CodyyyGardner Categories Trading

The first day back at work at the WTO.

What’s happened to the UK’s commitments (“schedules”) on goods (tariffs, tariff quotas, farm support) and services in the WTO now that the Brexit transition is over, and the UK no longer applies the EU’s commitments?

1/12

NEW UK DOCUMENT

The UK has circulated a new document outlining the latest situation with the commitments on goods and services, various agreements, applied tariffs and preferences (GSP, UK-EU deal), WTO dispute settlement, trade remedies, laws

https://t.co/DtiObLumJd

2/12

GOODS

Tariffs, tariff quotas, farm support

The UK is now applying the commitments it proposed in 2018 with amendments in May and Dec 2020 (correcting errors) even though they have not been agreed.

5 rounds of talks. Some agreement, or “close” to

https://t.co/DtiObLumJd

3/12

SERVICES

The UK is now also applying its proposed commitments on services. These have not been agreed either, but only one other country (understood to be Russia) is in negotiations with the UK. The rest have not raised objections.

https://t.co/DtiObLumJd

4/12

AGREEMENTS

The UK confirms accession/ratification in its own right

● Government Procurement

● intellectual property (amendment)

● Trade Facilitation

● Civil Aircraft

● information technology products (duty-free)

● pharma products (duty-free)

https://t.co/DtiObLumJd

5/12

2020 Predictions Report Card

Item 1 - Tesla will lose more money in 2020 than 2019.

❌

I missed this one clearly. Didn't realize that they could recognize three years of credits in a single year, because I was using GAAP. Tesla does not appear to be conforming to GAAP here.

2020 Predictions:

— Dean Sheikh (@DeanSheikh1) January 19, 2020

Tesla will lose more money in 2020 than in 2019.

The Model S will be discontinued.

MY prices will be cut $2K+ after the first batch of suckers make their purchase.

MY SR+ will come out this year to hide lack of growth from the weakest retail investors.

Doubt the auditors make a stink about it but who knows.

Also note that the total net income for the first nine months of 2020 ($451M) matches almost exactly the increase in A/R balance ($433M). A/R balance is now 1.76B, dwarfing their reported profits of $451M.

Item 2 - Model S will be discontinued.

✔️❌

They didn't discontinue. They dropped the price $10,000 instead. Combining this will the price cuts in 2019, including free EAP, gross margins for the Model S are now decisively negative. Giving myself partial credit on this one. (:

Item 3 - Model Y price will be cut $2K after initial orders are filled.

✔️

Ding ding ding. Prices were cut $3K right after initial backlog was filled.

Item 4 - MY SR+ will be released

❌

Missed this one. My best guess is that M3 SR+ are so low, they don't want to offer a similar MY variant.

Not just money - we're talking Industry Progress & WTF Moments.

1/ Thread 👇

2/ #Decentraland goes public - Feb 20th

First impressions were, empty, lonely, buggy, crashes, not much to do, etc.

Now there's HQ's, Top DJ Events, 100+ Galleries and

December so far had over 5k weekly visitors.

I wrote a post-launch

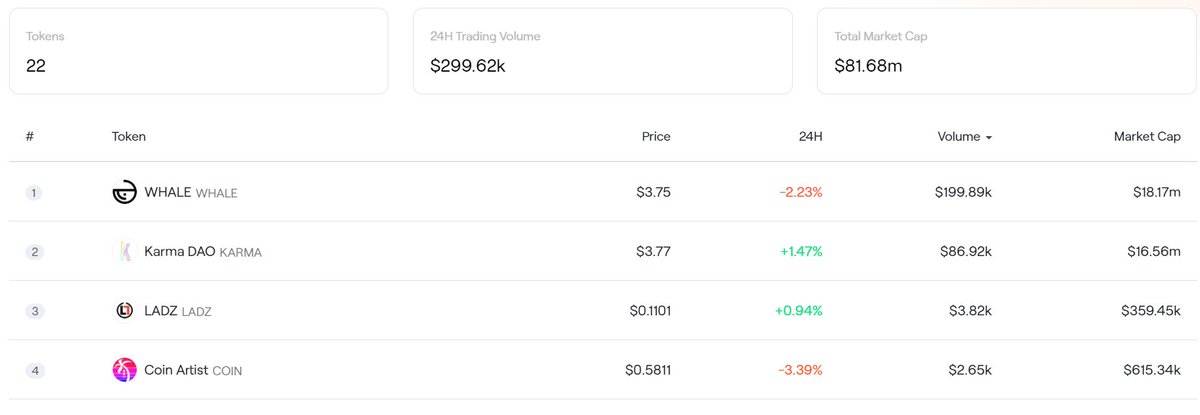

3/ $WHALE Launches May 3rd - A social currency backed by $2M+ of #NFT assets by @WhaleShark_Pro & @whale_community.

People across all NFT projects & platforms were incentivized to work together.

A top social currency by market cap, volume AND community.

https://t.co/7RZ4QyNu8N

$WHALE ENTERS NFT & CRYPTO LAND

— WhaleShark.Pro (@WhaleShark_Pro) May 2, 2020

A revolutionary Social Currency that is backed by over 2,900 of the most valuable NFT assets in the World.

Read our Whitepaper: https://t.co/gfqdDoAv2g

Visit our Website: https://t.co/27cP5MNyM5

Join our Discord: https://t.co/lvLi5Vc5gR

4/ @trevorjonesart Picasso's Bull sells for $55k on @niftygateway.

A record sale at the time for a single Art NFT. Many in the broader NFT space started to pay attention from here.

The drop totalled ~ $75k with a Silver /10 recently going for $19.5k! on 8th Dec, (from $750)

5/ Eth fees Sky rocket - Mid 2020

With Activity on ETH going berserk, ETH fees went from average $0.20 per transaction to now ~$5.4. More with NFTs.

This forced NFT projects, (especially gaming), to prioritize scaling/L2 while it was still 'ok' to trade Art as most are $300+

I did not *write* much this year, but I was lucky to have a few things published anyway:

1. My essay “What *was* primitive accumulation?” — which has been online since 2017 — got its permanent published form in @EJPTheory vol. 19, issue 4:

The article argues against the recent revisionist accounts of primitive accumulation.

2. My highly critical review of Gareth Stedman Jones’s biography of Marx was published in Historical Materialism: https://t.co/tTh3FUaW1s An excerpt:

3. My engagement with @martinhaegglund’s This Life: Secular Faith and Spiritual Freedom appeared in @LAReviewofBooks, as part of a symposium on Hägglund’s book.

They don't call him the ZOG Emperor for nothing. pic.twitter.com/QkEObaF7FC

— Johnny Gat (@vigilante_intel) December 30, 2020

I have repeatedly warned about the section 230 issue. You don't repeal it, you reform/enforce it. This will be a death blow to alternative tech platforms like GAB, who do not have teams of corporate lawyers to field frivolous lawfare attacks that will be waged if this happens...

It will give big tech the excuse they need to ban & censor even more accounts and to *really* act us publishers, editorializing. It gives them the excuse that they no longer have immunity and thus have to censor to avoid legal liability for posts/user behavior...

This will then cement the big tech companies who do have teams of corporate lawyers monopolies. This is what silicon valley has been lobbying for. They want to he regulated so they can use that as an excuse to purge content they don't like...

Removing section 230 will be the end of the internet as we know it. It will be the end of alt tech platforms like Gab that so many conservatives have been relegated to. So why are "Republicans" pushing to disenfranchise their own constituents even more? Because big donors want it

Ok - first, a *quick* history lesson - in the last ~3 months, I have been increasingly obsessed w/ learning about monoclonal antibodies. It started as a simple pattern recognition that a lot of the biotechs I was investing in were in this space - $HGEN $PRVB $MGNX $ONCT etc.

Not to mention, all of these new COVID therapeutics ( $LLY $REGN ) were antibody based - what the heck exactly are these things? I found myself watching basic videos - like this simple 3 minute cartoon summary...

.. to this podcast on the history of monoclonal antibodies, like this Nature podcast: https://t.co/iXcq56RR5l And a bunch of more academic / scientific white papers and articles that are far too dry to share here

Probably a good time to add that I barely made it past high school biology - my academic and professional background is all based around finance / math / SaaS - so as much as I'm interested in biotechnology, it's all self-taught and I needed to start with the basics

How high can #gold run during this next intermediate cycle?

— Gold Ventures (@TheLastDegree) January 1, 2021

my current target stands at $2440 by May

targets are not exit points: the combination of a lot of signals/ratio's are. we adapt along the way

(1) https://t.co/QjuekzVzw1

Today i want to look what some major miners did - between the 2 parabolic gold advances: how did they act?

Getting more historic context in the minds, will allow us to navigate calmer the stormy waters ahead, and HOW we want to manage them.

(2)

my basic framework is we will see a parabolic metal top mid 2021, followed by another parabolic metal top early 2023.

Now what did some miners do in a same situation: the 2006-2008 timeframe.

Notice the $GDX was launched exactly a few weeks after the 2006 top 😉

(3)

example 1 of 4 is Barrick

gold lines = 2 gold parabolic tops.

Barrick didn't advance much first, and as such had only a 23% retrace before setting a floor.

Not something you would have wanted to trade.

Even with the 50% gold parabola retrace, the metal floor was $150 higher

example 2 of 4 is Hecla

while Hecla corrected 42%, the correction was very fast in time. The new metal floor made it quickly rise back after.

Something we could have hedged with SLV puts for example.

Silver retraced 38% and traded in tandem with $gold

2/A few years ago we invested in a private company called Meituan (3690 HK). Meituan is like doordash or Uber eats and we thought in China, with over 100 cities >1m pop, this would be a huge market. The other competitor was owned by Alibaba.

3/The company went public less than two years later at 70. We were ecstatic! Then the stock rapidly plunged to 40 based on renewed fears of competition with https://t.co/oVbw4yOOYV (Alibaba)

4/At the time we were locked up so there was nothing we could do. Today the stock is at almost 300 and $250B market cap. I fear what we might have done if not subjected to the lock up!

5/What’s the learning? In the private markets, the focus -FIRST- is TAM (size of market), then second everything else. And the stock price is static unless there is a new round. So you have time to develop your thesis.