AnmolNarula11's Categories

AnmolNarula11's Authors

Latest Saves

Why do companies like Quibi raise billions, while companies like Peloton get nothing?

Because fundraising is a GAME

And the insiders keep the rules to themselves.

Here are 100 tips the insiders don’t want you to see but will help you win the game:

1. You can’t play the game without nailing the basics.

There are 5 core ingredients to a startup pitch.

Most have 2.

Good ones have 4.

The best have all 5.

There\u2019s a lot of bad advice out there on how to pitch your startup.

— Romeen Sheth (@RomeenSheth) April 10, 2021

Last year, I invested $1M+ and heard 200 companies pitch.

Every great pitch I've heard nails 5 ingredients.

In this thread, we'll go through each to help maximize your chances when fundraising

Let's dig in\U0001f447 pic.twitter.com/FBaUUWHz8L

2. Now that you have a grasp of the basics, it’s time to level up.

Good news - most founders make the same mistakes as each other.

Bad news - these mistakes are really easy to make.

Here's what not to do:

0/ After evaluating 200+ startups this year, I've been in some awesome and not so awesome pitches.

— Romeen Sheth (@RomeenSheth) December 28, 2020

Here are the top 10 mistakes I see Founders make that routinely derail fundraising \U0001f447\U0001f447\U0001f447

3. Ok so you told me what not to do.

So what should I do?

Read below.

0/ Last night I tweeted about the top 10 things Founders do that derail fundraising. It struck a chord. 2,500+ liked the tweet.

— Romeen Sheth (@RomeenSheth) December 30, 2020

I got a ton of DMs asking the opposite question: \u201cWhat are the top things Founders do well when fundraising?\u201d

Here's my top 10 \U0001f447\U0001f447\U0001f447

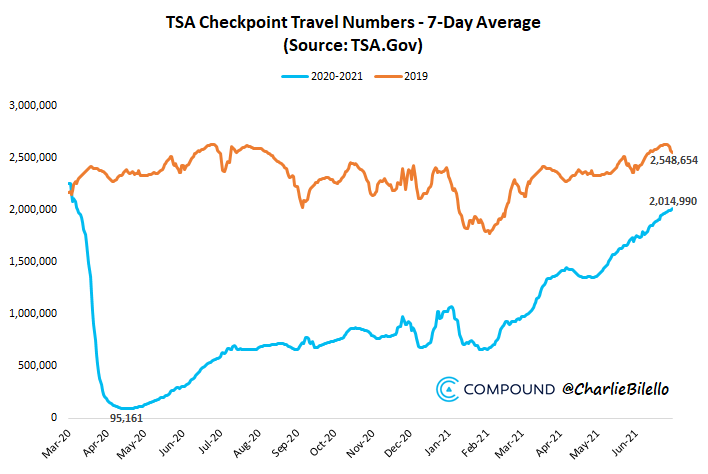

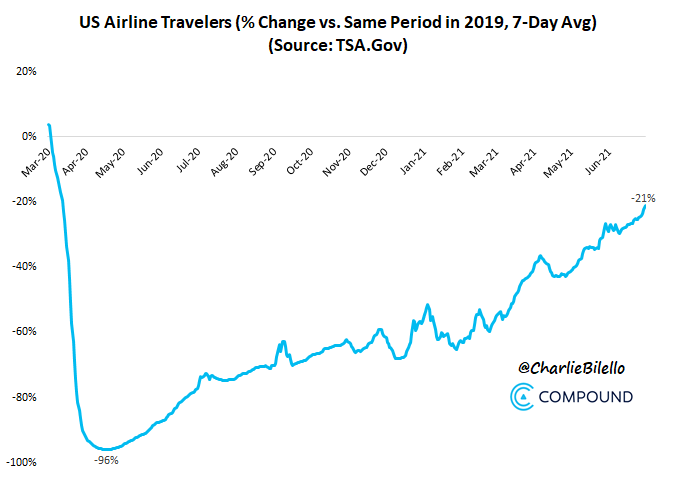

4. We’re in a really unique fundraising environment right now.

It’s important to contextualize all these tips in the “here and now” of what’s going on in the landscape.

Raising money for startups is wild right now. I\u2019ve never seen anything like it.

— Romeen Sheth (@RomeenSheth) May 5, 2021

Lots of Founders are wondering how to approach it and who they should partner with.

Here are 10 observations / practical tips I've shared with 100+ Founders in the last few months \U0001f447\U0001f447\U0001f447

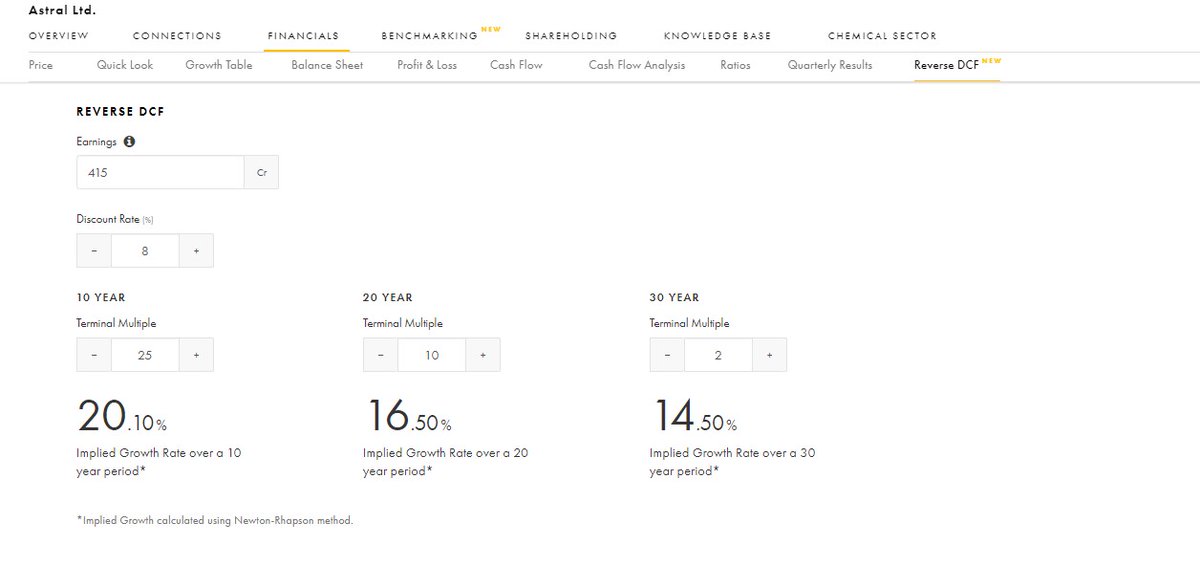

Can value investing strategies be improved by adding intangible assets?

👾 The Asset-Light Economy

🔮 The Dark Matter of Finance

🏰 Intangible Moats

📉 The Disruption of Value

👨🎓 Fixing the "Value Factor"

(Not investment advice)

🧵

(0/10) Full paper here 📘

Blog

https://t.co/omtrn9kfvt

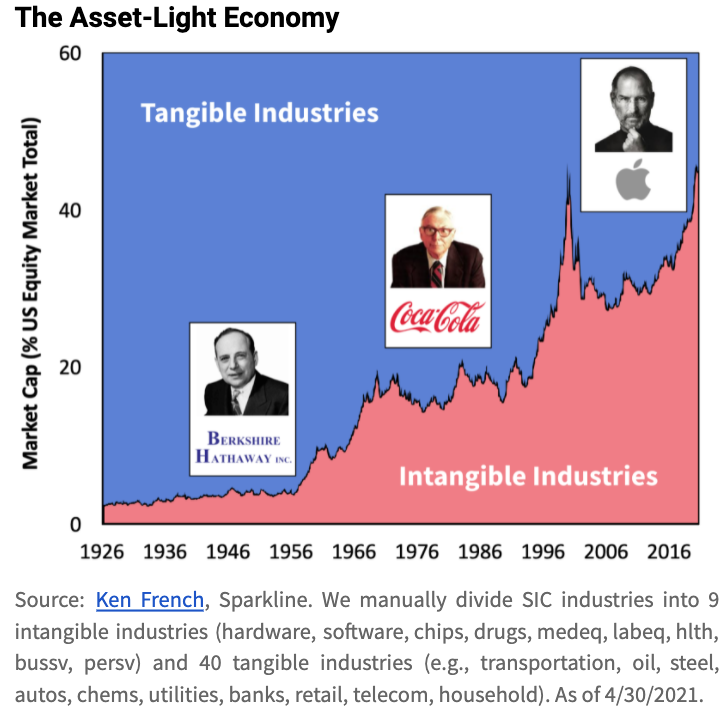

(1/10) The Asset-Light Economy 👾

“The four largest companies today by market value do not need any net tangible assets. They are not like AT&T, GM, or Exxon Mobil, requiring lots of capital to produce earnings. We have become an asset-light economy."

- Warren Buffett

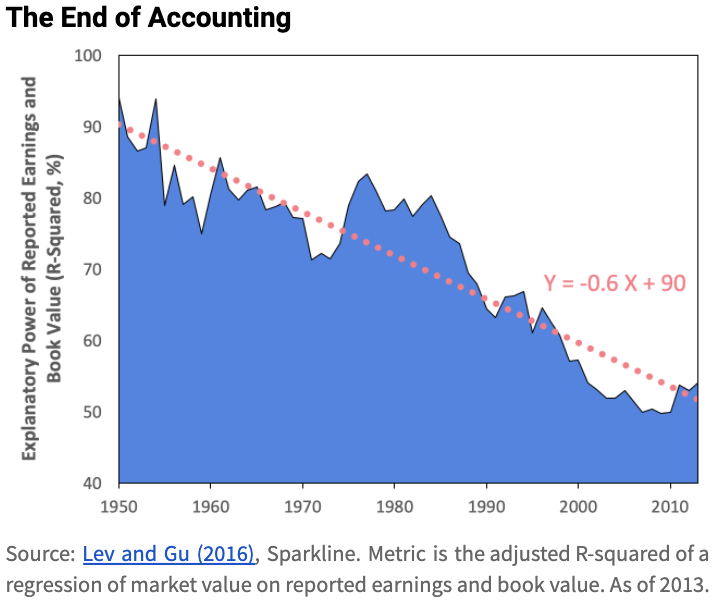

(2/10) The End of Accounting 🧮

“The constant rise in the importance of intangibles in companies’ performance and value creation, yet suppressed by accounting and reporting practices, renders financial information increasingly irrelevant.”

- Baruch Lev and Feng Gu

(3/10) The Dark Matter of Finance 🔮

While intangible matter holds the financial universe together, it is not visible to the naked eye. Unstructured data contains info on intangibles but is large, noisy, and resistant to standard statistical analysis.