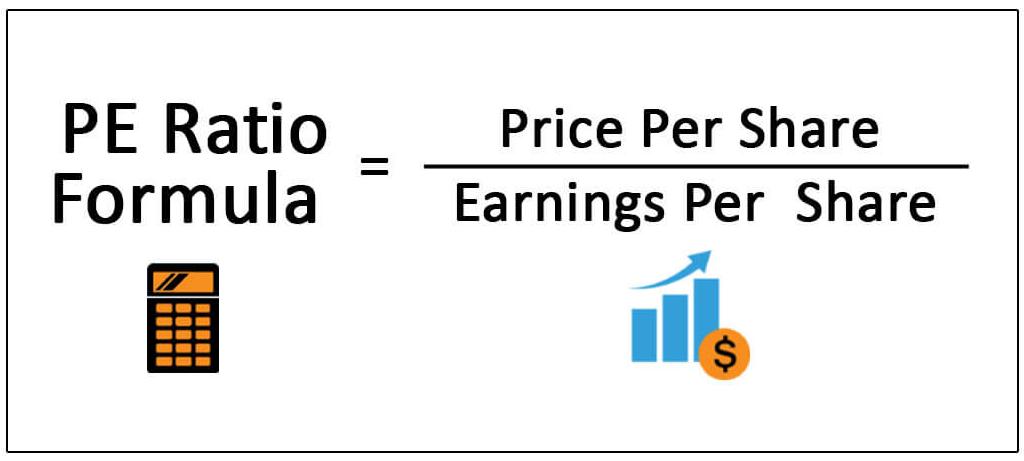

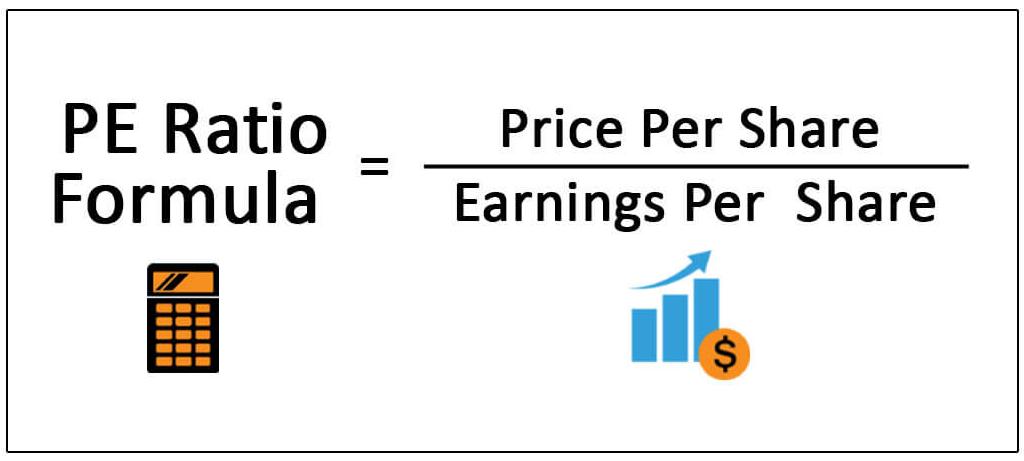

Price to Earnings (#PE) ratio, also known as price multiple or earnings multiple is the ratio obtained by dividing the current share price by earnings per share (#EPS).

#StockMarket #Investing #FundamentalAnalysis

It's simple, if ""FY23 PAT of this API to CDMO = FY21 PAT of largest pure-play CDMO/API"" then the FY23 Mcap of this API/CDMO= FY21 Mcap of largest pure-play CDMO/API, am I correct Sajal saab??

— richman (@greatrichman3) June 14, 2021

If everyone was holding bitcoin on the old x86 in their parents basement, we would be finding a price bottom. The problem is the risk is all pooled at a few brokerages and a network of rotten exchanges with counter party risk that makes AIG circa 2008 look like a good credit.

— Greg Wester (@gwestr) November 25, 2018

1/\u201cWhat would need to be true for you to\u2026.X\u201d

— Erik Torenberg (@eriktorenberg) December 4, 2018

Why is this the most powerful question you can ask when attempting to reach an agreement with another human being or organization?

A thread, co-written by @deanmbrody: https://t.co/Yo6jHbSit9