What happened to IEX can happen to CNXIT. Savdhaan rahe, satark rahe. Reiterating it again, every falling wedge/channel, RSI divergence is not a reversal signal.

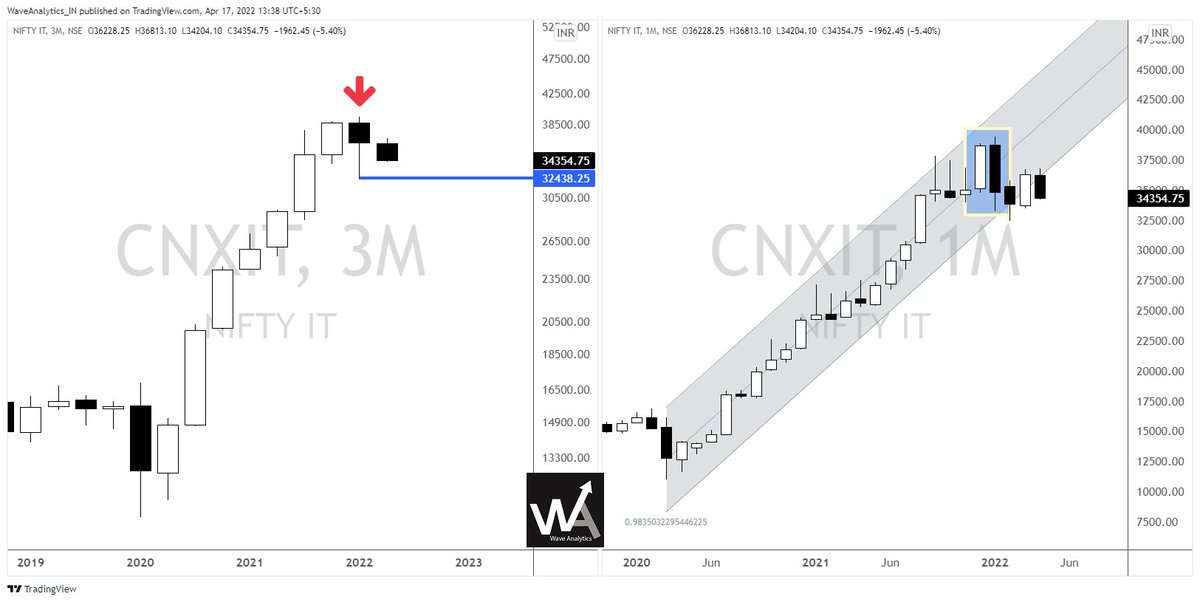

#CNXIT

Watching the marked zone to be tested. If it doesn't cross it, then most probably a parabolic downmove towards 24k. That would lead to even large caps cracking just like Small and Midcaps. #CNXIT https://t.co/FxbzP5vlBr pic.twitter.com/FSqcSqTQM9

— Aakash Gangwar (@akashgngwr823) June 21, 2022

More from Aakash Gangwar

#CNXIT https://t.co/bJeKTMoCji

The current formation might look like a falling wedge, but the way moving averages are placed, it looks like a falling wedge which can lead to a parabolic downmove for the marked target. #CNXIT pic.twitter.com/GmXOI3HmUN

— Aakash Gangwar (@akashgngwr823) May 10, 2022

Do read it completely to understand the stance and the plan.

This thread will present a highly probable scenario of markets for the upcoming months. Will update the scenario too if there is a significant change in view in between.

— Aakash Gangwar (@akashgngwr823) May 15, 2022

1/n https://t.co/jfWOyEgZyd

1. The moving average structure - Many traders just look at the 200 ma test or closing above/below it regardless of its slope. Let's look at all the interactions with 200 ma where price met it for the first time after the trend change but with 200 ma slope against it

One can clearly sense that currently it is one of those scenarios only. I understand that I might get trolled for this, but an unbiased mind suggests that odds are highly against the bulls for making fresh investments.

But markets are good at giving surprises. What should be our stance if price kept on rising? Let's understand that through charts. The concept is still the same. Divergent 200 ma and price move results in 200 ma test atleast once which gives good investment opportunities.

2. Zig-Zag bear market- There are two types of fall in a bear market, the first one is vertical fall which usually ends with ending diagonals (falling wedges) and the second one is zig zag one which usually ends with parabolic down moves.

More from Cnxitlongterm

#CNXIT https://t.co/w3qedea7T6

Almost there. Quick move. It can spend time over here before the next leg of fall. Let's see.#NIFTYIT https://t.co/GOB28HRvMp pic.twitter.com/6sNc7j8gEU

— Aakash Gangwar (@akashgngwr823) March 9, 2022

Weekly chart.

Each Fibonacci retracement level shown in #box likely to be tested in time to come.

#Perspective https://t.co/aDDZJV2KE3

#CNXIT-36442#NiFTY IT

— Waves_Perception(Dinesh Patel) \u092e\u0948\u0902Schedule Tribe) (@idineshptl) March 25, 2022

Weekly chart.

Objective is to creat lower top against ATH.(39446.70)

MACD showing negative divergence. Attract selling pressure in time to come.#Probability pic.twitter.com/hPx8SMpeoo

You May Also Like

Five billionaires share their top lessons on startups, life and entrepreneurship (1/10)

I interviewed 5 billionaires this week

— GREG ISENBERG (@gregisenberg) January 23, 2021

I asked them to share their lessons learned on startups, life and entrepreneurship:

Here's what they told me:

10 competitive advantages that will trump talent (2/10)

To outperform, you need serious competitive advantages.

— Sahil Bloom (@SahilBloom) March 20, 2021

But contrary to what you have been told, most of them don't require talent.

10 competitive advantages that you can start developing today:

Some harsh truths you probably don’t want to hear (3/10)

I\u2019ve gotten a lot of bad advice in my career and I see even more of it here on Twitter.

— Nick Huber (@sweatystartup) January 3, 2021

Time for a stiff drink and some truth you probably dont want to hear.

\U0001f447\U0001f447

10 significant lies you’re told about the world (4/10)

THREAD: 10 significant lies you're told about the world.

— Julian Shapiro (@Julian) January 9, 2021

On startups, writing, and your career: