ThomassRichards's Categories

ThomassRichards's Authors

Latest Saves

Book II of #WealthOfNations! It's all about stock! Not the kind you fill with chicken and noodles, but the kind that (according to #AdamSmith) makes commercial society go 'round. (II.intro)

https://t.co/FlxQLGdjbW

#WealthOfTweets #SmithTweets

First! A quick review: without division of labor, every person must provide everything they need. No one accumulates or stores up stock. You do what you can with what you have when you have it. (II.intro.1) #WealthOfTweets #SmithTweets

But once the division of labor develops (remember, it’s the secret sauce!) we have so many wants that we can’t provide for them all ourselves. Most of them are provided for by others, and we purchase their labor with our own. (II.intro.2) #WealthOfTweets #SmithTweets

Here's why this all matters when we think about stock: we can’t purchase other people’s labor until we have completed (and been paid for) our own. So we need a stock of supplies to sustain us until we can finish our work and get paid. (II.intro.2) #WealthOfTweets #SmithTweets

Obviously, we need that BEFORE we start working in this way. So to get the division of labor you need the accumulation of stock. It’s an ingredient of the secret sauce. (All the best sauces are made with stock!) (II.intro.3)

https://t.co/wi1HtrmBPb

#WealthOfTweets #SmithTweets

https://t.co/FlxQLGdjbW

#WealthOfTweets #SmithTweets

First! A quick review: without division of labor, every person must provide everything they need. No one accumulates or stores up stock. You do what you can with what you have when you have it. (II.intro.1) #WealthOfTweets #SmithTweets

But once the division of labor develops (remember, it’s the secret sauce!) we have so many wants that we can’t provide for them all ourselves. Most of them are provided for by others, and we purchase their labor with our own. (II.intro.2) #WealthOfTweets #SmithTweets

Here's why this all matters when we think about stock: we can’t purchase other people’s labor until we have completed (and been paid for) our own. So we need a stock of supplies to sustain us until we can finish our work and get paid. (II.intro.2) #WealthOfTweets #SmithTweets

Obviously, we need that BEFORE we start working in this way. So to get the division of labor you need the accumulation of stock. It’s an ingredient of the secret sauce. (All the best sauces are made with stock!) (II.intro.3)

https://t.co/wi1HtrmBPb

#WealthOfTweets #SmithTweets

1/ Welcome to #DeFi Wednesday.

Let's talk about how interest-bearing cash on a blockchain is going to revolutionise boring corporate treasury management that concerns every company is is a larger business than all crypto trading in the world.

Enter the thread

👇👇👇

2/ Blockchain community is often seen as toxic maxis and redditors who shill other their weekly favourite shitcoin in the hope of getting Lambo.

Sometimes we also do things that progress humanity towards the better future and interest-bearing cash is one of those things.

3/ Less chad and more things that actually matter:

My incomplete theory of interest-bearing cash is also available also as a blog post:

https://t.co/uiG0fZiVyu

It is 15 pages. Pick your slow poison or die fast by continue reading here.

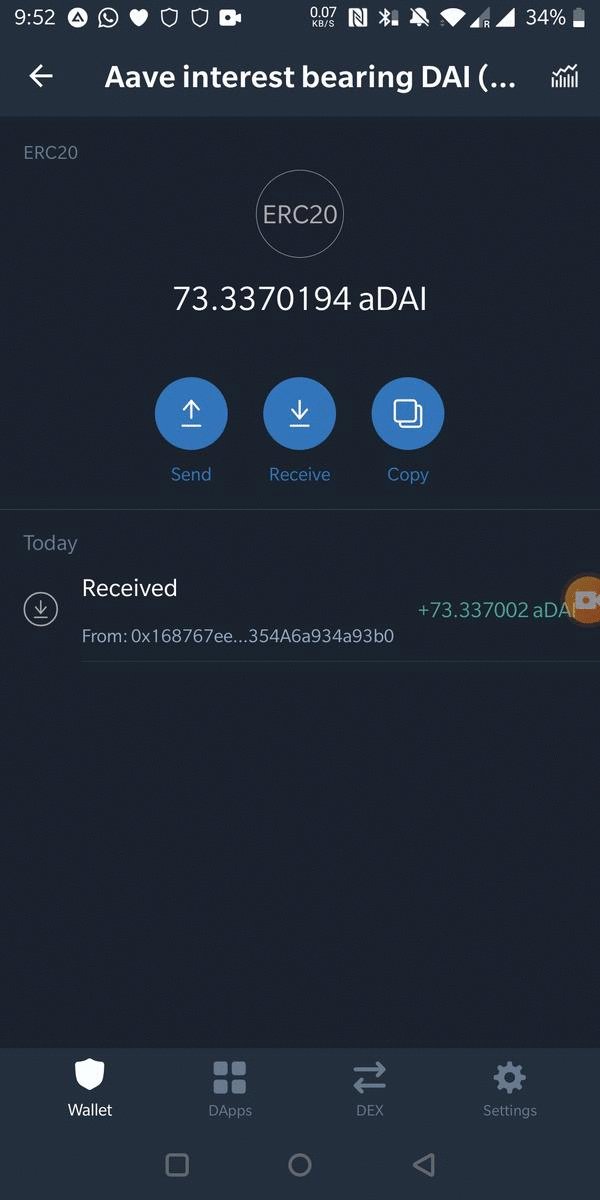

4/ First time in the history we have an ability to create interest-bearing cash-like instruments.

Interest-bearing cash ticks up dollar (euro) balance real-time in your wallet.

Here is a demonstration using @aaveaave aDAI, based on @makerdao DAI, and @TrustWalletApp

5/ Interest-bearing cash is not like your bank's saving account. Your money in a bank is not yours, but bank's. There are some flaws in the current banking system causing a headache for Chief Financial Officers (CFOs)

Let's talk about how interest-bearing cash on a blockchain is going to revolutionise boring corporate treasury management that concerns every company is is a larger business than all crypto trading in the world.

Enter the thread

👇👇👇

2/ Blockchain community is often seen as toxic maxis and redditors who shill other their weekly favourite shitcoin in the hope of getting Lambo.

Sometimes we also do things that progress humanity towards the better future and interest-bearing cash is one of those things.

3/ Less chad and more things that actually matter:

My incomplete theory of interest-bearing cash is also available also as a blog post:

https://t.co/uiG0fZiVyu

It is 15 pages. Pick your slow poison or die fast by continue reading here.

4/ First time in the history we have an ability to create interest-bearing cash-like instruments.

Interest-bearing cash ticks up dollar (euro) balance real-time in your wallet.

Here is a demonstration using @aaveaave aDAI, based on @makerdao DAI, and @TrustWalletApp

5/ Interest-bearing cash is not like your bank's saving account. Your money in a bank is not yours, but bank's. There are some flaws in the current banking system causing a headache for Chief Financial Officers (CFOs)

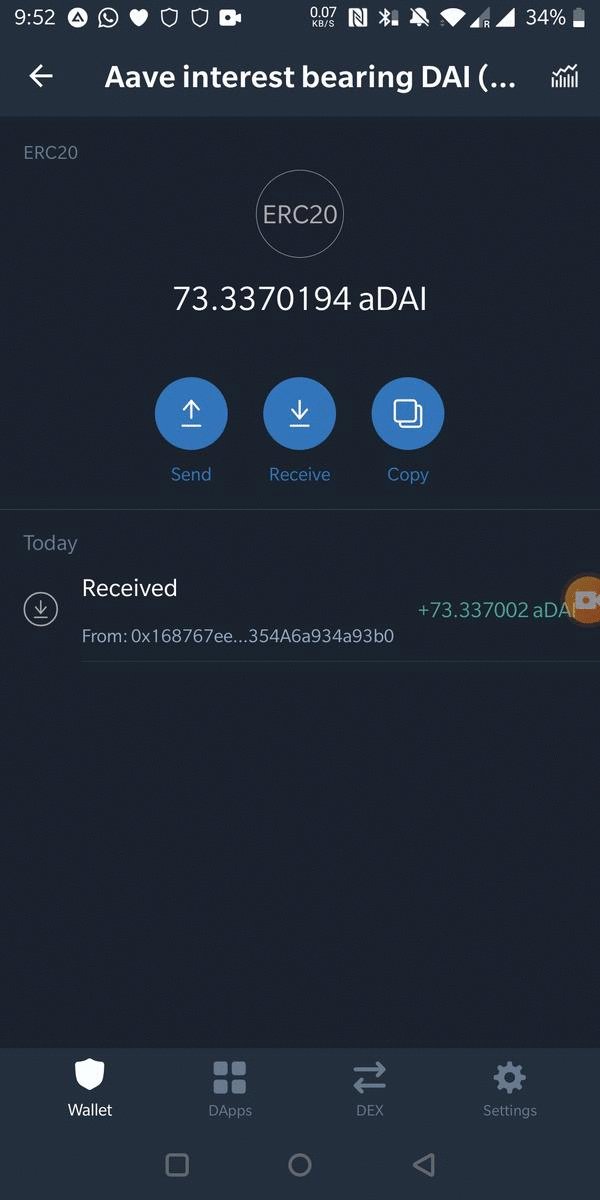

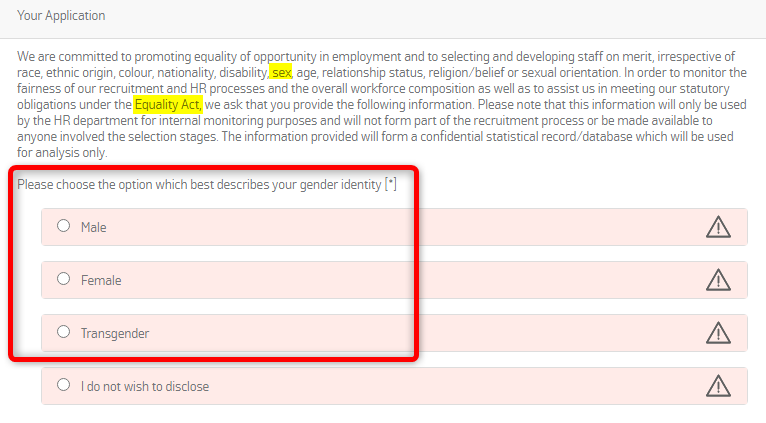

Hi @Argos_Online @ArgosCareers @EHRC @EHRCChair @KishwerFalkner @RJHilsenrath @trussliz @GEOgovuk

Your job application mentions your statutory obligations under the Equality Act and correctly has sex in a list of the protected characteristics under the Act.

However...

1/10

However, you then ask "Please choose the option which best describes your gender identity" with options:

Male

Female

Transgender.

2/10

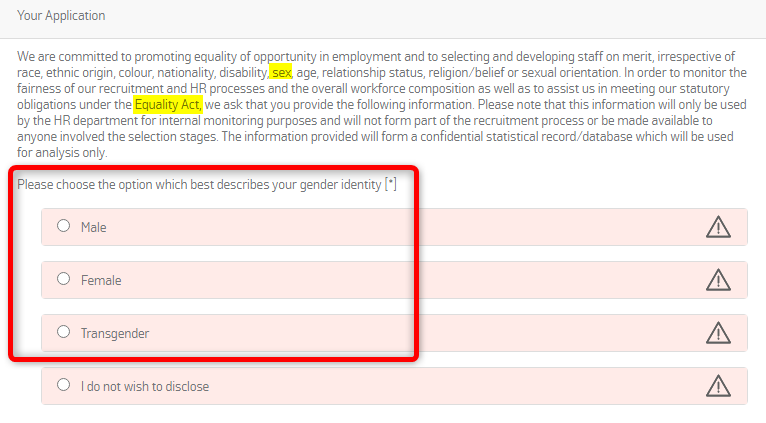

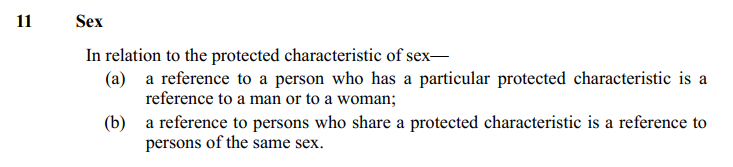

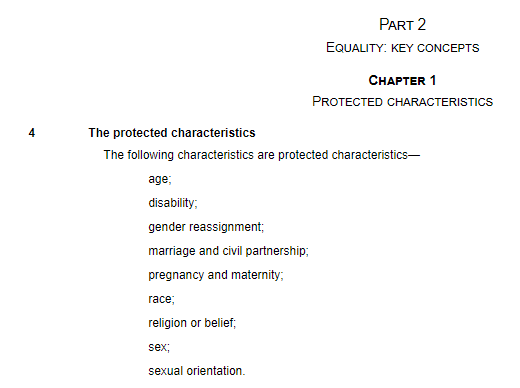

'Gender identity' is not a protected characteristic under the Equality Act 2010 and is not defined in the Act.

https://t.co/qisFhCiV1u

3/10

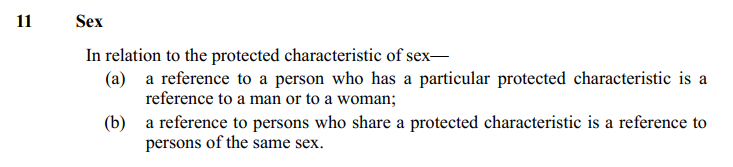

Sex is the protected characteristic and the only two possible options for sex are 'Female' and 'Male' as defined in the Act and consistent with biology, but you don't ask for that.

https://t.co/CEJ0gkr6nF

'Gender' is not a synonym for sex.

4/10

'Gender identity' relies on demeaning, regressive stereotypical notions of societal roles for the two sexes, concepts that I'm sure you would not wish to be associated with.

Your job application mentions your statutory obligations under the Equality Act and correctly has sex in a list of the protected characteristics under the Act.

However...

1/10

However, you then ask "Please choose the option which best describes your gender identity" with options:

Male

Female

Transgender.

2/10

'Gender identity' is not a protected characteristic under the Equality Act 2010 and is not defined in the Act.

https://t.co/qisFhCiV1u

3/10

Sex is the protected characteristic and the only two possible options for sex are 'Female' and 'Male' as defined in the Act and consistent with biology, but you don't ask for that.

https://t.co/CEJ0gkr6nF

'Gender' is not a synonym for sex.

4/10

'Gender identity' relies on demeaning, regressive stereotypical notions of societal roles for the two sexes, concepts that I'm sure you would not wish to be associated with.

As of the last time I checked, @NSBPInc President-Elect Hakeem Oluseyi’s blog entry that seeks to exonerate homophobic federal admin James Webb still contains what I consider to be potentially libelous comments about me, one of the only openly queer faculty in the organization.

"The...article references a professional astrophysicist as his original source for learning about the allegations against Webb. This scientist propagated unsubstantiated false information as if it were true without performing proper scientific rigor to investigate its veracity."

This comment specifically cites an article on https://t.co/5MxzND1CGW by Matthew Francis where Francis says that he first learned about the allegations against Webb because of me. Francis does not identify me as an authority nor does he quote me as an authoritative source.

I believe that what Francis was (quite reasonably) referring to is seeing me tweet The Stranger article by Dan Savage.

Oluseyi takes it a step further by insinuating that I knowingly made false statements and claiming that I did not investigate.

Oluseyi has no evidence.

Again, I want to highlight that the president elect of the National Society of Black Physicists wrote an essay, claiming to support queer people, where he makes a point of impugning the integrity of the only openly queer faculty member in the org, who is also early career.

"The...article references a professional astrophysicist as his original source for learning about the allegations against Webb. This scientist propagated unsubstantiated false information as if it were true without performing proper scientific rigor to investigate its veracity."

This comment specifically cites an article on https://t.co/5MxzND1CGW by Matthew Francis where Francis says that he first learned about the allegations against Webb because of me. Francis does not identify me as an authority nor does he quote me as an authoritative source.

I believe that what Francis was (quite reasonably) referring to is seeing me tweet The Stranger article by Dan Savage.

Oluseyi takes it a step further by insinuating that I knowingly made false statements and claiming that I did not investigate.

Oluseyi has no evidence.

Again, I want to highlight that the president elect of the National Society of Black Physicists wrote an essay, claiming to support queer people, where he makes a point of impugning the integrity of the only openly queer faculty member in the org, who is also early career.

The Mother of All Squeezes

How Volkswagen went from being on the brink of bankruptcy to the most valuable company in the world in two days

/THREAD/

1/ At the peak of the 2008 financial crisis, Volkswagen was considered a very likely candidate for bankruptcy.

Heavily indebted and already financially struggling before 2008, with car sales expected to plummet due to the ongoing global crisis.

2/ With GM and Chrysler filing for bankruptcy in 2009, shorting the VW stock would seem a safe bet.

If you are not familiar with stock shorts and short squeezes check my thread

3/ On October 26, 2008, Porsche announced it had increased its stake at VW from 30% to 74%.

This was a surprise to many who were led to believe that Porsche wasn't planning a takeover of VW, based on the company's announcements.

4/ Before the announcement, the short interest was approximately 13% of the outstanding shares, a number considered relatively low.

Porsche had a 30% stake, the Lower Saxony government fund held 20% of the shares, and another 5% was held by index funds.

How Volkswagen went from being on the brink of bankruptcy to the most valuable company in the world in two days

/THREAD/

1/ At the peak of the 2008 financial crisis, Volkswagen was considered a very likely candidate for bankruptcy.

Heavily indebted and already financially struggling before 2008, with car sales expected to plummet due to the ongoing global crisis.

2/ With GM and Chrysler filing for bankruptcy in 2009, shorting the VW stock would seem a safe bet.

If you are not familiar with stock shorts and short squeezes check my thread

Shorts, Squeezes, and Betting Against Stocks

— Kostas on FIRE \U0001f525 (@itsKostasOnFIRE) January 27, 2021

What is short selling, how is it used and why is it risky?

/THREAD/ pic.twitter.com/PyDd208hFe

3/ On October 26, 2008, Porsche announced it had increased its stake at VW from 30% to 74%.

This was a surprise to many who were led to believe that Porsche wasn't planning a takeover of VW, based on the company's announcements.

4/ Before the announcement, the short interest was approximately 13% of the outstanding shares, a number considered relatively low.

Porsche had a 30% stake, the Lower Saxony government fund held 20% of the shares, and another 5% was held by index funds.

My take on YOLO short squeeze and volatility..

I guess much has been said/written/memed about the most recent r/WSB YOLO short squeeze, and tbh have nothing really smart to add... but i'm puzzled by the pro-investment community reaction to this (namely HFs, bank sales desks

and prop traders)...

While squeezing traders position has long been a guilty pleasure of the Hedge Fund community (and few aggressive banks, with questionable motives to skew prices), everybody seem to be shocked that retail traders do that, and running a decent risk management

scheme...

My best recollection of a brutal position squeeze was the $12bn JPM lost on CDX spread (aka, the London Whale)

https://t.co/bDHAL2UwpX

Back in these days the entire market knew that JP's trader was, in fact, the entire position in the illiquid index (off-the-run)

so almost every credit trader that I knew traded against that position... Now, that's perfectly legal right? it's not crossing any legal boundaries of price manipulation, so why is it ok for pro traders to do that but it becomes shocking when your neighbor's kid does that?

and the CDX example is only one of a handful of examples of skewed position that got squeezed hard, the only difference is the orderbook distribution...

While in "normal" markets orderbook distribution oscillates between normal to slightly skewed, in the YOLO case I think that

I guess much has been said/written/memed about the most recent r/WSB YOLO short squeeze, and tbh have nothing really smart to add... but i'm puzzled by the pro-investment community reaction to this (namely HFs, bank sales desks

and prop traders)...

While squeezing traders position has long been a guilty pleasure of the Hedge Fund community (and few aggressive banks, with questionable motives to skew prices), everybody seem to be shocked that retail traders do that, and running a decent risk management

scheme...

My best recollection of a brutal position squeeze was the $12bn JPM lost on CDX spread (aka, the London Whale)

https://t.co/bDHAL2UwpX

Back in these days the entire market knew that JP's trader was, in fact, the entire position in the illiquid index (off-the-run)

so almost every credit trader that I knew traded against that position... Now, that's perfectly legal right? it's not crossing any legal boundaries of price manipulation, so why is it ok for pro traders to do that but it becomes shocking when your neighbor's kid does that?

and the CDX example is only one of a handful of examples of skewed position that got squeezed hard, the only difference is the orderbook distribution...

While in "normal" markets orderbook distribution oscillates between normal to slightly skewed, in the YOLO case I think that