Shubham51ngh's Categories

Shubham51ngh's Authors

Latest Saves

A solo media founder like Rogan or Mr Beast can make as much money as a strong tech founder, with significantly less managerial stress.

Tech created this ecosystem but there’s a historical cultural bias in tech towards media as unprofitable. That changed a long time ago.

Many more angels that invest in people will invest in media founders. Many traditional media people will *become* media founders.

But not necessarily big companies. Just solo individuals or small groups doing content, like Notch doing Minecraft. Because media scales like code.

Increasingly feeling like “keeping the team size as small as possible, even to one person” is the unarticulated key to making media profitable.

Substack and all the creator tools are just the start of this ecosystem.

The process of converting social influencers into media founders (a trend that has been going on for 10+ years at this point) will be increasingly streamlined.

V1 is link-in-bio, Substack, and sponcon.

V2 likely involves more angels & tokenization a la @tryrollhq. What else?

Why lack of awareness? Influencer monetization numbers are not as public as tech numbers.

There isn’t a TechCrunch & CrunchBase for media founders, chronicling the valuations of influencers.

But that’d be quite valuable. If you are interested in doing this, please DM with demo.

Tech created this ecosystem but there’s a historical cultural bias in tech towards media as unprofitable. That changed a long time ago.

Many more angels that invest in people will invest in media founders. Many traditional media people will *become* media founders.

But not necessarily big companies. Just solo individuals or small groups doing content, like Notch doing Minecraft. Because media scales like code.

Increasingly feeling like “keeping the team size as small as possible, even to one person” is the unarticulated key to making media profitable.

Substack and all the creator tools are just the start of this ecosystem.

Useful concept: the media stack for content creators

— balajis.com (@balajis) January 20, 2020

- Spotify, iTunes for podcasts

- Descript for podcast editing

- Figma, Canva for graphics

- YouTube for video

- Twitter, FB for distribution

- Substack for newsletters

- Makerpad for nocode

- Ghost, Medium for blog

What else?

The process of converting social influencers into media founders (a trend that has been going on for 10+ years at this point) will be increasingly streamlined.

V1 is link-in-bio, Substack, and sponcon.

V2 likely involves more angels & tokenization a la @tryrollhq. What else?

Why lack of awareness? Influencer monetization numbers are not as public as tech numbers.

There isn’t a TechCrunch & CrunchBase for media founders, chronicling the valuations of influencers.

But that’d be quite valuable. If you are interested in doing this, please DM with demo.

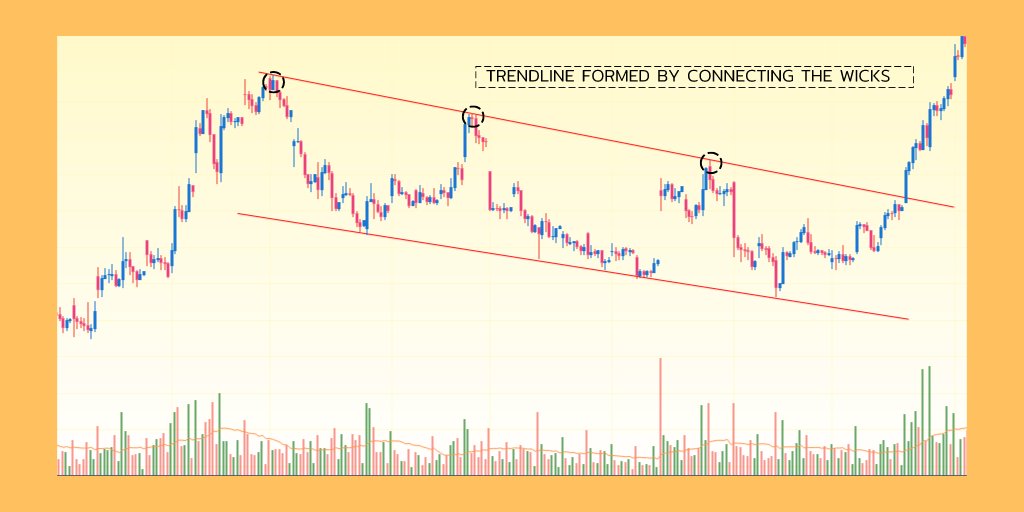

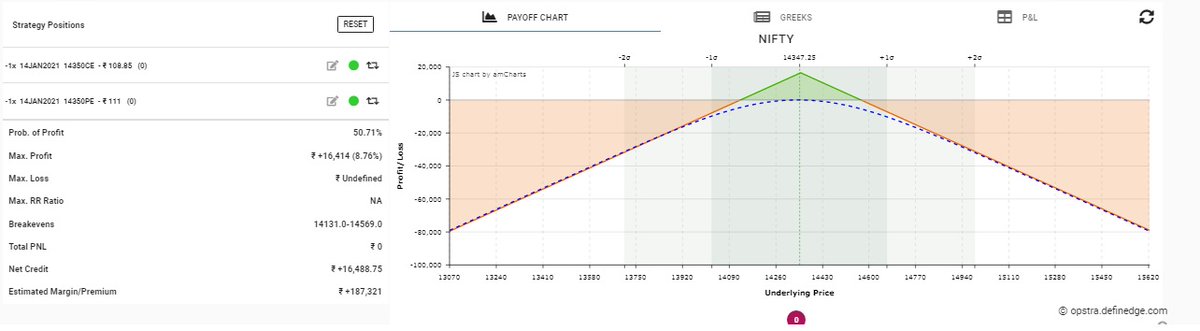

Thread on Short straddle with adjustments:

Short straddle is non-directional strategy

Selling same strike price CALL/PUT option same underlying with same expiry.

Nifty Spot at 14353, So you can sell 14350 CE as well 14350 PE of 14 Jan. Expiry.

(1/n)

*RETWEET for max response

Bullish short straddle: Selling 14400 CE and 14400 PE of same expiry.

Bearish short straddle: Selling 14250 CE and 14250 PE of same expiry.

You can sell straddle as per your market view.

If you are natural view sell CE and PE at ATM strike.

(2/n)

Short straddle has limited profit potential (only premium) and unlimited risk without adjustment.

In Example, Short straddle of 14350, Breakeven is (14131.0-14569.0), need 1.7Lac Margin to sell straddle.

Maximum profit: 16k and Loss: Unlimited, Winning probability: 50%

(3/n)

If market staying near at 14350 then win. Probability increase slowly. Rewards also increase slowly.

Volatility(IV) is also play important role in selling straddle, Like If IV increase so straddle premium increase and IV cool off so premium casually comes down.

(4/n)

Short straddle adjustment:

https://t.co/59Lr64kEtK way to limit the overnight risk.

Convert short straddle in Ironfly, its nothing we have to add long strangle in short straddle it become Ironfly. It gives the good Risk Rewards.

(5/n)

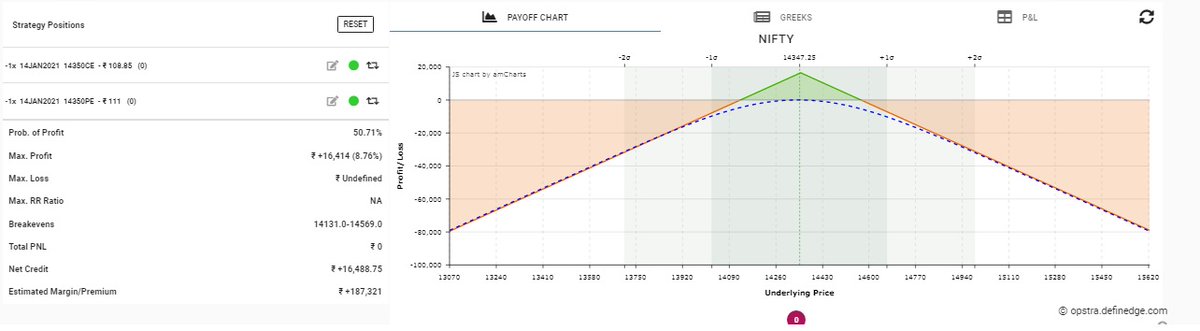

Short straddle is non-directional strategy

Selling same strike price CALL/PUT option same underlying with same expiry.

Nifty Spot at 14353, So you can sell 14350 CE as well 14350 PE of 14 Jan. Expiry.

(1/n)

*RETWEET for max response

Bullish short straddle: Selling 14400 CE and 14400 PE of same expiry.

Bearish short straddle: Selling 14250 CE and 14250 PE of same expiry.

You can sell straddle as per your market view.

If you are natural view sell CE and PE at ATM strike.

(2/n)

Short straddle has limited profit potential (only premium) and unlimited risk without adjustment.

In Example, Short straddle of 14350, Breakeven is (14131.0-14569.0), need 1.7Lac Margin to sell straddle.

Maximum profit: 16k and Loss: Unlimited, Winning probability: 50%

(3/n)

If market staying near at 14350 then win. Probability increase slowly. Rewards also increase slowly.

Volatility(IV) is also play important role in selling straddle, Like If IV increase so straddle premium increase and IV cool off so premium casually comes down.

(4/n)

Short straddle adjustment:

https://t.co/59Lr64kEtK way to limit the overnight risk.

Convert short straddle in Ironfly, its nothing we have to add long strangle in short straddle it become Ironfly. It gives the good Risk Rewards.

(5/n)

Health and Wealth

We have bad metrics as a society. Rather than GDP, GDP-per-capita, or the stock market perhaps we should have dashboards of:

- life expectancy (health)

- net worth (wealth)

A good leader is one who improves these metrics for individuals & society as a whole.

Reasoning:

- Most people can't tell you how to compute GDP

- But they can tell you what net worth and life expectancy are

- So they know what it means for those numbers to go up

- And they know that making them go up is valuable

If these numbers went up for you, life improved.

By adding health, we add Andy Grove's paired metric. We don't just focus on economics alone, because you can optimize & distort financial metrics at the expense of health.

For example, it's been hypothesized that the rise in diabetes is due in part to sugar subsidies.

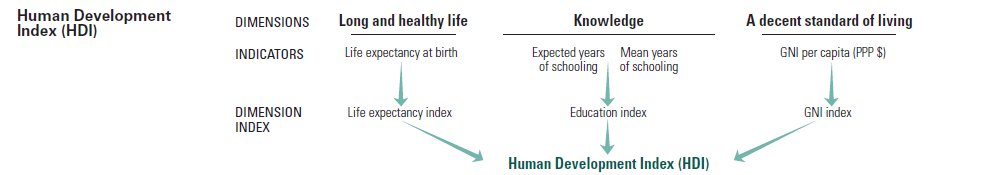

Btw, some people have mentioned HDI. This is actually a bad metric because it's hard to explain and reason about, and it's not a simple ratio-scale variable.

You can understand 72.3 years of life expectancy. You can't understand 0.614 HDI. https://t.co/jylH7qm3Ev

We have bad metrics as a society. Rather than GDP, GDP-per-capita, or the stock market perhaps we should have dashboards of:

- life expectancy (health)

- net worth (wealth)

A good leader is one who improves these metrics for individuals & society as a whole.

Reasoning:

- Most people can't tell you how to compute GDP

- But they can tell you what net worth and life expectancy are

- So they know what it means for those numbers to go up

- And they know that making them go up is valuable

If these numbers went up for you, life improved.

By adding health, we add Andy Grove's paired metric. We don't just focus on economics alone, because you can optimize & distort financial metrics at the expense of health.

For example, it's been hypothesized that the rise in diabetes is due in part to sugar subsidies.

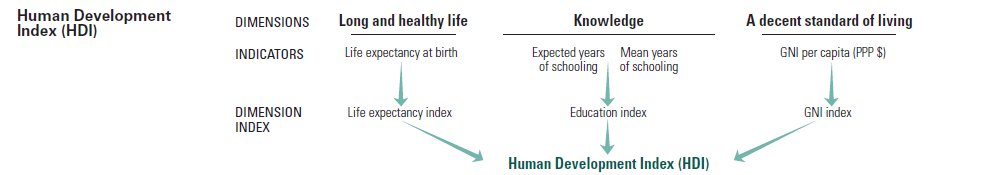

Btw, some people have mentioned HDI. This is actually a bad metric because it's hard to explain and reason about, and it's not a simple ratio-scale variable.

You can understand 72.3 years of life expectancy. You can't understand 0.614 HDI. https://t.co/jylH7qm3Ev

Introducing "The Balloon Effect"

Many businesses & creators have experienced a similar pattern of success.

From @MrBeastYT and @MorningBrew to @oatly and @Rovio.

Let's break down what "The Balloon Effect" is and examples of it in real life.

Keep reading 👇

1/ What is "The Balloon Effect"?

It is a particular pattern of growth.

It is not Instagram's growth trajectory.

It is not https://t.co/5axsTUKek6's growth trajectory.

"The Balloon Effect" is defined by several years of hard work & grit complemented by slow, linear growth.

2/ And then one day, one month, or one quarter...everything changes.

A business hits a tipping point and its trajectory shifts entirely.

Gradual growth turns to exponential growth & your brand and your size explode.

Like a step function.

3/ Now, you're probably wondering.

Why is it called "The Balloon Effect"?

Because filling/popping a water balloon follows the exact pattern I just described (and so many businesses experience).

Long unsexy slog 👉 Exponential tipping point.

4/ Initially, you turn on the faucet & water takes up space in the empty balloon.

Through effort you open the faucet, yet the results are unexciting.

But it's what must be done for water (or growth) to happen at all.

It's not sexy, but it's necessary.

Many businesses & creators have experienced a similar pattern of success.

From @MrBeastYT and @MorningBrew to @oatly and @Rovio.

Let's break down what "The Balloon Effect" is and examples of it in real life.

Keep reading 👇

1/ What is "The Balloon Effect"?

It is a particular pattern of growth.

It is not Instagram's growth trajectory.

It is not https://t.co/5axsTUKek6's growth trajectory.

"The Balloon Effect" is defined by several years of hard work & grit complemented by slow, linear growth.

2/ And then one day, one month, or one quarter...everything changes.

A business hits a tipping point and its trajectory shifts entirely.

Gradual growth turns to exponential growth & your brand and your size explode.

Like a step function.

3/ Now, you're probably wondering.

Why is it called "The Balloon Effect"?

Because filling/popping a water balloon follows the exact pattern I just described (and so many businesses experience).

Long unsexy slog 👉 Exponential tipping point.

4/ Initially, you turn on the faucet & water takes up space in the empty balloon.

Through effort you open the faucet, yet the results are unexciting.

But it's what must be done for water (or growth) to happen at all.

It's not sexy, but it's necessary.