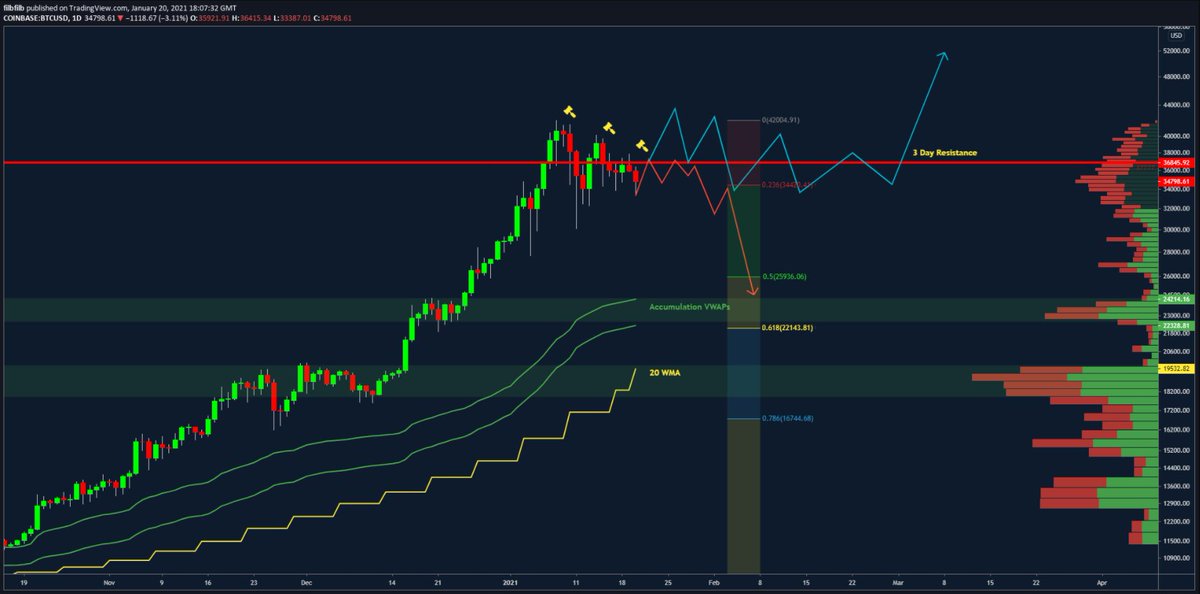

- Demand at low $30s was tested today and has since bounced & Coinbase led price on the drop

- Market structure is complex - Triangle is misleading

- Lots of orders stacked @ 30-33k.

ECB President Christine Lagarde called for global regulation of #Bitcoin, saying the digital currency had been used for money laundering activities in some instances and that any loopholes needed to be closed. Follow #ReutersNext updates here: https://t.co/4MgFy4jnw5 pic.twitter.com/qlBtoDuZLW

— Reuters (@Reuters) January 13, 2021

My $BTC short-term view after long deliberation and some flip flopping is rangebound in 30K-40K until the curve and vols come off a further. Then, 50K. I wouldn't be surprised if 30K is briefly breached but the risk is to the upside. Those calling for 20K missing the big picture.

— Alex (@classicmacro) January 12, 2021

Bad ballot design led to a lot of undervotes for Bill Nelson in Broward Co., possibly even enough to cost him his Senate seat. They do appear to be real undervotes, though, instead of tabulation errors. He doesn't really seem to have a path to victory. https://t.co/utUhY2KTaR

— Nate Silver (@NateSilver538) November 16, 2018