There are regional banks, Small Finance Bank, Public Sector Banks, Regional NBFCs, Deposit taking NBFCs, Housing Finance companies, Microfinance companies, CV Financiers etc.

Creating segments and classifications about what really works in a sector can help you massively.

EG:- IT is just not about IT, there are Product companies, SAAS Businesses, services companies, ER&D companies and Corporate Learning Companies.

There are regional banks, Small Finance Bank, Public Sector Banks, Regional NBFCs, Deposit taking NBFCs, Housing Finance companies, Microfinance companies, CV Financiers etc.

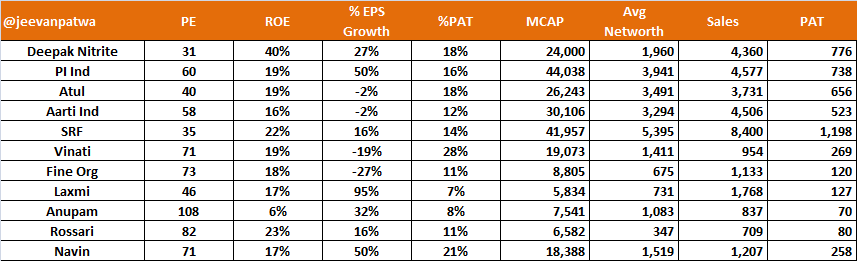

There are Bulk Chemicals like Phenol, Speciality Chemical and different chemistry chains expert like Fluorine, Bromine, Phosgene etc. Then there are niche product manufacturers like SDA or ATBS.

There are various segments within retail too! Someone might be doing value retail, someone might be doing luxury retail, Some companies might go for a COCO model (Company owned+Company Operated). Some might go for FOFO model (Franchise owned)