1. Multi-timeframe Technical Analysis

2. Option Chain Data

Also, 3 strategies to deploy for:

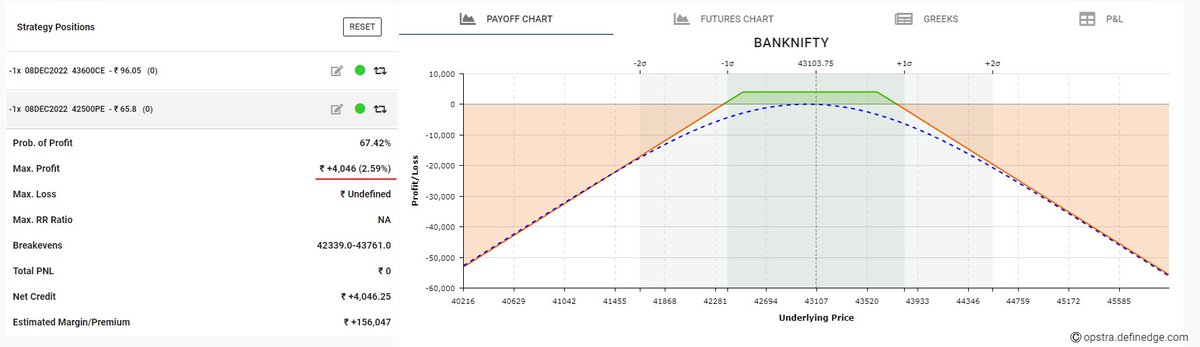

1. Aggressive Traders (2.6%)

2. Moderate Risk Traders (1.3%)

3. Low-Risk Traders (0.8%)

1. Let's start option selling learning.

— Mitesh Patel (@Mitesh_Engr) February 10, 2019

Strangle selling. ( I am doing mostly in weekly Bank Nifty)

When to sell? When VIX is below 15

Assume spot is at 27500

Sell 27100 PE & 27900 CE

say premium for both 50-50

If bank nifty will move in narrow range u will get profit from both.

Few are selling 20-25 Rs positional option selling course.

— Mitesh Patel (@Mitesh_Engr) November 3, 2019

Nothing big deal in that.

For selling weekly option just identify last week low and high.

Now from that low and high keep 1-1.5% distance from strike.

And sell option on both side.

1/n

Sold 29200 put and 30500 call

— Mitesh Patel (@Mitesh_Engr) April 12, 2019

Used 20% capital@44 each

Already giving more than 2% return in a week. Now I will prefer to sell 32500 call at 74 to make it strangle in equal ratio.

— Mitesh Patel (@Mitesh_Engr) February 7, 2020

To all. This is free learning for you. How to play option to make consistent return.

Stay tuned and learn it here free of cost. https://t.co/7J7LC86oW0

A thread about STBT options selling,

— Jig's Patel (@jigspatel1988) July 17, 2021

The purpose is simple to capture overnight theta decay,

Generally, ppl sell ATM straddle with hedge or sell naked options,

But I am using Today\u2019s price action for selling options in STBT,

(1/n)

Thread on

— Jig's Patel (@jigspatel1988) July 4, 2021

"Intraday Banknifty Strangle based on OI data"

(System already shared, today just share few examples)

(1/n)

#OpenDrive#intradaySetup

— Pathik (@Pathik_Trader) April 16, 2019

Sharing one high probability trending setup for intraday.

Few conditions needs to be met

1. Opening should be above/below previous day high/low for buy/sell setup.

2. Open=low (for buy)

Open=high (for sell)

(1/n)

Screeners helps trader in saving lot of time in filtering best stocks out of 5000+ stocks listed.

— Yash Mehta (@YMehta_) October 28, 2022

Here is the list of top 10 Free Candlestick Pattern based screeners that I use:

Also, last two screeners are my favorite to pick early momentum stocks.

Screeners helps trader in saving lot of time in filtering best stocks out of 1000+ stocks listed.

— Yash Mehta (@YMehta_) September 16, 2022

Here is the list of top 9 Free Price Action based screeners that I use:

Also, last screener is my favorite to pick early momentum stocks.

Screeners helps trader in saving lot of time in filtering best stocks out of 5000+ listed stocks.

— Yash Mehta (@YMehta_) December 9, 2022

Here is the list of top 7 Free Strategy and its respective screeners that I use:

Also, last screener is my favorite to pick early momentum stocks.

There are so many investment strategies, still hardly anyone creates long term wealth in stocks.

— Yash Mehta (@YMehta_) November 25, 2022

Sharing 4 Investment Strategies based on Technical Analysis and Screeners for free (sold as a \u20b9 50,000 course!).

Shared a bonus trading strategy at the end.

A thread \U0001f9f5:

A thread about STBT options selling,

— Jig's Patel (@jigspatel1988) July 17, 2021

The purpose is simple to capture overnight theta decay,

Generally, ppl sell ATM straddle with hedge or sell naked options,

But I am using Today\u2019s price action for selling options in STBT,

(1/n)

Thread on

— Jig's Patel (@jigspatel1988) July 4, 2021

"Intraday Banknifty Strangle based on OI data"

(System already shared, today just share few examples)

(1/n)

#OpenDrive#intradaySetup

— Pathik (@Pathik_Trader) April 16, 2019

Sharing one high probability trending setup for intraday.

Few conditions needs to be met

1. Opening should be above/below previous day high/low for buy/sell setup.

2. Open=low (for buy)

Open=high (for sell)

(1/n)