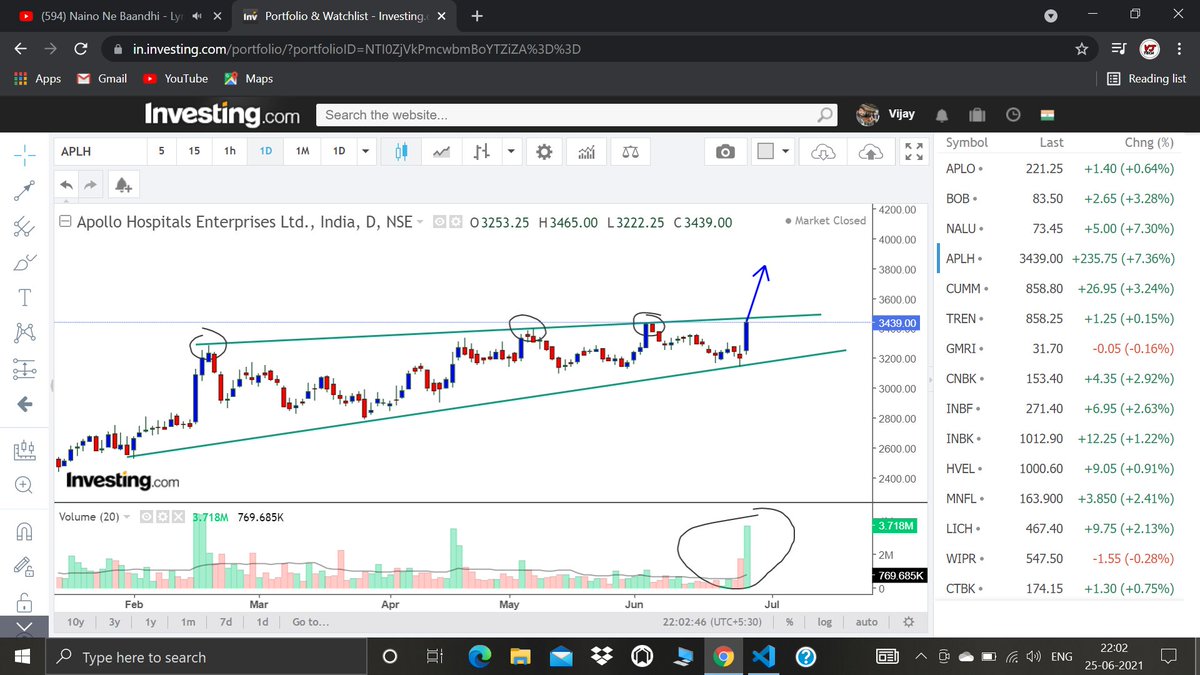

Option Buying watchlist with destination and SL mentioned.

1. SRT Finance

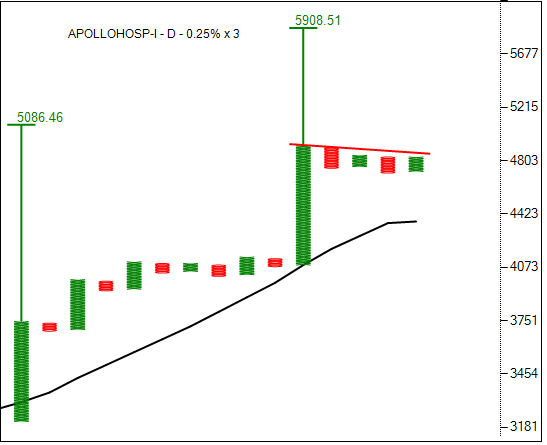

2. Apollo Hospital

3. India Cement

4. Bandhan Bank

More from Aakash Gangwar

Time for a new thread on the possibilities I am looking for.

Do read it completely to understand the stance and the plan.

1. The moving average structure - Many traders just look at the 200 ma test or closing above/below it regardless of its slope. Let's look at all the interactions with 200 ma where price met it for the first time after the trend change but with 200 ma slope against it

One can clearly sense that currently it is one of those scenarios only. I understand that I might get trolled for this, but an unbiased mind suggests that odds are highly against the bulls for making fresh investments.

But markets are good at giving surprises. What should be our stance if price kept on rising? Let's understand that through charts. The concept is still the same. Divergent 200 ma and price move results in 200 ma test atleast once which gives good investment opportunities.

2. Zig-Zag bear market- There are two types of fall in a bear market, the first one is vertical fall which usually ends with ending diagonals (falling wedges) and the second one is zig zag one which usually ends with parabolic down moves.

Do read it completely to understand the stance and the plan.

This thread will present a highly probable scenario of markets for the upcoming months. Will update the scenario too if there is a significant change in view in between.

— Aakash Gangwar (@akashgngwr823) May 15, 2022

1/n https://t.co/jfWOyEgZyd

1. The moving average structure - Many traders just look at the 200 ma test or closing above/below it regardless of its slope. Let's look at all the interactions with 200 ma where price met it for the first time after the trend change but with 200 ma slope against it

One can clearly sense that currently it is one of those scenarios only. I understand that I might get trolled for this, but an unbiased mind suggests that odds are highly against the bulls for making fresh investments.

But markets are good at giving surprises. What should be our stance if price kept on rising? Let's understand that through charts. The concept is still the same. Divergent 200 ma and price move results in 200 ma test atleast once which gives good investment opportunities.

2. Zig-Zag bear market- There are two types of fall in a bear market, the first one is vertical fall which usually ends with ending diagonals (falling wedges) and the second one is zig zag one which usually ends with parabolic down moves.

Reasons-

1. Long term channel top.

2. Curvature shift of 20 and 50 WMA along with price hitting 20 WMA frequently.

3. Overall weakness in IT sector.

4. For reference, study reliance top in August 2020, study Nasdaq Weekly chart and the top made in Nov 2021.

#tataelxi https://t.co/RmJa5LrdAP

1. Long term channel top.

2. Curvature shift of 20 and 50 WMA along with price hitting 20 WMA frequently.

3. Overall weakness in IT sector.

4. For reference, study reliance top in August 2020, study Nasdaq Weekly chart and the top made in Nov 2021.

#tataelxi https://t.co/RmJa5LrdAP

I have traded the current fav Tata Elxi from 2200 to 4500. No regret on missing out rest of the move because I am not an investor. Now there are many technical red flags. I might be trolled but 10.5k looks max target while 5k or 3-4 years of sideways looks inevitable.#tataelxi

— Aakash Gangwar (@akashgngwr823) March 26, 2022

Won't be surprised to see 300 in KPIT this year.

#KPITTECH https://t.co/qPLH3li2Yy

#KPITTECH https://t.co/qPLH3li2Yy

Charts for reference. During a downtrend, news based buying is an opportunity to make an exit in most of the cases. #KPITTECH #Hikal https://t.co/63WBMFZ6BT pic.twitter.com/OgWzulTXiD

— Aakash Gangwar (@akashgngwr823) April 27, 2022