123priyanshu's Categories

123priyanshu's Authors

Latest Saves

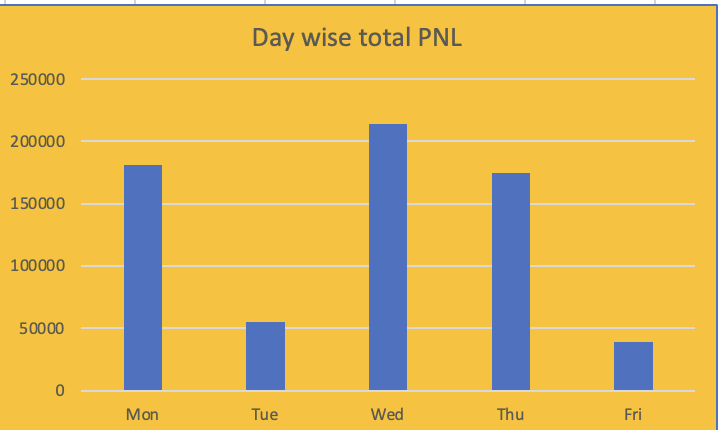

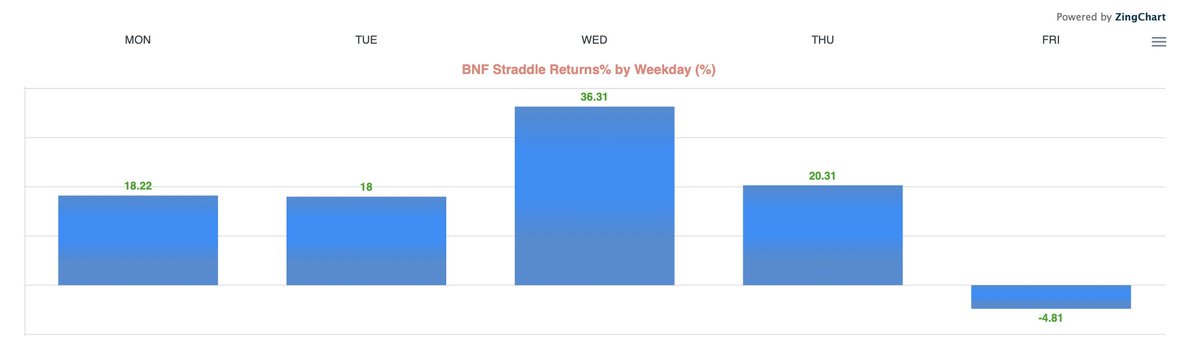

Here's day wise total profits, Wednesday are the days it has generated highest profits compared to all other days and Friday being the least profitable day.

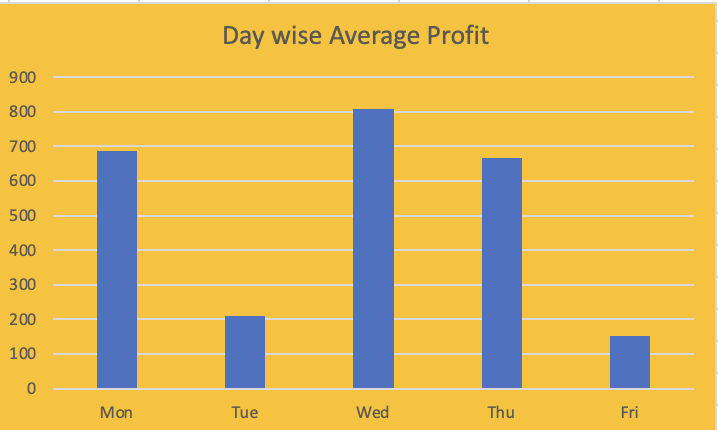

Here's day wise average profits, obviously Wednesday are the days it has generated highest average profits compared to all other days and Friday being the least profitable day.

Even the live profits after all charges generated through 920 straddle trading bots at https://t.co/AKj4vqky6X also reflected Fridays are not profitable when you incur all charges. Wednesday being the most profitable day. Live profits are shown here https://t.co/3hgti23lRB

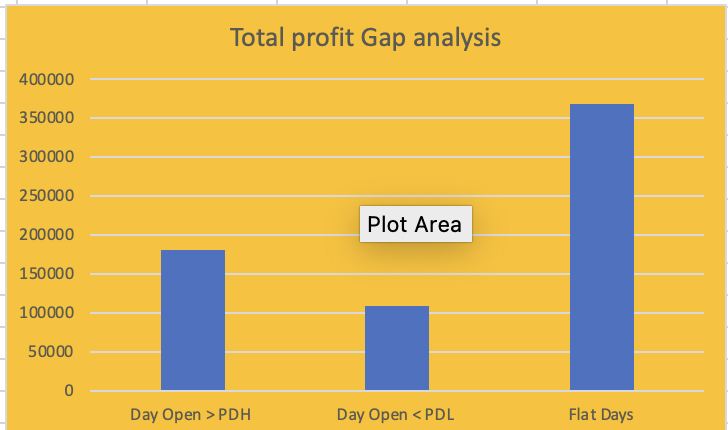

Here's total profits made during gaps, when day open is greater than previous day high, Day open < Prev day low and flat days. Irrespective of gaps, its able to generate profits over all. Even the avg profits denotes the same

🧵

Here is a compilation of 42 of his tweets that I found useful in my quest for system building:

1) His first 100% ROI

Reached 100% returns today in less than 6 months goal no 1 achieved.writing a thread to share my journey what kind of systems i trade and future plans.started this experiment in may with a capital of 9.86L till yesterday profit was 9.56L today's profit made me cross 100%. pic.twitter.com/j2ZGfCRKZZ

— Logical Trader (@TraderLogical) November 3, 2020

2) Backtesting Bar by Bar is the real deal. He had spent 6 months, 6+ hours per day doing bar by bar

reading/listening the story of many successful trader friends from twitter i feel i really got lucky in trading. The only thing i did right was Watched charts for 10Years in 5-15-30 and 1hour and went live with system trading from Day 1.

— Logical Trader (@TraderLogical) August 15, 2021

3) Average points and Max DD for

my system stats since many have asked avg point 13 for nifty 42 for bnf max dd 340 for nifty 1100 for bank-nifty avg 200-220 trades in a year i do for each system.hope it help

— Logical Trader (@TraderLogical) November 3, 2020

4) How to calculate average points and account for

for nifty look for total points captured without cost and divide it with total no of trades. u will get avg points per trade if it is less than 8-9 points system will not be making money as 2.6pps cost plus slippage on entry exit will make a system loosing if avg is 6-7 points

— Logical Trader (@TraderLogical) March 19, 2020

Host:-@AnandableAnand

GUEST:- @Macro_Maniac_ @UndercoverTrad3 @Kg16476926 @A_Macro_Guy

Topic:- How To Get Job In A PROP TRADING FIRM.

RECORDING LINK👉:-https://t.co/vBEi4wxBMd

#StockMarket #Trading #finances

HOST:-@AnandableAnand

Speaker:-@Ronak_Unadkat @GurleenKaur_19 @gourav_nayak

TOPIC:- Medium To Long Term View On #Nifty and

INDIAN Stocks.

Recording Link👉:- https://t.co/fpeSephvMI

#Nifty #Investing #StockMarketindia #Stocktowatch

Host:- @AnandableAnand

Speaker:- @TraderLogical @JigneshTrade @nitishnarang

@Buy_The_Dip_ @sohamtweet @avi_fintwit

Topic:- Complete Guide To ALGO TRADING From Successful ALGO TRADER.

RECORDING LINK👉:-https://t.co/u3GRfHudds

#algotrading #StockMarket #Algo

Host:-@AnandableAnand

GUEST:- @srinivasaiims

Topic:- PSYCHEDELICS

https://t.co/SjlLK6FwY6

#psychedelic #psychedelicart

It's much more powerful than you think

9 things TradingView can do, you'll wish you knew yesterday: 🧵

Collaborated with @niki_poojary

1/ Free Multi Timeframe Analysis

Step 1. Download Vivaldi Browser

Step 2. Login to trading view

Step 3. Open bank nifty chart in 4 separate windows

Step 4. Click on the first tab and shift + click by mouse on the last tab.

Step 5. Select "Tile all 4 tabs"

What happens is you get 4 charts joint on one screen.

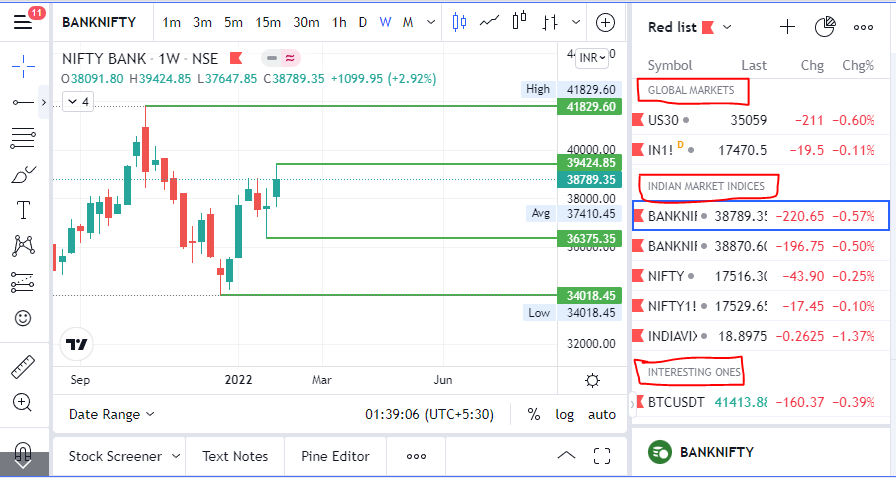

Refer to the attached picture.

The best part about this is this is absolutely free to do.

Also, do note:

I do not have the paid version of trading view.

2/ Free Multiple Watchlists

Go through this informative thread where @sarosijghosh teaches you how to create multiple free watchlists in the free

\U0001d5e0\U0001d602\U0001d5f9\U0001d601\U0001d5f6\U0001d5fd\U0001d5f9\U0001d5f2 \U0001d600\U0001d5f2\U0001d5f0\U0001d601\U0001d5fc\U0001d5ff \U0001d604\U0001d5ee\U0001d601\U0001d5f0\U0001d5f5\U0001d5f9\U0001d5f6\U0001d600\U0001d601 \U0001d5fc\U0001d5fb \U0001d5e7\U0001d5ff\U0001d5ee\U0001d5f1\U0001d5f6\U0001d5fb\U0001d5f4\U0001d603\U0001d5f6\U0001d5f2\U0001d604 \U0001d602\U0001d600\U0001d5f6\U0001d5fb\U0001d5f4 \U0001d601\U0001d5f5\U0001d5f2 \U0001d5d9\U0001d5e5\U0001d5d8\U0001d5d8 \U0001d603\U0001d5f2\U0001d5ff\U0001d600\U0001d5f6\U0001d5fc\U0001d5fb!

— Sarosij Ghosh (@sarosijghosh) September 18, 2021

A THREAD \U0001f9f5

Please Like and Re-Tweet. It took a lot of effort to put this together. #StockMarket #TradingView #trading #watchlist #Nifty500 #stockstowatch

3/ Free Segregation into different headers/sectors

You can create multiple sections sector-wise for free.

1. Long tap on any index/stock and click on "Add section above."

2. Secgregate the stocks/indices based on where they belong.

Kinda like how I did in the picture below.

Collaborated with @niki_poojary

We'll divide these separately into sections of

1. Intraday Trading Strategies

2. Positional Trading Strategies

3. Uses of Indicators

From the accounts

1. @RijhwaniSheetal

2. @jigspatel1988

3. @YMehta_

1. 6 Intraday Strategies 🧵

How to Filter Stocks for Intraday

How you can filter stocks for Intraday trades - \U0001f9f5

— Sheetal Rijhwani (@RijhwaniSheetal) August 15, 2021

As a kid, we would do homework before school the next day - you have to do homework here too. A specific sector performs on a particular day and studying things a day before will help you spot that particular sector. (1/11)

Intraday BNF strangle based on OI data. 🧵

Thread on

— Jig's Patel (@jigspatel1988) July 4, 2021

"Intraday Banknifty Strangle based on OI data"

(System already shared, today just share few examples)

(1/n)

A few setups to make intraday trading easy.

A few setups/strategies that can make your intraday trading easy. I follow them personally:

— Sheetal Rijhwani (@RijhwaniSheetal) September 12, 2021

Add these stocks in your watchlist for next few days -

-If a stock closed exactly at resistance with good volumes or it has been consolidating near resistance for a long time. (1/10)

Firstly, I'm not here for money nor I will provide you turn-key solution, you will have to put the effort and code on your own, I can help/guide you whenever needed.

++

Secondly, you need to arrange for reliable data (or if you can get it for free from your contacts).

Regarding my credentials, I'm no expert in coding. I consider myself a amateur, I just know how to get my work done and I believe if I can code (python) then anyone can code.

++

There are many queries about how/where to start, I'm jotting down what I did, you can consider it the starting point.

for Python, go through the basic tutorial at https://t.co/vjrzcW0xAL

Try to absorb as much as possible for 1-2 weeks.

++

Once you are familiar with basic python structure and syntax, start going through the most important Python library for time series data analysis i.e. PANDAS

I referred lot of resource but I will recommend https://t.co/dMRPQ5G2qJ

Again, try to absorb and practice.

++

Another major learning source for me was "Corey Schafer" video, refer his channel at https://t.co/DzT6WMQiDQ

I just love watching his videos.

While coding if you know how to break a problem in small parts and focus on the immediate next part, you can solve any problem.

++

Topic - Data Points to check as a Option seller

Mega Thread 🧵 of all the data points to check as a option seller shared by Mr. Kapil Dhama is complied

Retweet to reach wider -Learning should never stop

#StockMarketindia

1/18 https://t.co/m0NXToSU1p

\U0001f50a Twitter Space with @kapildhama for the first time

— Learn to Trade (@learntotrade365) January 15, 2022

Topic - Data points to check as a option seller

Sunday ( 16/01/22 ) evening 06:00 p.m

Link - https://t.co/XMaoRfOWp4

Click on the link and set reminder #stockmarkets #trading #StockMarketindia pic.twitter.com/HRPEooa5H2

2/18

-Make your own trading system

- First identify what suits you ?

Trend Following

Directional or Non-directional option selling

9:20straddle

Naked option buying/selling

-Never take more than 1% loss in intraday

-There is no specific trick in market only important is process

3/18

-Chart & Data plays a important role ( Understand to combine to identify trades/direction )

-In all trades knowing exit point is very important

Simple target for Kapil sir in straddle is 100 points in a week on BNF & Loss exit point is 50 points after adjustment (R:R 1:2)

4/18

- Simple target for Kapil sir in straddle is 50 points in a week on NF & Loss exit point is 25 points after adjustment (R:R 1:2)

Check data after 3:00 p.m Chart + Data ?

Check how is the closing ( Location of closing - Near Day high or Day low or mid of the day )

5/18

Example:

-If market is near high ( Check in data whether Near ATM PE has more writing & in CE writing whether is less at higher strike price) - It is a Probability

Once Data is bullish along with the close he choose

Strangle- Rs.70 PE & Rs.40 CE or scroll down