AnmolNarula11 Authors Sajal Kapoor

7 days

30 days

All time

Recent

Popular

MCap is a function of market sentiments. Balance sheet, cash flows, R&D execution, talent acquisition, regulatory compliance, M&As and so on....are a function of management/governance. Never mix the business with the stock. Stock is not the business. Business is not the stock :)

It's simple, if ""FY23 PAT of this API to CDMO = FY21 PAT of largest pure-play CDMO/API"" then the FY23 Mcap of this API/CDMO= FY21 Mcap of largest pure-play CDMO/API, am I correct Sajal saab??

— richman (@greatrichman3) June 14, 2021

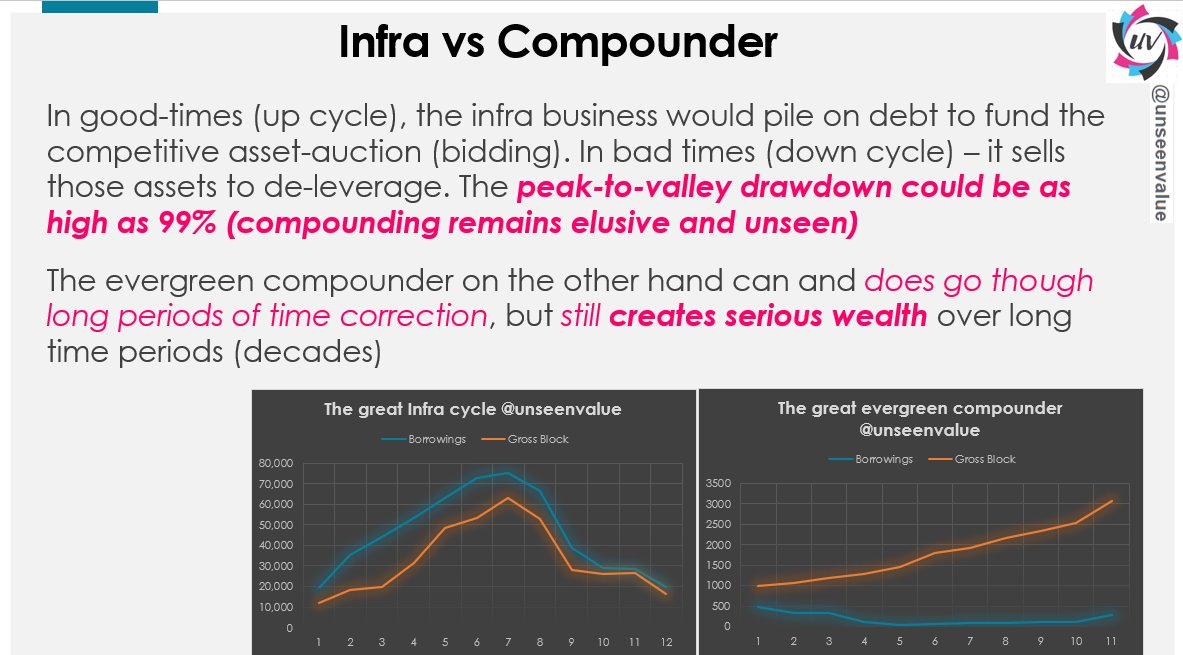

When we put a high multiple to sales, the most important thing to worry about is - what could disrupt those cash flows. A lower multiple to sales (like a 1x or 2x) justifies Yo-Yo cyclicality and 10x sales implies relatively stable gross margins, cash flow and business economics.

It's amazing \U0001f60a 25% NP

— Avinash (@Aviral_Bharat) February 17, 2022

$8b revenue

$2b Profit

$92b MCap

At 11 times revenue, it seems to be cheap compared to\U0001f609

18-19% ROE wale being bought by institutions at anywhere b/w 12 and 20x price to sales. Not many liked this space in 2013. Not many hate it today. Social validation in investing is a big curse ...

Ghor ChemYug 😆

Ghor ChemYug 😆

#DeepakNitrite valuation is most attractive in the space...

— jeevan patwa (@jeevanpatwa) June 30, 2021

growth will be most explosive in the space... pic.twitter.com/8VYdWwFApY