The cash flow statement is presented in the quarterly and annual company filings

Most people want to be an investor

But most investors don’t know how to read a cash flow statement

Here’s how to read a cash flow statement:

The cash flow statement is presented in the quarterly and annual company filings

-Is operating cash flow positive or negative? (Positive)

-Is capital expenditures less than OCF? (Yes)

-Is the company buying back stock or issuing new shares? (Buying back)

These are 3 simple questions to ask yourself before reading one

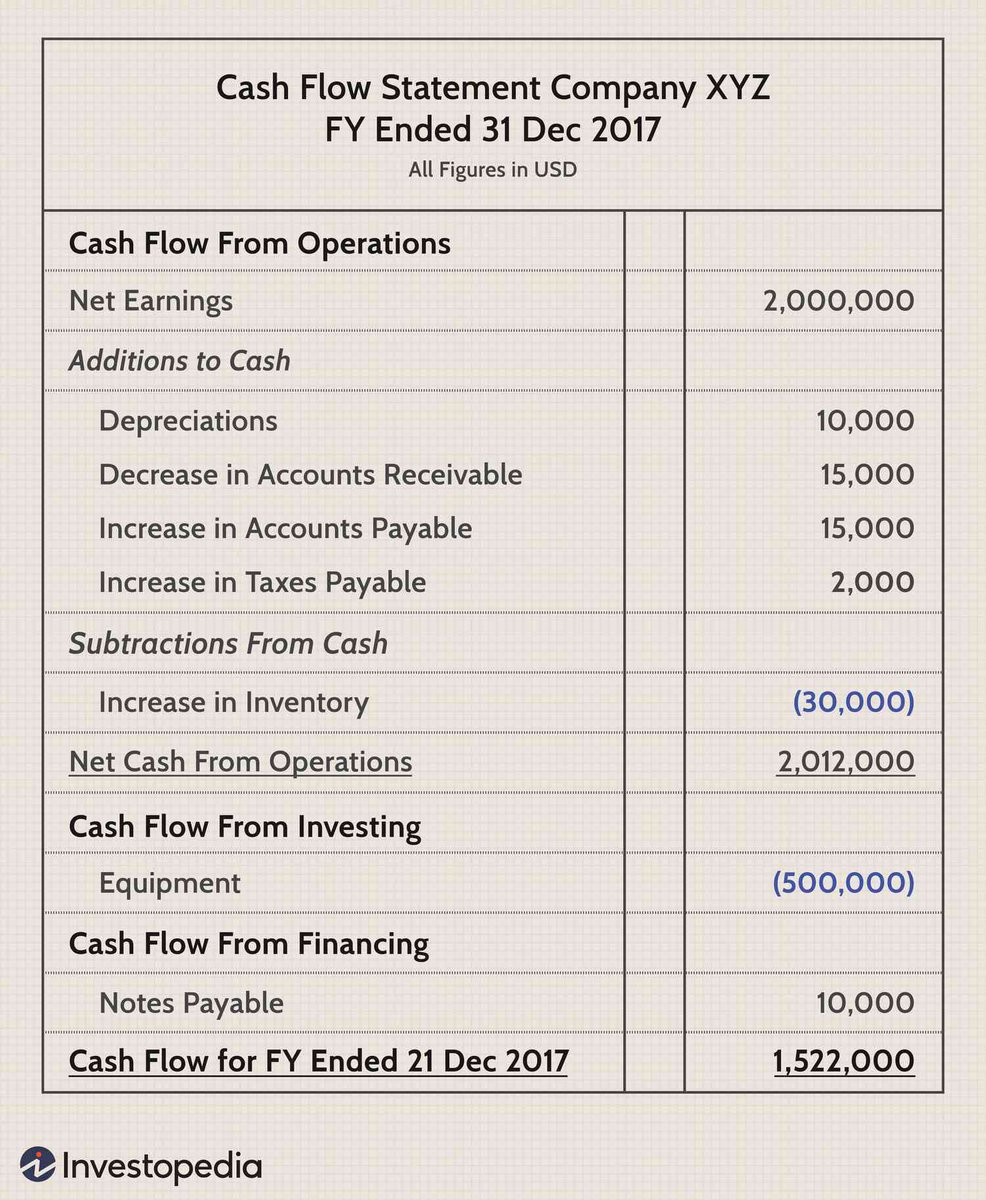

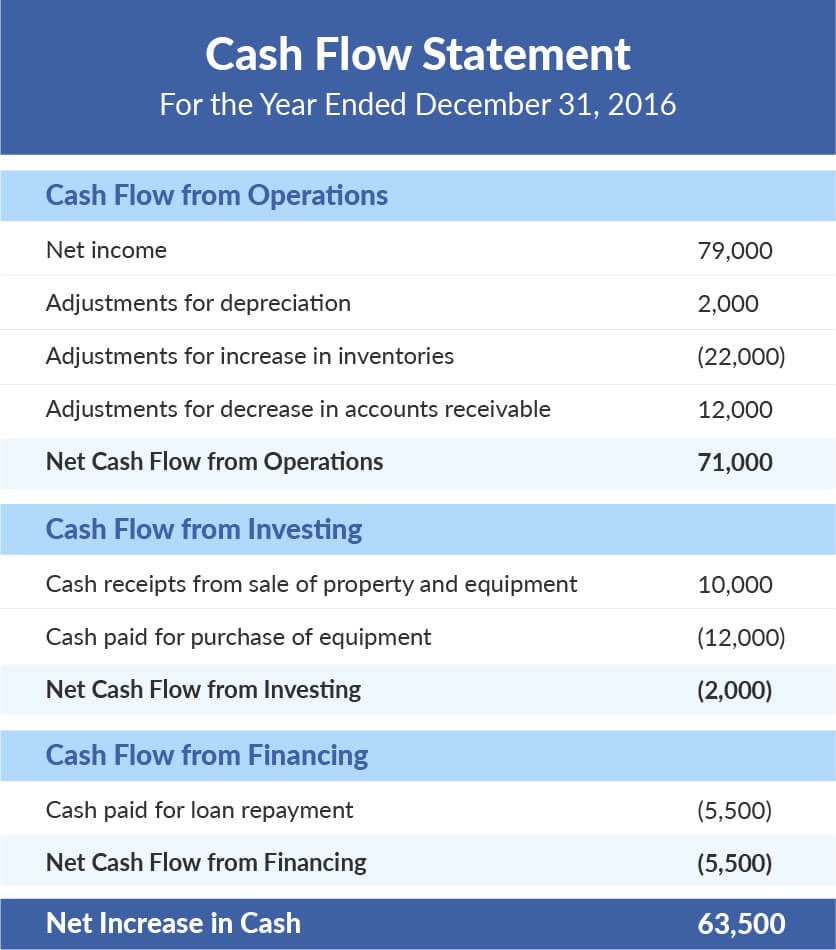

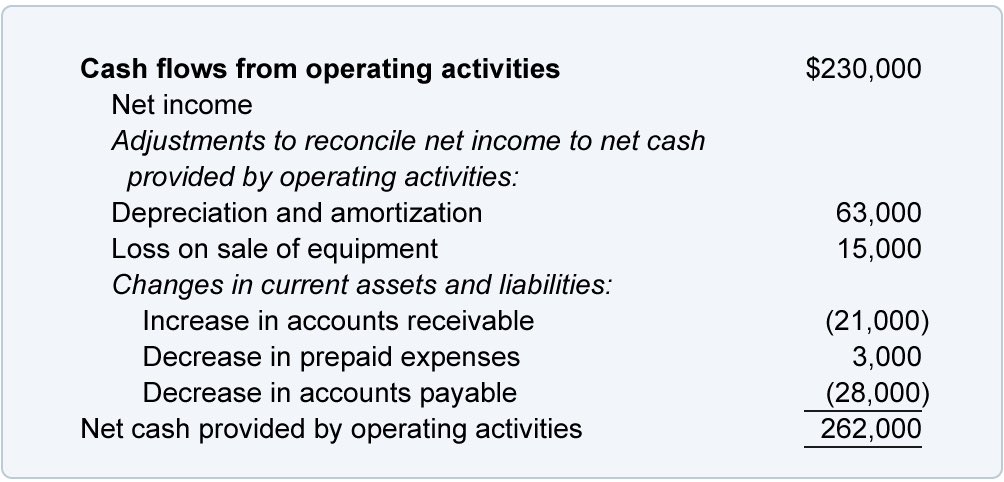

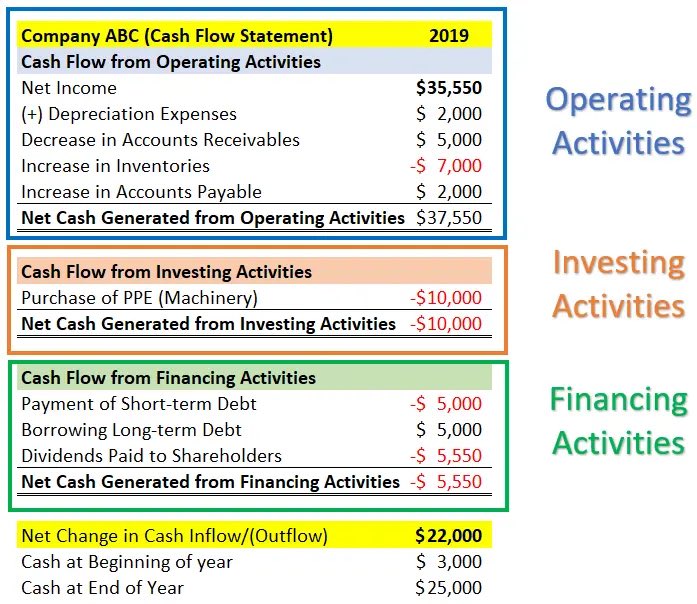

-Cash from operating activities

-Cash from investing activities

-Cash from financing activities

These are the 3 main components of every cash flow statement.

Cash flows from operating activities explains the cash flows within the business for its normal operations over a particular period.

This will show whether a company is capable of generating positive cash flow to maintain and grow its operations.

The most important thing when looking at operating activities is to make sure the number is positive.

If the number is positive this means it is generating more money than it’s spending for the normal operations.

If the number is negative this means the company could be in major long term trouble. They will most likely have to take on debt to fund their company.

If a company is taking on debt to fund their operations, they will not survive

Cash flows from investing activities comes from the profit and losses from investments that the company has made

Any long-term physical or intangible asset that the company expects to deliver value in the future will be included

Common line items in this section include:

-Purchase of Property, Plant, and Equipment (PP&E)

-Proceeds from disposal of PPE

-Proceeds from sell of stocks

-Acquisitions

Cash Flow from financing activities explains the cash flows used to fund the company’s operations and payback their shareholders along with creditors

Common line items include:

-Borrowing of long-term debt

-Repayment of Long-term debt

-Repayment of short-term debt

-Proceeds from stock options

-Proceeds from stock offering

-Repurchases of Common Stock

-Dividends Paid

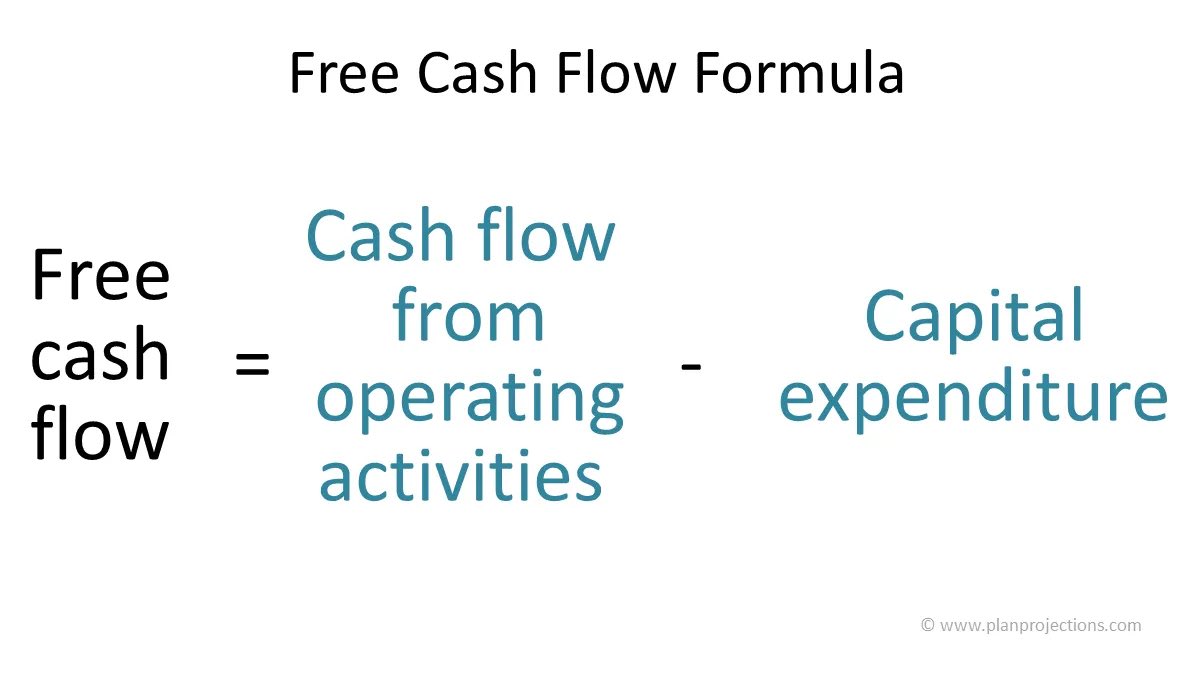

The most important numbers you can gather from the cash flow statement is free cash flow

FCF tells investors and analysts how much cash a business generates after growing and maintaining it’s business

This cash can be paid to shareholders as a dividend, be used to pay down debt, buyback shares or to just keep as cash on balance sheet

This is a very important metric to gauge when valuing a stock

You should look for a company with FCF of 10%+

Learning how to read and analyze these are crucial when purchasing individual stocks

In closing, the cash flow statement shows how much cash different activities generate (or cost) a particular business over time

If you enjoyed this twitter thread:

-RT my first tweet

-Follow me @investmattallen

-Subscribe to my newsletter

I tweet things like this everyday to help people create generational wealth

Typically a 5-minute read and free, it’s a no brainer :)

Sign up:

https://t.co/aDWX11a7g9

More from All

You May Also Like

1/Politics thread time.

To me, the most important aspect of the 2018 midterms wasn't even about partisan control, but about democracy and voting rights. That's the real battle.

2/The good news: It's now an issue that everyone's talking about, and that everyone cares about.

3/More good news: Florida's proposition to give felons voting rights won. But it didn't just win - it won with substantial support from Republican voters.

That suggests there is still SOME grassroots support for democracy that transcends

4/Yet more good news: Michigan made it easier to vote. Again, by plebiscite, showing broad support for voting rights as an

5/OK, now the bad news.

We seem to have accepted electoral dysfunction in Florida as a permanent thing. The 2000 election has never really

To me, the most important aspect of the 2018 midterms wasn't even about partisan control, but about democracy and voting rights. That's the real battle.

2/The good news: It's now an issue that everyone's talking about, and that everyone cares about.

3/More good news: Florida's proposition to give felons voting rights won. But it didn't just win - it won with substantial support from Republican voters.

That suggests there is still SOME grassroots support for democracy that transcends

4/Yet more good news: Michigan made it easier to vote. Again, by plebiscite, showing broad support for voting rights as an

5/OK, now the bad news.

We seem to have accepted electoral dysfunction in Florida as a permanent thing. The 2000 election has never really

Bad ballot design led to a lot of undervotes for Bill Nelson in Broward Co., possibly even enough to cost him his Senate seat. They do appear to be real undervotes, though, instead of tabulation errors. He doesn't really seem to have a path to victory. https://t.co/utUhY2KTaR

— Nate Silver (@NateSilver538) November 16, 2018