Positional trader - weekly/monthly

Swing trader - daily /3hours

Intraday trader - 15/30min

Full #volume anlaysis thread \U0001f9f5

— Vikrant (@Trading0secrets) October 20, 2021

One thing which big player can never hide - VOLUME https://t.co/MjtFq384N0

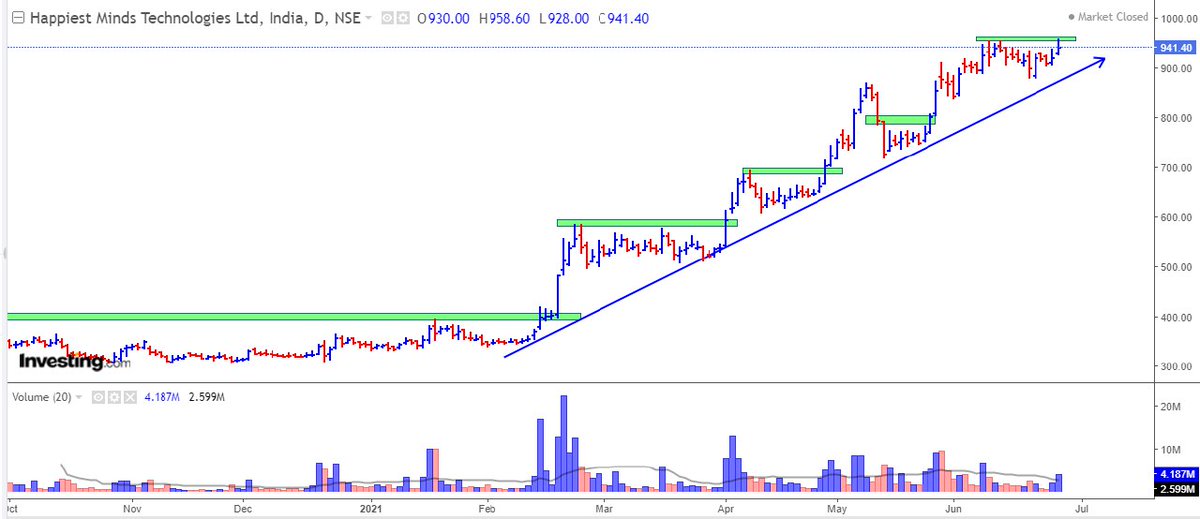

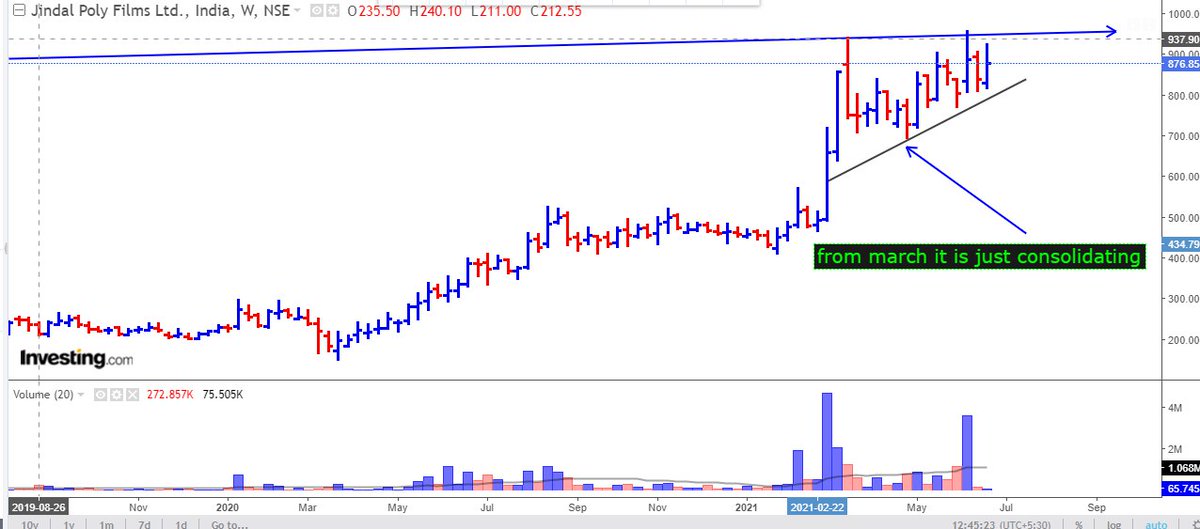

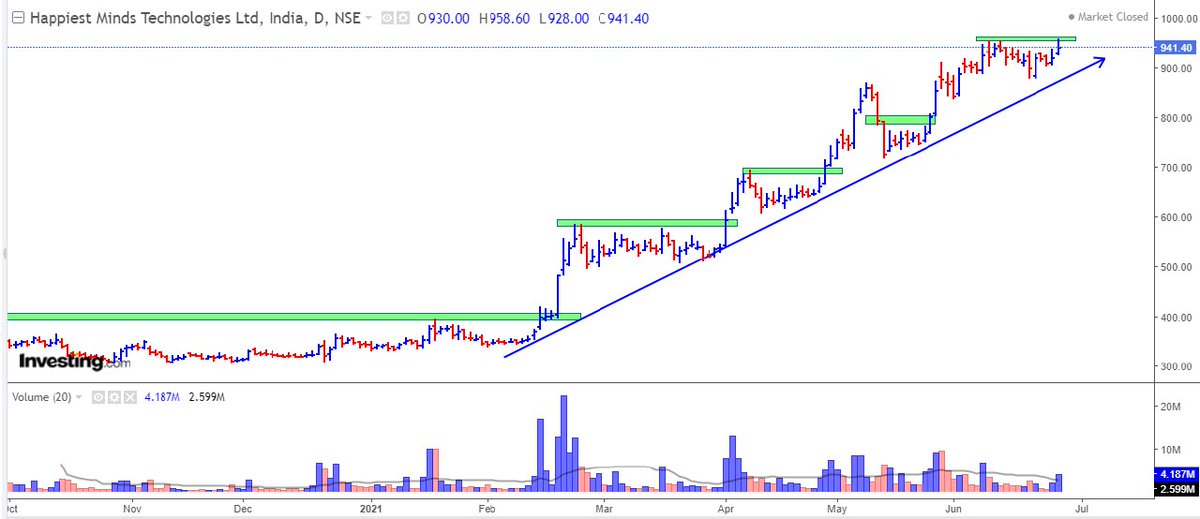

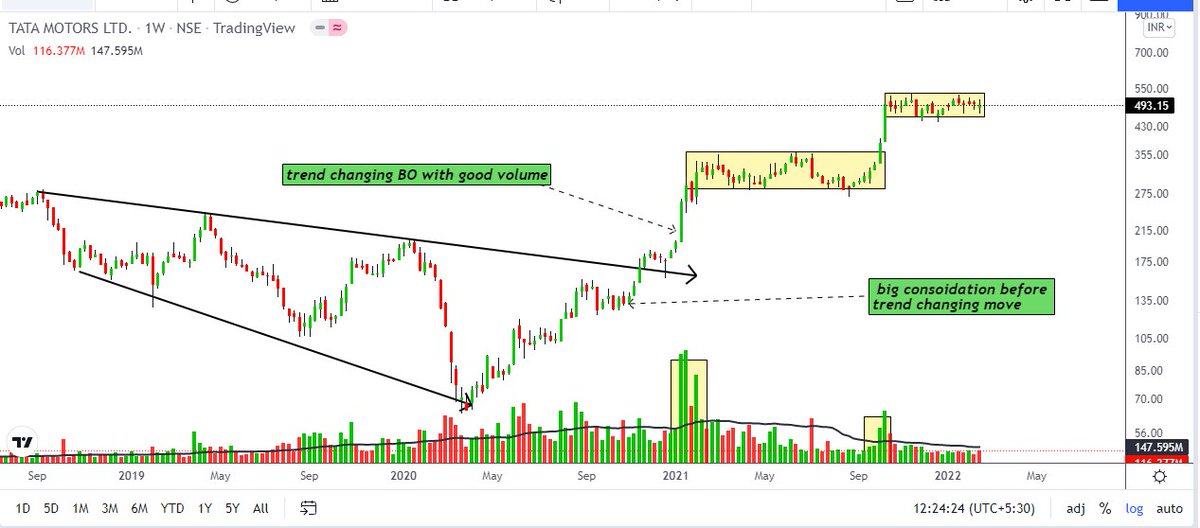

I am going to make #priceaction breakout thread with real examples

— V\xb6k\u03c0nT (@Trading0secrets) June 24, 2021

By which u can easily find out blasting stocks.

it is only based on my experience of last 5 years

How many learners are excited \U0001f973

Show your love \u2764 by likes & retweets so that most new one can take advantage.

Trading view scanner process -

— Vikrant (@Trading0secrets) October 23, 2021

1 - open trading view in your browser and select stock scanner in left corner down side .

2 - touch the percentage% gain change ( and u can see higest gainer of today) https://t.co/GGWSZXYMth

Full #volume anlaysis thread \U0001f9f5

— Vikrant (@Trading0secrets) October 20, 2021

One thing which big player can never hide - VOLUME https://t.co/MjtFq384N0

In such volatile market I mainly trading intraday with low risk breakout setup .

— Vikrant (@Trading0secrets) February 18, 2022

Making thread \U0001f9f5 on Intraday breakout strategy.

And how I play & when you should avoid intraday.

Try to explain full BO intraday strategy

With examples

Will share thread \U0001f9f5 after completed\U0001f4af

Making thread \U0001f9f5 on trading view scanner by which you can select intraday and btst stocks .

— Vikrant (@Trading0secrets) October 22, 2021

In just few hours (Without any watchlist)

Some manual efforts u have to put on it.

Soon going to share the process with u whenever it will be ready .

"How's the josh?"guys \U0001f57a\U0001f3b7\U0001f483