1) This year has been difficult for many investors, whether you are a novice or an experienced risk taker.

It would be useful to revisit today's money masters and see how they dealt with gut-wrenching loss.

It always helps renew my ambition. THREAD 👇

“I am not cut out for this business," he said. "I don’t think I can hack it much longer.”

"It was a cathartic experience for me, in the sense that I went to the edge, questioned my very ability as a trader, and decided that I was not going to quit. I was determined to come back and fight."

As Richard Dennis used to say to new traders, “When you start, you ought to be as bad a trader as you are ever going to be.”

He lost money for three straight semesters—on sugar, gold, and cotton—and had to ask his father for money to pay his living expenses.

He didn’t turn a profit until his final year.

He was so mortified that he returned the rest of the money back to the partners. It took a couple of years before he was coaxed into another try.

His success was built on, “Hard work, patience, knowing when to hold ‘em, fold ‘em, or go all in.”

It was an easy decision because of a consulting arrangement on the side that provided $120,000 in revenues.

His fund performed well and assets swelled to $7 million by May 1982.

His 1% management fee only generated $70,000. His overhead per year was $180,000. At the time, the firm had assets of just under $50,000.

He was convinced that interest rates would fall. He put all of the firm’s capital into T-bill futures.

In four days, he lost everything. To keep himself in business, he sold 25% of his company for $150,000.

There are important lessons in it for all of us.

That tests an individual’s grit; does he have the stamina, courage, guts, and smarts to get up and engage the battle again?"

That is actually scarier because it acknowledges a certain lack of control over anything."

More from Trading

A thread on getting intraday (any timeframe) data to excel without any coding. Limited to only last 60 days. Fetches from zerodha chart.

👇

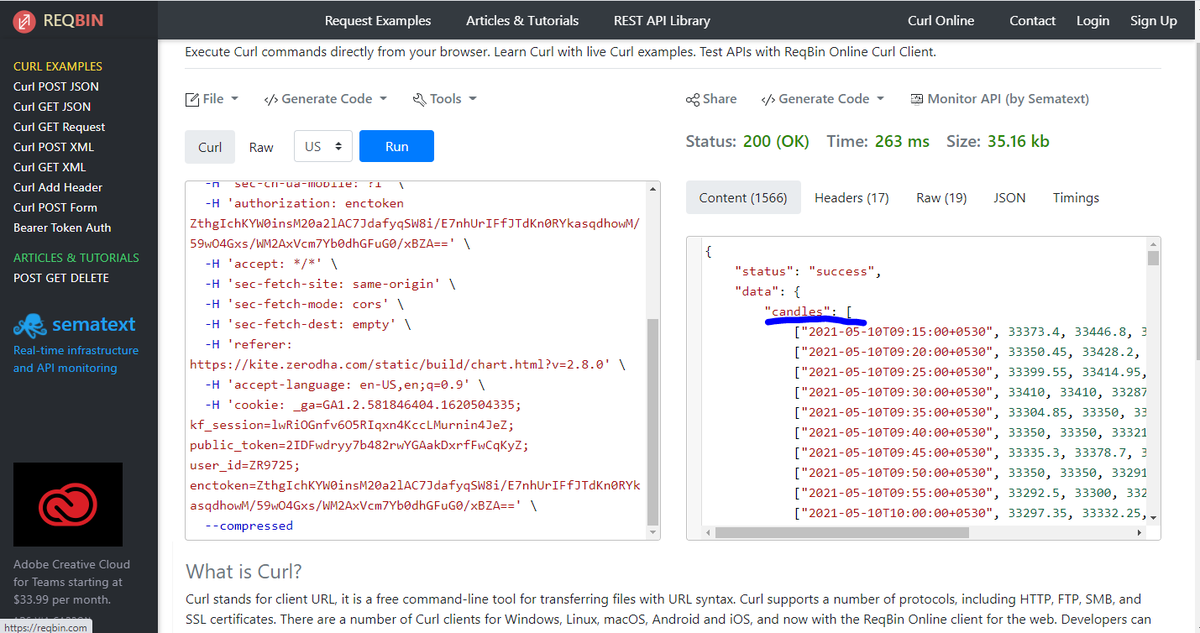

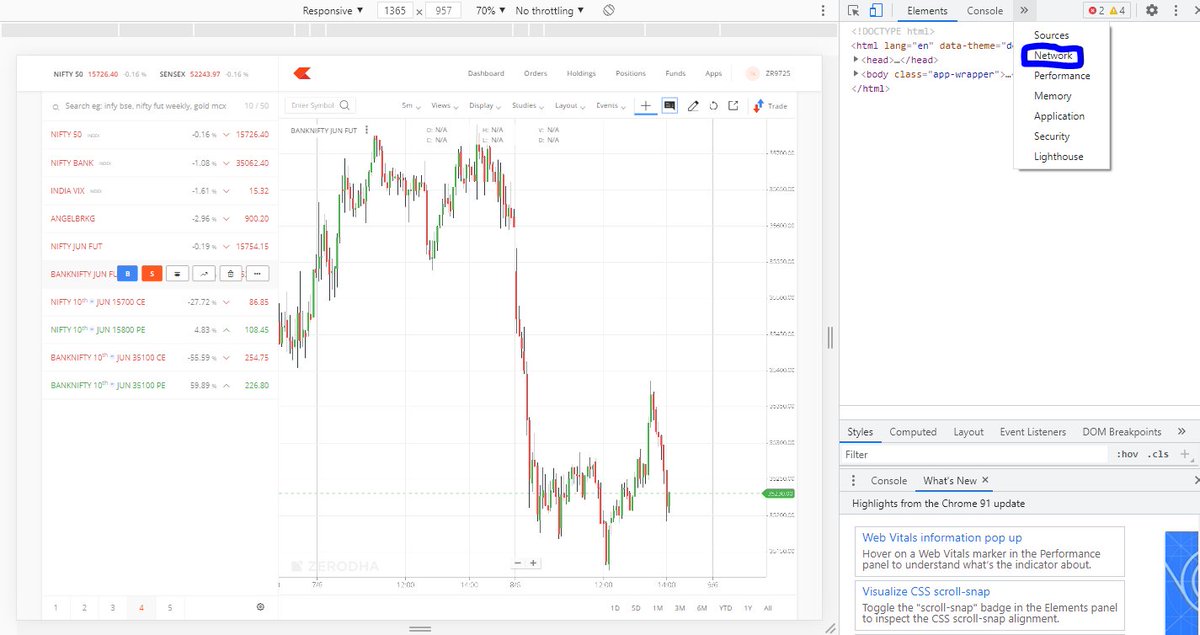

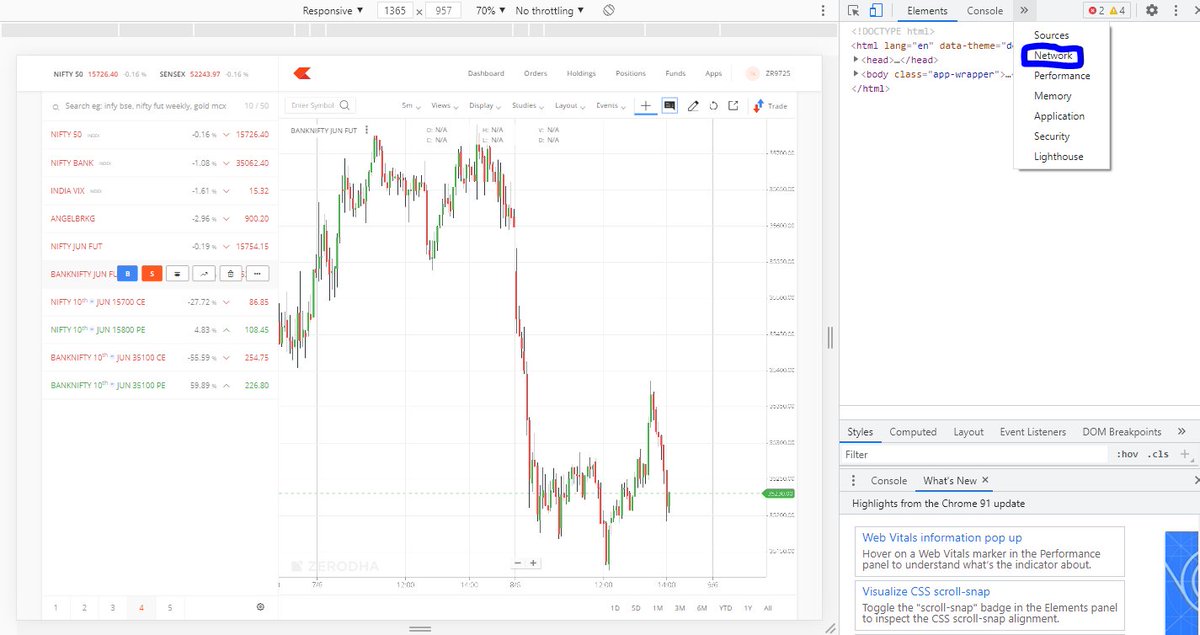

1. Open the chart on zerodha web in chrome. Right click and select 'Inspect'. Click 'Network' as shown in this pic.

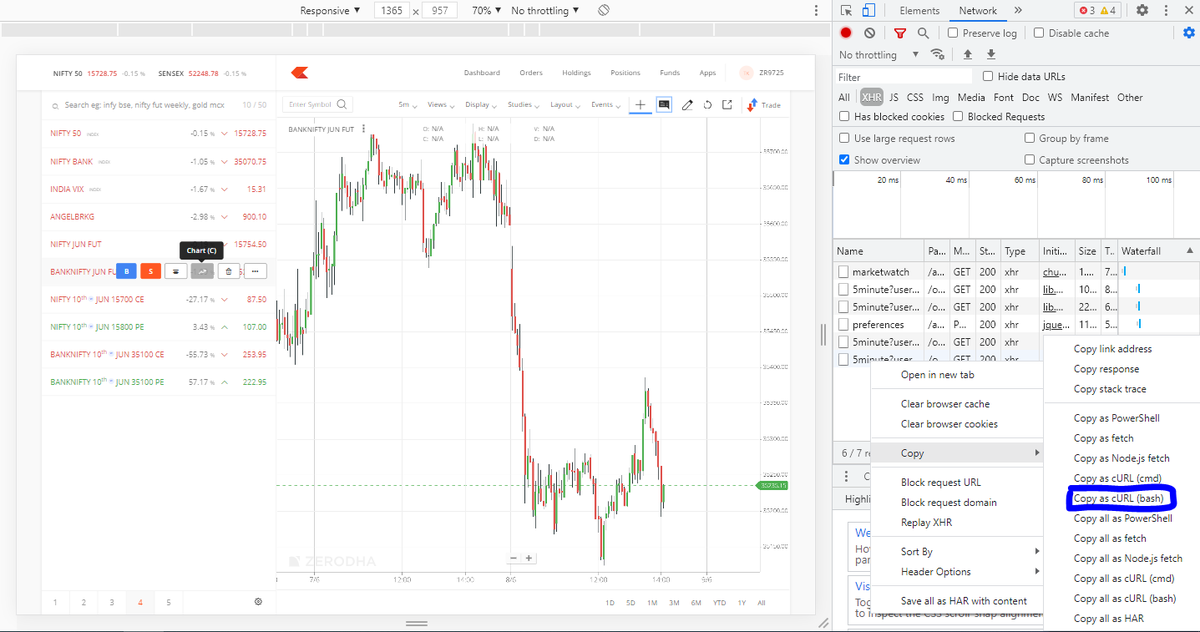

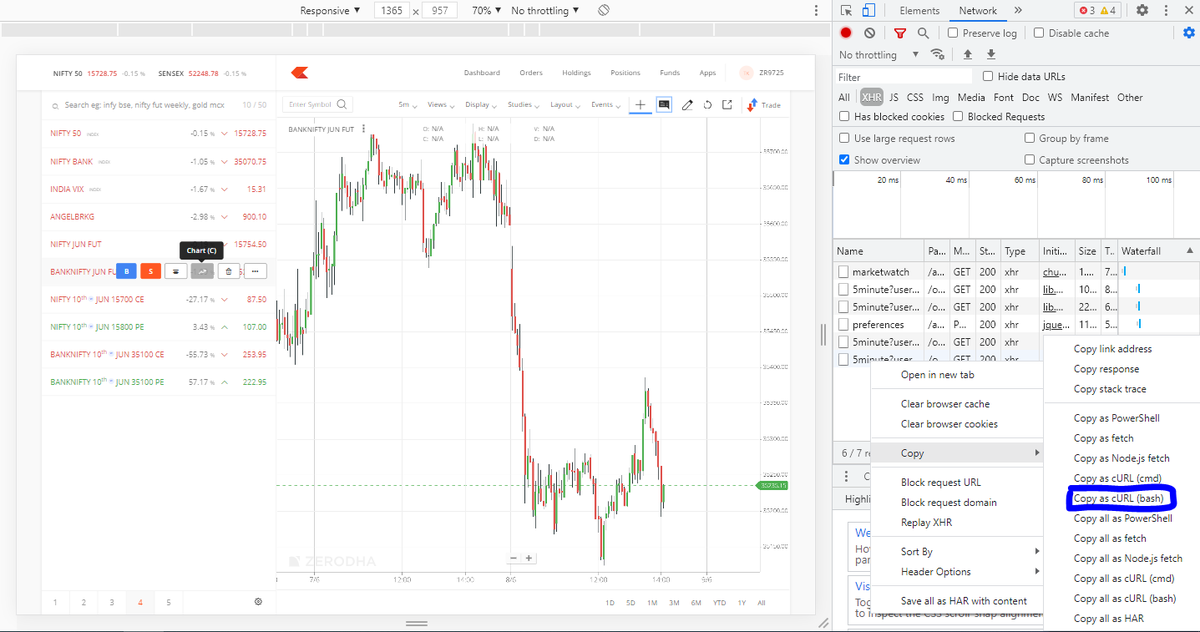

2. Right click on the last entry on the table you see and click 'copy as cURL (bash)'

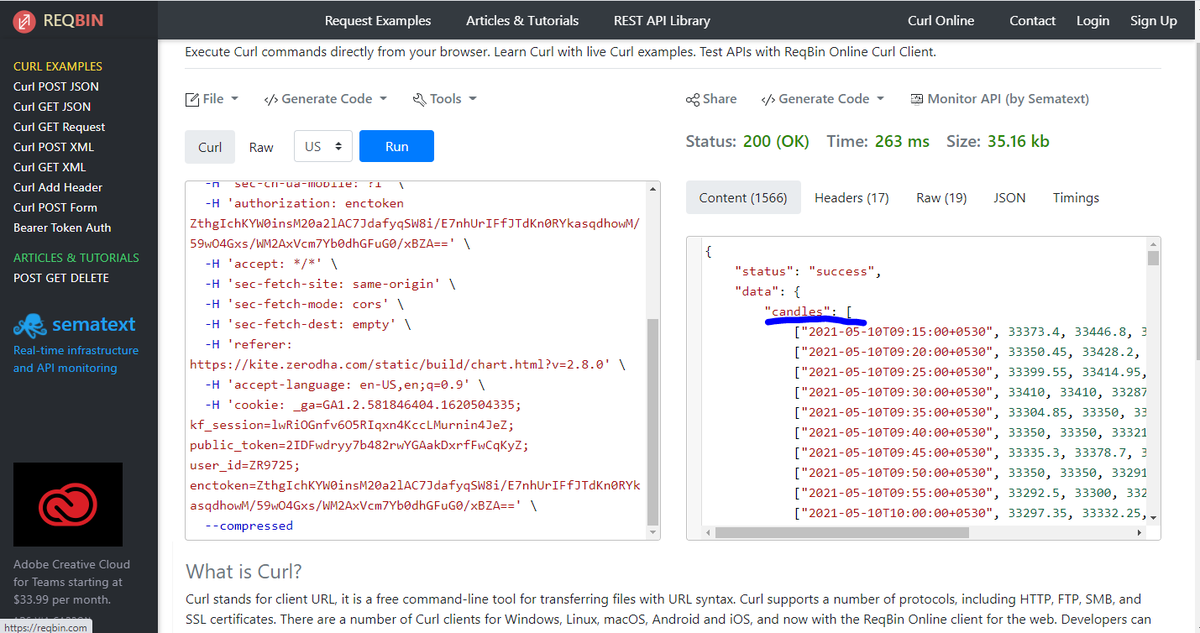

3. Go to website https://t.co/f8rhwoGLUc and paste on the left box and click 'Run'

4. The output below candles written on right of box is the ohlc, volume and oi data. Copy and paste to excel.

👇

1. Open the chart on zerodha web in chrome. Right click and select 'Inspect'. Click 'Network' as shown in this pic.

2. Right click on the last entry on the table you see and click 'copy as cURL (bash)'

3. Go to website https://t.co/f8rhwoGLUc and paste on the left box and click 'Run'

4. The output below candles written on right of box is the ohlc, volume and oi data. Copy and paste to excel.