123priyanshu Authors Learn to Trade

7 days

30 days

All time

Recent

Popular

2 hours of non-stop Twitter space by @kapildhama

Topic - Data Points to check as a Option seller

Mega Thread 🧵 of all the data points to check as a option seller shared by Mr. Kapil Dhama is complied

Retweet to reach wider -Learning should never stop

#StockMarketindia

1/18 https://t.co/m0NXToSU1p

2/18

-Make your own trading system

- First identify what suits you ?

Trend Following

Directional or Non-directional option selling

9:20straddle

Naked option buying/selling

-Never take more than 1% loss in intraday

-There is no specific trick in market only important is process

3/18

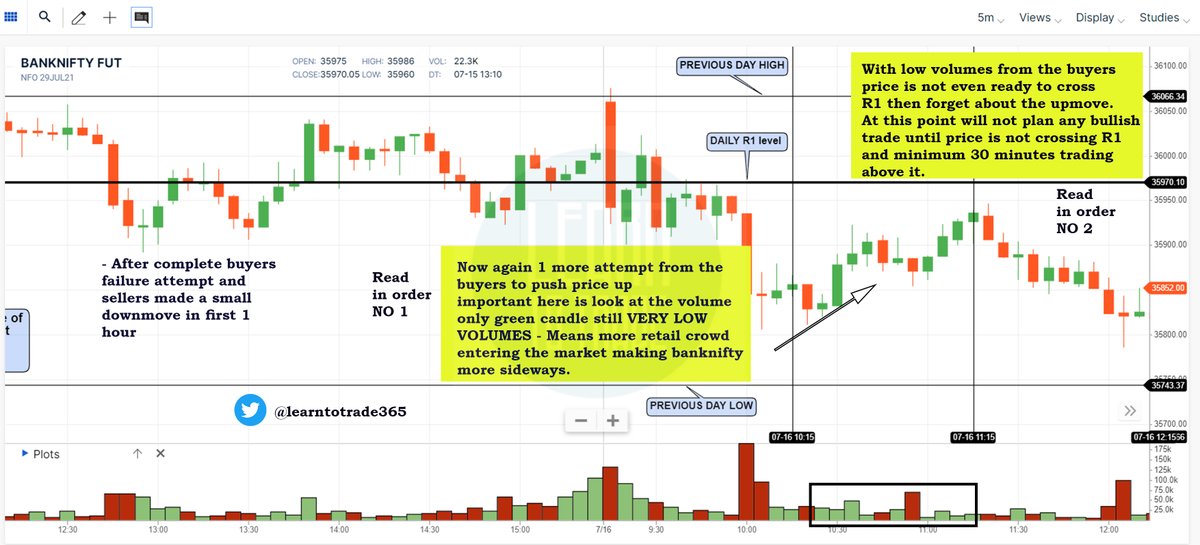

-Chart & Data plays a important role ( Understand to combine to identify trades/direction )

-In all trades knowing exit point is very important

Simple target for Kapil sir in straddle is 100 points in a week on BNF & Loss exit point is 50 points after adjustment (R:R 1:2)

4/18

- Simple target for Kapil sir in straddle is 50 points in a week on NF & Loss exit point is 25 points after adjustment (R:R 1:2)

Check data after 3:00 p.m Chart + Data ?

Check how is the closing ( Location of closing - Near Day high or Day low or mid of the day )

5/18

Example:

-If market is near high ( Check in data whether Near ATM PE has more writing & in CE writing whether is less at higher strike price) - It is a Probability

Once Data is bullish along with the close he choose

Strangle- Rs.70 PE & Rs.40 CE or scroll down

Topic - Data Points to check as a Option seller

Mega Thread 🧵 of all the data points to check as a option seller shared by Mr. Kapil Dhama is complied

Retweet to reach wider -Learning should never stop

#StockMarketindia

1/18 https://t.co/m0NXToSU1p

\U0001f50a Twitter Space with @kapildhama for the first time

— Learn to Trade (@learntotrade365) January 15, 2022

Topic - Data points to check as a option seller

Sunday ( 16/01/22 ) evening 06:00 p.m

Link - https://t.co/XMaoRfOWp4

Click on the link and set reminder #stockmarkets #trading #StockMarketindia pic.twitter.com/HRPEooa5H2

2/18

-Make your own trading system

- First identify what suits you ?

Trend Following

Directional or Non-directional option selling

9:20straddle

Naked option buying/selling

-Never take more than 1% loss in intraday

-There is no specific trick in market only important is process

3/18

-Chart & Data plays a important role ( Understand to combine to identify trades/direction )

-In all trades knowing exit point is very important

Simple target for Kapil sir in straddle is 100 points in a week on BNF & Loss exit point is 50 points after adjustment (R:R 1:2)

4/18

- Simple target for Kapil sir in straddle is 50 points in a week on NF & Loss exit point is 25 points after adjustment (R:R 1:2)

Check data after 3:00 p.m Chart + Data ?

Check how is the closing ( Location of closing - Near Day high or Day low or mid of the day )

5/18

Example:

-If market is near high ( Check in data whether Near ATM PE has more writing & in CE writing whether is less at higher strike price) - It is a Probability

Once Data is bullish along with the close he choose

Strangle- Rs.70 PE & Rs.40 CE or scroll down