SeekerHari's Categories

SeekerHari's Authors

Latest Saves

Excellent short summaries of many good investing books. 👏

cc: @dmuthuk @Gautam__Baid

(Some of the pages might open in German. Use the Translate to English option on the

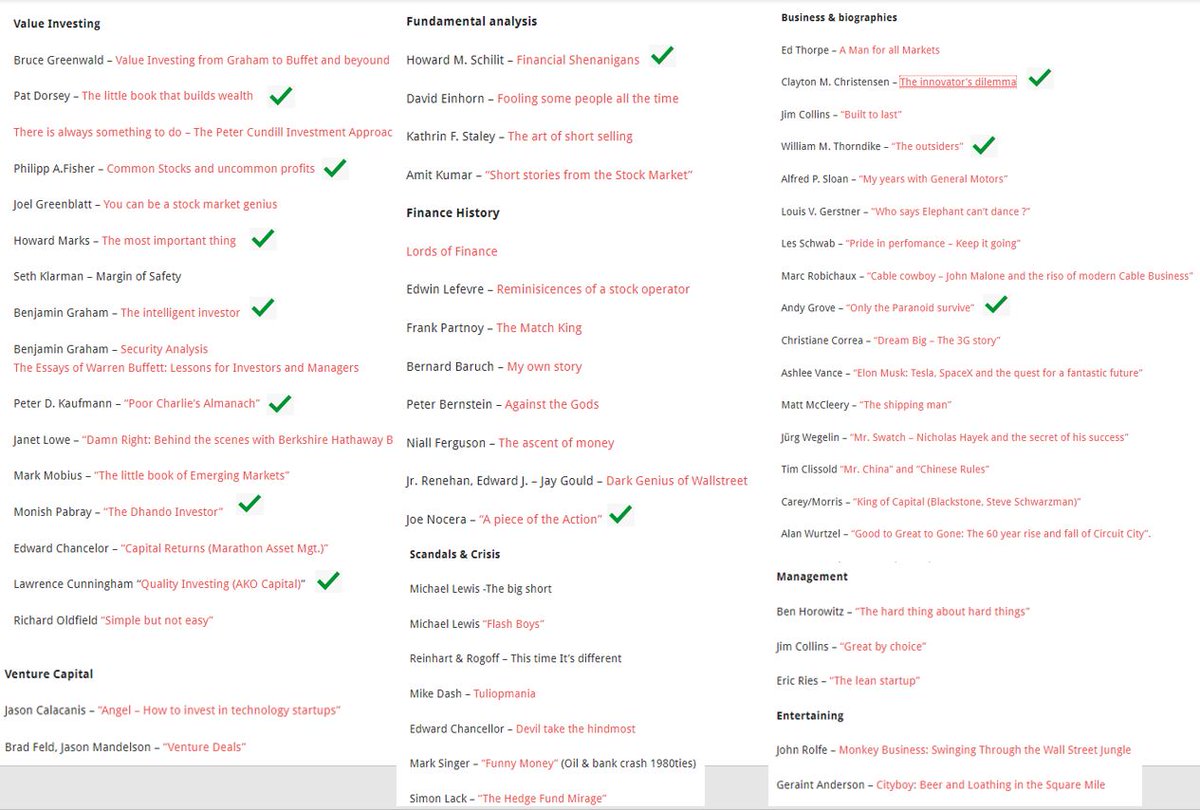

List 👇

Some of my fav summaries from the list.

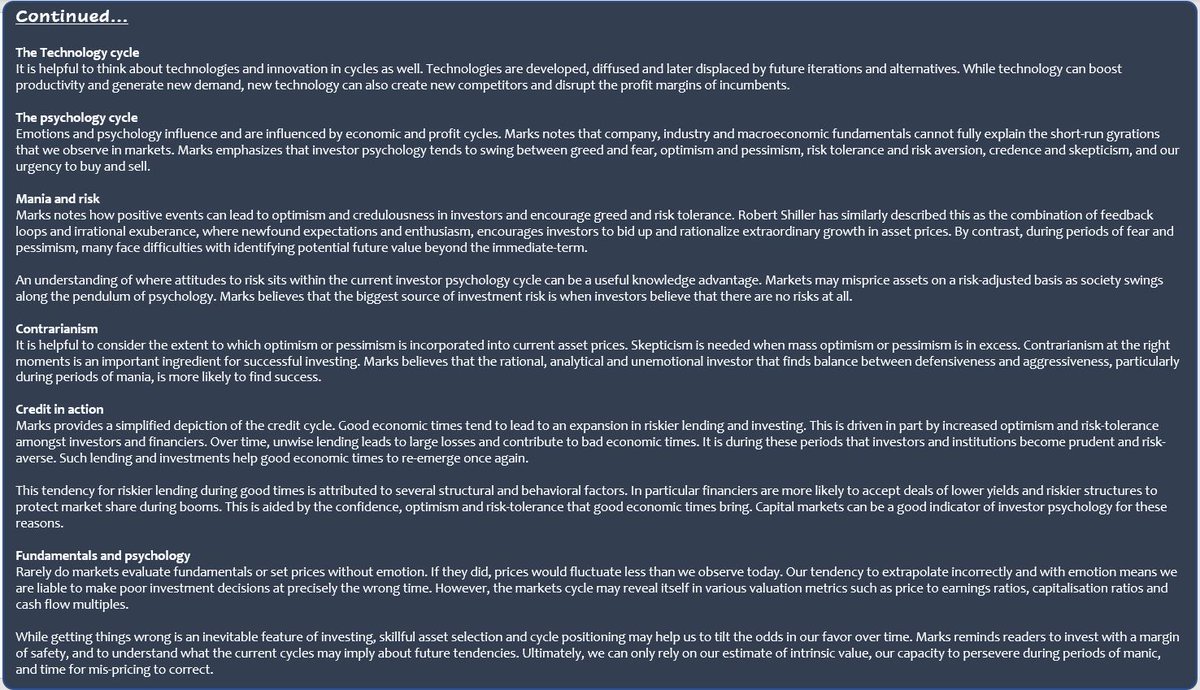

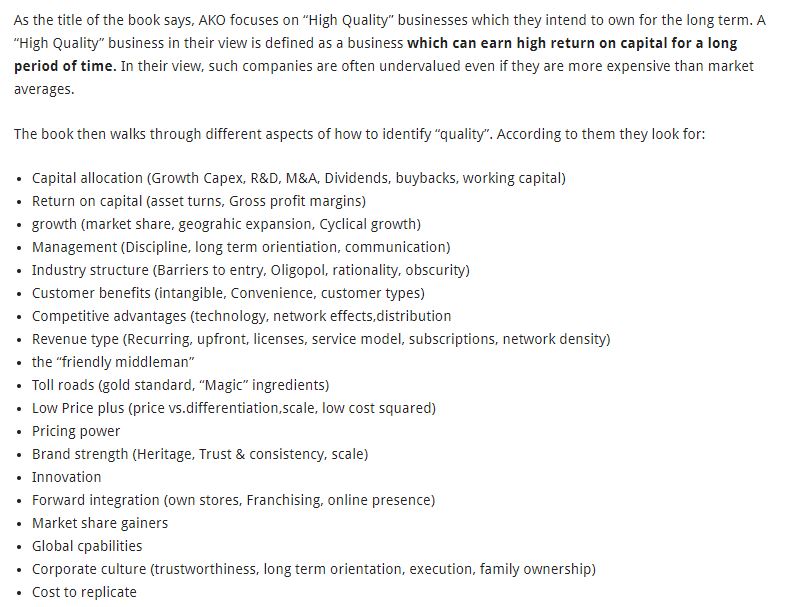

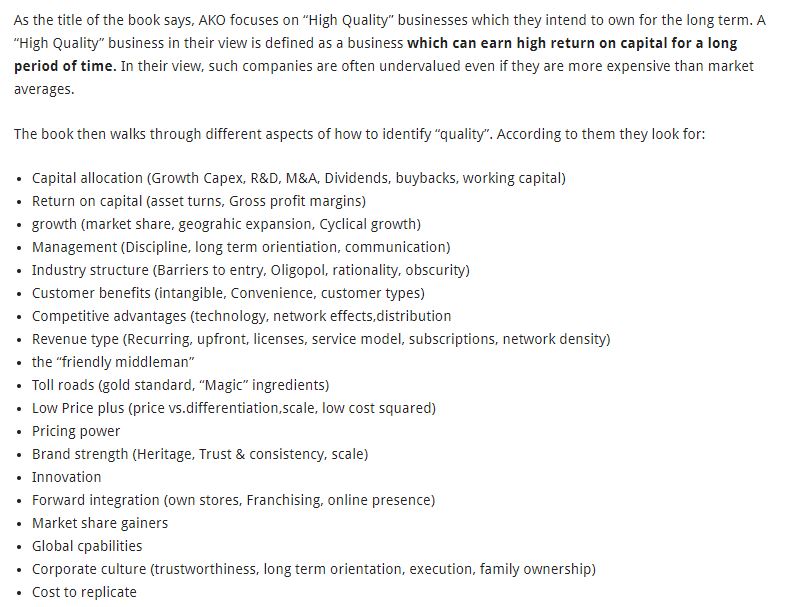

✔️Quality Investing - Lawrence Cunningham

https://t.co/pmVQFPlWby

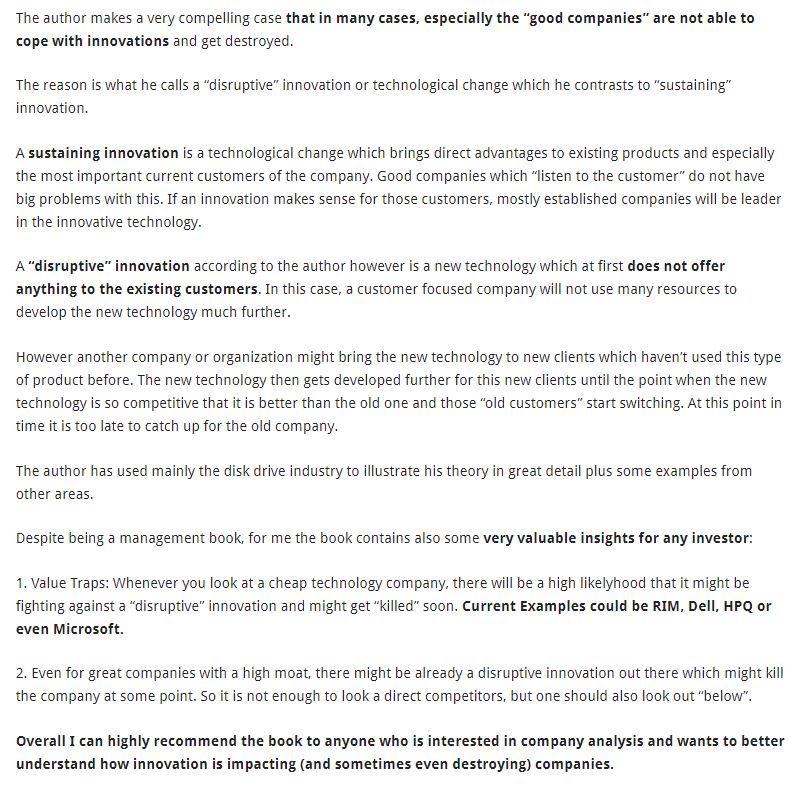

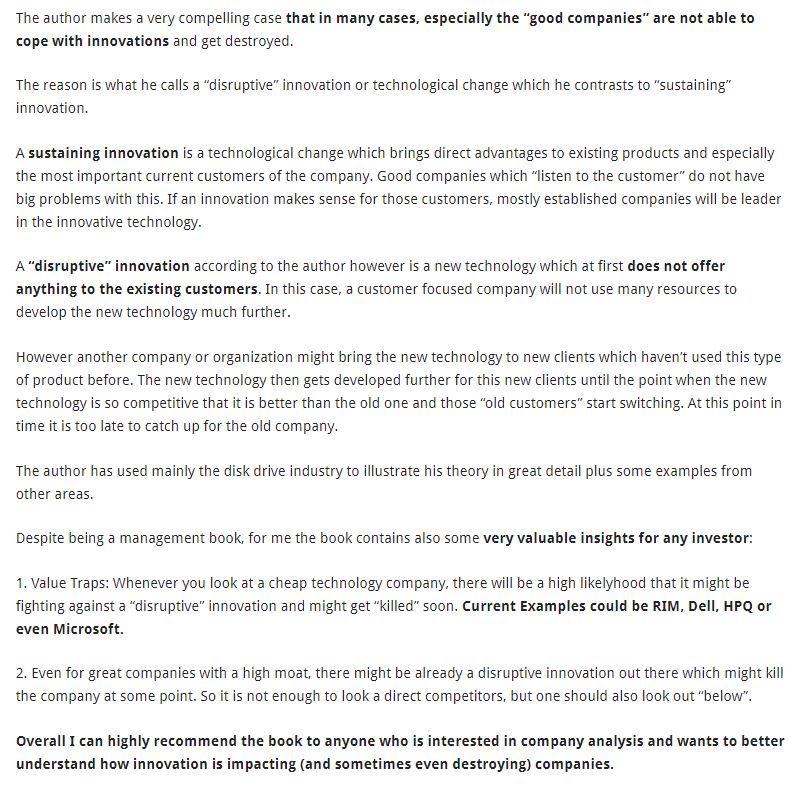

✔️The Innovator's Dilemma – Clayton Christensen

https://t.co/VazvMPEE7D

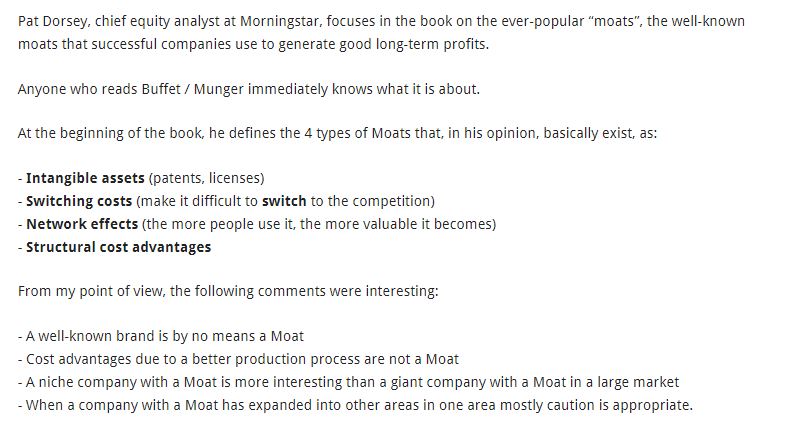

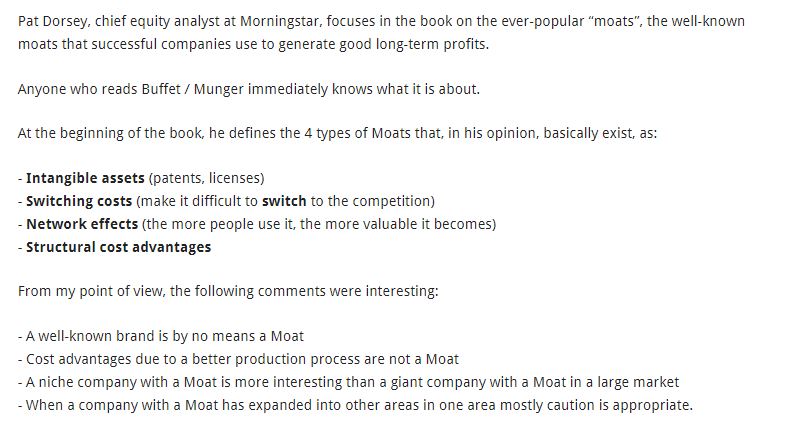

✔️The Little Book That Builds Wealth - Pat Dorsey

https://t.co/sMJspTTQcA

cc: @dmuthuk @Gautam__Baid

(Some of the pages might open in German. Use the Translate to English option on the

List 👇

Some of my fav summaries from the list.

✔️Quality Investing - Lawrence Cunningham

https://t.co/pmVQFPlWby

✔️The Innovator's Dilemma – Clayton Christensen

https://t.co/VazvMPEE7D

✔️The Little Book That Builds Wealth - Pat Dorsey

https://t.co/sMJspTTQcA

Excellent collection of articles related to Financial Statement Analysis and related topics, on Harvard Business School Online blog. h/t @online_HBS 👏

✔️The Beginner's Guide to Reading & Understanding Financial

How to Read & Understand

✔️Income Statement

https://t.co/sx2QP2kDvx

✔️Balance Sheet

https://t.co/xK5r04EmPT

✔️Cash Flow

✔️GAAP vs. IFRS : What are the Key Differences?

https://t.co/9vqtZVmOys

✔️20 Financial Terms to

✔️How to quickly & effectively read an Annual Report

https://t.co/6vNPoHY3yi

✔️Cash Flow vs Profit : What's the

✔️How to Value a Company : 6 Methods &

✔️The Beginner's Guide to Reading & Understanding Financial

How to Read & Understand

✔️Income Statement

https://t.co/sx2QP2kDvx

✔️Balance Sheet

https://t.co/xK5r04EmPT

✔️Cash Flow

✔️GAAP vs. IFRS : What are the Key Differences?

https://t.co/9vqtZVmOys

✔️20 Financial Terms to

✔️How to quickly & effectively read an Annual Report

https://t.co/6vNPoHY3yi

✔️Cash Flow vs Profit : What's the

✔️How to Value a Company : 6 Methods &

The "Financial Terms Dictionary" on @Investopedia is such a great resource to learn or quickly re-check major Financial terms and concepts. One of the most useful investing bookmark pages. 👏

cc: @dmuthuk @Gautam__Baid

Few samples

✔️Business Cycle

https://t.co/E4Ukh94yi3

✔️Business Model

https://t.co/zCe1CIfMCA

✔️Economic

✔️Real Estate Investment Trust (REITs)

https://t.co/yMXlps6rtz

✔️Master Limited Partnership (MLPs)

https://t.co/M3mD37H8x4

✔️Venture

✔️Accounting Equation

https://t.co/Oix0I3wA5j

✔️Quality of

cc: @dmuthuk @Gautam__Baid

Few samples

✔️Business Cycle

https://t.co/E4Ukh94yi3

✔️Business Model

https://t.co/zCe1CIfMCA

✔️Economic

✔️Real Estate Investment Trust (REITs)

https://t.co/yMXlps6rtz

✔️Master Limited Partnership (MLPs)

https://t.co/M3mD37H8x4

✔️Venture

✔️Accounting Equation

https://t.co/Oix0I3wA5j

✔️Quality of

This I agree with. While 100 Baggers by @chriswmayer is a fabulous book, there is a need for literature on building the conviction to hold.

And it’s not easy to develop a conviction to hold on to things that should be held. There are these “demons” that will enter the mind of the investor, which will prevent them from holding on to what will turn out to be an outstanding stock.

Demon # 1: The market is too expensive, so I should sell this business. This demon shifts the investor’s focus from the economics of the underlying business to the markets.

Demon # 2: It’s gone up so much, and it can’t go up much more from here. This demon makes the investors anchor to their cost, which is irrelevant.

Demon # 3: Look at the P/ E multiple. It’s too high. Other things are much cheaper. I should switch and lower the P/E of the portfolio. This demon makes one sell an outstanding business and replace it with a mediocre one.

i think we need more books on sticking than picking

— ContrarianEPS (@contrarianEPS) June 26, 2021

And it’s not easy to develop a conviction to hold on to things that should be held. There are these “demons” that will enter the mind of the investor, which will prevent them from holding on to what will turn out to be an outstanding stock.

Demon # 1: The market is too expensive, so I should sell this business. This demon shifts the investor’s focus from the economics of the underlying business to the markets.

Demon # 2: It’s gone up so much, and it can’t go up much more from here. This demon makes the investors anchor to their cost, which is irrelevant.

Demon # 3: Look at the P/ E multiple. It’s too high. Other things are much cheaper. I should switch and lower the P/E of the portfolio. This demon makes one sell an outstanding business and replace it with a mediocre one.