$BTC: Two Bitcoin FUDs to address this Thanksgiving weekend:

1. China PlusToken FUD: Old news. Please see linked thread.

2. U.S. Treasury FUD: Read thread below...

$BTC:

— David Puell (@kenoshaking) November 27, 2020

1/ So here's the deal with all the PlusToken news we've been seeing recently in the crypto media. Thing is, tho it's just being reported now after the Chinese government put out official balances, @ErgoBTC blew this story open for the on-chain community over a year ago... https://t.co/epNjZaNcJ1

a. Armstrong's analysis is correct. And I would go further in saying, this regulation would leave the U.S. severely handicapped to continue to be the leader in the cryptocurrency industry worldwide.

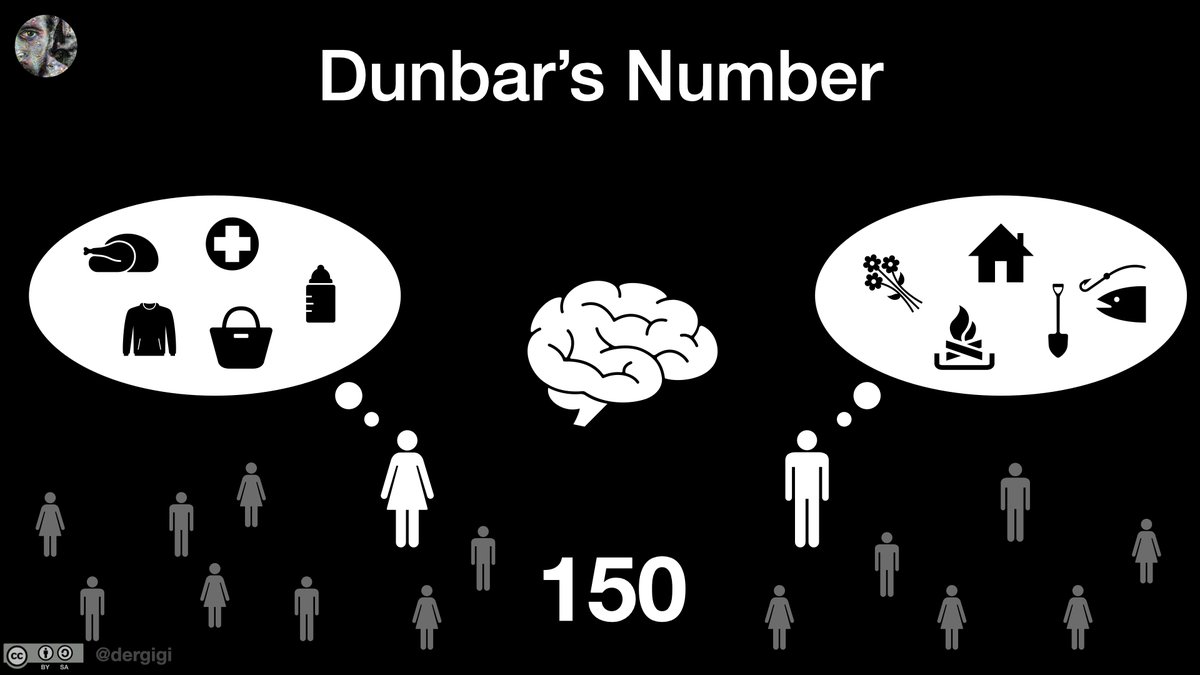

The former see the value of Bitcoin as a mechanism to protect individuals against government overreach, as well as save and invest their property in a permissionless manner.

Conservationists will continue to HODL (with the added incentive of keeping their coins burried for no-one to find, so even less sell pressure there).

Privacy and ownsership, even more so than price, will be the most contested subjects in Bitcoin in the next few years.

More from Bitcoin

The is no Devcoin Gold yet. But then again, we've never been one to "peg" to anything. I came across an interesting article about 'recreating' addresses with Bgold that @bitcoincoreorg cut out since 0.13.0 - perhaps one day we can do a similar thing in future Devcoin software :)

https://t.co/cv4UqsaVAK

That being said I hold some Doge @blockio in an "A-" address myself after 0. 1. "9-" versions :). Don't believe Bitcoin Core the Coin (Utility) is the only visible value on Core chain. Color me crazy. I believe in script. And FOSS that is used to export📜

And that's just a guy @MeniRosenfeld who put his identity and ideas out in the public to build a Web of Trust back when the web was much less of a safe place. His identity at stake and the implementation of a branch in source code by another unsung hero @killerstorm reveals value

Some of those who set up our bright future quietly implemented it in a branch on the main source code before it was officially the Bitcoin Core main repository, before a "Bitcoin Core" entity existed

Just because Bitcoin Core nodes dominate and do not read "smart" colored satoshis or display them, doesn't mean they do not exist on chain. The example of recreating P2WSH-over-P2SH address from BTC https://t.co/ZWSP2MO5bY wallets in Bitcoin Core Gold I shared proves -rescan's $

https://t.co/cv4UqsaVAK

That being said I hold some Doge @blockio in an "A-" address myself after 0. 1. "9-" versions :). Don't believe Bitcoin Core the Coin (Utility) is the only visible value on Core chain. Color me crazy. I believe in script. And FOSS that is used to export📜

And that's just a guy @MeniRosenfeld who put his identity and ideas out in the public to build a Web of Trust back when the web was much less of a safe place. His identity at stake and the implementation of a branch in source code by another unsung hero @killerstorm reveals value

Some of those who set up our bright future quietly implemented it in a branch on the main source code before it was officially the Bitcoin Core main repository, before a "Bitcoin Core" entity existed

Just because Bitcoin Core nodes dominate and do not read "smart" colored satoshis or display them, doesn't mean they do not exist on chain. The example of recreating P2WSH-over-P2SH address from BTC https://t.co/ZWSP2MO5bY wallets in Bitcoin Core Gold I shared proves -rescan's $

Another #FreeLoveFriday. So far, I’ve covered Bitcoin, Mastercoin/Omni, and last week ChainLink and the importance of decentralized oracles. Today, let’s talk about one of the most fascinating projects in crypto - @MakerDAO

In my thread about Mastercoin, I briefly touched on the vital role fiat-backed stablecoins play in crypto markets, but there’s a catch with them:

The counterparty risk of a third-party holding fiat in reserves.

Enter MakerDAO, which set out to create a decentralized, collateral-backed cryptocurrency, DAI, that would be “soft-pegged” to the U.S. Dollar using the power of algorithms. In crypto tradition, its supporters said trust game theory, not operators.

In 2017, MakerDAO published a whitepaper describing a system where anyone could create DAI by leveraging ETH as collateral to create Collateralized Debt Positions. Essentially, you take out a digital USD loan against your crypto.

The game theory of the system is structured such that DAI issuance is controlled to keep the price pegged to $1.00. In essence, it buffers the fluctuations of the underlying collateral to create a synthetic dollar bill.

Back with another #FreeLoveFriday. Last time, we covered how Mastercoin/@Omni_Layer pioneered digital asset issuance on blockchains. Today, let\u2019s discuss @Chainlink and the vital role it plays in connecting blockchains to the real world. https://t.co/0poYIBtGrt

— Emin G\xfcn Sirer (@el33th4xor) January 22, 2021

In my thread about Mastercoin, I briefly touched on the vital role fiat-backed stablecoins play in crypto markets, but there’s a catch with them:

The counterparty risk of a third-party holding fiat in reserves.

Enter MakerDAO, which set out to create a decentralized, collateral-backed cryptocurrency, DAI, that would be “soft-pegged” to the U.S. Dollar using the power of algorithms. In crypto tradition, its supporters said trust game theory, not operators.

In 2017, MakerDAO published a whitepaper describing a system where anyone could create DAI by leveraging ETH as collateral to create Collateralized Debt Positions. Essentially, you take out a digital USD loan against your crypto.

The game theory of the system is structured such that DAI issuance is controlled to keep the price pegged to $1.00. In essence, it buffers the fluctuations of the underlying collateral to create a synthetic dollar bill.