Or the service itself has strategies that you just subscribe to and authorize your trading account with, and it will automatically trade your money.

Are you planning on handing over your money to an algo trading platform?

Maybe you want to subscribe to a strategy or two and make insane returns.

Here's why you shouldn't do it, and save your money instead.

Or the service itself has strategies that you just subscribe to and authorize your trading account with, and it will automatically trade your money.

Let's keep aside the lack of transparency and the total regulatory non-compliance for a moment.

First off, with most of the strategies, the backtests are BOGUS.

Most of them are.

Don't take my word for it. Do your own due diligence.

And, those backtests aren't even for 10+ yrs. Some were done only for months.

- minimum net worth of the company

- qualifications of the fund manager

- minimum number of clients

- minimum amount to start with

and so on, for qualifying people who want to manage other people's money.

- Mutual Funds

- Portfolio Management Service (PMS)

- Alternative Investment Funds (AIF)

There's no LEGAL way to manage other people's money outside of these three structures offered by SEBI.

Most popular one:

- Become a sub broker to a large broker

- Get terminal access

- Add clients

- Place trades for all your clients together

To do this, you should

- Enter into an agreement with the client that you will be investing/trading their account

- Have an Associated Persons SEBI license

Even if you don't take permission for one trade also, that's considered fraud.

But that's how most people operate.

This is not entirely legal and won't be valid if push comes to stove.

Phone call recording + non-automated emails should be legal.

But nobody does that.

This again, is the most popular way with which people who have capital of < 25c operate.

There are things you should do regularly in terms of reporting.

You will definitely need a well-qualified compliance officer also.

Small guys aren't ready to invest in all this overhead.

RIA - Registered Investment Advisor.

It's usually a fixed fee format (although there are some who get a % profit based on agreement).

You take the trades on your own.

Usually does well for long term investing & positional trading.

There are certain limitations as to what an RIA can and can not do.

So many RIAs breach those rules too and act in a grey area.

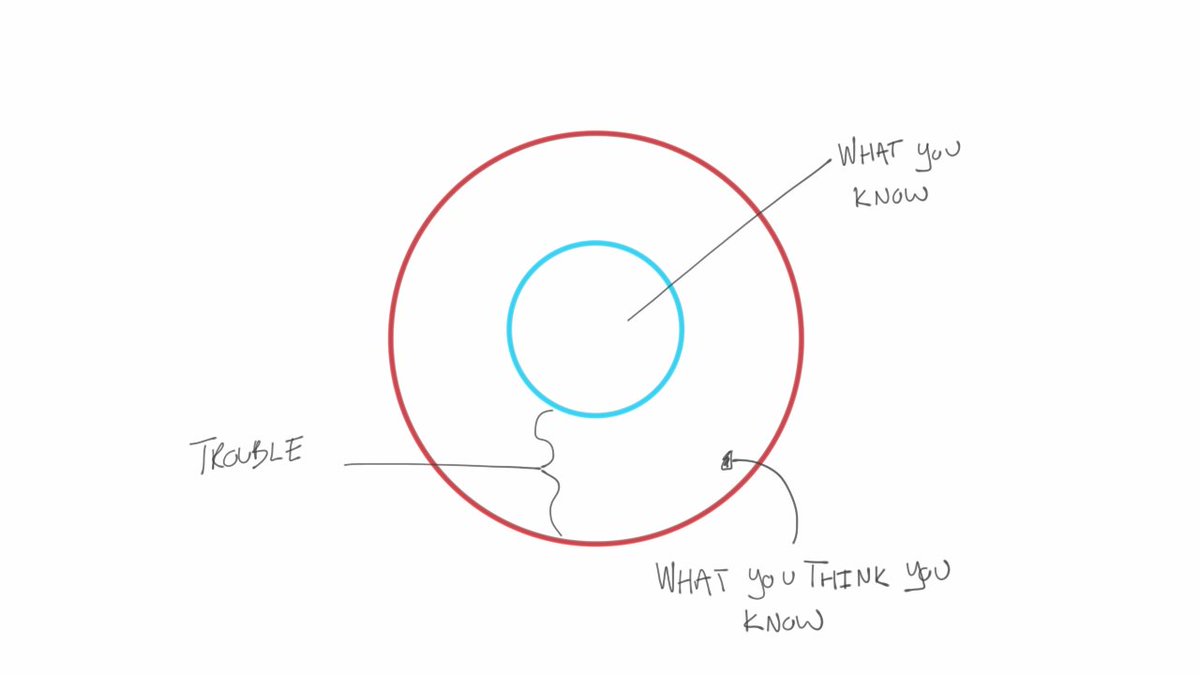

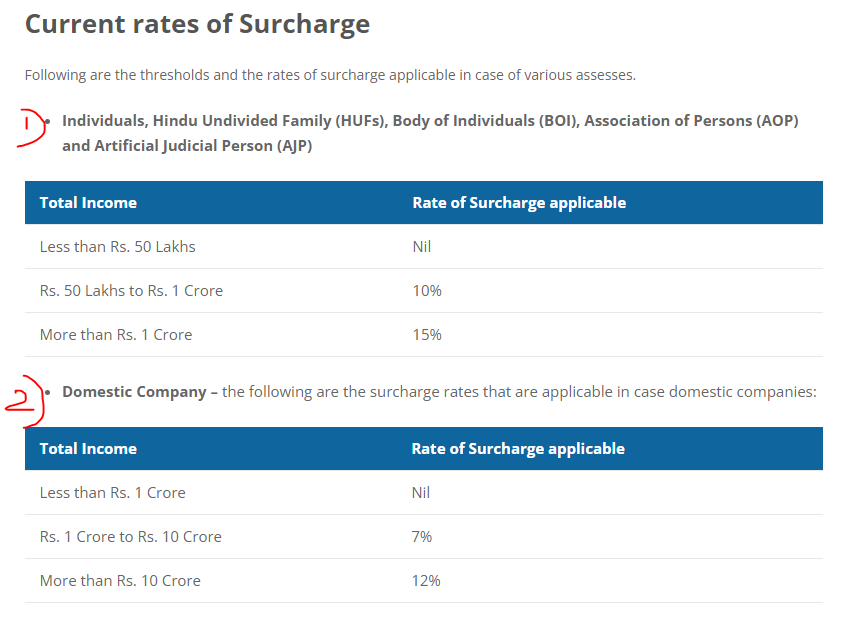

i) Are their strategy creators SEBI registered?

ii) Is the company's entire modus operandi legal?

iii) How are their backtests vetted?

iv) Are the backtests vetted and verified or anyone can post anything?

i) What are the underlying technical issues people face? (Lots of people have faced execution issues, slippages, etc.)

ii) How are the backtests conducted? (full test, out of sample, walk forward, and then monte-carlo, etc., is required)

For some reason (valid one) I can't see a SEBI registration number on the websites of TradeTron or similar services.

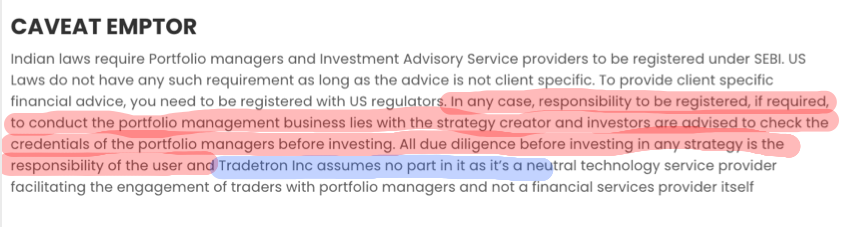

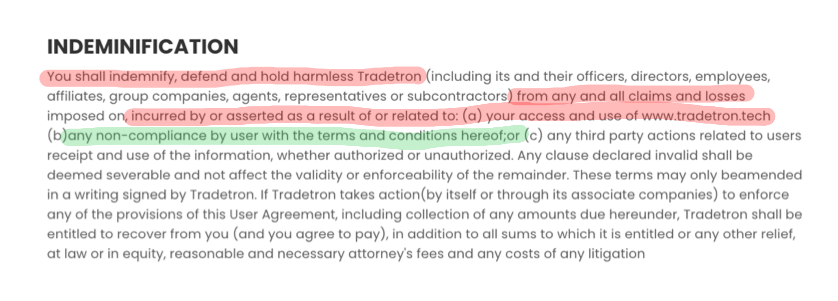

One step further, Tradetron buries this information in their "terms of use" page.

For ex: Is @__paperstreet__ SEBI registered? Nobody knows. Nobody even knows who he is. But so many people are subscribed to his strategy.

Refer to the screenshot below.

i) Screening strategy creators

ii) Screening backtest legitimacy

iii) Screening strategy legitimacy

iv) Making sure creators are SEBI registered and licensed, and that their license/regn hasn't expired.

Most of the strategies are half baked. Looks like people testing something on stockmock for a year or two and creating that as strategy on tradetron to make money.

https://t.co/Z7XJDKF0ep

100% ROI in a year with 10-20% drawdown is possible. But not over a period of 10 years.

Cherry picking a good year and posting that as entire backtest result is dangerous.

visited Tradetron website today and saw so many strategies having ROI of 100% 200% with DD of 10% 15% is it this easy to make money ? or am i missing something ? although i know its possible i thought such strategies are very rare.

— Logical Trader (@TraderLogical) November 21, 2020

https://t.co/nzxW0buQB8

You can see that they have deleted the -ve comments in some strategies.

Last i checked, this strategy had the comments in the screenshot. Currently, I can only see the comment from the Tradetron founder.

— Shravan Venkataraman \U0001f525\U0001f680\U0001f4b0 (@theBuoyantMan) October 25, 2020

Did the comments get deleted? Or did the original commenter delete the comments? Not sure.

But anything with respect to Tradetron, be cautious. https://t.co/n4Bx6Or2gr

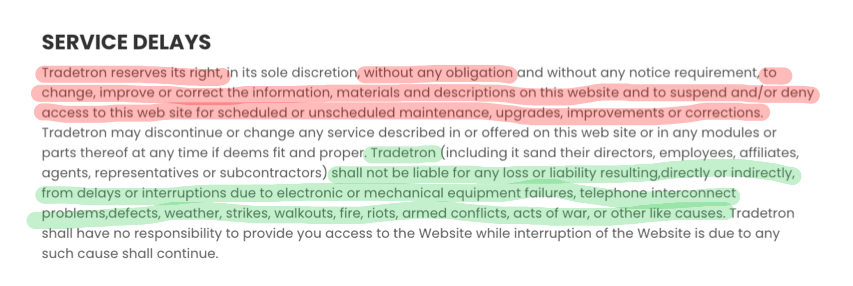

Also, if you face huge slippages and execution issues at their end, they can always wash their hands off any responsibility by saying it's an internet/server issue, and show you these terms.

- Grossly misleading backtests

- Backtest / live trades huge discrepancies

- Some accounts blown out

- Backtests done only for few months

- Huge slippage and execution delays

- Loss due to outages

You pick any similar service. You check for the following things.

- SEBI/legal registration/compliance of the company

- SEBI registration of strategy creators

- Backtest methodology

- No of years tested for

- Backtest / Actual live trades differentiation

- How many years backtest was conducted for

- How long the strategy has been active, and what its actual live returns are (after costs)

- Whether backtests are pre/post comms/spread/slippages

Use this as a checklist and protect your downside first by doing your due diligence.

More often these claims are only a bag of farts. You'll be left holding just those.

So, save yourself all the trouble and go SIP in MFs.

Spend a year or two, learn python, backtest different ideas/systems yourself, and automate them.

Amazon EC2 or Azure + Broker's API, code in python and automate your strategies.

https://t.co/OoHznZbfTI

Ignore the first and last 20-25 mins (about me in the intro, and about my course and the QNA in the outro) and watch the remaining 3 hours, for a head start.

https://t.co/NjMM50AOE4

More from Shravan Venkataraman 🔥🚀💰

Have you ever had 4-5 profitable trades in a row, and you bet all your profits on your next trade feeling "in the zone" only to lose it all?

That's called as "hot-hand fallacy" bias.

I ran a poll recently to outline two classic biases we have as humans.

Thread below 👇👇

1/ *Hot-Hand Fallacy* first had its origin in the game of basketball.

If a player shoots few baskets in a row, people generally predict that the next shot will also be a basket.

This is ignoring the fact that each shot is independent of the ones that came prior.

2/ In this poll, 41.1% people voted that the batsman who hit 4 sixes in a row, will hit a sixer in the 5th ball also.

This is classic hot-hand fallacy.

Each ball's outcome is independent.

The probability is not 50% FYI (number of outcomes is not 2).

These 148 people who voted that the next ball will also be a sixer, did so because they believe that the batsman is on a hot streak, and that his streak would continue.

This is an emotional bias and is usually attached to human performance related events only.

3/ 45.3% (162) people voted that the 5th ball would be a dot ball, meaning the batsman wouldn't score anything.

These people displayed the classic "negative-recency" bias, which is also called the "Gambler's Fallacy".

That's called as "hot-hand fallacy" bias.

I ran a poll recently to outline two classic biases we have as humans.

Thread below 👇👇

Let's say you see a cricketer hit four 6's in a row.

— Shravan Venkataraman \U0001f525\U0001f680\U0001f4b0 (@theBuoyantMan) December 30, 2020

If you have to bet on the next ball's outcome, what would you bet on?

1/ *Hot-Hand Fallacy* first had its origin in the game of basketball.

If a player shoots few baskets in a row, people generally predict that the next shot will also be a basket.

This is ignoring the fact that each shot is independent of the ones that came prior.

2/ In this poll, 41.1% people voted that the batsman who hit 4 sixes in a row, will hit a sixer in the 5th ball also.

This is classic hot-hand fallacy.

Each ball's outcome is independent.

The probability is not 50% FYI (number of outcomes is not 2).

These 148 people who voted that the next ball will also be a sixer, did so because they believe that the batsman is on a hot streak, and that his streak would continue.

This is an emotional bias and is usually attached to human performance related events only.

3/ 45.3% (162) people voted that the 5th ball would be a dot ball, meaning the batsman wouldn't score anything.

These people displayed the classic "negative-recency" bias, which is also called the "Gambler's Fallacy".