Having now taken a few days to digest the detail of the UK-EU agreement, here's a couple of observations from me on the deal, what it means, how we got here, & where it might take future UK-EU relations.

(A long thread)

This shouldn't preclude us, or MPs and MEPs, from looking critically at the deal on the table. /3

From the EU's view, integrity of the single market is preserved with level-playing field obligations which go virtually beyond any other 3rd-country (even the Swiss). /4

This negotiation was about defensiveness: protecting "sovereignty" on the UK side and "integrity of the single market" on the EU side, and at any price. /6

This is far more than UK initial position, but less than the EU’s ask. /7

Again, a reasonable compromise, but closer to the EU position than the UK's. /8

The scope is wide: it applies to any future subsidies, or labour/social, or envi/climate protections. /9

Importantly, the right to impose rebalancing measures is symmetrical (both sides can use it), and /10

The two principles are just what I proposed several weeks ago as a way to break the deadlock. /11

https://t.co/jhPOopV36z

There's a compromise here if the UK and EU can agree on 2 principles:

— Anton Spisak (@AntonSpisak) December 12, 2020

(1) the unilateral right to retaliate must be symmetrical (which the EU seems to accept now), and

(2) the proportionality of any tariffs can be challenged before independent arbitration.

(4/n)

Fortunately, there's a review clause after 4 yrs. /12

Otherwise, it has folded completely. It accepted a single legal treaty that it had vehemently opposed at the outset; /13

I'd note one aspect where the UK has conceded: dispute resolution & cross-retaliation (there can be tariffs if there's no future agreement on quotas). /15

https://t.co/knd9FDO0gf

Fish thread.

— John Lichfield (@john_lichfield) December 26, 2020

Having read the Brexit deal, I believe B. Johnson misled the nation on Thurs when he said Britain could catch \u201call the fish that it wants \u201d in UK waters in 5 years\u2019 time. The clear presumption in the text is that EU fleets will have similar access after 2026.1/12

In my view, what matters in assessing the quality of a deal is not only the obligations, but also the rights it gives and the balance btwn rights & obligations. /16

True, it provides access without tariffs and quotas (fow now, and s.t. goods qualifying for zero tariffs).

Plus, helpful provisions on air and road transport & energy; which are all a function of UK-EU proximity. /17

Here're several notable examples. /18

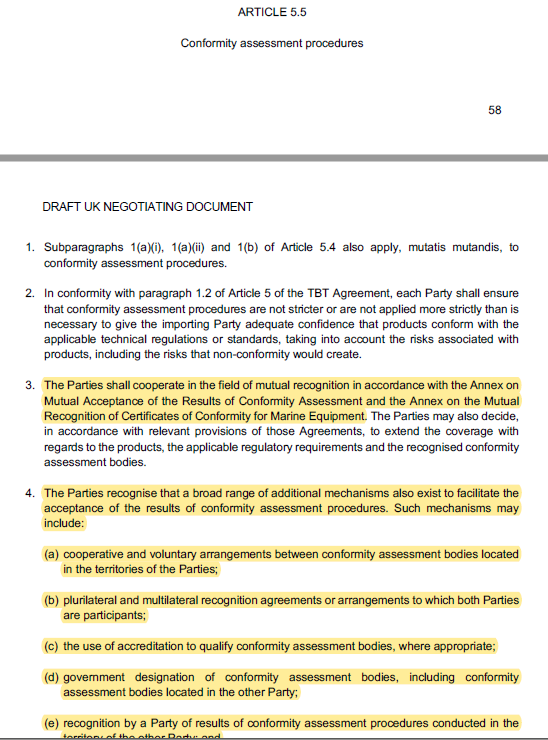

The EU agreed it (in limited way) with Canada, US, Switzerland, etc. The UK asked for It in its initial offer (see below).

With the exception of a handful of sectoral annexes, you won’t find it in the final deal. /19

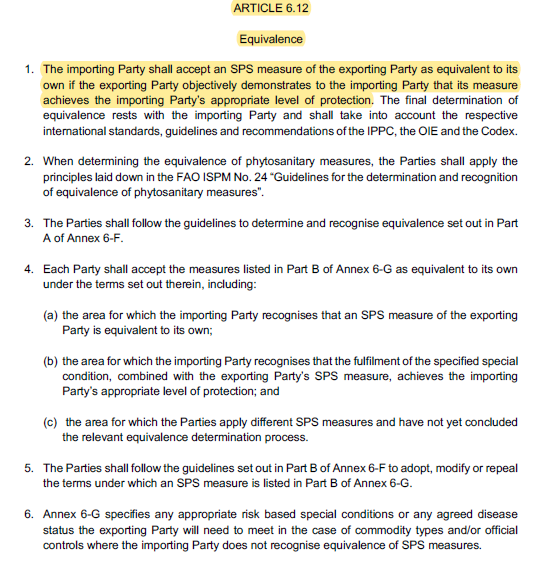

The same. The EU agreed with Canada, Japan, and proposed it to AUS/NZ.

Search for it in the deal, but you won’t find it. With implications for trade between GB and NI. /20

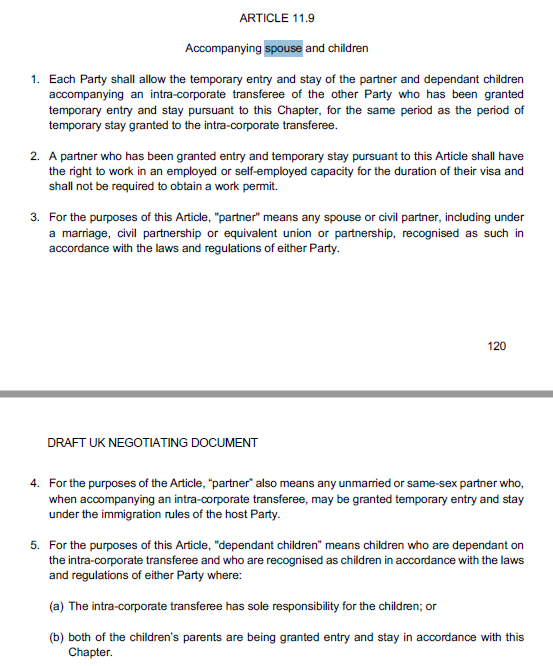

The final offer on temporary movement of business visitors (Mode 4) is less generous than EU-Japan.

Also, forget about accompanying spouses, children, etc, that the UK had proposed initially. /21

This isn't about equivalence, but about ongoing cooperation. It can be found in EU-Japan. Forget about it here.

There'll be a non-binding MoU next year.

(Btw, this, from Sunak, is embarrassing) /22

https://t.co/pjQFi0oEyq

More from Trading

You May Also Like

He's STILL in charge of the Mueller investigation.

He's STILL refusing to hand over the McCabe memos.

He's STILL holding up the declassification of the #SpyGate documents & their release to the public.

I love a good cover story.......

The guy had a face-to-face with El Grande Trumpo himself on Air Force One just 2 days ago. Inside just about the most secure SCIF in the world.

And Trump came out of AF1 and gave ol' Rod a big thumbs up!

And so we're right back to 'that dirty rat Rosenstein!' 2 days later.

At this point it's clear some members of Congress are either in on this and helping the cover story or they haven't got a clue and are out in the cold.

Note the conflicting stories about 'Rosenstein cancelled meeting with Congress on Oct 11!"

First, rumors surfaced of a scheduled meeting on Oct. 11 between Rosenstein & members of Congress, and Rosenstein just cancelled it.

Rep. Andy Biggs and Rep. Matt Gaetz say DAG Rod Rosenstein cancelled an Oct. 11 appearance before the judiciary and oversight committees. They are now calling for a subpoena. pic.twitter.com/TknVHKjXtd

— Ivan Pentchoukov \U0001f1fa\U0001f1f8 (@IvanPentchoukov) October 10, 2018