ThomassRichards Categories Trading

7 days

30 days

All time

Recent

Popular

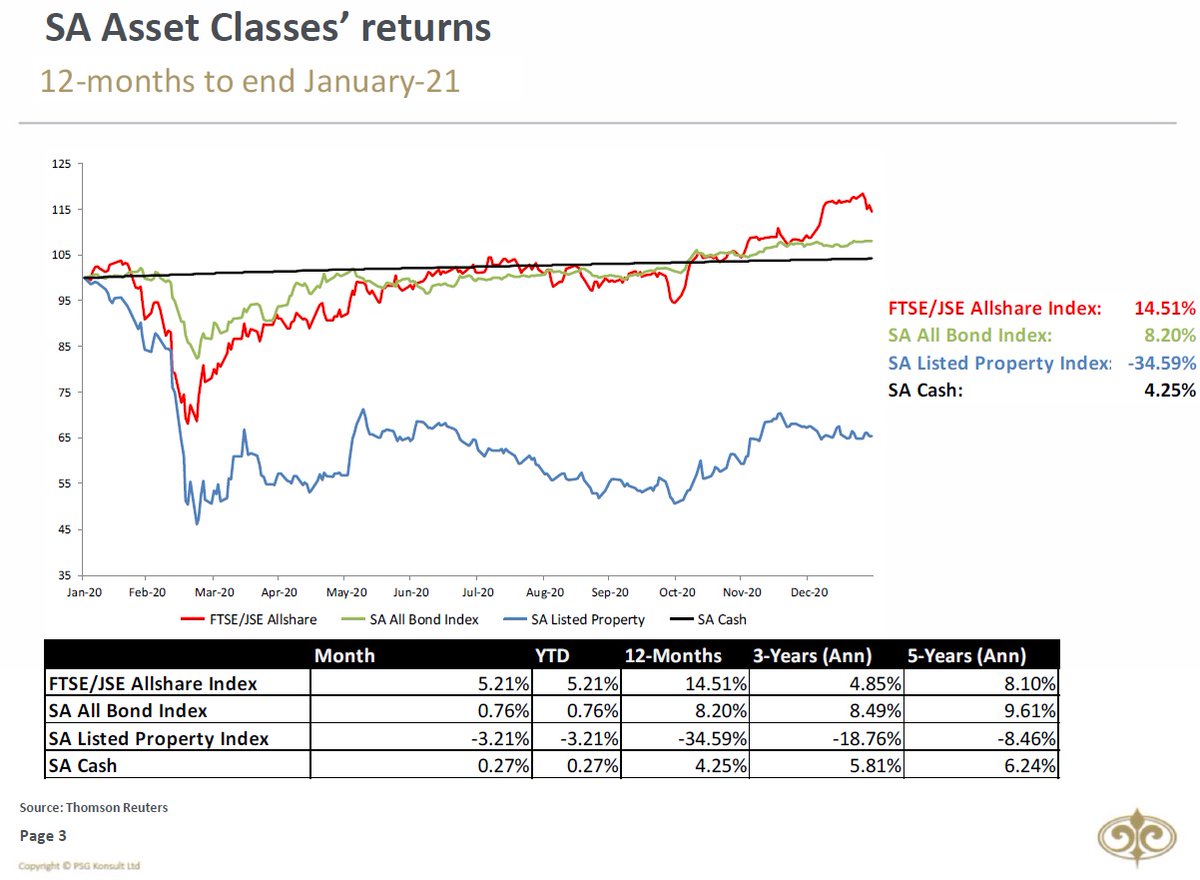

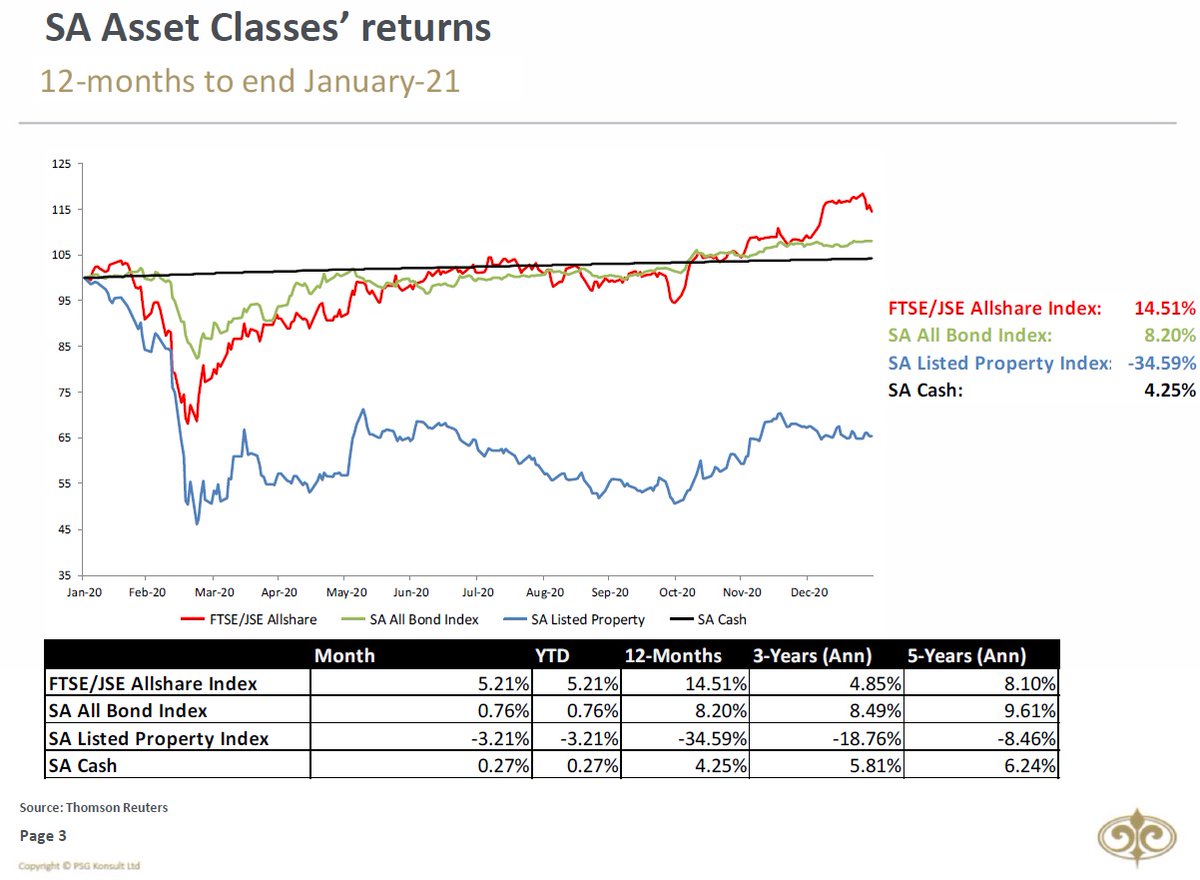

UPDATE ON MARKETS: What an eventful start to 2021. Between short-squeezes and hedge funds blowing up, volatility was definitely on the forefront during January. FTSE/JSE All Share (JSE) improved by 5.21% during January, bringing the 12-month returns to 14.51%.

2/12

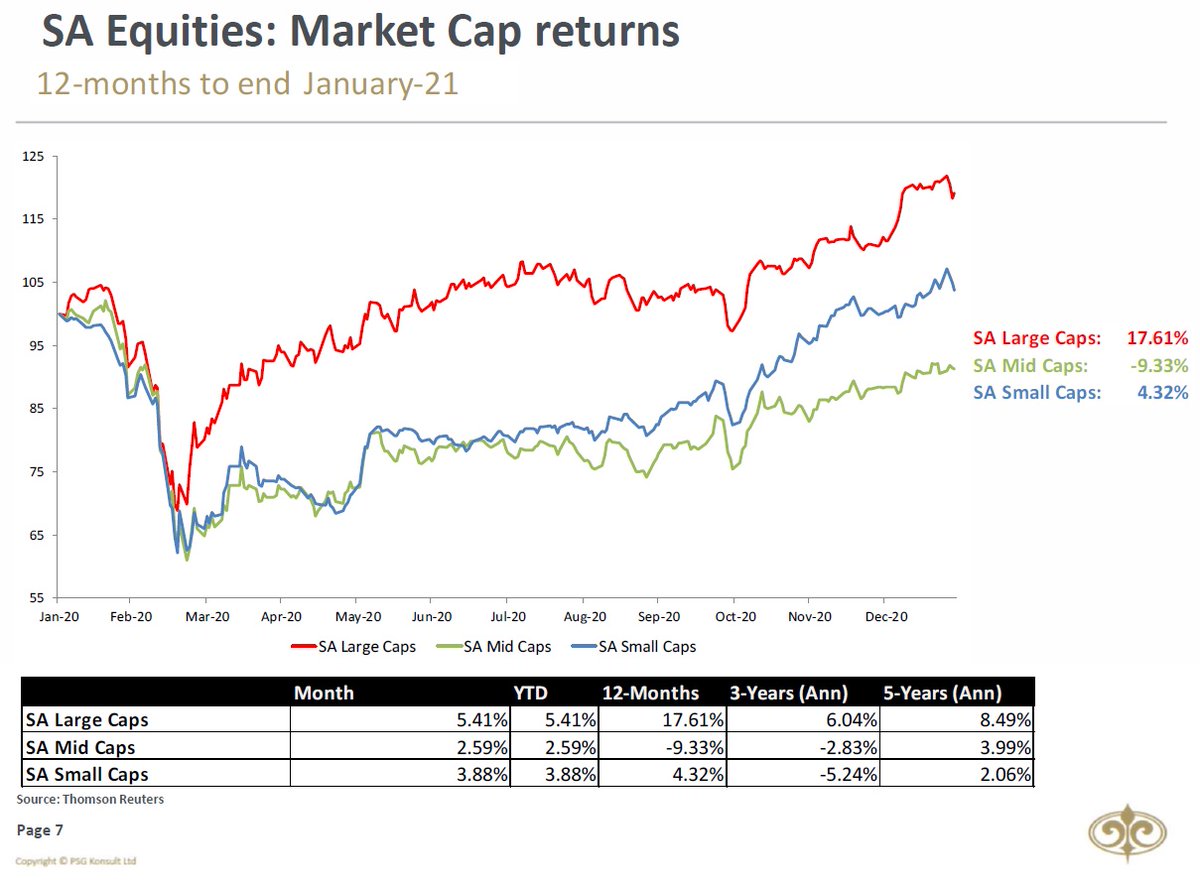

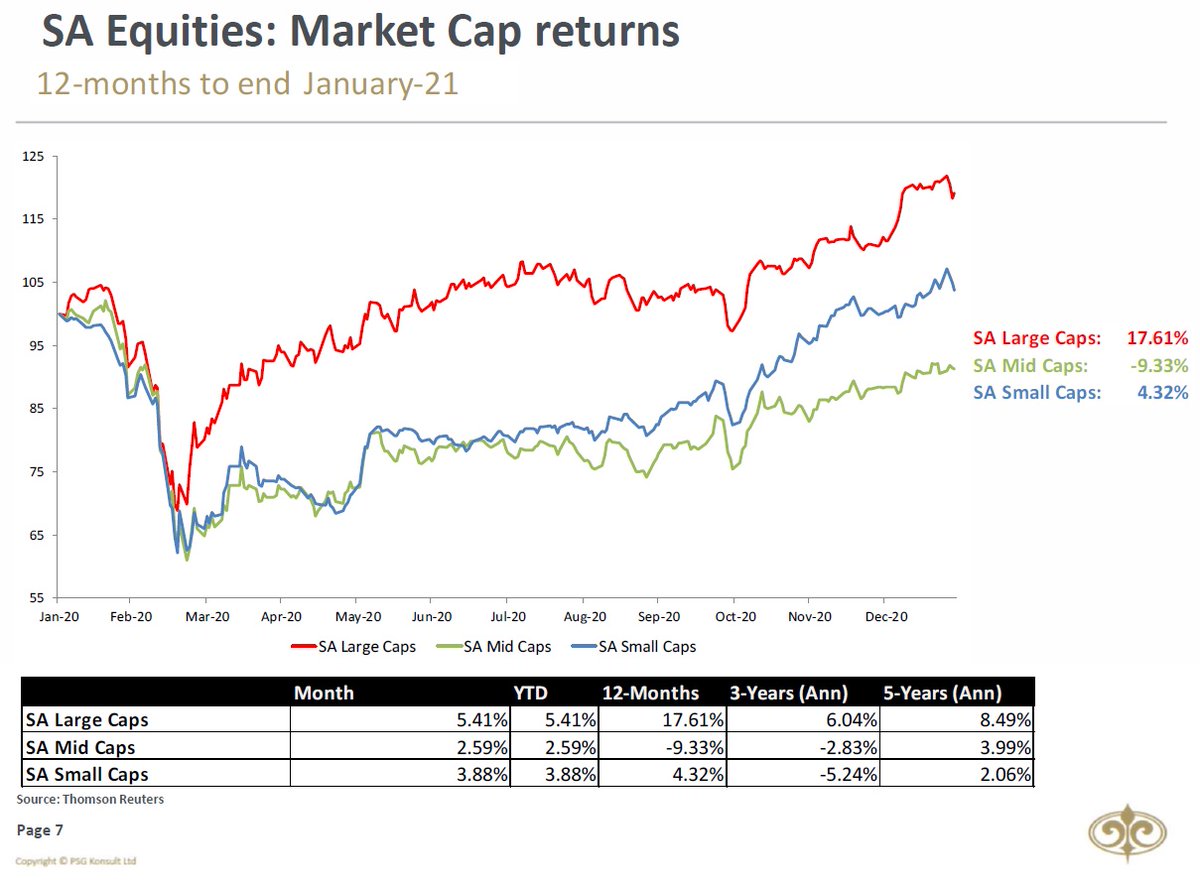

South African Large Caps dominated during January, growing by 5.41%. Mid Caps and Small Caps grew by 2.59% and 3.88%, respectively.

3/12

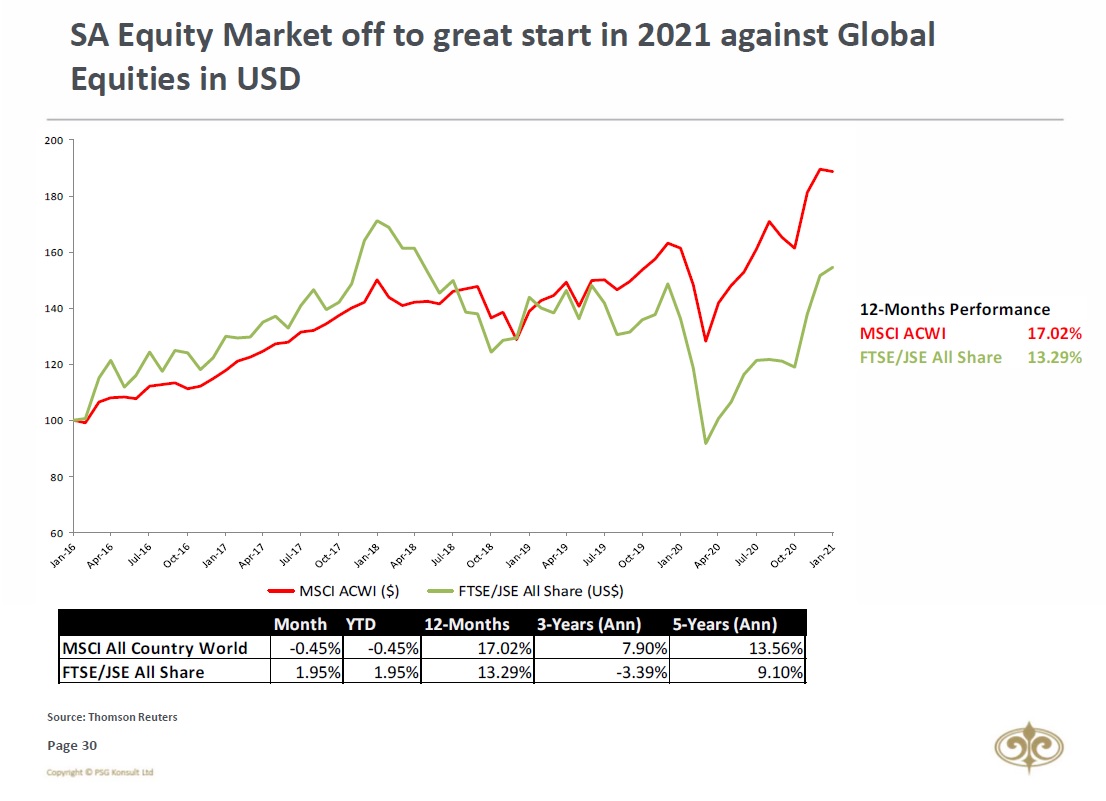

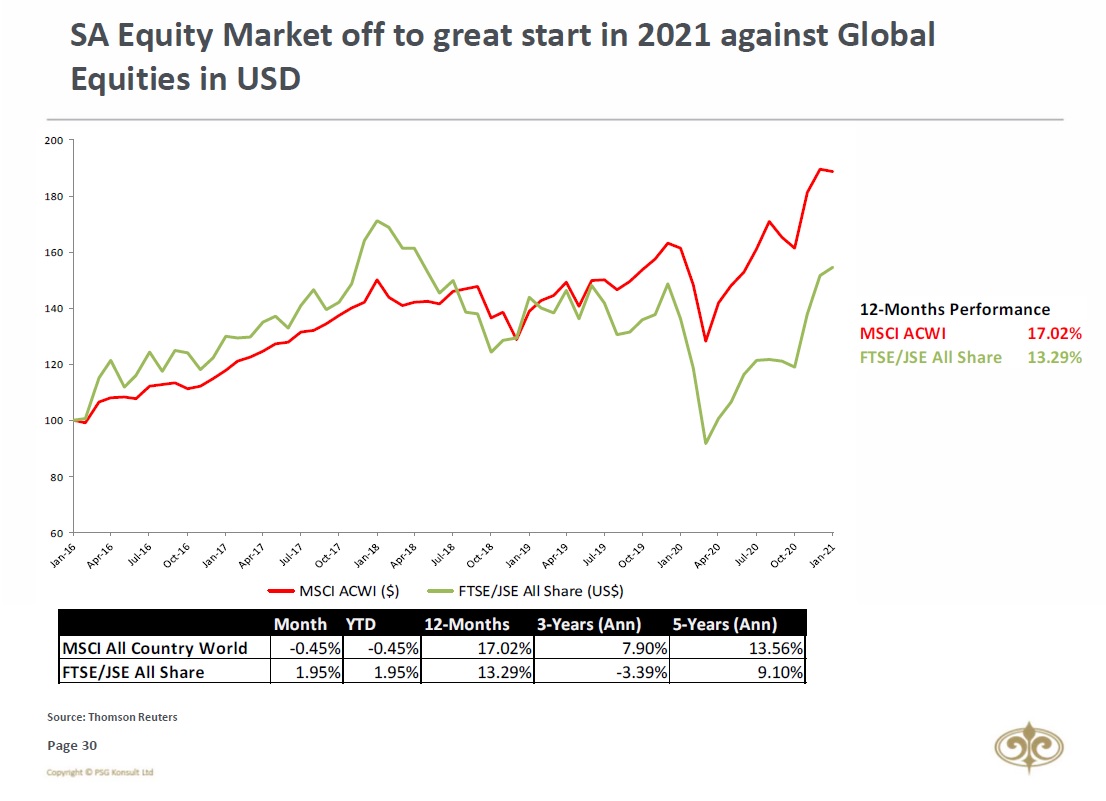

The FTSE/ JSE All Share (+1.95%) enjoyed a better month than the MSCI All Country World Index (-0.45%) again in USD terms. The 12-month performance for the JSE in USD-terms is now only lagging behind the MSCI ACWI´s performance by 3.7%.

4/12

The #FearandGreed #SouthAfrica #Index moved into GREED territory during January. For those followers who'd like to get more information on the Fear & Greed South African Index, can click here: https://t.co/bYOL5Bz2cf

5/12

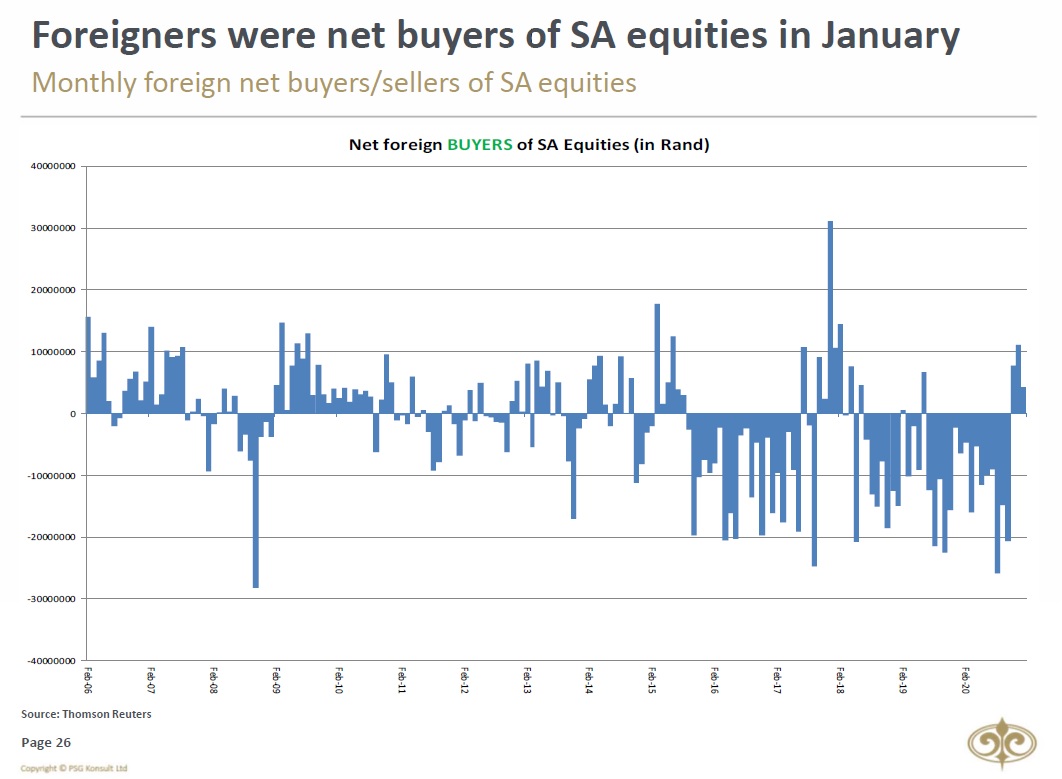

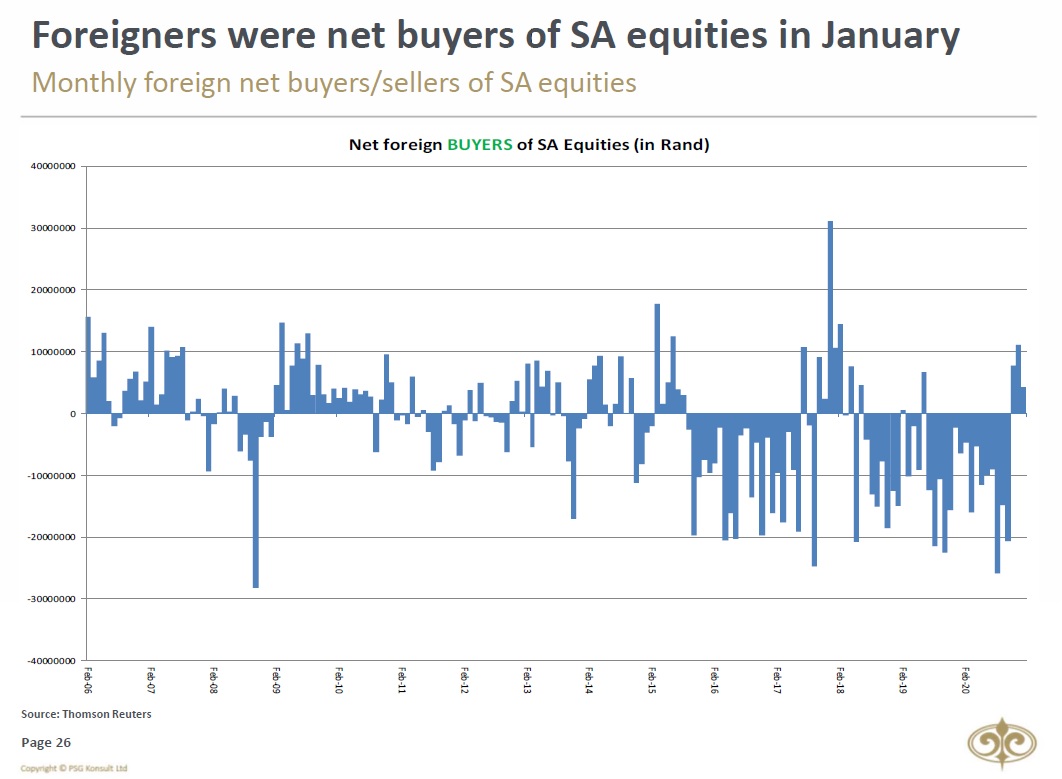

Foreigners were net buyers of both SA Equities and Bonds during January. This makes foreigners buyers of SA Equities and Bonds for 3 months in a row now.

2/12

South African Large Caps dominated during January, growing by 5.41%. Mid Caps and Small Caps grew by 2.59% and 3.88%, respectively.

3/12

The FTSE/ JSE All Share (+1.95%) enjoyed a better month than the MSCI All Country World Index (-0.45%) again in USD terms. The 12-month performance for the JSE in USD-terms is now only lagging behind the MSCI ACWI´s performance by 3.7%.

4/12

The #FearandGreed #SouthAfrica #Index moved into GREED territory during January. For those followers who'd like to get more information on the Fear & Greed South African Index, can click here: https://t.co/bYOL5Bz2cf

5/12

Foreigners were net buyers of both SA Equities and Bonds during January. This makes foreigners buyers of SA Equities and Bonds for 3 months in a row now.

1/10 I detest Warren simply b/c she's an inconsistent, low IQ, lying opportunist, & her "wealth tax" idea. What the majority of her stans fail to realize is that wealth doesn't mean money. Now she's on the wagon attacking retail investors-plebes. How do her actions hurt farmers?

2/10 Let's start w/ wealth tax. I believe I'm wealthy, but not in the financial sense. I have a loving family, patriarchs who taught me self reliance & the value of hard work, I've worked hard to get a good job, I have the most amazing fiance, I could go on but this is my wealth.

3/10 Yeah, we have acreage, cattle & goats, flocks of chickens, tracts of crop land & a fleet of 50+yo equipment/implements that have been purchased & repaired, then repaired again. We make modest salaries from our day jobs & are fiscally responsible. Farming isn't get rich quick

4/10 though, it's a break back life that sees you lucky to break out 15% in the black on your yields averaged. How does this wealth tax idea impact us? We already pay property taxes, fuel taxes, personal property tax on some equipment, income taxes when I report sold livestock &

5/10 crops, income tax on land leased to other folks, capital gains are applied to leased land too, then we have to title & tag the farm trucks that touch the road in any capacity, sales tax on supplies, feed & seeds, then sales tax IF I need to buy goods back. At the end of the

Casino-like swings in stock prices of GameStop reflect wild levels of speculation that don\u2019t help GameStop\u2019s workers or customers and could lead to market instability. Today I told the SEC to explain what exactly it's doing to prevent market manipulation. https://t.co/NWaZe1jFVb pic.twitter.com/MAbjHcq47i

— Elizabeth Warren (@SenWarren) January 29, 2021

2/10 Let's start w/ wealth tax. I believe I'm wealthy, but not in the financial sense. I have a loving family, patriarchs who taught me self reliance & the value of hard work, I've worked hard to get a good job, I have the most amazing fiance, I could go on but this is my wealth.

3/10 Yeah, we have acreage, cattle & goats, flocks of chickens, tracts of crop land & a fleet of 50+yo equipment/implements that have been purchased & repaired, then repaired again. We make modest salaries from our day jobs & are fiscally responsible. Farming isn't get rich quick

4/10 though, it's a break back life that sees you lucky to break out 15% in the black on your yields averaged. How does this wealth tax idea impact us? We already pay property taxes, fuel taxes, personal property tax on some equipment, income taxes when I report sold livestock &

5/10 crops, income tax on land leased to other folks, capital gains are applied to leased land too, then we have to title & tag the farm trucks that touch the road in any capacity, sales tax on supplies, feed & seeds, then sales tax IF I need to buy goods back. At the end of the

>more than half of all robinhood users own some gamestop stock

Okay, this is starting to make sense, I'm about to do a massive infodump in the comments, get ready folks.

The tl;dr is this: Melvin Capital made an overleveraged short on gamestop last week which was floated to 140% of all available shares. Since xmas GME has been doing well thanks to console releases and so on. Few days ago, a new CEO from Chewys got on board and price 2x to $40

A user on reddit, deepfuckingvalue had been holding it and buying various pulls on the stock since last year as a YOLO option with a possible initial investment of $56,000. It has since ballooned to tens of millions if he sells it at all.

So, with that redditor being popular last week as well as the leveraged shorts that Melvin explicitly went on youtube/social media to call resulted in WSB jumping on them for even daring to short it. As such, media attention started to pop up and speculation happened.

On Friday, the 21st, a gameplan was made to pump the stock up to initiate the beginning of a short squeeze and prevent the shorts from profiting for melvin & citron (another hedge fund that also shorted GME). For whatever reason, the stock price jumped up to $69 at EOD.

Okay, this is starting to make sense, I'm about to do a massive infodump in the comments, get ready folks.

More than half of all Robinhood users own at least some GameStop stock.

— Motherboard (@motherboard) January 28, 2021

They are now unable to freely trade it; the app is only allowing users to close out their positions. https://t.co/DgN1H496wx

The tl;dr is this: Melvin Capital made an overleveraged short on gamestop last week which was floated to 140% of all available shares. Since xmas GME has been doing well thanks to console releases and so on. Few days ago, a new CEO from Chewys got on board and price 2x to $40

A user on reddit, deepfuckingvalue had been holding it and buying various pulls on the stock since last year as a YOLO option with a possible initial investment of $56,000. It has since ballooned to tens of millions if he sells it at all.

So, with that redditor being popular last week as well as the leveraged shorts that Melvin explicitly went on youtube/social media to call resulted in WSB jumping on them for even daring to short it. As such, media attention started to pop up and speculation happened.

On Friday, the 21st, a gameplan was made to pump the stock up to initiate the beginning of a short squeeze and prevent the shorts from profiting for melvin & citron (another hedge fund that also shorted GME). For whatever reason, the stock price jumped up to $69 at EOD.

I am shocked...SHOCKED...that nobody in the media or political sphere can understand what is going on behind the scenes that is causing clearing firms to block trading in certain ridiculously volatile securities.

Pretend Robin Hood is a casino (a stretch I know).

Casinos hold a certain amount of cash reserve on hand to cover all daily activities. Now imagine everyone playing starts winning big all at the same time. Slots, tables, etc and the House is losing huge. /2

The Casino's cash reserve is getting dangerously low, a few more big wins to pay out and they'll have no cash left. So they go out and close a few rows of tables, rope off some slot machines, forcing some players to be unable to play. /3

Then they call the bank and have them deliver a new boatload of cash, and reopen the Casino fully once they have enough to operate again.

That's kind of what is going on behind the scenes here, in the plumbing of the markets. /4

Most people have never heard of a "clearing firm", but without them the stock markets wouldn't function. Most of the largest brokerages are "self-clearing", meaning they also run their own clearing firm, but many use a third party.

See below: /5

Pretend Robin Hood is a casino (a stretch I know).

Casinos hold a certain amount of cash reserve on hand to cover all daily activities. Now imagine everyone playing starts winning big all at the same time. Slots, tables, etc and the House is losing huge. /2

The Casino's cash reserve is getting dangerously low, a few more big wins to pay out and they'll have no cash left. So they go out and close a few rows of tables, rope off some slot machines, forcing some players to be unable to play. /3

Then they call the bank and have them deliver a new boatload of cash, and reopen the Casino fully once they have enough to operate again.

That's kind of what is going on behind the scenes here, in the plumbing of the markets. /4

Most people have never heard of a "clearing firm", but without them the stock markets wouldn't function. Most of the largest brokerages are "self-clearing", meaning they also run their own clearing firm, but many use a third party.

See below: /5

wow, @apexclearing now blocking @public from allowing customers to trade specific stocks

— Mike Dudas (@mdudas) January 28, 2021

wall street norms imploding in real time, fallout is gonna be wild pic.twitter.com/gUyhufV32t

Ok here is the extended thread on $XL I promised.

It is pretty straight forward.

For those that are new to stocks / options (because of the influx of interest due to $GME, $AMC, $SLV, etc), here are some terms you should google:

-Short Interest

-Call option

-Open Interest

/1

XL Fleet short interest increased from 50% to 72% in the latest reporting (came out Friday)

That alone piqued my curiosity in the company so I took a position in some Feb calls (in my robinhood account) and will be adding more in my TD account this coming week.

/2

Several days ago, Biden announced that he would be replacing the entire govt. fleet with electric vehicles

https://t.co/DNNMOwq6dv

$WKHS got a massive pump on this news but that was about it.

Who are the other likely candidates? $GOEV and $XL

Why is $XL one of the top candidates?

-Partnerships with Coke and Pepsi

-Board of Director members have strong ties with UPS and FedEx

-Management team is very connected in govt. associations for clean energy in wind, solar, and EV

- $XL is focused on transforming existing FLEETS

All of this can be found on their

It is pretty straight forward.

For those that are new to stocks / options (because of the influx of interest due to $GME, $AMC, $SLV, etc), here are some terms you should google:

-Short Interest

-Call option

-Open Interest

/1

XL Fleet short interest increased from 50% to 72% in the latest reporting (came out Friday)

That alone piqued my curiosity in the company so I took a position in some Feb calls (in my robinhood account) and will be adding more in my TD account this coming week.

/2

Several days ago, Biden announced that he would be replacing the entire govt. fleet with electric vehicles

https://t.co/DNNMOwq6dv

$WKHS got a massive pump on this news but that was about it.

Who are the other likely candidates? $GOEV and $XL

Why is $XL one of the top candidates?

-Partnerships with Coke and Pepsi

-Board of Director members have strong ties with UPS and FedEx

-Management team is very connected in govt. associations for clean energy in wind, solar, and EV

- $XL is focused on transforming existing FLEETS

All of this can be found on their