Jay_millerjay Categories Trading

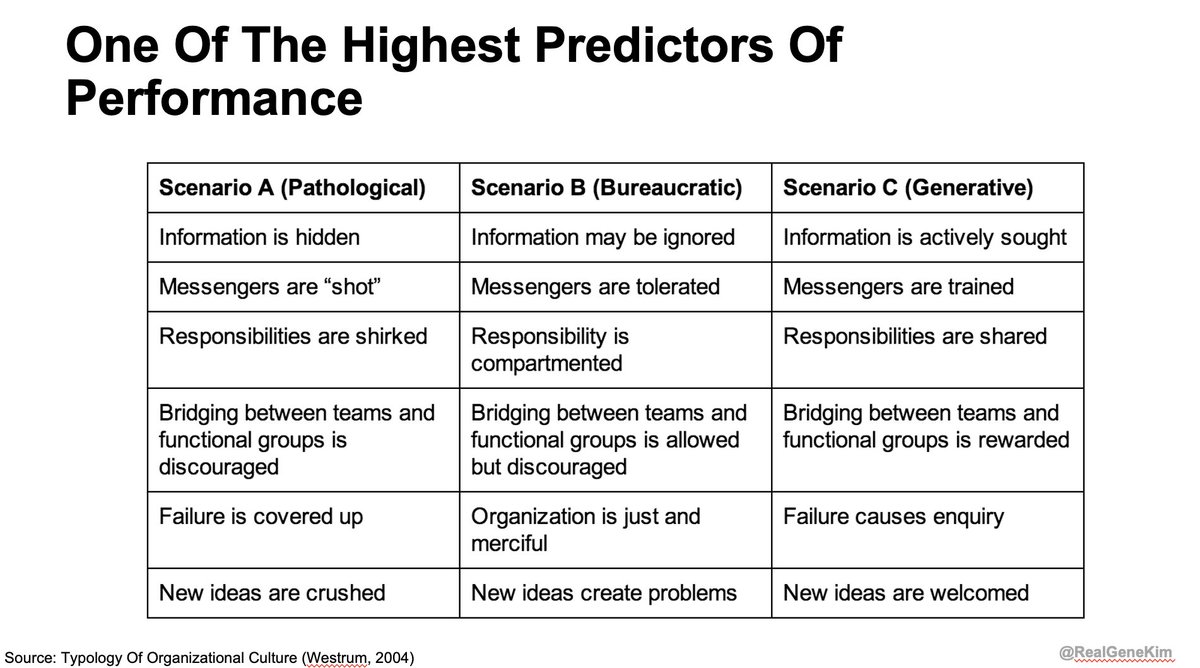

This model was created Dr. Ron Westrum, a widely-cited sociologist who studied the impact of culture on safety

Thanks to Dr. @nicolefv, I was able to interview him for an upcoming episode of the Idealcast! 🤯

It was a very heady experience, and while preparing to interview him, I was startled to discover how much work he's done in healthcare, aviation, spaceflight, but also innovation.

I've read 4+ of his papers, so I thought I was familiar with his work. (Here's one paper: https://t.co/7X00O67VgS)

I was startled to learn he has also studied in depth what enables innovation. He wrote a wonderful book "Sidewinder: Creative Missile Development at China Lake"

Dr. Westrum writes about China Lake Research Labs: "its design and structure had one purpose: to foster technical creativity. It did; China Lake operated far outside the normal envelope... Sidewinder & others were "impossible" accomplishments,

I love this book because it describes traits of organizations that routinely create and maintain greatness: US space program (Mercury, Gemini, Apollo), US Naval Reactors, Toyota, Team of Teams, Tesla, the tech giants (Amazon, Google, Netflix, Google)

Is there anyone I have missed?🧐 Please feel free to tag them 👇

In no particular order:

– We like his investment philosophy; his stock picks tend to be great, he understands the macro environment. Also, here and there, he provides excellent resources for researching stocks. He is polite and humble. Hence, fun to interact with.

– His stock picks are magic, primarily focusing on hyper-growth story.

He also provides a detailed write-up, and you can enjoy his write-up for free https://t.co/tcNTaQ2GuU. We recommend signing up for the premium subscription plan as some names he covers 🚀

regularly post research, ideas, and podcast. Highly recommend for long term investor to understand disruptive trends and innovation. Apologies if its a bit of an obvious one

- Daily updates for Cathie Wood's Ark Invest fund. I like to see what she is buying ;) Low key fan

[A quick thread]

So yesterday I sold two of my holdings that I didn't like very much for the following

Risk reduction in the case of DataDog. I have too many holdings in a similar space. GoodRx's business model doesn't entice me as much as I would like it to. Ultimately, it was to free up some cash in the event that a significant dip comes along. I like to keep 10% in free cash.

— That Pragmatic Guy (@MpiloGMangali) February 16, 2021

I know what you thinking: "smart move! 😎"

Will I be going on a buying frenzy today? Not quite. I think I'll sit today out. I've had some great lessons about the dip that I'd like to share with you.

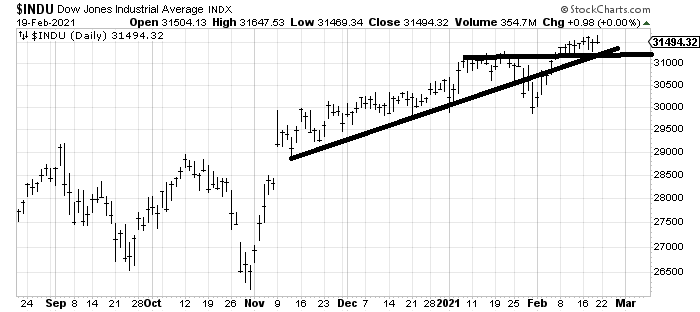

I came across this fortune teller on YouTube who could predict pullbacks.

If this guy is anything to go by, we may have a sale on our hands next week. Do you have:

— That Pragmatic Guy (@MpiloGMangali) October 21, 2020

a) Free cash available, and

b) Wishlist of holdings you want to add to? pic.twitter.com/ASCrGy3H71

Of course I thought to myself, I'm going to be smart about this and decided to split my money over the full week because no one can predict the bottom. However, this

I'm not okay. I've been buying stocks bit by bit since Monday and by Tuesday I got greedy and decided to split my money to last me until yesterday. Today, the market is even lower.

— That Pragmatic Guy (@MpiloGMangali) October 30, 2020

I deviated from my original plan to split my money over the full week and it cost me. pic.twitter.com/1kcRgvj5H3