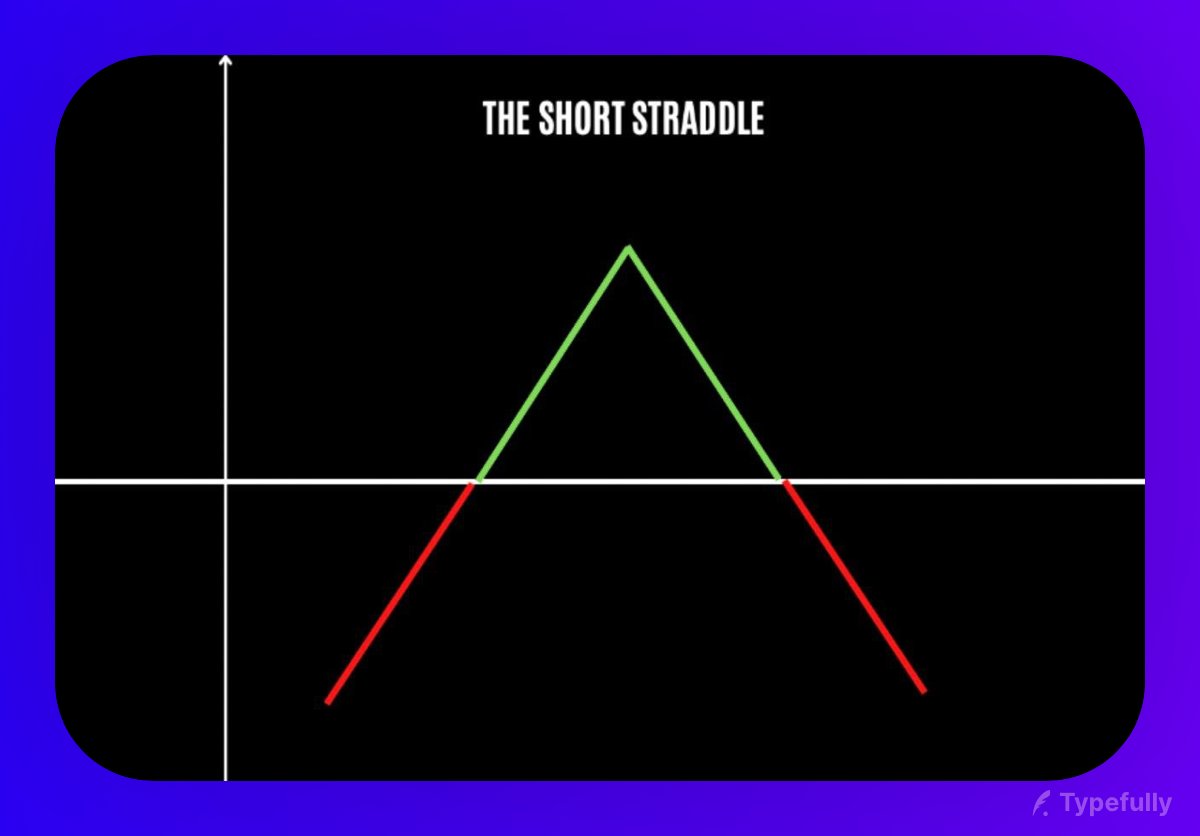

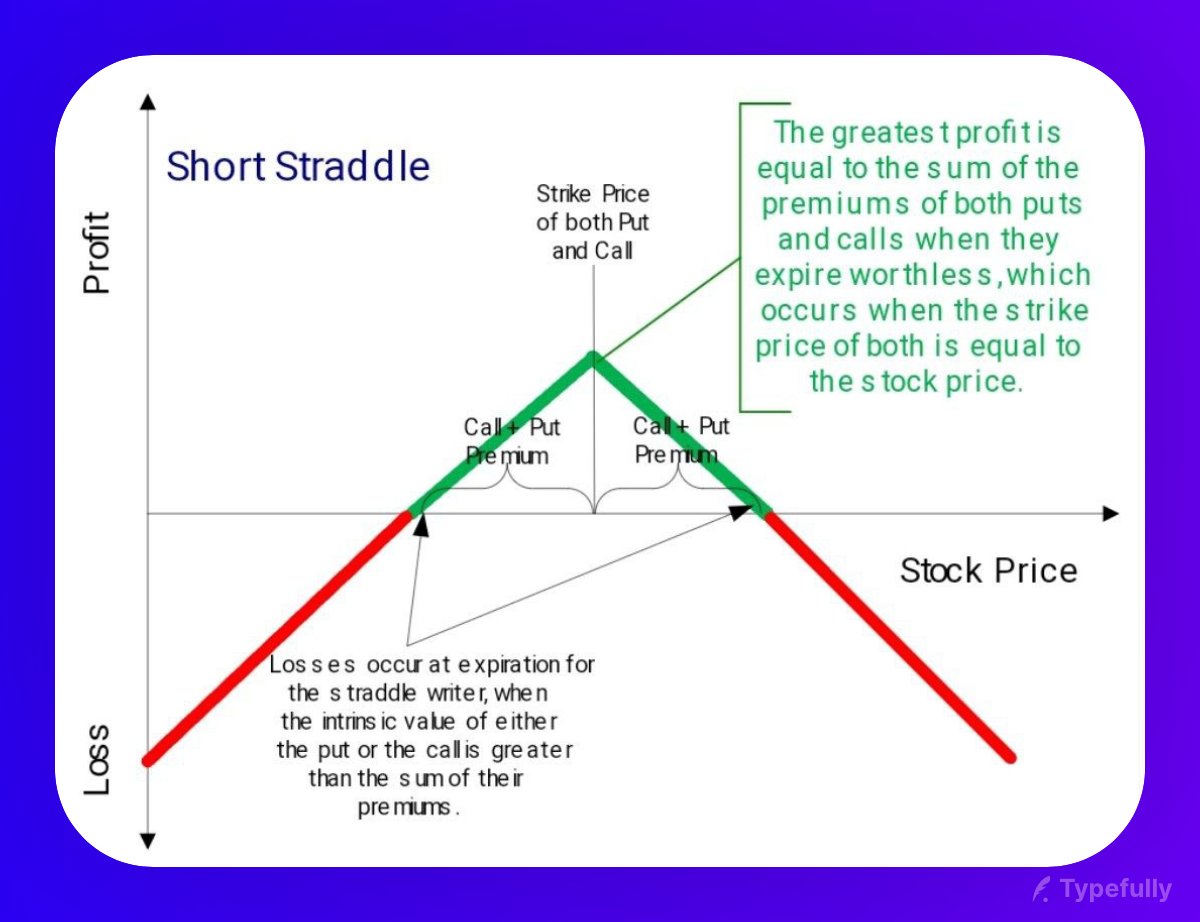

Where a call option and a put option are sold at the same strike price.

Traders often overlook the SHORT STRADDLE due to its simplicity.

It remains the TOP strategy to make money when the market is not trending.

Here's how you can make money using only the short straddle

in various market conditions

⬇️ A comprehensive thread🧵

Where a call option and a put option are sold at the same strike price.

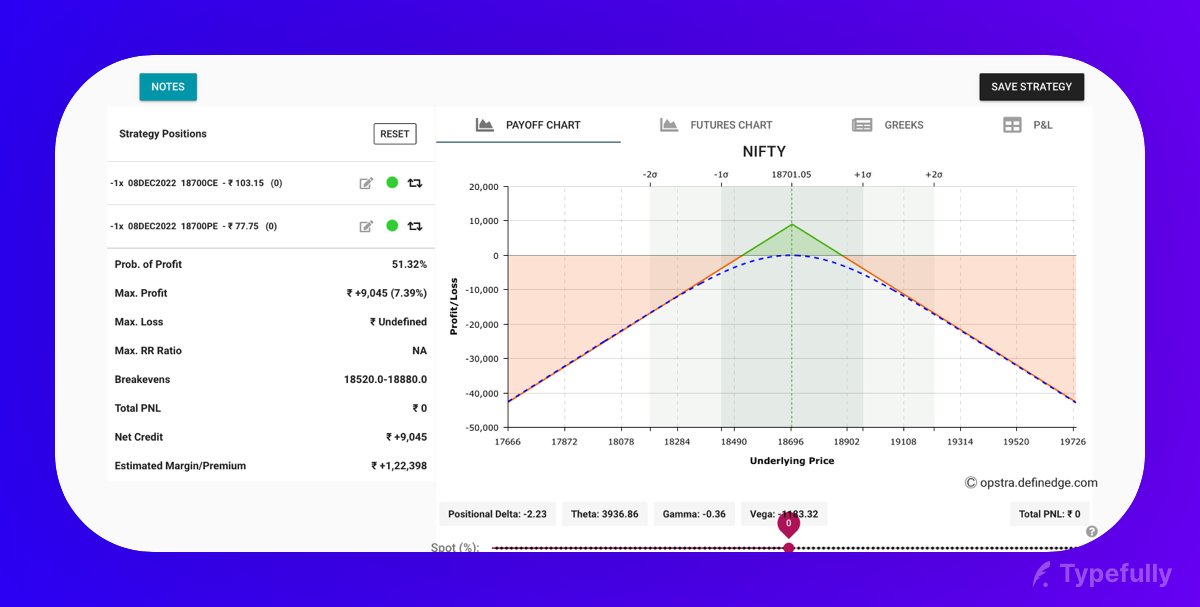

Max risk = Unlimited

(using SLs would be wise)

Upper breakeven = Strike price + Total Premium received

Lower breakeven = Strike price - Total Premium received

Long-term short straddles usually require fewer adjustments since the range is wide.

You will have to define your criteria based on your risk appetite and the gap between the breakevens.

Ex:- gap between the breakevens is 360 points, so I would prefer making adjustments on every 50-point move.

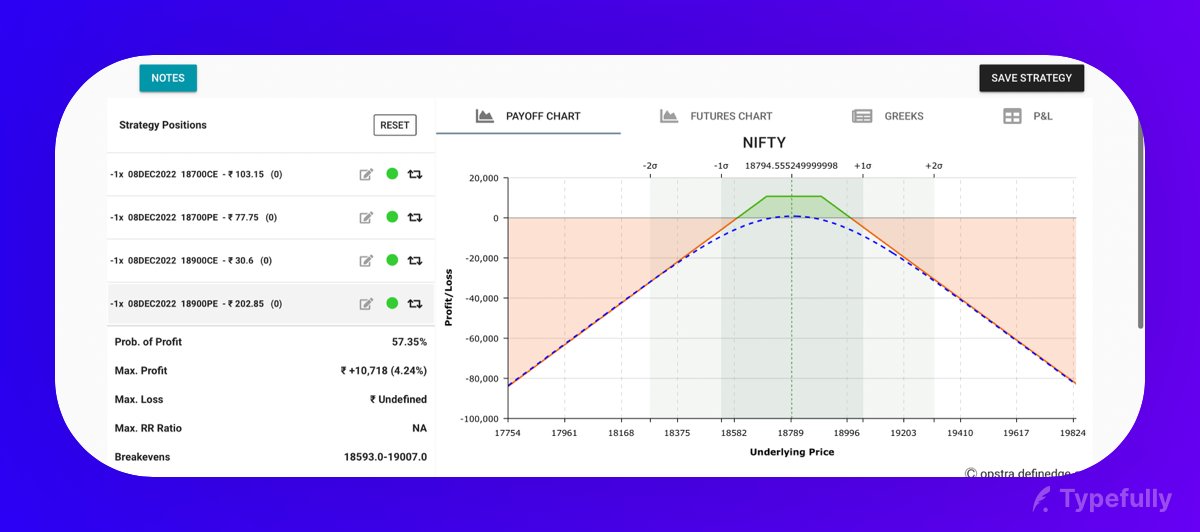

Suppose the straddle is initially made at 18700 strike price, then,

NIFTY moves up to 18794 ( 94 points from our strike price/ max profit point )

The trader can now create a new straddle at 19000 strike price.

Which provides a larger range

Initial strike price ± 2*(Movement)

In the given example,

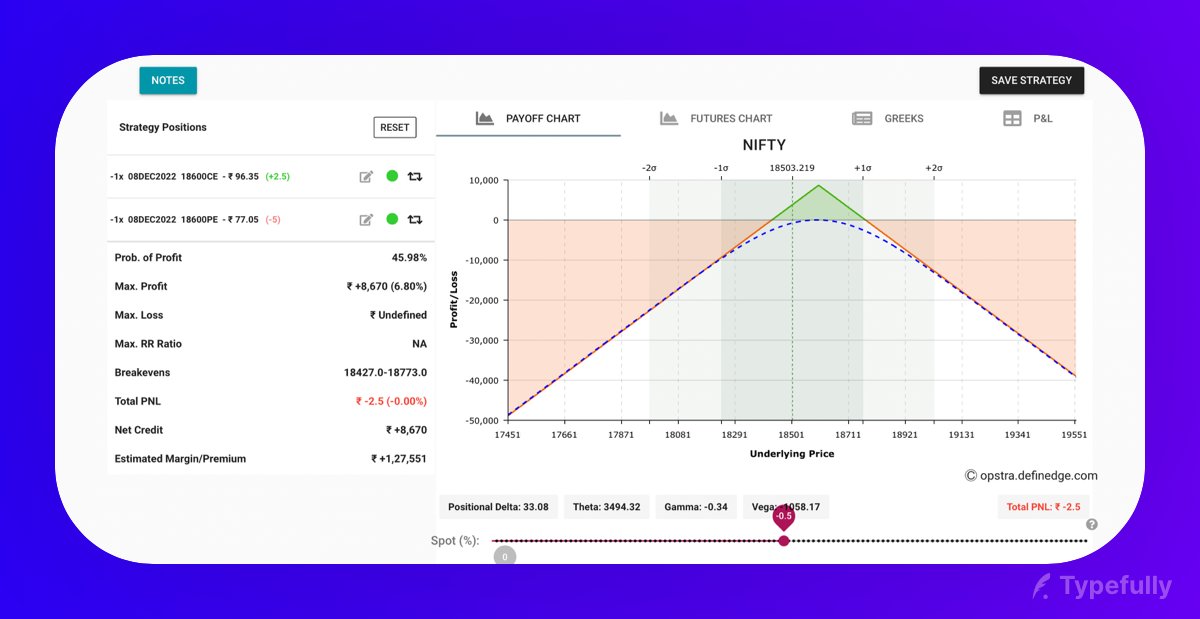

NIFTY has shifted to 18499 from our strike price of 18600 (101 points)

The trader can sell a call option for wider range

If the underlying moves drastically in any direction,

The trader can book his profit/loss in the straddle and initiate a new one after the market is relatively calm

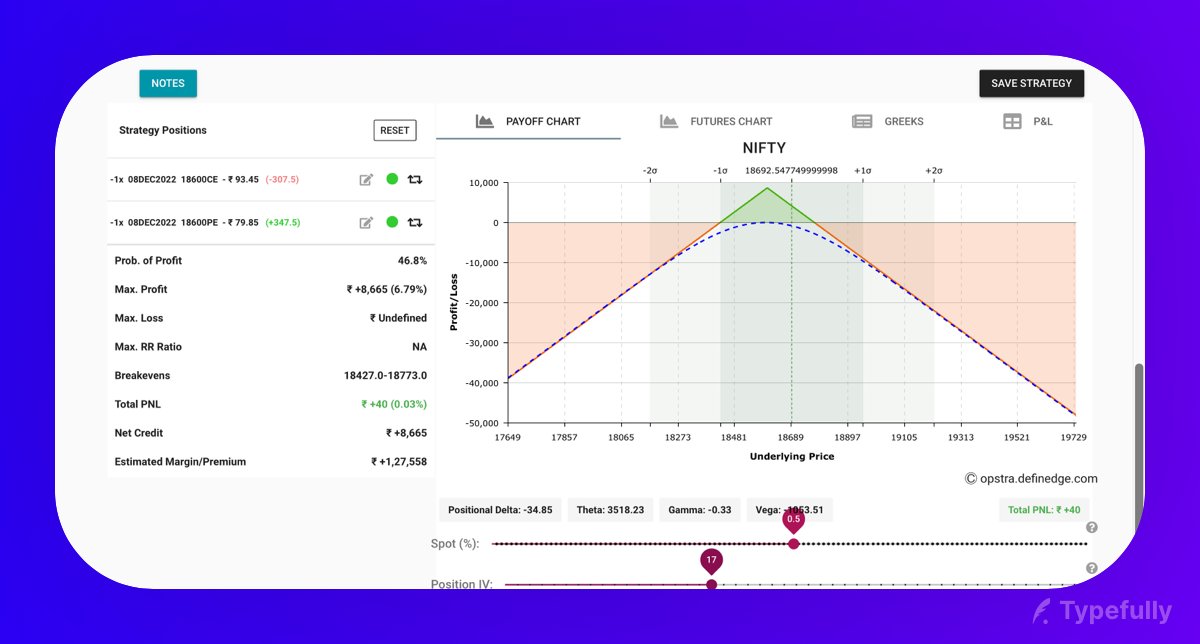

NIFTY has moved up by 86 points

We can keep the square off the short call option(at a loss)

and we can

1) Put an SL on the put leg (this would make it a directional trade)

or

2) We can sell a 18850 CE to create a strangle

In the below example,

NIFTY has moved 92 points from our strike price

We can buy 18850 CE to reduce the risk on the upper side.

• For profit booking, trailing stop loss is suggested so that maximum points can be extracted from the straddle

• If one has lost over 2% of his/her total capital, he/she should probably terminate the strategy and book the loss.

Where I share live trading and market-related updates, you can join my FREE TELEGRAM CHANNEL by clicking on the link below. 👇

https://t.co/GHfoJevtw1

Follow me @mohitsharmadl for more.

Like/Retweet 👍 the first tweet below if you can: https://t.co/xo8VsfeQu9

Traders often overlook the SHORT STRADDLE due to its simplicity.

— Mohit Sharma (@mohitsharmadl) December 9, 2022

It remains the TOP strategy to make money when the market is not trending.

Here's how you can make money using only the short straddle

in various market conditions

\u2b07\ufe0f A comprehensive thread\U0001f9f5 pic.twitter.com/inHebjXzZA

More from Trading

Collaborated with @niki_poojary

Here's what you'll learn in this thread:

1. Capture Overnight Theta Decay

2. Trading Opening Range Breakouts

3. Reversal Trading Setups

4. Selling strangles and straddles in Bank Nifty

6. NR4 + IB

7. NR 21-Vwap Strategy

Let's dive in ↓

1/ STBT option Selling (Positional Setup):

The setup uses price action to sell options for overnight theta decay.

Check Bank Nifty at 3:15 everyday.

Sell directional credit spreads with capped

A thread about STBT options selling,

— Jig's Patel (@jigspatel1988) July 17, 2021

The purpose is simple to capture overnight theta decay,

Generally, ppl sell ATM straddle with hedge or sell naked options,

But I am using Today\u2019s price action for selling options in STBT,

(1/n)

@jigspatel1988 2/ Selling Strangles in Bank Nifty based on Open Interest Data

Don't trade till 9:45 Am.

Identify the highest OI on puts and calls.

Check combined premium and put a stop on individual

Thread on

— Jig's Patel (@jigspatel1988) July 4, 2021

"Intraday Banknifty Strangle based on OI data"

(System already shared, today just share few examples)

(1/n)

@jigspatel1988 3/ Open Drive (Intraday)

This is an opening range breakout setup with a few conditions.

To be used when the market opens above yesterday's day high

or Below yesterday's day's

#OpenDrive#intradaySetup

— Pathik (@Pathik_Trader) April 16, 2019

Sharing one high probability trending setup for intraday.

Few conditions needs to be met

1. Opening should be above/below previous day high/low for buy/sell setup.

2. Open=low (for buy)

Open=high (for sell)

(1/n)

Complete Backtest and Indicator link

🧵 A Thread 🧵

𝗦𝗲𝘁𝘂𝗽:

🔸 Monthly Option Buying

🔸 50 ema on 3 min timeframe

🔸 Supertrend 10 , 3

🔸 Chart : Banknifty , Nifty Futures as we backtested on futures

🔸 Entry 9:20 to 3:00

🔸 Max 3 Entries per day

🔸 Premium nearest to 200 Rs only

[2/18]

Why Monthly Option buying ?

🔸 Less theta decay compared to weekly options

🔸 Less Volatility

🔸 Supertrend and MA Settings

[3/18]

🔸 Indicator Link

🔸 Click on the below 𝘭𝘪𝘯𝘬 -> 𝘈𝘥𝘥 𝘵𝘰 𝘍𝘢𝘷𝘰𝘶𝘳𝘪𝘵𝘦𝘴 -> 𝘈𝘥𝘥 𝘰𝘯 𝘊𝘩𝘢𝘳𝘵 from favourites and start using it !

🔸 https://t.co/zVXavqLBto

[4/18]

𝗜𝗻𝗱𝗶𝗰𝗮𝘁𝗼𝗿 𝗦𝗲𝘁𝘁𝗶𝗻𝗴𝘀 :

🔸 Max 6 Trades per day ( Both CE and PE buy)

🔸 Timings 9:20 am to 3:00 pm

🔸 Supertrend : 10,3

🔸 Moving Average 50 ema

[5/18]

You May Also Like

Like company moats, your personal moat should be a competitive advantage that is not only durable—it should also compound over time.

Characteristics of a personal moat below:

I'm increasingly interested in the idea of "personal moats" in the context of careers.

— Erik Torenberg (@eriktorenberg) November 22, 2018

Moats should be:

- Hard to learn and hard to do (but perhaps easier for you)

- Skills that are rare and valuable

- Legible

- Compounding over time

- Unique to your own talents & interests https://t.co/bB3k1YcH5b

2/ Like a company moat, you want to build career capital while you sleep.

As Andrew Chen noted:

People talk about \u201cpassive income\u201d a lot but not about \u201cpassive social capital\u201d or \u201cpassive networking\u201d or \u201cpassive knowledge gaining\u201d but that\u2019s what you can architect if you have a thing and it grows over time without intensive constant effort to sustain it

— Andrew Chen (@andrewchen) November 22, 2018

3/ You don’t want to build a competitive advantage that is fleeting or that will get commoditized

Things that might get commoditized over time (some longer than

Things that look like moats but likely aren\u2019t or may fade:

— Erik Torenberg (@eriktorenberg) November 22, 2018

- Proprietary networks

- Being something other than one of the best at any tournament style-game

- Many "awards"

- Twitter followers or general reach without "respect"

- Anything that depends on information asymmetry https://t.co/abjxesVIh9

4/ Before the arrival of recorded music, what used to be scarce was the actual music itself — required an in-person artist.

After recorded music, the music itself became abundant and what became scarce was curation, distribution, and self space.

5/ Similarly, in careers, what used to be (more) scarce were things like ideas, money, and exclusive relationships.

In the internet economy, what has become scarce are things like specific knowledge, rare & valuable skills, and great reputations.