Agrawal_ayyush's Categories

Agrawal_ayyush's Authors

Latest Saves

#RS is an indicator which helps in finding strong stock or index in the market.

This learning thread would be on

"𝙐𝙨𝙚𝙨 𝙤𝙛 𝙍𝙚𝙡𝙖𝙩𝙞𝙫𝙚 𝙎𝙩𝙧𝙚𝙣𝙜𝙩𝙝"

Shared some strategy.

Like👍 & Retweet🔄for wider reach and for more such learning thread in the future.

1/22

Most of us would confuse it with Relative Strength Index (RSI) but Relative Strength is a different indicator.

We have already covered about "Uses of RSI" in below thread👇

https://t.co/oTOrW7joNI

One can go through this if you haven't.

2/22

Now coming to Relative Strength (RS).

It is basically a strategy used in momentum investing which shows strength or weakness between two asset classes (two stocks, index, commodity).

One can read about this in below

As of now, I am using this indicator on .@tradingview platform.

It's free and one can add it in their Tradingview account as well, using this link👇

https://t.co/FxCjJFsNOG

There are multiple variants in this as well. Some traders use multiple time frame RS.

4/22

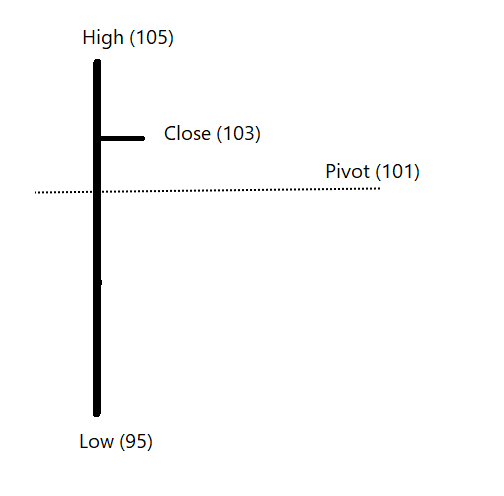

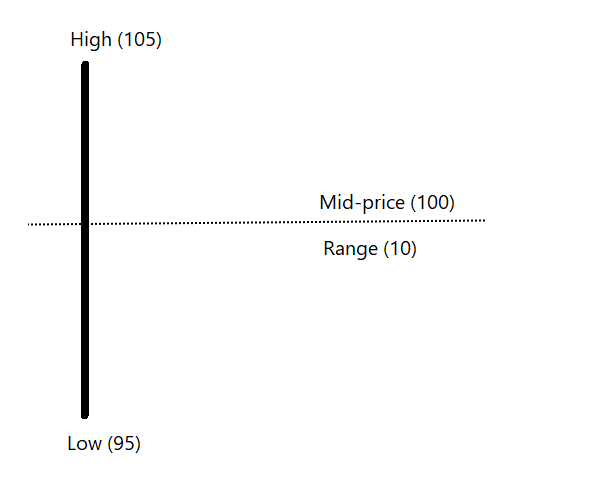

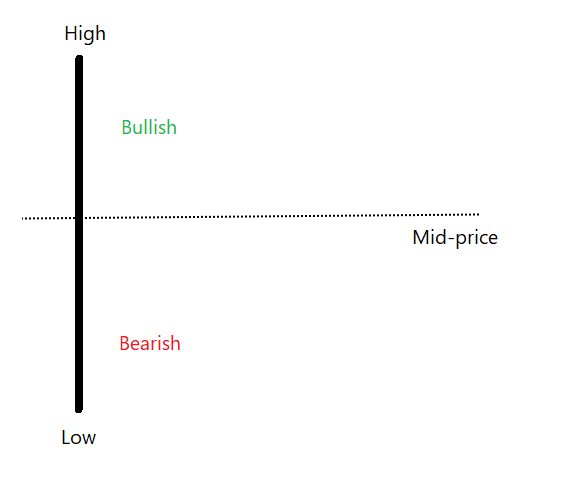

RS basically compares returns of one stock/index with the returns of benchmark stock/index at a particular time horizon.

Let's say, I want to analyze TCS and Benchmark Index is Nifty.

5/22

This learning thread would be on

"𝙐𝙨𝙚𝙨 𝙤𝙛 𝙍𝙚𝙡𝙖𝙩𝙞𝙫𝙚 𝙎𝙩𝙧𝙚𝙣𝙜𝙩𝙝"

Shared some strategy.

Like👍 & Retweet🔄for wider reach and for more such learning thread in the future.

1/22

Most of us would confuse it with Relative Strength Index (RSI) but Relative Strength is a different indicator.

We have already covered about "Uses of RSI" in below thread👇

https://t.co/oTOrW7joNI

One can go through this if you haven't.

2/22

#RSI is a common indicator which most of us use in the stock market.

— Yash Mehta (@YMehta_) October 22, 2021

This learning thread would be on

"\U0001d650\U0001d668\U0001d65a\U0001d668 \U0001d664\U0001d65b \U0001d64d\U0001d64e\U0001d644"

Like\U0001f44d & Retweet\U0001f504 for wider reach and for more such learning thread in the future.

Also, an investment strategy is shared using RSI in the end.

1/16

Now coming to Relative Strength (RS).

It is basically a strategy used in momentum investing which shows strength or weakness between two asset classes (two stocks, index, commodity).

One can read about this in below

As of now, I am using this indicator on .@tradingview platform.

It's free and one can add it in their Tradingview account as well, using this link👇

https://t.co/FxCjJFsNOG

There are multiple variants in this as well. Some traders use multiple time frame RS.

4/22

RS basically compares returns of one stock/index with the returns of benchmark stock/index at a particular time horizon.

Let's say, I want to analyze TCS and Benchmark Index is Nifty.

5/22

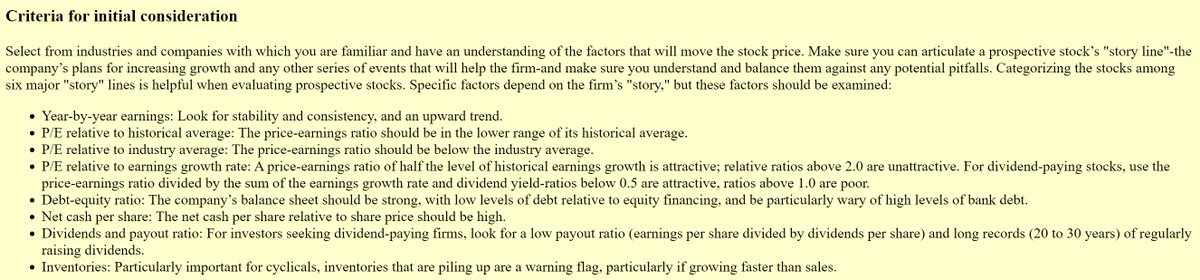

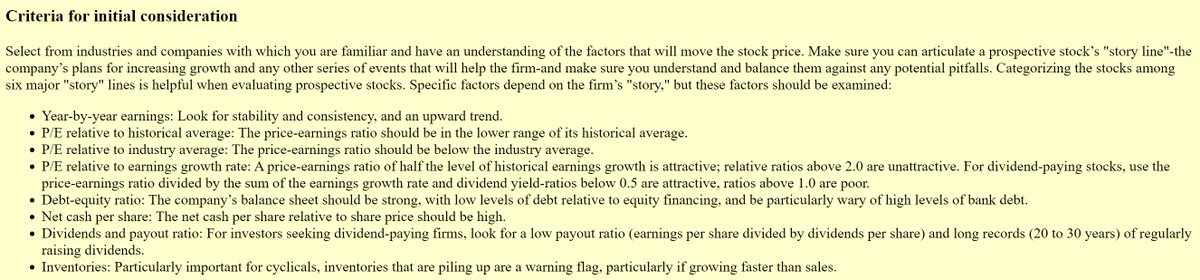

Starting the Beginner’s Pathway thread for Fundamental Investing.

One Chadarmod on timeline posted that I’m giving gyan without having experience or expertise.

So I’ll begin with paying my portfolio performance tribute to these charlies.

https://t.co/GNM5SsNFNo

Fundamentals based investing can generate serious wealth as the most famous (rather infamous) Warren Buffett has shown.

In India also we have many success stories like @VijayKedia1 @Raamdeo R K Damani Rakesh Jhunjhunwala Late Chandrakant Sampat and many many more....

Though I can't stop mentioning that both Rakesh Jhunjhunwala and R K Damani were traders in their initial days.

Rakesh Jhunjhunwala still trades, he once said Traing is fun, its le fatafat, de fatafat

A lot of people (specially the beginners) buy stocks based on some friend's recommendation : XYZ le le, pukka chalega, maine bhi le rakha hai.

Few might have made money this way, but most do not. Why ?

There has to be a process.

Fundamentals based investing need thorough analysis of the Business & Company.

Here is a preliminary checklist by the legendary investor Peter lynch

One Chadarmod on timeline posted that I’m giving gyan without having experience or expertise.

So I’ll begin with paying my portfolio performance tribute to these charlies.

https://t.co/GNM5SsNFNo

Sadda Haqq ! Aithe Rakhh......... pic.twitter.com/IH5q3v2gw9

— Professor (@DillikiBiili) October 5, 2021

Fundamentals based investing can generate serious wealth as the most famous (rather infamous) Warren Buffett has shown.

In India also we have many success stories like @VijayKedia1 @Raamdeo R K Damani Rakesh Jhunjhunwala Late Chandrakant Sampat and many many more....

Though I can't stop mentioning that both Rakesh Jhunjhunwala and R K Damani were traders in their initial days.

Rakesh Jhunjhunwala still trades, he once said Traing is fun, its le fatafat, de fatafat

A lot of people (specially the beginners) buy stocks based on some friend's recommendation : XYZ le le, pukka chalega, maine bhi le rakha hai.

Few might have made money this way, but most do not. Why ?

There has to be a process.

Fundamentals based investing need thorough analysis of the Business & Company.

Here is a preliminary checklist by the legendary investor Peter lynch