You could choose to make yr entries IF in Hour t/f, it closes above mid point, 13Sma- Your choice

Elliott wave alerted to termination of "ABC" correction at 2540-2550; Now, with "i" & "ii" almost done, would be looking for "iii"rd https://t.co/rSbLlguwp1

Bollinger band has been a trusted guide with the settings of 13sma & 2 std deviation. Add to it 5 & 8 smas and it works in all time frames.

— Van Ilango (JustNifty) (@JustNifty) September 29, 2020

Start from week & Day for investments; Hour & 5 minute for intraday.

Experiment initially; you'll still need other tools to read the mkt\U0001f600\U0001f64f pic.twitter.com/yEkHiDHiha

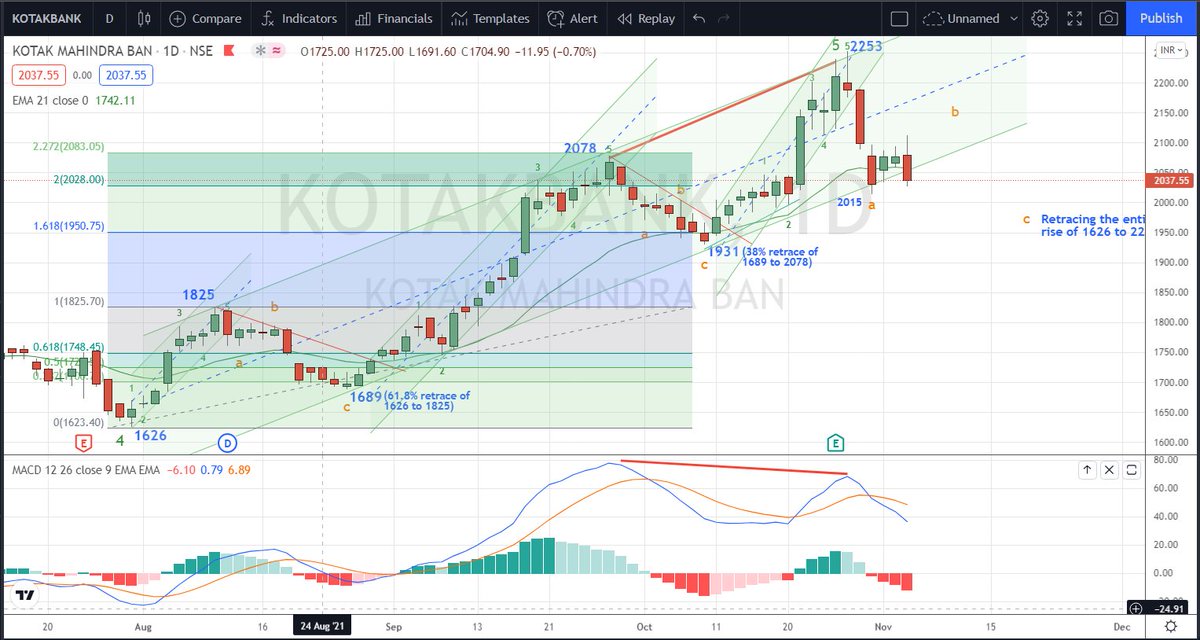

#Elliottwave puts #PriceAction in it's context

— Van Ilango (JustNifty) (@JustNifty) December 2, 2021

You're 1 undisputed expert on prime source of everything, #PriceAction

Let beginner start with #PriceAction & then step up to 12345 & ABC

Baby steps alone will take to maturity

Read this book months ago - "Rich Experience shared"\U0001f64f https://t.co/VUbG6F5Ems pic.twitter.com/PProaFsMsV

Only 2 signals - Buy & Sell

There is no stop loss in this system.

There could be some wild swings in prices like on "Budget Day" - In such a scenario, Keep 30 - 50 points below 21Sma to avoid big DD

It's a SAR system

how to take stop loss..? low of prev candle?

— ABHINAV JAIN (@abhijain017) February 9, 2022

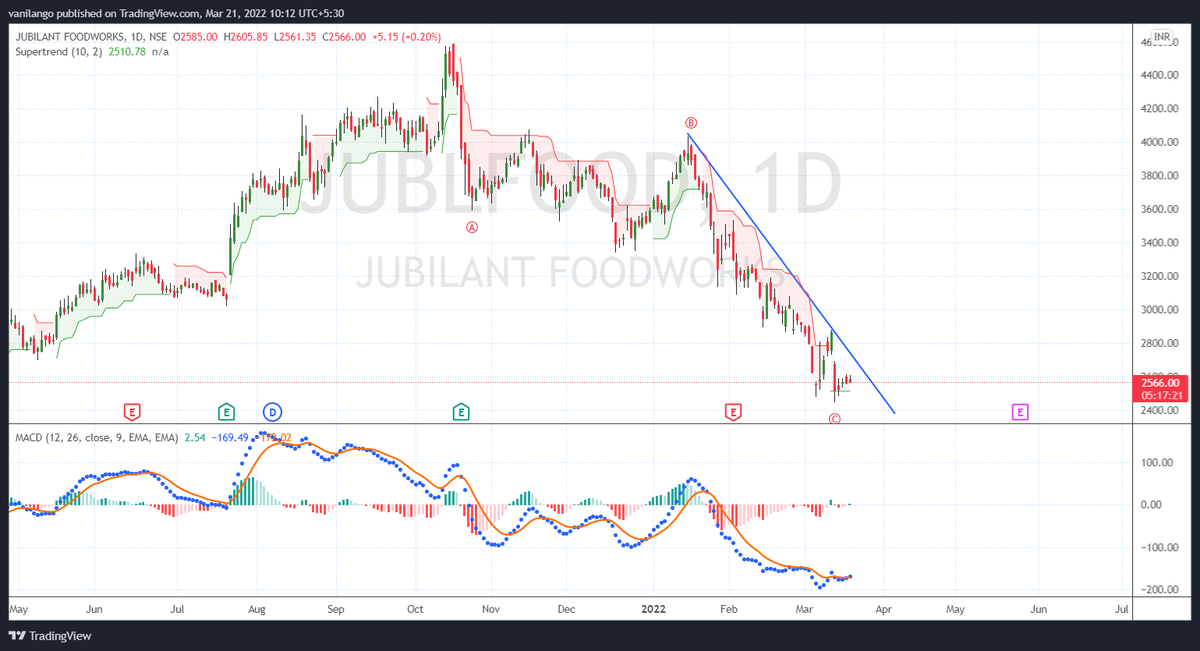

Holding 2500 & moving past 2615 would be the 1st sign of reversal attempt

Only +ve factor "Highly oversold"-meant for aggressive traders

Conservative traders wait for some "Bull candle" formation in Day t/f https://t.co/NbwmqJxo0W

sir view on jubilant food works pls

— om namo venkatesaya (@being__trader) March 21, 2022

Simple: When 13 moves above 21 in "15 Minute t/f for Intraday only", BUY

When 13 moves below 21 in "15 Minute t/f for Intraday only", SELL as in a SAR system

Master just one doubt about the re-entry part

— Sunny Singh (@SurendraSinghJi) February 10, 2022

You mentioned to re-enter at 17430 levels.

How to initiate the trade at the lowest point when the candle is in the formation mode.

Is it that when the price touches 21ma we should entry longs till 13ma is above 21ma.

Show path \U0001f64f

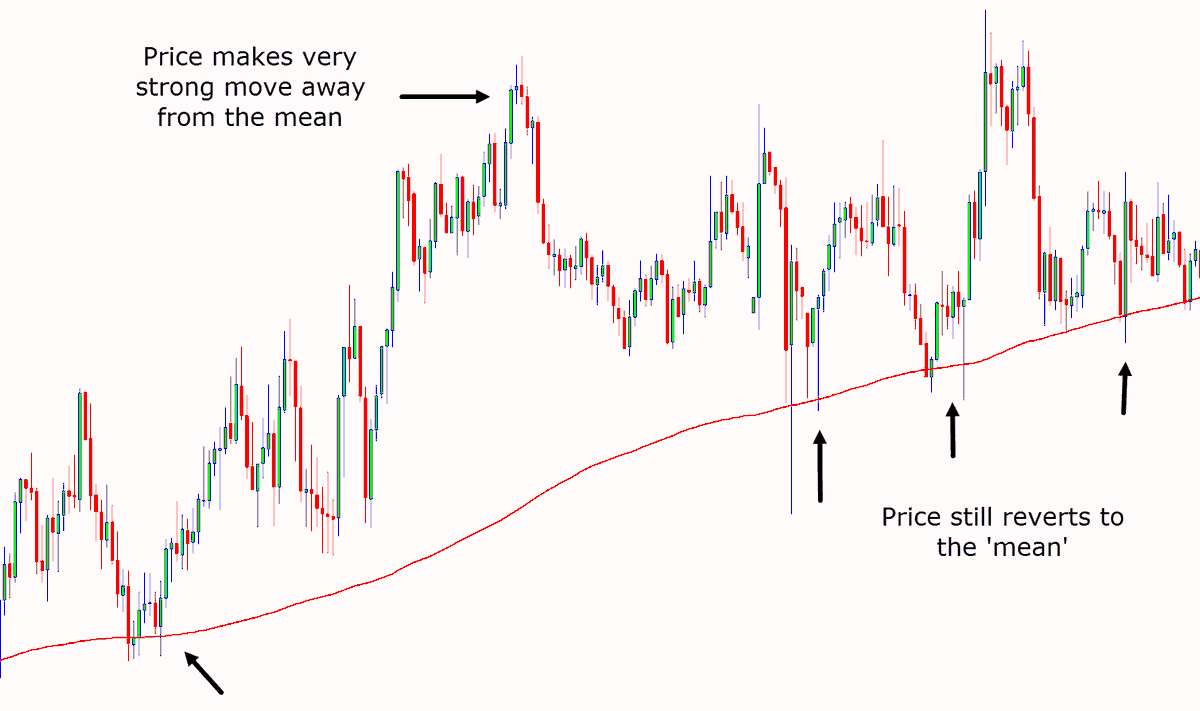

Addl.strategy: When prices move far from MA, say 150 to 200 pts, "Part book" & re-enter when prices pull back to MA

Choose to do this way 1 or 2 times only for intraday

Idea is "Mean Reversion" - Prices tend to move back to MA IF they move far away from MA in a trending phase.🙏

OR, it just moves between 13 & 21 & move higher

Channel bottom comes around "17300"- no guarantee that every time it touches the channel bottom

Patience pays

IF you miss a trade, wait for the next

They always come🙂🙏 https://t.co/CfVFhgbFxl

Is it better to buy when price below ema 21 ?\u2026 as SL will be less

— TaksJ (@TaksJoh) February 16, 2022

And, you still want to search for something better..

Do not fear few whipsaws that happen now & then.

This "SAR" captures all the large moves 💯of the time.

Simple things are beautiful.

BUT you're adamant to make it complicated🤔😏

This is the daily update and attached is the trade sheet from 1st Dec till date. Total profit is 3922 Points per Nifty lot by simply following price. https://t.co/8ZCC0nSWuW

— Harsh (@_Harsh_Mehta_) February 17, 2022

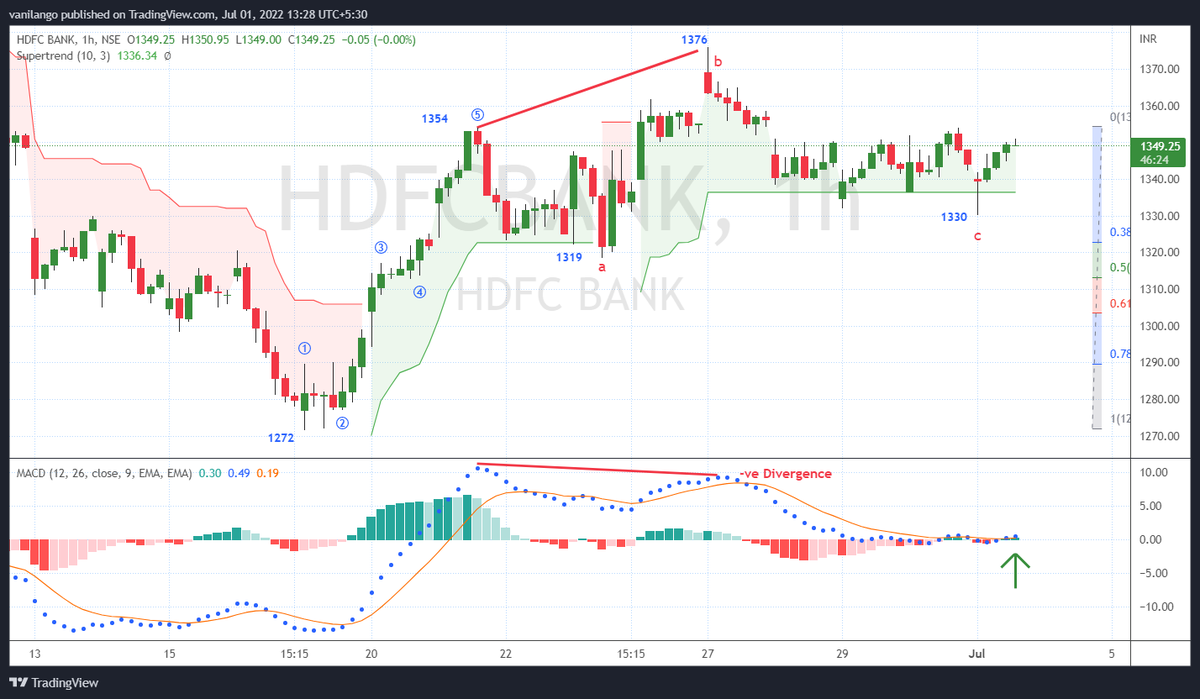

I use MACD for reversal points only.

Do not follow it at every 5 minute.

Yesterday and today both we had MACD divergence . Yet market was just continuing in the opposite direction . Can you please what to do in such case ? . For eg - today I was unable to go long because there was divergence . Same case was for yesterday . Can you please guide .\U0001f64f pic.twitter.com/vfqy8dRAU2

— Mehul (@MehulGarodia9) May 20, 2022