Assume a country to be like a company, which has income & expenses. Income source can be tax collections & expense can be government employee salaries, defence sending’s, social security schemes etc. (2/13)

Is US going to default on its debt?

This 🧵 will surely help you understand. Do ‘re-tweet’ & help us educated investors (1/13)

Assume a country to be like a company, which has income & expenses. Income source can be tax collections & expense can be government employee salaries, defence sending’s, social security schemes etc. (2/13)

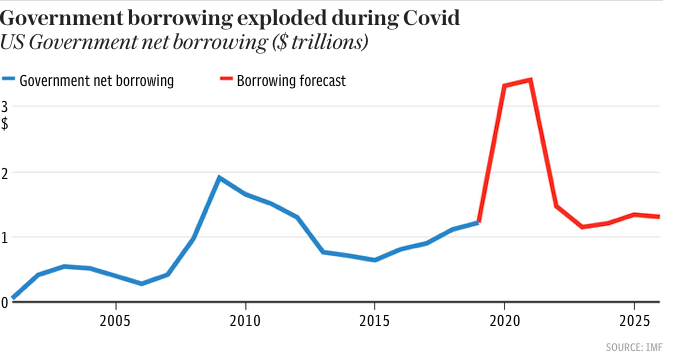

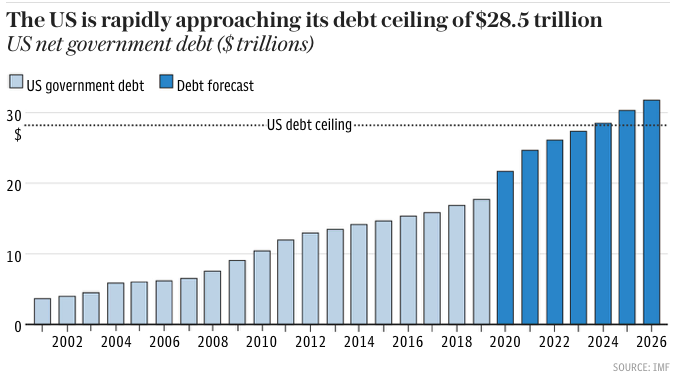

Similarly US has been borrowing & the total debt today roughly stands at a whooping $28.5T. (3/13)

Ideally a yes but they are not allowed to borrow more! (5/13)

During the 1st world war, US understood if they keep spending money on the war, the debt will be a big liability 4 the future generation & hence they introduced a ceiling on the maximum debt US could take. In 1917, this was capped at $1 Billion

Political parties would pass a legislation to increase the debt limits. From $1B in 1917, the debt ceiling has been moved up multiple times to the current $28.5T (https://t.co/XaLWSSGxN5), which is about to get reached now (7/13)

Political parties (Like India has BJP & congress, US has Democrats & Republicans) need to agree on either suspending the debt ceiling all together or increasing the limit of borrowing by passing legislation like they have been doing in the past (8/13)

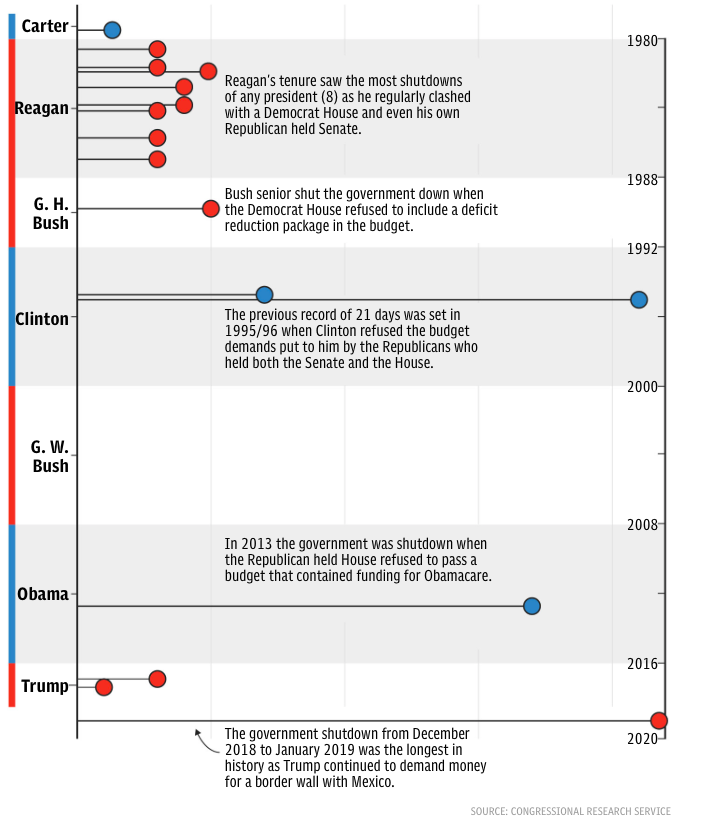

May be, but republicans r nt in favor of suspension or ⬆️ in the debt ceiling. But this is common, has happened multiple times in the past. Till the legislation is passed, the government shuts down for few days & is back in action as soon as it is passed

A suspension or rise in the debt ceiling can be passed through a process known as budget reconciliation, due to Democrat's majority in the Senate. But some conservative democrats may not support ⬆️in spending so this may face challenges

Doomsday! US can't borrow more & can default eventually!

-US will not be able to pay salaries to government employees, will not be able to release social security payments, will not be able to pay other liabilities (11/13)

- $ will crash

- Both of the above to have a massive impact on world trade & markets as still 84% of the world trade happens in $ & other countries have huge investments in US treasuries (12/13)

Have earlier written on,

-Sector Analysis - Banking, Paints, Logistic, REIT, InvIT, Sugar, Steel

- Macro

- Debt Markets

- Equity

- Gold

- Personal Finance etc.

You can find them all in the link below https://t.co/UrRt87xaU7 (END)

Here\u2019s a compilation of Personal Finance threads I have written so far. Thank you for motivating me to do it.

— Kirtan A Shah (@KirtanShahCFP) December 13, 2020

Hit the 're-tweet' and help us educated more investors

More from Kirtan A Shah

Hit the 're-tweet' and help us educated more investors

Yes Bank’s additional Tier 1 bonds, written off. Lakshmi Villas Banks Tier 2 bonds, written off. Understand what & why of ATI and Tier 2 bonds in this thread.

https://t.co/VBmV2dwpPn (1/n)

Yes Bank\u2019s additional Tier 1 bonds, written off. Lakshmi Villas Banks Tier 2 bonds, written off. Understand what & why of ATI and Tier 2 bonds in this thread.

— Kirtan A Shah (@KirtanShahCFP) December 4, 2020

Do \u2018re-tweet\u2019 and help us benefit more investors (1/n)

'Floating Rate Funds' - A case for debt investing in the current interest rate situation

'Floating Rate Funds' - A case for debt investing in the current interest rate situation (A Thread)

— Kirtan A Shah (@KirtanShahCFP) November 27, 2020

You should not miss this if you invest in Debt.

Do \u2018re-tweet\u2019 & help us benefit more investors (1/n)

Fixed Income investment strategies

It’s a misconception that FD, RBI Bond, PPF etc have no risk. The reason we don’t see the risk in them is because for us, risk ONLY means loss of capital.

Fixed Income investment strategies (Thread)

— Kirtan A Shah (@KirtanShahCFP) November 20, 2020

Do 're-tweet' & help us reach & benefit investors

It\u2019s a misconception that FD, RBI Bond, PPF etc have no risk. The reason we don\u2019t see the risk in them is because for us, risk ONLY means loss of capital. (1/n)

Index Funds v/s ETFs

While index funds and ETF’s look similar, there are multiple differences you need to keep in mind before investing in either of them. Let me highlight the important ones

Index Funds v/s ETFs

— Kirtan A Shah (@KirtanShahCFP) November 17, 2020

Do 're-tweet' so that we can reach a larger audience :)

(Thread)

(1) While index funds and ETF\u2019s look similar, there are multiple differences you need to keep in mind before investing in either of them. Let me highlight the important ones (1/n)

Do re-tweet and help us educate more retail investors

#investing

What better day to discuss Gold, isn\u2019t it?

— Kirtan A Shah (@KirtanShahCFP) November 13, 2020

Topic - Physical Gold v/s Digital Gold v/s Gold ETF v/s Sovereign Gold Bond (SGB)

(Thread) \u2013 DO RE-TWEET FOR A LARGER REACH :)

(1/n)

A thread 🧵to guide retail on why & what should they do at these historic market highs.

Do ‘re-tweet’ and help us educate more retail investors (1/n)

#investing #StockMarket

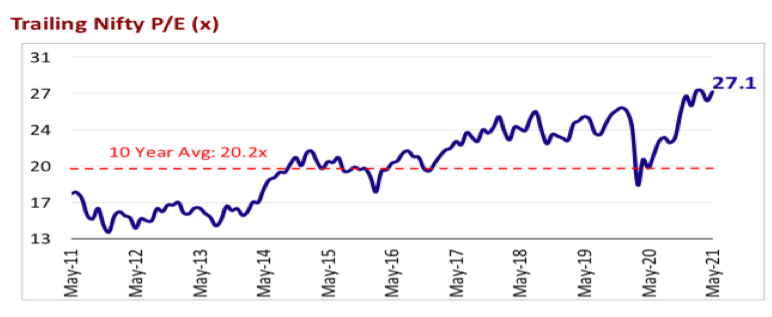

Some investors feel that markets are trading at a PE of 27 vs 10 years historical average of 20 and a market-cap to GDP of 105 vs historical average of 79 and hence markets look expensive (2/n)

But, in such crazy liquidity driven markets, prices can move much ahead of the fundamentals & suddenly we start hearing commentaries of how the market is pricing in the earnings of FY 22 & 23 to justify the rally

If you r new to fundamentals, 👇 can help

Market PE at 40 and yet the market is not falling, why? Getting asked this question multiple times. Here's a thread covering \u2018very basic\u2019 premier on valuation for my retail investor friends.

— Kirtan A Shah (@KirtanShahCFP) January 14, 2021

Do hit the \u2018re-tweet\u2019 and help us educate more investors (1/n) pic.twitter.com/8oCkBmmOXY

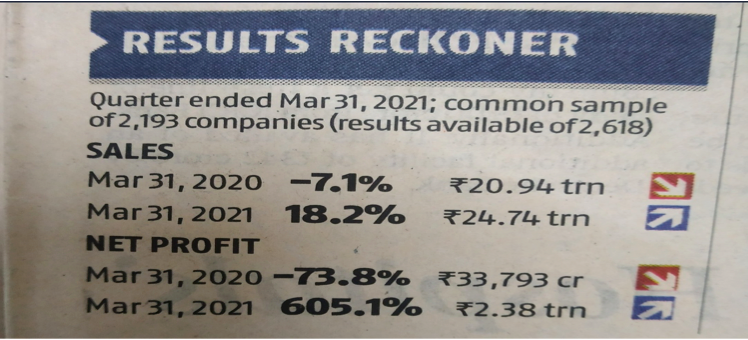

Results for Q4 have come out very well but that is also because of the lower base effect of the last year.

Over the last many years, markets have corrected 10-15% each calendar year. Can it happen this year as well? Can very much and that can be a great entry point. Why? (4/n)

There are a lot of over hangs in the near term,

-Crude going up

-$ index moving up

-Inflation moving up

-COVID uncertainties

All of the above are –ve for markets & liquidity on the other side driving markets up, its impossible to judge the near term movement of the markets (5/n)

You May Also Like

One thing I've been noticing about responses to today's column is that many people still don't get how strong the forces behind regional divergence are, and how hard to reverse 1/ https://t.co/Ft2aH1NcQt

— Paul Krugman (@paulkrugman) November 20, 2018

See this thing that @lymanstoneky wrote:

And see this thing that I wrote:

And see this book that @JamesFallows wrote:

And see this other thing that I wrote:

Just added Telegram links to https://t.co/lDdqjtKTZL too! Now you can provide a nice easy way for people to message you :)

Less than 1 hour since I started adding stuff to https://t.co/lDdqjtKTZL again, and profile pages are now responsive!!! 🥳 Check it out -> https://t.co/fVkEL4fu0L

Accounts page is now also responsive!! 📱✨

💪 I managed to make the whole site responsive in about an hour. On my roadmap I had it down as 4-5 hours!!! 🤘🤠🤘

THE WINNERS OF THE 24 HOUR STARTUP CHALLENGE

Remember, this money is just fun. If you launched a product (or even attempted a launch) - you did something worth MUCH more than $1,000.

#24hrstartup

The winners 👇

#10

Lattes For Change - Skip a latte and save a life.

https://t.co/M75RAirZzs

@frantzfries built a platform where you can see how skipping your morning latte could do for the world.

A great product for a great cause.

Congrats Chris on winning $250!

#9

Instaland - Create amazing landing pages for your followers.

https://t.co/5KkveJTAsy

A team project! @bpmct and @BaileyPumfleet built a tool for social media influencers to create simple "swipe up" landing pages for followers.

Really impressive for 24 hours. Congrats!

#8

SayHenlo - Chat without distractions

https://t.co/og0B7gmkW6

Built by @DaltonEdwards, it's a platform for combatting conversation overload. This product was also coded exclusively from an iPad 😲

Dalton is a beast. I'm so excited he placed in the top 10.

#7

CoderStory - Learn to code from developers across the globe!

https://t.co/86Ay6nF4AY

Built by @jesswallaceuk, the project is focused on highlighting the experience of developers and people learning to code.

I wish this existed when I learned to code! Congrats on $250!!