SAnngeri Categories Screeners

7 days

30 days

All time

Recent

Popular

Never trust a slow mover

if demand is enough, it should go up fast

if not, a small increase in supply can trigger substantial fall

#coforge https://t.co/2yJRCUFMIO

if demand is enough, it should go up fast

if not, a small increase in supply can trigger substantial fall

#coforge https://t.co/2yJRCUFMIO

failing to find momentum

— Aneesh Philomina Antony (ProdigalTrader) (@ProdigalTrader) April 6, 2022

too slow for my liking

4408 - 4508 (0.7R)

cutting it off#coforge https://t.co/NtN2ECRSA4 pic.twitter.com/sz1kH8LPI7

Except ici, none others went above O=H.

(I personally never trade based on O=H/ O=L; area is prone to spikes.)

But, when index & heavyweights have O=H at same time, it lends more credibility. -> today Gapup buyers were not in control.

(I personally never trade based on O=H/ O=L; area is prone to spikes.)

But, when index & heavyweights have O=H at same time, it lends more credibility. -> today Gapup buyers were not in control.

#nifty #hdfc #infy #hdfcbank #icicibank #tcs have nearly O=H. (Give or take few points)

— Pankaj DP (@voPAtrader) March 10, 2022

Rarely this happens.

25Sma in "15 min. t/f" is same as 75 Sma in "5 min. t/f" which we use as 1 Day average

Earlier chart in 5 Min. t/f with 75Sma

Relate oscillator movement to #priceaction & you'll notice price rise as "corrective" based on the feeble rise compared to indicator's rise except once. https://t.co/Tt1kD3iPlY

Earlier chart in 5 Min. t/f with 75Sma

Relate oscillator movement to #priceaction & you'll notice price rise as "corrective" based on the feeble rise compared to indicator's rise except once. https://t.co/Tt1kD3iPlY

Good afternoon master,

— Sunny Singh (@SurendraSinghJi) May 7, 2022

What does sma 5 means with 25 ma as seen in this chart.

How to use it with macd master?

Already following systems that i learned from you.

Want to add another learning from this.

Keep blessings master \U0001f64f

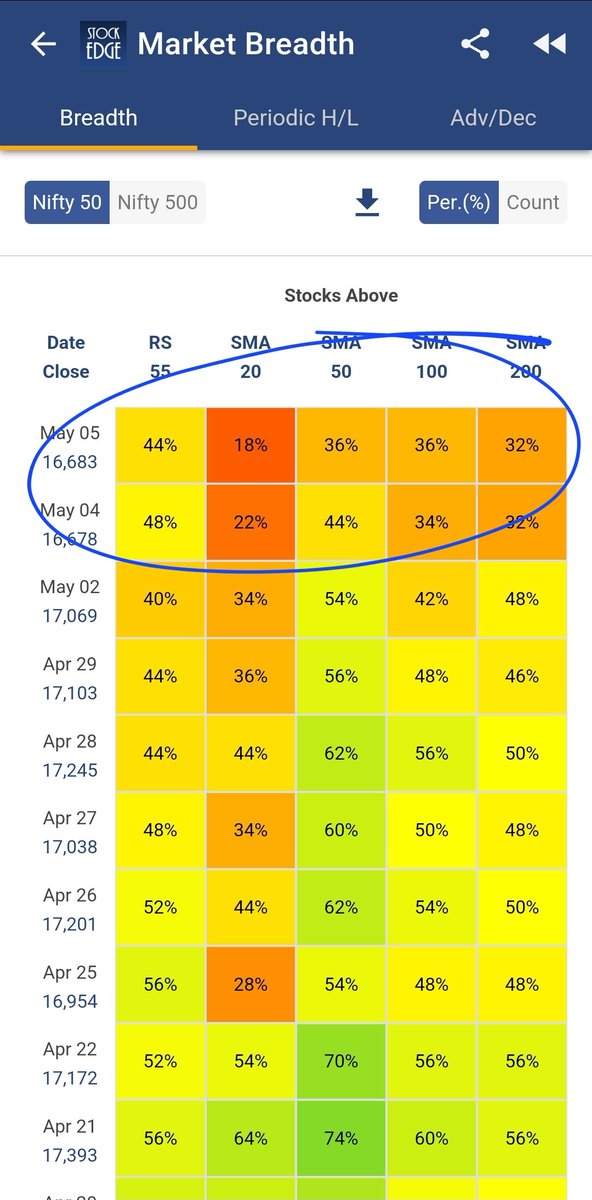

How to know bottom formed?

As per classical tech analysis

Whenever daily RSI starts trading above weekly RSI. Consider it as short term bottom

When weekly RSI, above monthly RSI midium term bottom

Now daily RSI 30

Weekly 37

Monthly 59

@bankniftydoctor ..RSI king.view pl

As per classical tech analysis

Whenever daily RSI starts trading above weekly RSI. Consider it as short term bottom

When weekly RSI, above monthly RSI midium term bottom

Now daily RSI 30

Weekly 37

Monthly 59

@bankniftydoctor ..RSI king.view pl

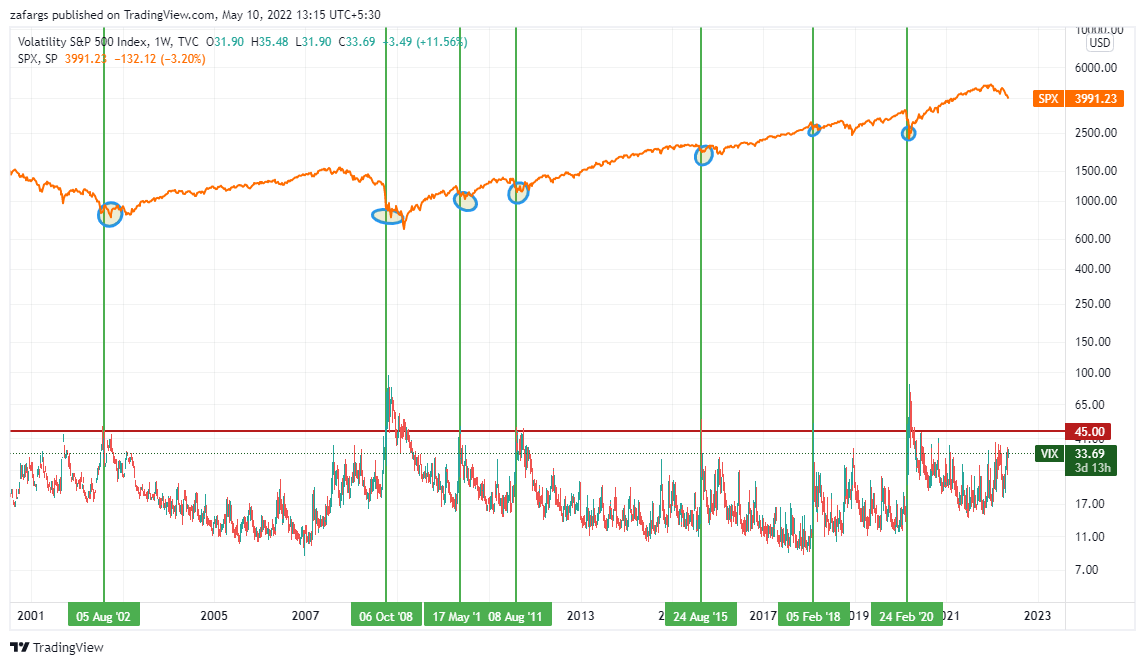

I will do either

— Discipline TrendFollower\U0001f600 (@SouravSenguptaI) March 7, 2022

1.Monthly RSI near 40 ( presently 58)..Did nearly 20 yr backtesting

Or

2 A close above 17350 ( monthly)..This will confirm HH Structure

Levels r as of now