1. Darvas Box System

2. ATR based trailing

3. PSAR based trailing

4. EMA Crossover based trailing

Okay sir but dusre konse method se exit ya profit book kar sakte hai sir sry apako bohot pareshan kar raha hu but sry sir

— learner \u2600\ufe0f\u2600\ufe0f (@darvaxfan1845) March 12, 2022

Lest some charlie jumps to point out, let me make it clear that I haven't invented anything in stock market, all my knowledge of stock market comes from old farts. Just my observation is my own. https://t.co/uHNw8tV4AO

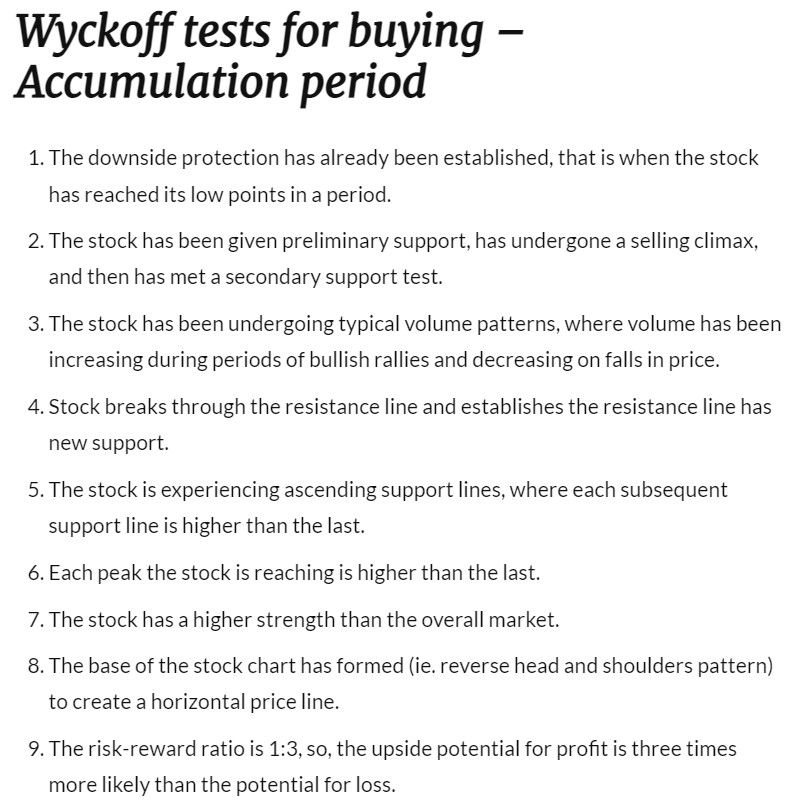

Plz advice how to identify accumulation and distribution phase...... to me Both looks same

— VIVEK VAID (@bobvaid) February 12, 2022

I am retweeting my Beginners Pathway Thread No, 3 on Open Interest Data Analysis for benefit of all. https://t.co/cwYtbYK6JP

Here comes the 3rd and final part of the long weekend 'Beginners' Pathway" series.

— Professor (@DillikiBiili) October 17, 2021

In this we'll see Open Interest basics and Option Chain Analysis.

Have no intention to enjoy the misery of fellow market participants but 'Maine Bola Tha' !

#ProfGyan - If a freak low gets made some day, Stocks/Indices always try to visit it at least once (seekh lo, mere mentorship course ka launch kuch pukka nahi hai) https://t.co/3B6e2nMx0y

Two prophecies about IRCTC:

— Professor (@DillikiBiili) May 1, 2022

1. It would touch 640 someday

2. It would get expelled from F&O https://t.co/qJ04hG0qFH pic.twitter.com/TPUBSQFW1y

1. Go through Zerodha Varsity chapters on Technical Analysis at least 2 times.

2. Then read 'Technical Analysis Explained' by Martin Pring

3. Finally read 'Price Action bar by bar' by Al Books (Not for casual reader).

Sir @DillikiBiili , could you please suggest a book for technical analysis ?

— Pawan Yadav (@pawan_yadav86) March 25, 2022

See Large OIl buildup kin strikes par hai and in between strikes data kaise move ho raha hai.

Thumb Rule:

Calls Reduction + Puts addition = Upthrust

Calls Addition + Put Reduction = Down move

Higher the Delta OI velocity, faster is the move.

For Nifty Intraday Traders: As of now, this seems to be a buy on dip market and looks like there won't be any juicy trades on short side. Will update if data changes. https://t.co/PCIyyPld4A pic.twitter.com/ES3o4z60rY

— Professor (@DillikiBiili) March 11, 2022

Gold is down for now, but every time demand is coming from the support zone.

— Professor (@DillikiBiili) May 8, 2022

I am bullish on Gold for long terms, as per me it would break its ATH resistance, my expected target is BRN of USD 3K/Oz. https://t.co/XT1l48pEx5 pic.twitter.com/8ViSeIPDzN

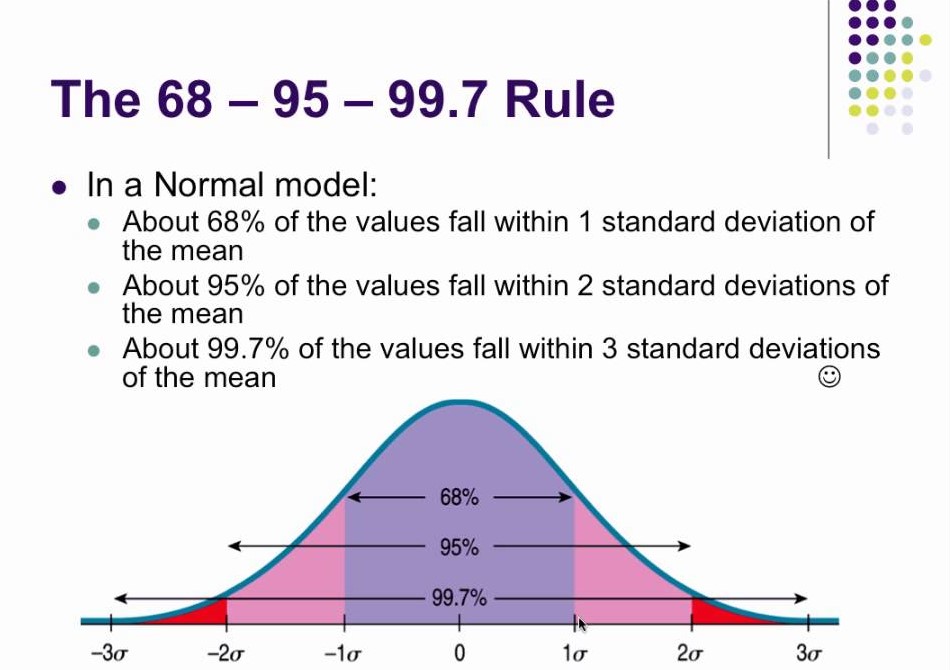

As per Normal Distribution 68% of the time movement is with 1% SD Limits.

For 95% pf the times movement is within 2% SD limits.

And its only 0.3% of the times that movement exceeds 3 SD.

Since 95% covers a lot of ground that's why 2SD is considered to be a a safe range for most events.

The farther we move from the average, chances of occurrence go down. This is what Taleb sahab calls Tail risk, because it lies in the tail of the standard distribution curve.

Normal distribution occurs everywhere. See this

The Galton Machine shows order from randomness. Each ball bounces left or right at random, 12 times, but together where they fall can be predicted - the normal distribution. This one made by: https://t.co/oI9wOGq7nG pic.twitter.com/VQtVu66OSE

— Tom Stafford (@tomstafford) April 19, 2018

Bollinger Band, which is a very popular indicator has a setting of 2SD. Because its expected that 95% of the time moves will be confined to 2SD limits.

When we say that price is at upper/lower Bollinger band, we are saying that it has reached 2 SD limits and likely to reverse.

Now coming to current scenario, open Nifty daily chart and apply two bollinger Bands on it.

First with default setting and in second change settings to 3 standard deviation.

Crossing 3 SD boundary means that Nifty is now in very rare territory where it has been only 0.3%