SeekerHari Authors Richard Moglen 📽️🚢🦁

7 days

30 days

All time

Recent

Popular

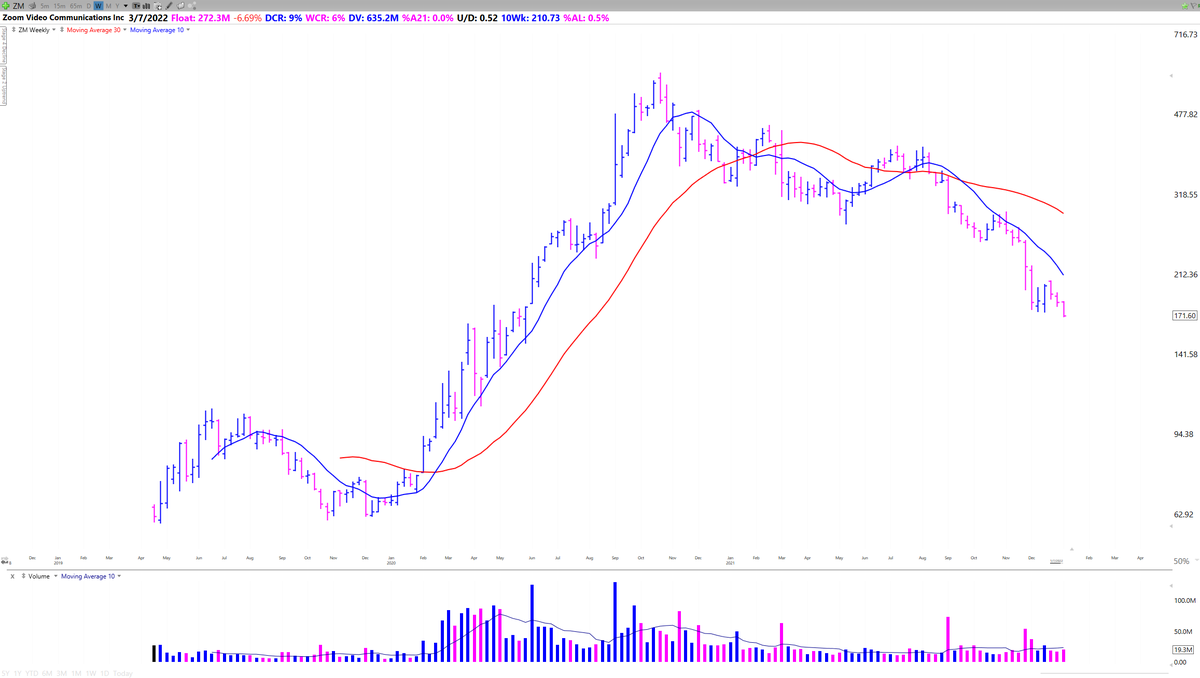

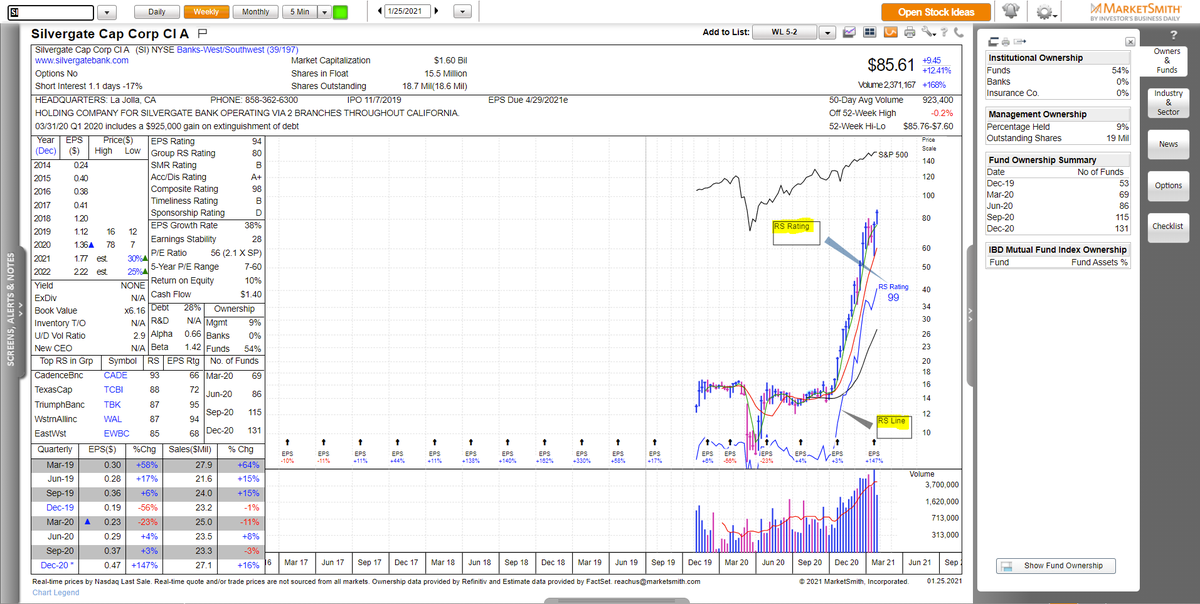

What is a True Market Leader / TML (Thread)

(And how to find them)

In one sentence a TML is an institutional quality stock in a leading industry group with superior fundamentals and technicals

These are monster stocks which over the course of weeks and months increase +100% to +5,000%

TMLs are popular with traders/investors whose methodology is based on the CANSLIM system developed by William O'Neil.

He called them Model Book Stocks. Huge winners worth studying to identify common characteristics that they all share

O'Neil studied over 1000 model book stocks going back to the 1880s.

Many are shown and discussed in these must read books

How To Make Money in Stocks, O"Neil

https://t.co/S2sShZedUm

Monster Stocks, John Boik @monsterstocks1

A Few Examples courtesy of @SystematiCK_

Pic N Save

(And how to find them)

In one sentence a TML is an institutional quality stock in a leading industry group with superior fundamentals and technicals

These are monster stocks which over the course of weeks and months increase +100% to +5,000%

TMLs are popular with traders/investors whose methodology is based on the CANSLIM system developed by William O'Neil.

He called them Model Book Stocks. Huge winners worth studying to identify common characteristics that they all share

O'Neil studied over 1000 model book stocks going back to the 1880s.

Many are shown and discussed in these must read books

How To Make Money in Stocks, O"Neil

https://t.co/S2sShZedUm

Monster Stocks, John Boik @monsterstocks1

A Few Examples courtesy of @SystematiCK_

Pic N Save

#Study & #learn from past super #stocks

— SystematiCK Trader (@SystematiCK_) September 26, 2020

Example 22: Pic N Save - 1979

Sharpen your eyes & internalize

- which fundamental and technical setup fuelled the big gain

- how trade management was done

- the importance of acc./distr. volume

Credit to the great W. O\u2019Neil! pic.twitter.com/m888ZaGyMV

How to time the market (thread)

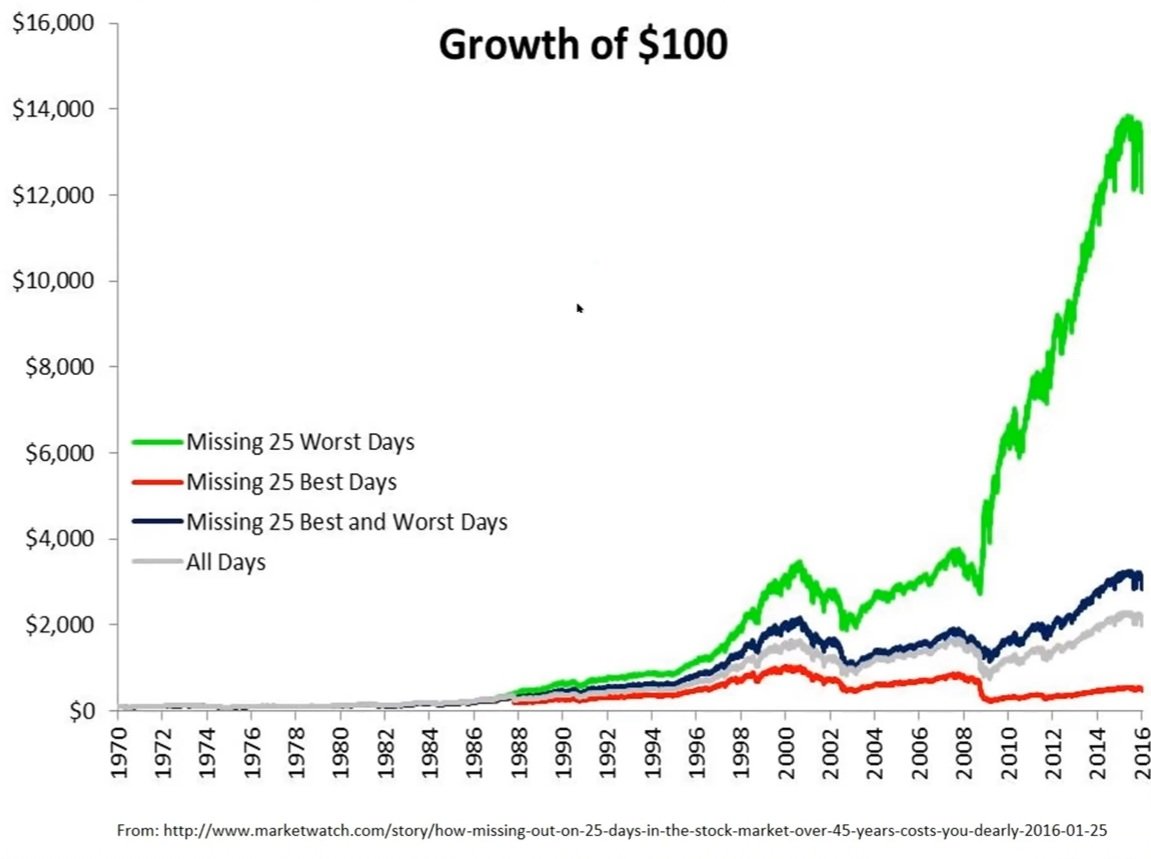

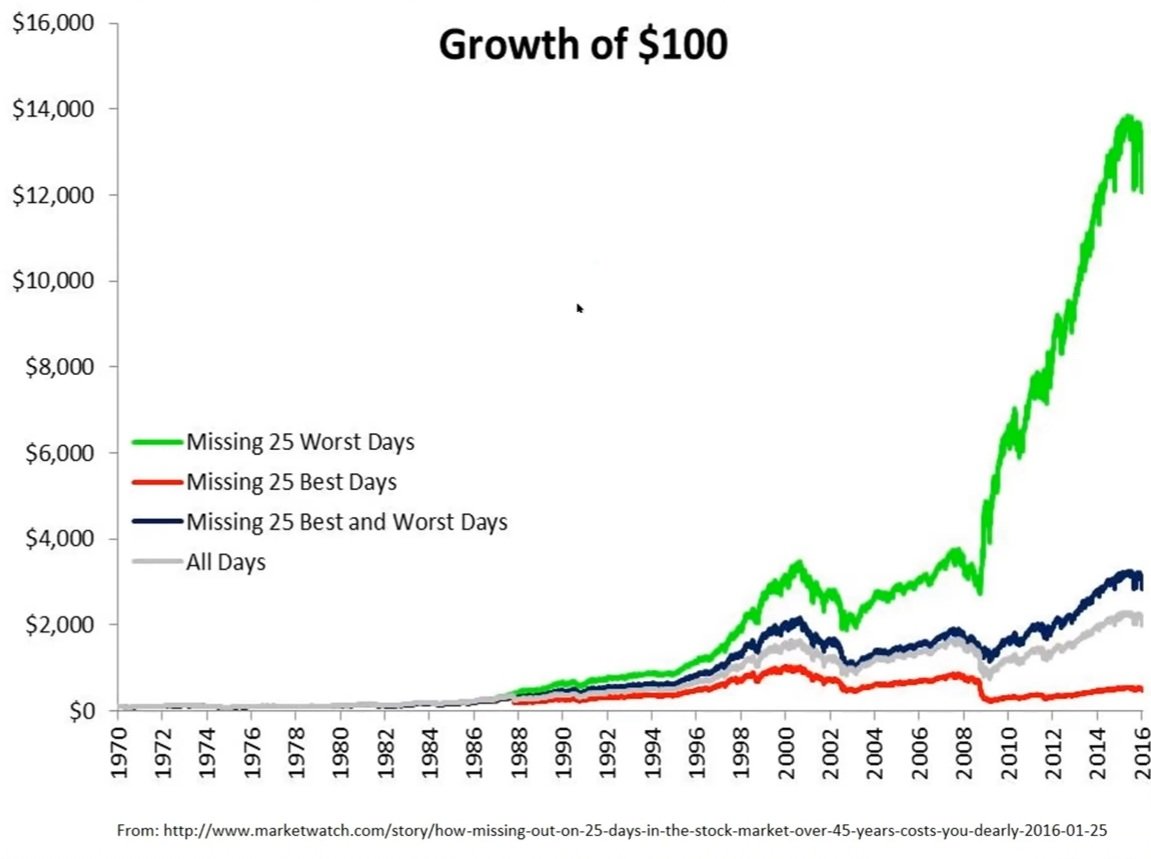

There is the old saying that “Time in the market beats timing the market” The chart below from Dr. Wish’s @WishingWealth presentation at the @TraderLion_ conference shows that to be false.

Full presentation: https://t.co/o2f21GBXci

The green line is unattainable realistically, however, missing volatile times during corrections yields better performance than buy and hold and we can aim for the green line.

Investors usually only show the gray and red results.

More

There are many strategies for investing/trading in the stock market operating within different timeframes and with different objectives.

That is of course what creates a market and opportunity. Timing the market may not be what works for you or what fits your goals/lifestyle.

However, everyone involved in the market is here to make money over time and corrections can cause huge drawdowns in the high alpha names negating incredible performance during strong market uptrends.

There is the old saying that “Time in the market beats timing the market” The chart below from Dr. Wish’s @WishingWealth presentation at the @TraderLion_ conference shows that to be false.

Full presentation: https://t.co/o2f21GBXci

The green line is unattainable realistically, however, missing volatile times during corrections yields better performance than buy and hold and we can aim for the green line.

Investors usually only show the gray and red results.

More

There are many strategies for investing/trading in the stock market operating within different timeframes and with different objectives.

That is of course what creates a market and opportunity. Timing the market may not be what works for you or what fits your goals/lifestyle.

However, everyone involved in the market is here to make money over time and corrections can cause huge drawdowns in the high alpha names negating incredible performance during strong market uptrends.

The Importance of Trading Rules (Quick thread)

Last week I sent out this poll asking if people have a written

Over 60% of people said they did not have one.

It's now one of my main goals to get as many people as possible to commit to writing their own rules which codify their goals and methods.

I strongly believe that writing down your strategy especially if you are a new trader/investor will lead to improved and more consistent performance in the stock market.

Trading the markets is a tough business, money is on the line and emotions can run high.

Preparing ahead of time is essential so that in the moment you are just executing your plan.

This is the best way to stay in the game for the long haul

Last week I sent out this poll asking if people have a written

Do you have a written Trading/Investing Plan?

— Richard Moglen \U0001f4fd\ufe0f\U0001f981\U0001f6a2 (@RichardMoglen) March 7, 2021

Over 60% of people said they did not have one.

It's now one of my main goals to get as many people as possible to commit to writing their own rules which codify their goals and methods.

I strongly believe that writing down your strategy especially if you are a new trader/investor will lead to improved and more consistent performance in the stock market.

Trading the markets is a tough business, money is on the line and emotions can run high.

Preparing ahead of time is essential so that in the moment you are just executing your plan.

This is the best way to stay in the game for the long haul