1/ Basics about the IPO 👇

Incorporated in 2001

Fresh Issue of 165crs (50 for capex | 48 for Working capital | 20 for debt payment) + OFS of 237crs (Partially by promoter & PE Tano selling out as the fund tenure is up)

~ Total raise of 402crs

2/ About the company (Not a Biotech company)

A Contract manufacturer for formulation cos. (204 in total) for Indian markets & a small domestic OTC biz

3279 products, 4 plants with 700cr tablets/capsules capacity

Emphasis on chronic (60% of rev) & complex generics (70% of rev)

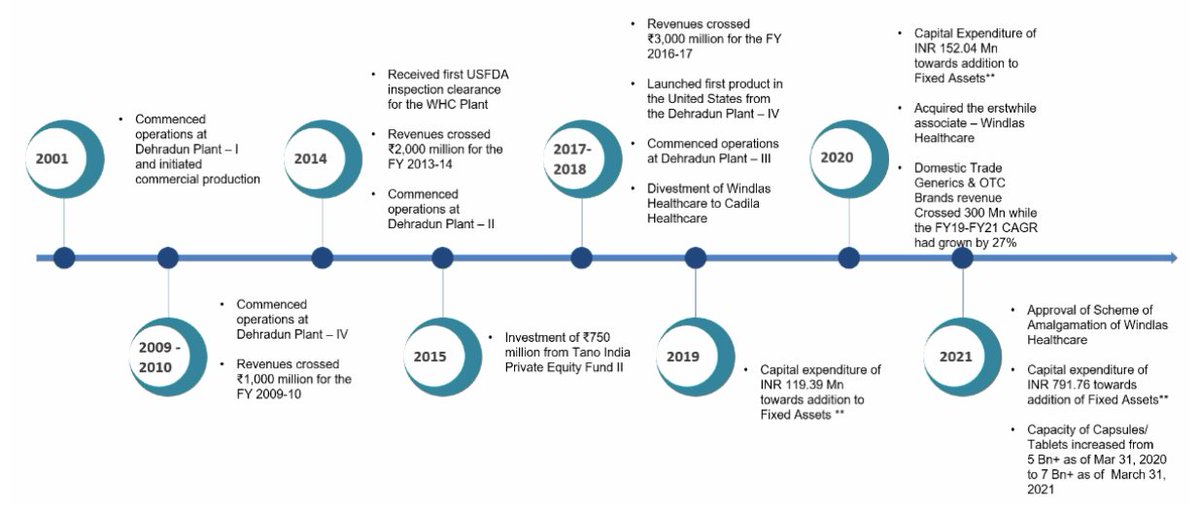

3/ History

Revenues:

FY11 - 100cr 👉 FY14 - 200cr 👉 FY21 - 400cr

Growth is similar to the Indian pharmaceutical sector, not gaining any market share even after increasing products.

Customers include Pfizer, Sanofi India, Eris, Cadila, etc.

4/ Competition: No Moat

400+ organized & 15000 unorganized players in the same space: 2% market share

Some of the things that can drive consolidation: Customers preferring better compliance

However, a single customer usually has 35-40 contract manufacturers for products.

5/ Top competitors

Scale: Players much larger also show a lack of any improvement in metrics.

Remains a low margin & high asset turnover business.

6/ Concentration

Top customer accounts for 11% of rev & Top 10 account for 58%

Interestingly, ramped up number of customers from 97 to 204 in the last 2yrs, however, the concentration remains constant.

7/ R&D

3-4crs spends: at 1% of sales, Increased complex portfolio to 934

Complex generic products have technical complexity in (i) manufacturing or handling of the API; or (ii) formulation; or (iii) route of delivery; or (iv) pairing with a device to make a drug-device combo.

8/ Manufacturing

Utilization at 35-40% currently, can go up to 60-65% before they would have to increase capacity again.

9/ Strategic areas going forward

- Will look for inorganic growth

- Industry to grow at 1.25-1.5x GDP: Increased capacities inline

- To invest 50crs in Injectables facility

- Increase customer base

- Scale-up Domestic OTC & trade generics business

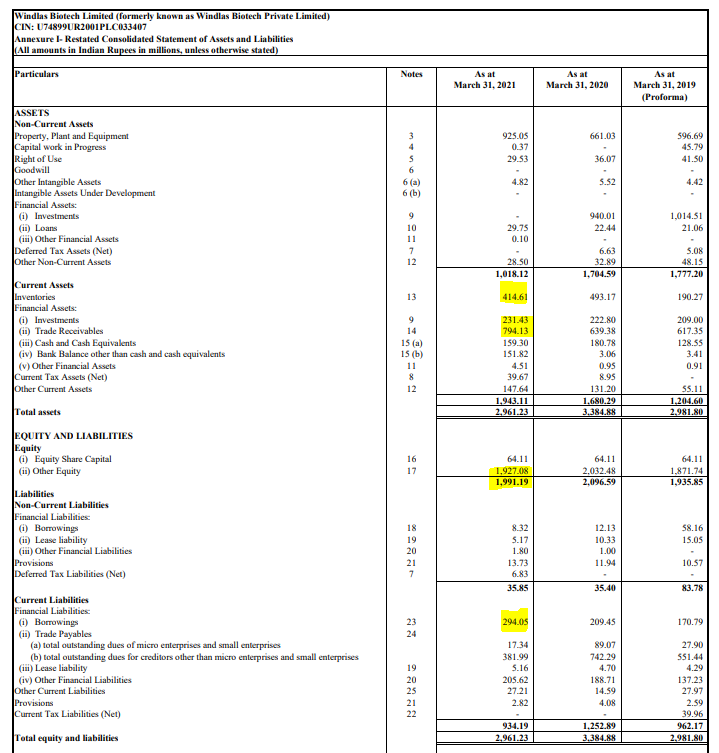

10/ Financials

- Bad Cashflow conversion (20-30% EBITDA) due to huge WC investments

- Low margin business (4-5% net & 10-12% EBITDA & 35% gross margins)

- WC days to stay at 65-75 days

- Asset turnover at 4-5x & can take it to 6-7x

- Rev scaleup needs to be monitored

11/ Risks:

- Dependence on their customers doing well: 90% in B2B business

- Highly competitive, no moat & gruesome business

- Shady dealings with a promoter owned subsidiary: Windlas Healthcare

- No geographical diversification wrt plants.

12/

- Formulations players backwardly integrating their operations: Eris doing the same as it helps them maintain consistent quality & achieve higher margins

- API prices going up (No long term contract with supplier)

- Litigations 👇

- Loss-making Subsidiaries.

13/

At valuations of 2.3x P/S, 19x P/EBITDA & 65x PE, this is valued much higher than most Indian branded formulations are; leaving little to nothing on the table for the investors.

End of Thread.

Industry terms that are mentioned above explained 👇