3 to 4 weeks for your easier/easiest strategies if you have some (bare minimum is enough) amount of coding experience. Even basic experience writing loops helps the process.

1/ A primer on how I achieved end to end automation via algos.

First up, Why?

Trades execute the moment your setups trigger. No hesitating/panicking/worrying/overthinking when you need to take a new trade daily. That's why. Also, spend less screen time going fwd.

3 to 4 weeks for your easier/easiest strategies if you have some (bare minimum is enough) amount of coding experience. Even basic experience writing loops helps the process.

- Zerodha API subscription (2k per month).

- Historical data subscription (2k per month). You can unsub after the first month if you don't need it.

- Udemy course (Price keeps changing but it's 490/- right now).

- AWS (Free tier for the first year)

Python as it is relatively easy with a lot of inbuilt libraries. C++ is better and faster I'm told but it's not like you are running nanosecond HFT strategies with your peasant like retail capital.

https://t.co/Ao7dCxS7kx By going thru this course and following it step by step.

(This is for Zerodha&Python. If you are on another broker then you'll need to spend additional time to understand your broker's API and functions)

It is that simple but simple is not easy. Post that course, you will need to spend a lot of time on google, Youtube, Stackoverflow etc. for all the questions and issues you'll have. It's part of the process

- Are you a genius? Always have been

- Do I have to turn on my PC daily to keep the algos running? No. End to end automation. Your algos run in the cloud on AWS. You can run them from your PC if you want. It's up to you on which path you want to take

- Do I need to know/install Linux? Yes, if you choose to deploy stuff from the cloud. It's not that hard. Trust me

8.2/n

- Python, you'll learn it on a "as you go" and "need only" basis. You don't have to know everything. https://t.co/KEZmnqh5UJ This guy has good Python tutorials. Use them wisely.

Sample Zerodha codes: https://t.co/wz26rtqtI0

@sakuag333 @f2003062 @TarunNayak2905 @jigspatel1988 @vishalmehta29 @TraderLogical @avi_gadicherla @quatltd

More from Trading

You May Also Like

1/“What would need to be true for you to….X”

Why is this the most powerful question you can ask when attempting to reach an agreement with another human being or organization?

A thread, co-written by @deanmbrody:

2/ First, “X” could be lots of things. Examples: What would need to be true for you to

- “Feel it's in our best interest for me to be CMO"

- “Feel that we’re in a good place as a company”

- “Feel that we’re on the same page”

- “Feel that we both got what we wanted from this deal

3/ Normally, we aren’t that direct. Example from startup/VC land:

Founders leave VC meetings thinking that every VC will invest, but they rarely do.

Worse over, the founders don’t know what they need to do in order to be fundable.

4/ So why should you ask the magic Q?

To get clarity.

You want to know where you stand, and what it takes to get what you want in a way that also gets them what they want.

It also holds them (mentally) accountable once the thing they need becomes true.

5/ Staying in the context of soliciting investors, the question is “what would need to be true for you to want to invest (or partner with us on this journey, etc)?”

Multiple responses to this question are likely to deliver a positive result.

Why is this the most powerful question you can ask when attempting to reach an agreement with another human being or organization?

A thread, co-written by @deanmbrody:

Next level tactic when closing a sale, candidate, or investment:

— Erik Torenberg (@eriktorenberg) February 27, 2018

Ask: \u201cWhat needs to be true for you to be all in?\u201d

You'll usually get an explicit answer that you might not get otherwise. It also holds them accountable once the thing they need becomes true.

2/ First, “X” could be lots of things. Examples: What would need to be true for you to

- “Feel it's in our best interest for me to be CMO"

- “Feel that we’re in a good place as a company”

- “Feel that we’re on the same page”

- “Feel that we both got what we wanted from this deal

3/ Normally, we aren’t that direct. Example from startup/VC land:

Founders leave VC meetings thinking that every VC will invest, but they rarely do.

Worse over, the founders don’t know what they need to do in order to be fundable.

4/ So why should you ask the magic Q?

To get clarity.

You want to know where you stand, and what it takes to get what you want in a way that also gets them what they want.

It also holds them (mentally) accountable once the thing they need becomes true.

5/ Staying in the context of soliciting investors, the question is “what would need to be true for you to want to invest (or partner with us on this journey, etc)?”

Multiple responses to this question are likely to deliver a positive result.

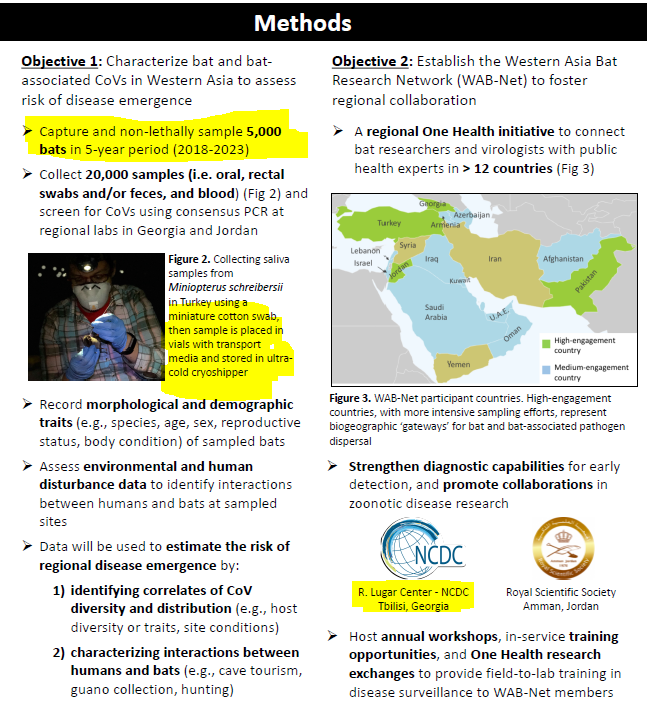

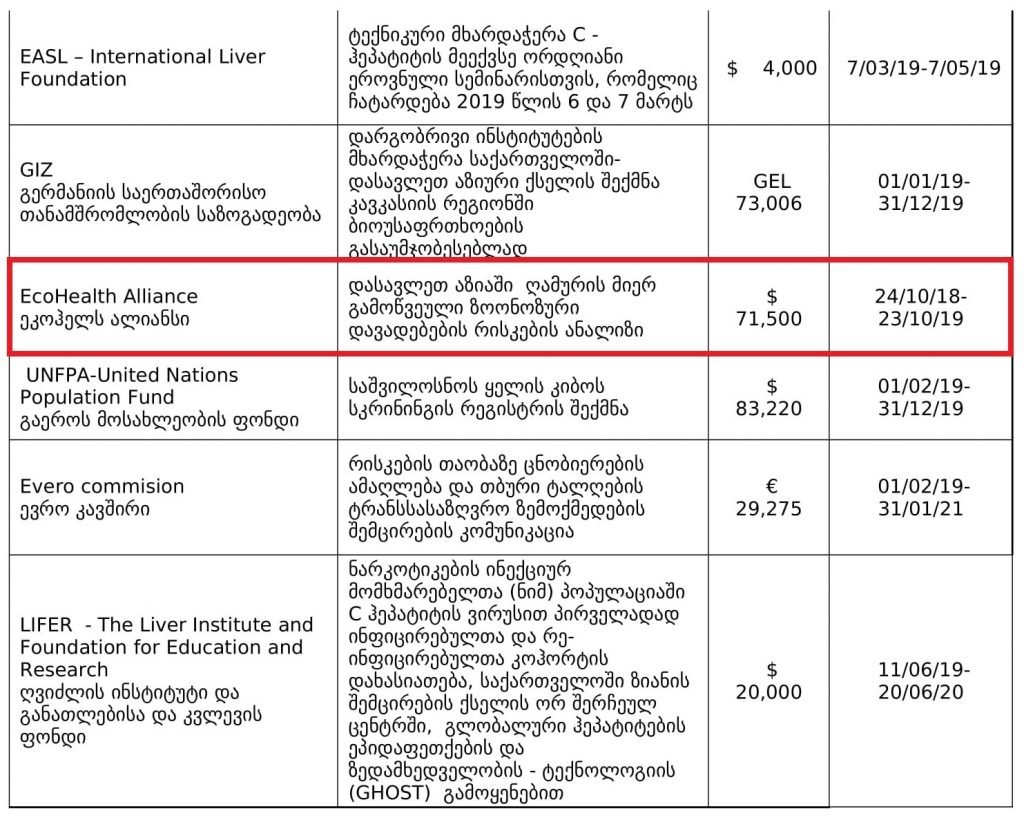

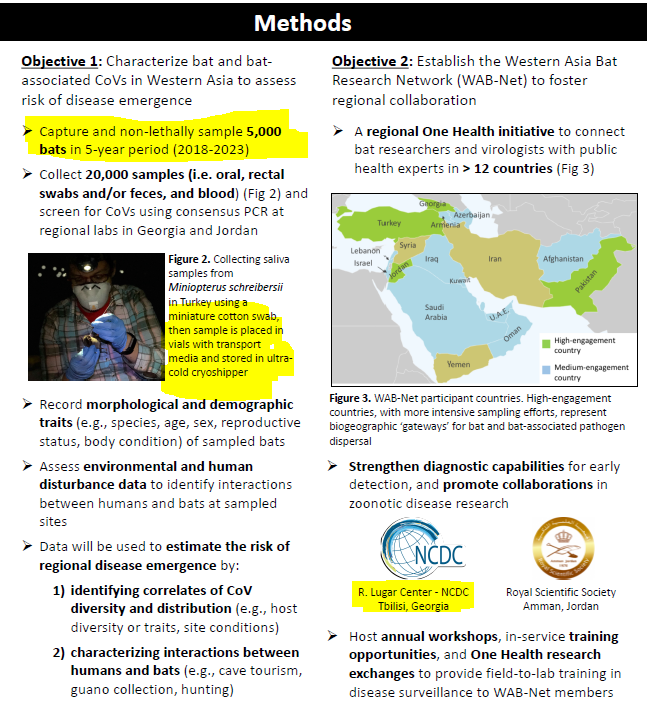

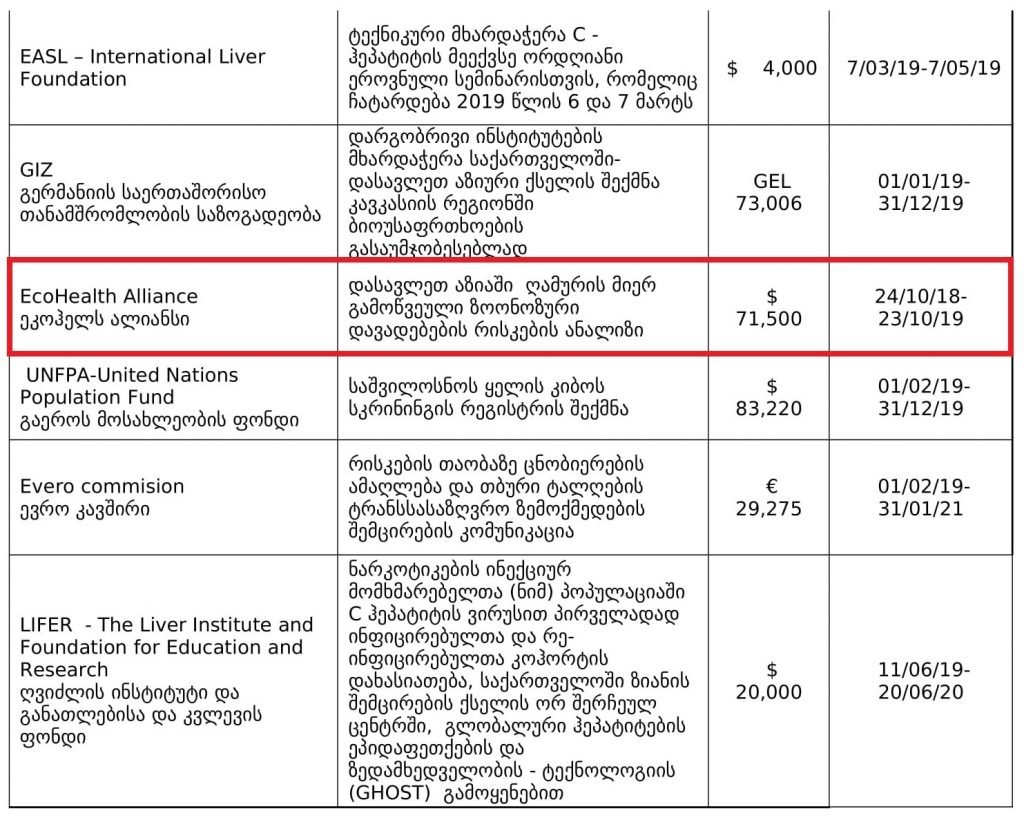

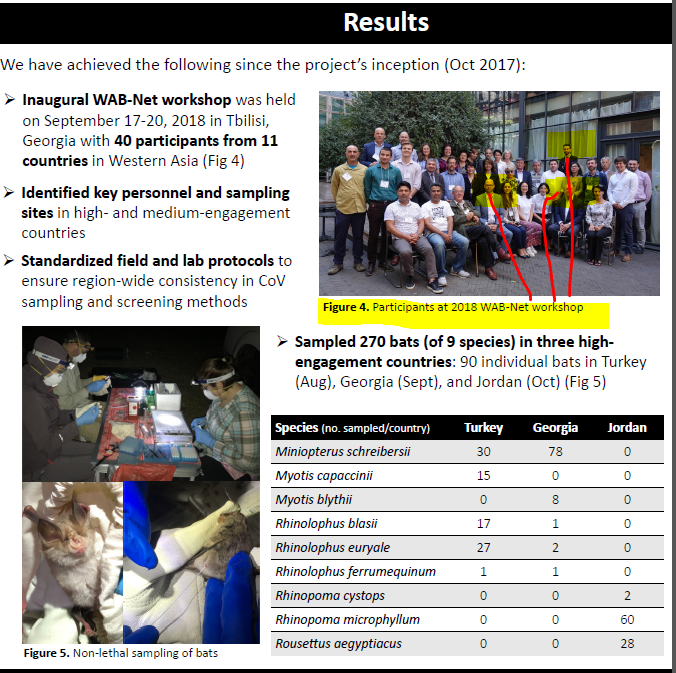

1. Project 1742 (EcoHealth/DTRA)

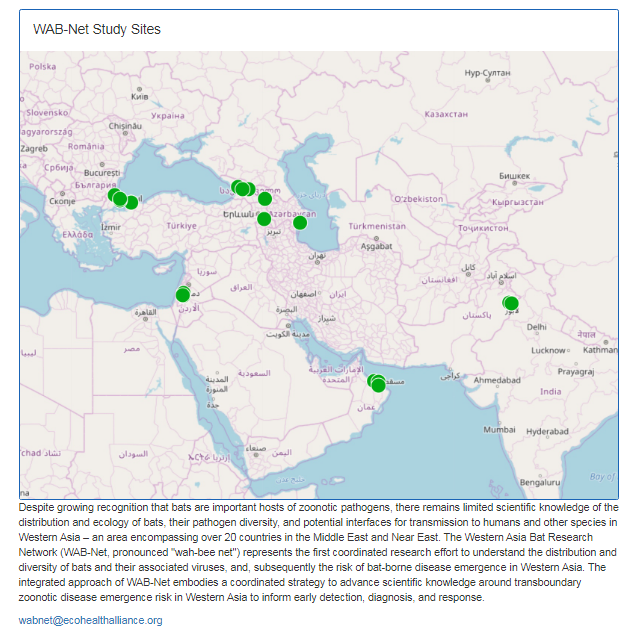

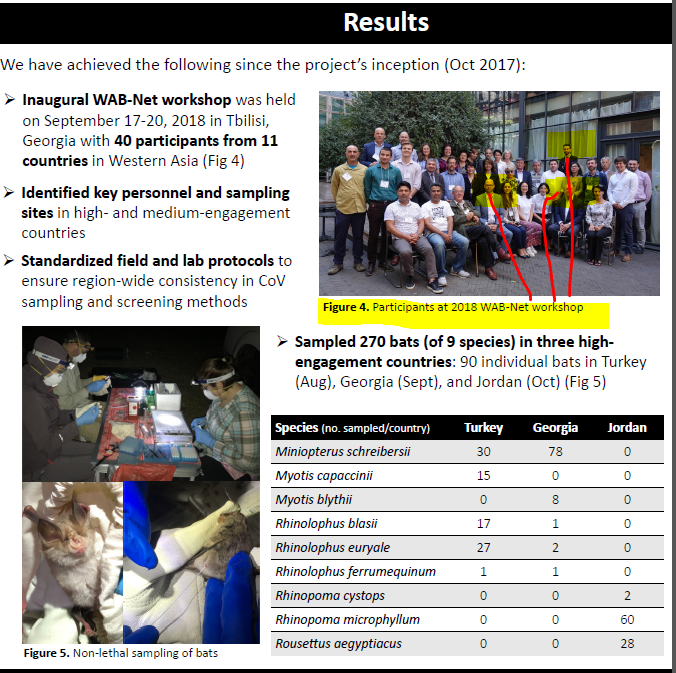

Risks of bat-borne zoonotic diseases in Western Asia

Duration: 24/10/2018-23 /10/2019

Funding: $71,500

@dgaytandzhieva

https://t.co/680CdD8uug

2. Bat Virus Database

Access to the database is limited only to those scientists participating in our ‘Bats and Coronaviruses’ project

Our intention is to eventually open up this database to the larger scientific community

https://t.co/mPn7b9HM48

3. EcoHealth Alliance & DTRA Asking for Trouble

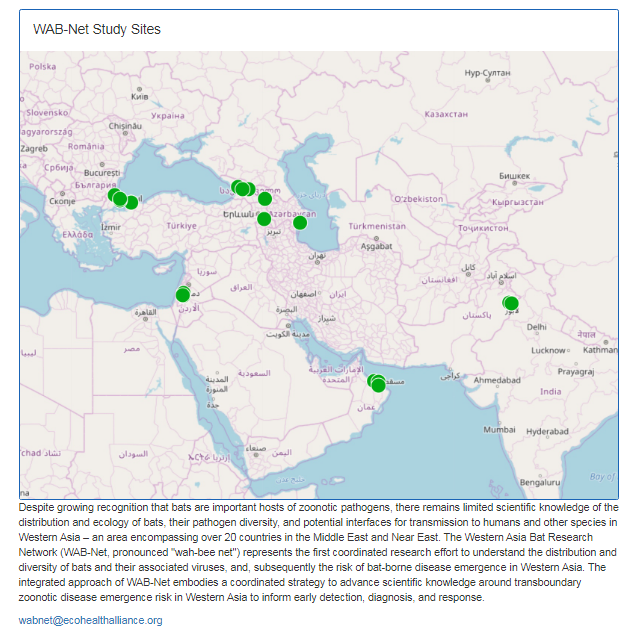

One Health research project focused on characterizing bat diversity, bat coronavirus diversity and the risk of bat-borne zoonotic disease emergence in the region.

https://t.co/u6aUeWBGEN

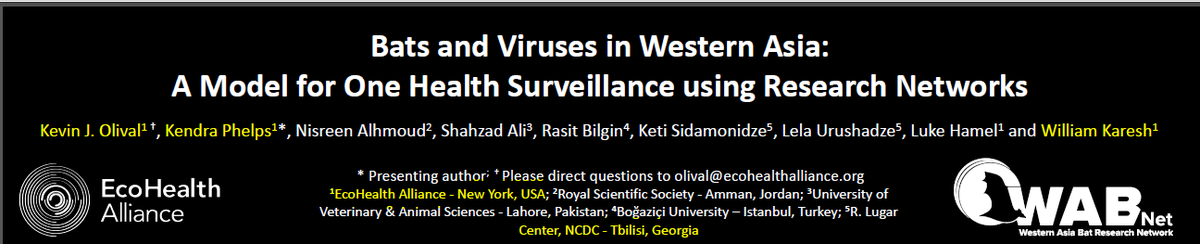

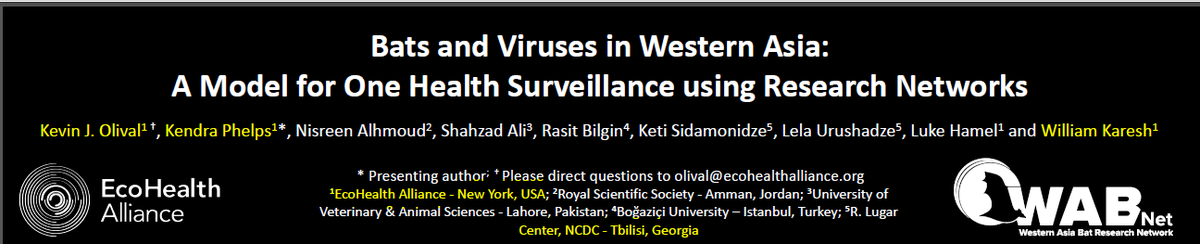

4. Phelps, Olival, Epstein, Karesh - EcoHealth/DTRA

5, Methods and Expected Outcomes

(Unexpected Outcome = New Coronavirus Pandemic)

Risks of bat-borne zoonotic diseases in Western Asia

Duration: 24/10/2018-23 /10/2019

Funding: $71,500

@dgaytandzhieva

https://t.co/680CdD8uug

2. Bat Virus Database

Access to the database is limited only to those scientists participating in our ‘Bats and Coronaviruses’ project

Our intention is to eventually open up this database to the larger scientific community

https://t.co/mPn7b9HM48

3. EcoHealth Alliance & DTRA Asking for Trouble

One Health research project focused on characterizing bat diversity, bat coronavirus diversity and the risk of bat-borne zoonotic disease emergence in the region.

https://t.co/u6aUeWBGEN

4. Phelps, Olival, Epstein, Karesh - EcoHealth/DTRA

5, Methods and Expected Outcomes

(Unexpected Outcome = New Coronavirus Pandemic)