But this requires your latency to be the least.

Working on some execution optimisation related backtesting. I have so far been executing with market orders only. Going towards higher lot sizes, I'd like to optimise for minimal slippage.

First off, on NSE, if you place a market order, you get filled at the best bid/ask right?

But this requires your latency to be the least.

I looked at tick historical data, and there are more than 18-20 ticks in a second (auction and quote combined).

Even if you keep 10 ticks per second, your best bid/ask can shift from the time you place to the time exchange receives the order.

What you need is liquidity.

More from Shravan Venkataraman 🔥🚀💰

Here's the roundup of 17 of the best and the most useful threads, tweets, and resources I found last week. 🧵

1/ How to find spreadsheets on any topic in the

How to find spreadsheets on any topic in the world:

— Blake Emal (@heyblake) February 13, 2022

1. Go to Google

2. Search site:docs(dot)Google(dot)com/spreadsheets \u201cYOUR TOPIC\u201d

3. Search, scroll, succeed pic.twitter.com/VJsYQKyi0J

2/ A thread by @wes_kao on making your customers hungry and excited to buy from

How to get customers excited, hungry to buy, and ready to say yes:

— Wes Kao \U0001f3db (@wes_kao) February 13, 2022

3/ Life brings you a lot of afflictions. But if you look around, there's a lot of beauty around you. Most often, drowning in the afflictions, we can't recognise or appreciate the beauty.

@wdmorrisjr wrote a damn good thread on finding beauty around us.

You\u2019re not looking for more success, stuff, or sex.

— David Morris (@wdmorrisjr) February 13, 2022

You\u2019re searching for beauty.

Here\u2019s how to find it: \U0001f9f5

4/ This one is for all the job goers and job seekers.

@SahilBloom who recently hit 500k followers and has several accomplishments to his belt (career wise) wrote this thread on standing out in a hiring

10 ways to stand out in a hiring process (that don\u2019t involve your resume):

— Sahil Bloom (@SahilBloom) February 13, 2022

More from Trading

It's much more powerful than you think

9 things TradingView can do, you'll wish you knew yesterday: 🧵

Collaborated with @niki_poojary

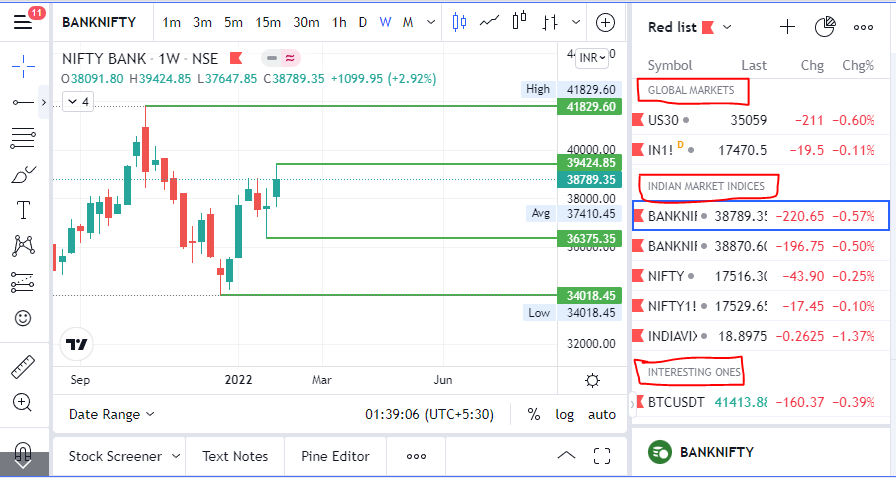

1/ Free Multi Timeframe Analysis

Step 1. Download Vivaldi Browser

Step 2. Login to trading view

Step 3. Open bank nifty chart in 4 separate windows

Step 4. Click on the first tab and shift + click by mouse on the last tab.

Step 5. Select "Tile all 4 tabs"

What happens is you get 4 charts joint on one screen.

Refer to the attached picture.

The best part about this is this is absolutely free to do.

Also, do note:

I do not have the paid version of trading view.

2/ Free Multiple Watchlists

Go through this informative thread where @sarosijghosh teaches you how to create multiple free watchlists in the free

\U0001d5e0\U0001d602\U0001d5f9\U0001d601\U0001d5f6\U0001d5fd\U0001d5f9\U0001d5f2 \U0001d600\U0001d5f2\U0001d5f0\U0001d601\U0001d5fc\U0001d5ff \U0001d604\U0001d5ee\U0001d601\U0001d5f0\U0001d5f5\U0001d5f9\U0001d5f6\U0001d600\U0001d601 \U0001d5fc\U0001d5fb \U0001d5e7\U0001d5ff\U0001d5ee\U0001d5f1\U0001d5f6\U0001d5fb\U0001d5f4\U0001d603\U0001d5f6\U0001d5f2\U0001d604 \U0001d602\U0001d600\U0001d5f6\U0001d5fb\U0001d5f4 \U0001d601\U0001d5f5\U0001d5f2 \U0001d5d9\U0001d5e5\U0001d5d8\U0001d5d8 \U0001d603\U0001d5f2\U0001d5ff\U0001d600\U0001d5f6\U0001d5fc\U0001d5fb!

— Sarosij Ghosh (@sarosijghosh) September 18, 2021

A THREAD \U0001f9f5

Please Like and Re-Tweet. It took a lot of effort to put this together. #StockMarket #TradingView #trading #watchlist #Nifty500 #stockstowatch

3/ Free Segregation into different headers/sectors

You can create multiple sections sector-wise for free.

1. Long tap on any index/stock and click on "Add section above."

2. Secgregate the stocks/indices based on where they belong.

Kinda like how I did in the picture below.

You May Also Like

Where to begin?

So our new Secretary of State Anthony Blinken's stepfather, Samuel Pisar, was "longtime lawyer and confidant of...Robert Maxwell," Ghislaine Maxwell's Dad.

"Pisar was one of the last people to speak to Maxwell, by phone, probably an hour before the chairman of Mirror Group Newspapers fell off his luxury yacht the Lady Ghislaine on 5 November, 1991." https://t.co/DAEgchNyTP

OK, so that's just a coincidence. Moving on, Anthony Blinken "attended the prestigious Dalton School in New York City"...wait, what? https://t.co/DnE6AvHmJg

Dalton School...Dalton School...rings a

Oh that's right.

The dad of the U.S. Attorney General under both George W. Bush & Donald Trump, William Barr, was headmaster of the Dalton School.

Donald Barr was also quite a

Donald Barr had a way with words. pic.twitter.com/JdRBwXPhJn

— Rudy Havenstein, listening to Nas all day. (@RudyHavenstein) September 17, 2020

I'm not going to even mention that Blinken's stepdad Sam Pisar's name was in Epstein's "black book."

Lots of names in that book. I mean, for example, Cuomo, Trump, Clinton, Prince Andrew, Bill Cosby, Woody Allen - all in that book, and their reputations are spotless.