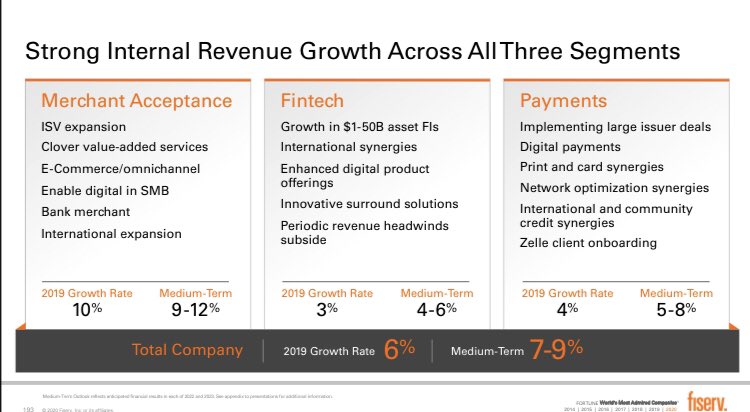

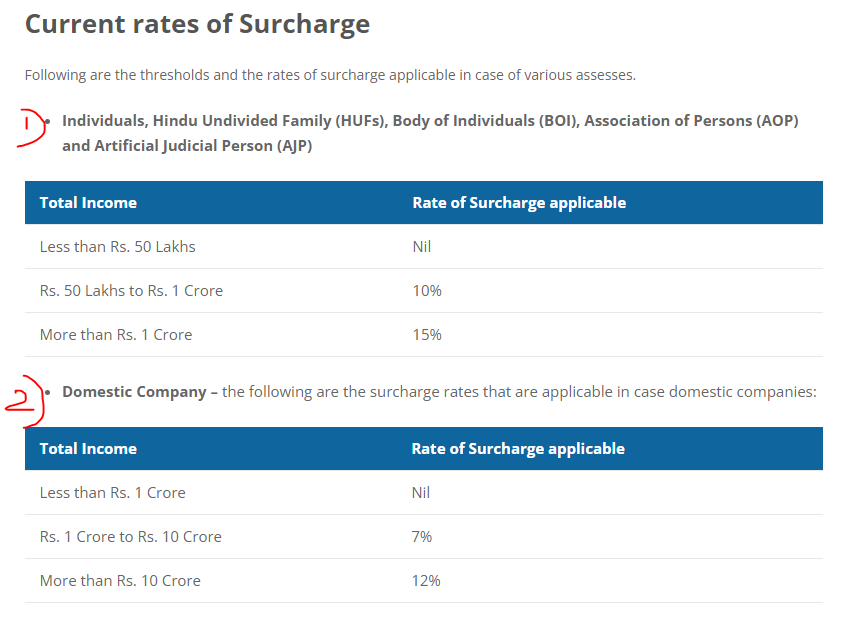

Will also try to bridge to an earlier thread laying out the $FISV growth algorithm and the operational/financial levers that support its medium-term outlook of 15-20% FCF/share growth

Here we focus on the top line, most notably the impressive acceleration across all 3 segments

https://t.co/8HzMhEC5Bj

Let’s start with Merchant:

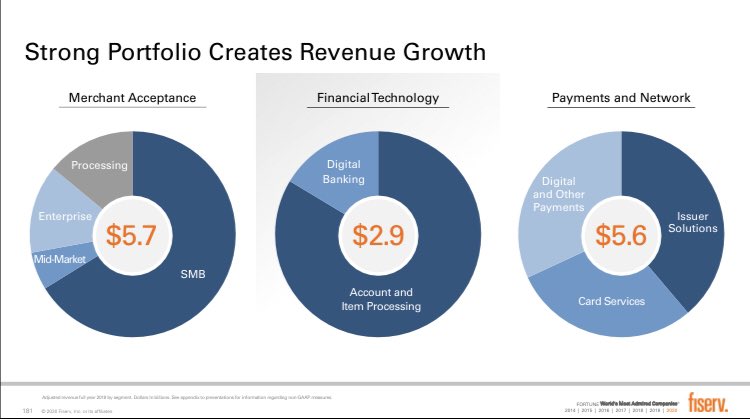

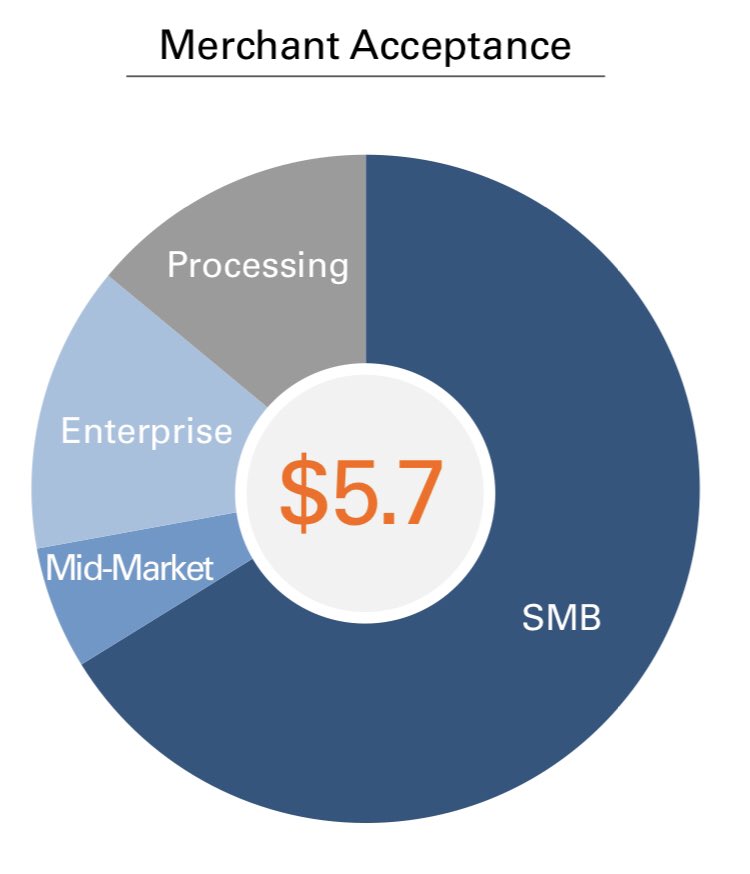

1) This segment, which ~40% of $FISV revenue today, is the #1 merchant acquirer globally processing $3T+ annually for 6M merchants worldwide

2/3 of revenue is from SMBs, ~20% from mid-to-enterprise merchants, remaining ~15% is wholesale processing

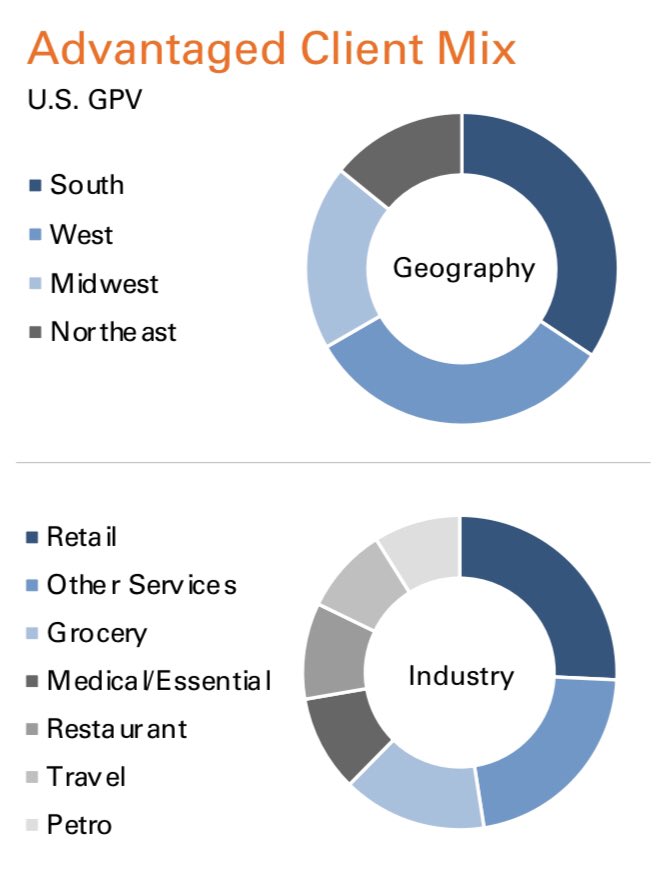

2) 🇺🇸 is 3/4 of the $FISV Merchant segment and the scale of this business is unmatched: it processes 40% of all in-person purchases in the US, covers 80% of all US zip codes and accounts for 10% of US GDP. This book of business is the most balanced in the industry

https://t.co/Qlkk7lz3jQ

3) Internationally, $FISV Merchant has strong position in EMEA (top 3 through various JVs and alliances) and several high growth countries, among others: India 🇮🇳 (top 3 with ~15% share), Argentina 🇦🇷 (~50% market share today), Brazil 🇧🇷 (routing ~30% of all electronic payments)

4) Within $FISV Merchant, there are 2 growth engines which together account for an estimated ~40% of the segment’s revenue (some $2B+ growing at 20%+ annually)

- Clover, inclusive of the SMB offering and ISV platform

- Carat, the new branding for its e-/omni-commerce solution

5) Clover is the single most exciting thing going on at $FISV

From 6 engineers and a patent in 2012 to $133B of GPV today, Clover has now surpassed $SQ growing 2x+ as fast

Other SMB platforms like $LSPD/Upserve (< $40B combined), Toast, etc. are just a fraction the size

https://t.co/EJqhKl6Kaz

6) Clover was growing 40%+ pre-COVID and 30%+ in Q3, adding 96k new merchants during the pandemic 🚀 but still only 1/4 of FISV’s SMB merchant base

Importantly, ~90% of new Clover merchants are net new $FISV. This explosive growth is not self-cannibalization as previously feared

https://t.co/QOHo1dTOST

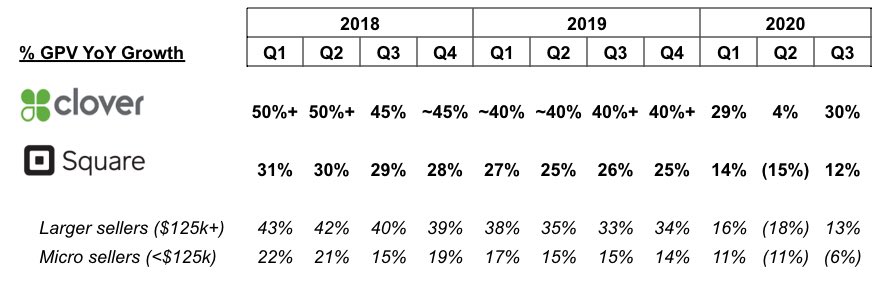

7) Here’s the updated head-to-head comparison between $SQ (which was decelerating even before COVID and skews micro-sellers) vs $FISV Clover (scaling fast and growing rapidly despite COVID)

It’s a 2🐴 race, and while one is getting tired, the other is pulling ahead for the win🏅

https://t.co/UPy1OJma6v

8) Oh yeah... and that strong growth is before any of “bank merchant” synergies from offering Clover to its 4,000 small/community bank customers where $FISV is core account processor

Since FDC deal closed, 200+ banks have signed up to resell Clover to SMBs, 500+ more in pipeline

9) Why is Clover so exciting for $FISV?

Remember, Clover is an open platform, not just a cloud POS integrated with payment processing

It has both FISV-delivered and 3rd party apps that help SMB merchants manage and grow their business, with attach rate for software near 50%

10) Even more powerful is how $FISV has integrated ISV capabilities (CardPointe/CoPilot) into Clover to grow further up market

Now 3rd party ISVs can build specialized vertical solutions with integrated payments on top of the Clover form factor, and resell it to their customers

11) The ISV/Integrated market is growing 15-20% annually, the leaders are $GPN and $FIS/WorldPay

$FISV/FDC is a relative newcomer, with 1,000 ISV partners and growing at ISV revenue growing 50%+ despite COVID

Clover target verticals: Spa/Salons, B2B, Field Services, Vet/Health

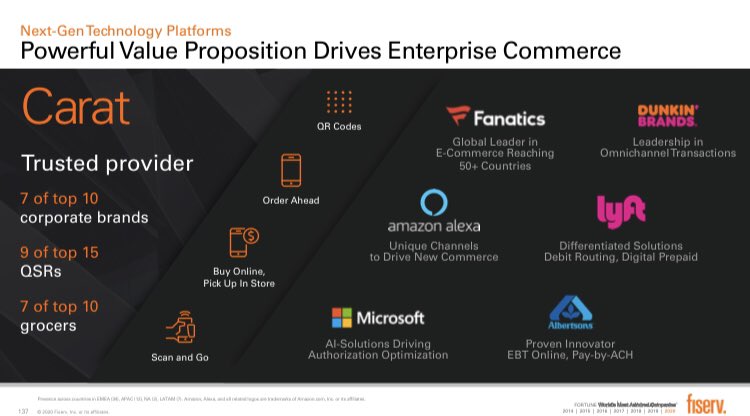

12) The second growth engine within $FISV merchant is Carat, the new brand for the global e-comm/omni-commerce platform

Today, e-commerce accounts for $1B+ of FISV/FDC revenue, doubling since FDC’s investor day in 2016 (15-20% annual growth, in line with global e-comm)

13) Carat is a culmination of 3 yrs of investment by $FISV, the re-platforming of FDC’s multi-currency/multi-country OmniPay technology

While the Carat name is new, its market presence is not. FISV is already used by a number of leading brands for omni-channel commerce

14) It should already be widely known today that $FISV is the underlying processor behind Stripe, Braintree and PayPal, and therefore benefits from their success. This indirect, wholesale e-comm processing business is some $250M of annualized revenue today

https://t.co/ei2To0u4CF

15) What’s probably less well appreciated is the size of $FISV direct e-comm business. Today this is ~$750M of revenue (about the size of Adyen)

In Q3, FISV e-comm transactions grew 25%, in line with the market

Was FDC/FISV late to the game in e-comm? Yes

Is the game over? No

16) I know there’s a narrative that Adyen and Stripe are going to take over the world, and legacy players like $FISV are just share donors

This threat is serious/real as more of commerce is shifting from offline to online. It’s 85/15 today and is only going in one direction ...

17) ... but let’s put all this in context

Stripe is ~100% online merchants and sits on top of $FISV for processing

Adyen is ~85% online and has offline ambitions. It’s a much larger threat given full stack acquiring, global footprint and focus on enterprise merchants

18) Remember, Adyen is ~$800M of revenue, of which 2/3 is Europe and 95%+ is large multinational merchants wanting a single integration for global acquiring

It’s offline capabilities center around omni-channel commerce but are still nascent (< $50B annual GPV worldwide)

19) $FISV is not ceding this market to Adyen without a fight

It’s new Carat Commerce Hub is an orchestration layer for multi-party global acquiring through a single point of integration, enabling FISV to sit “on top” to integrate a merchant’s multiple acquiring relationships

20) Will Carat be enough to mitigate the Adyen threat? We’ll have to see 🤗

But let’s add some more perspective: Enterprise is < $1B of $FISV Merchant revenue, add in Mid-Market where Adyen is trying to gain some presence and we’re at maybe ~20% exposure to the Adyen threat ...

21) ... but remember, in its biggest market 🇺🇸, categories such as Groceries, Pharmacies, Gas are 1/3 of $FISV Merchant GPV and probably account for most of the non-SMB revenue that would be exposed to Adyen if it made significant inroads into the US (< 20% of Adyen today) ...

22) ... and in these categories, scale/pricing matter more than slick API integrations or multi-country acquiring. All of these merchants have razor thin margins and heavily utilize the PIN debit routing/on-us benefits of $FISV that Adyen just doesn’t have

Scale matters here

https://t.co/dUMVJV9LkN

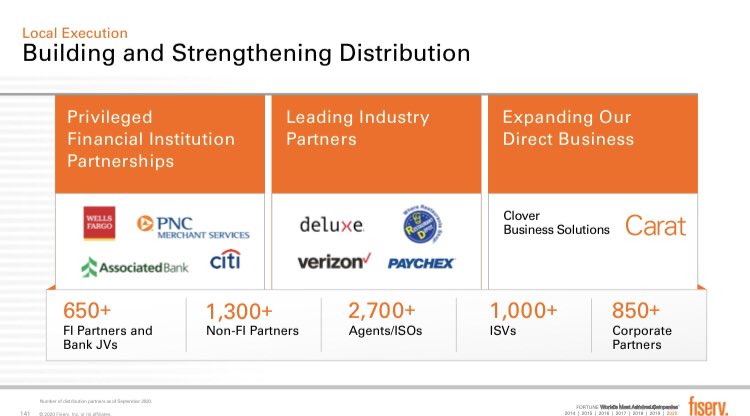

23) Why isn’t Adyen a threat to the SMB merchant franchise?

One word: Distribution. Adyen sells its solution alone

$FISV leverages SMB acquisition partners across bank and non-bank channels, ISOs, ISVs, and other local partners, in addition to its own direct sales force ...

24) ... and this unparalleled distribution is the same reason $FISV was able to scale Clover so rapidly to over take $SQ despite being a second mover following a copycat strategy.

In SMB land, “feet on the street” beats “innovation” all day long 🤗

Distribution matters here

https://t.co/8PKUBpmdSw

25) Tying this all back to growth

Not too long ago, $FISV Merchant was a low-single digit grower

It grew 10% in 2019, so a 9-12% medium term outlook certainly looks achievable — particularly if it’s 2 growth engines (Clover + Carat) are ~40% of segment revenue and growing 20%+