Alex1Powell Categories Trading

7 days

30 days

All time

Recent

Popular

Med-tech is a great industry to get to know

Study these stocks to learn more:

$ABMD

$ALGN

$AMWL

$DXCM

$GDRX

$GH

$IRTC

$ISRG

$LGVW / $BFLY

$NARI

$NVCR

$NNOX

$OM

$ONEM

$PGNY

$PODD

$SDGR

$SILK

$SLP

$SMLR

$SWAV

$TDOC

$TNDM

$VEEV

$ZYXI

Podcast deep dives ⬇️⬇️⬇️⬇️⬇️⬇️⬇️

Podcast deep

$DXCM $PODD

$GDRX

https://t.co/PGhTW6JffI

$NARI

https://t.co/T5q1XPc044

Study these stocks to learn more:

$ABMD

$ALGN

$AMWL

$DXCM

$GDRX

$GH

$IRTC

$ISRG

$LGVW / $BFLY

$NARI

$NVCR

$NNOX

$OM

$ONEM

$PGNY

$PODD

$SDGR

$SILK

$SLP

$SMLR

$SWAV

$TDOC

$TNDM

$VEEV

$ZYXI

Podcast deep dives ⬇️⬇️⬇️⬇️⬇️⬇️⬇️

Podcast deep

$DXCM $PODD

$GDRX

https://t.co/PGhTW6JffI

$NARI

https://t.co/T5q1XPc044

I was still in high school in 2000, so obviously wasn't investing.

But the more I read, the more I realize it wasn't just a using "eyeballs" for valuation problem.

Thread below:

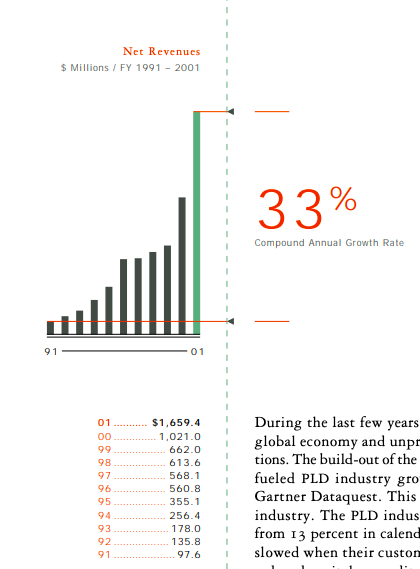

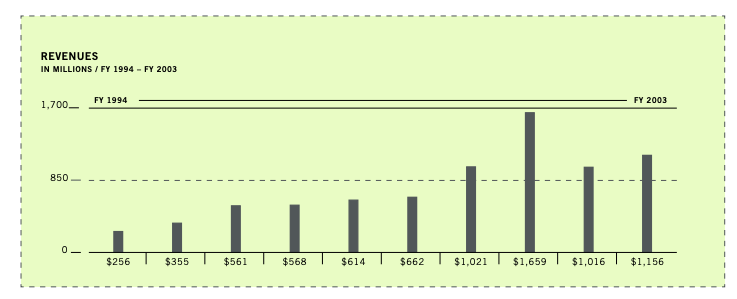

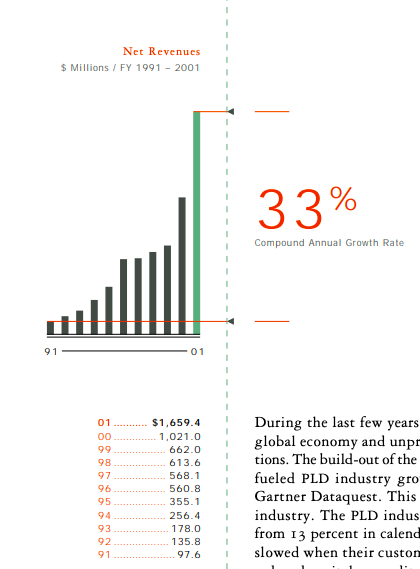

First up Xilinx

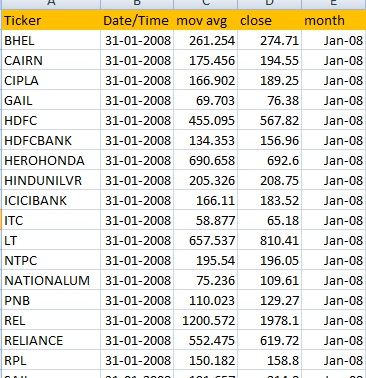

They were the leaders (and still are) with ~40% share in FPGAs. The end market was growing. They were growing fast as shown in this chart for fiscal year 2001 ending in March 2001

The CAGR was lot higher in closer to 2000 - it was growing 50%+. Until 2001 that is. That's when revenues dropped 30% due to market correction.

Xilinx - an innovator and leader in FPGAs - did not reach same stock price until 2018!

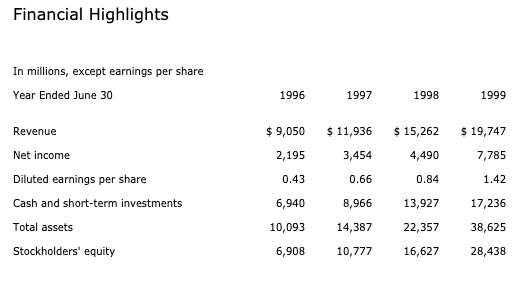

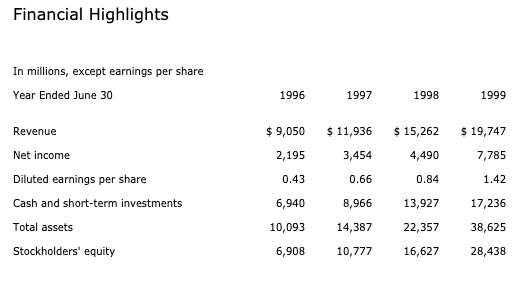

Next up - Microsoft

It was growing fast, Bill Gates was talking of PC plus era where internet would enable new features

But MSFT got multiple compression problem as covered in this excellent tweet from @corry_wang

Stock price to dropped from the highs of late 1999 and didn't get back till 2016, despite quadrupling earnings in the next

But the more I read, the more I realize it wasn't just a using "eyeballs" for valuation problem.

Thread below:

First up Xilinx

They were the leaders (and still are) with ~40% share in FPGAs. The end market was growing. They were growing fast as shown in this chart for fiscal year 2001 ending in March 2001

The CAGR was lot higher in closer to 2000 - it was growing 50%+. Until 2001 that is. That's when revenues dropped 30% due to market correction.

Xilinx - an innovator and leader in FPGAs - did not reach same stock price until 2018!

Next up - Microsoft

It was growing fast, Bill Gates was talking of PC plus era where internet would enable new features

But MSFT got multiple compression problem as covered in this excellent tweet from @corry_wang

Stock price to dropped from the highs of late 1999 and didn't get back till 2016, despite quadrupling earnings in the next

12/ "The multiple matters just as much as the growth"

— Corry Wang (@corry_wang) September 1, 2020

Sorry guys, I couldn't resist fitting at least one truly hot take in here... pic.twitter.com/NuT7dIeRBd