and 100% owned by Joe, no networks, no middle men and a 100M+ people audience.

👏

https://t.co/RywAiBxA3s

Joe is the #1 / #2 podcast (depends per week) of all podcasts

120 million plays per month source https://t.co/k7L1LfDdcM

https://t.co/aGcYnVDpMu