Their decision came with a tradeoff: A spike in volatility could be very, very bad 2/X

Robinhood is not the only brokerage that limited buys on GameStop this week, so why is it catching all the heat?

Maybe because @stoolpresidente & others were quick to spread a theory that hedge funds must have forced the move? Or, Robinhood acted alone

A thread on facts 1/X

Their decision came with a tradeoff: A spike in volatility could be very, very bad 2/X

They carry some liability in the days it takes for your trade to settle. That usually isn't a problem, but can become one if a stock swings fast 3/X

But Robinhood in 2018 decided to cut ties with Apex to build their own clearing house called Clearing By Robinhood 4/X

In Robinhood's own blog they trumpeted their achievement as the "only clearing system built from scratch, and on modern technology, in the last decade." 5/X

So what took Robinhood so long? 7/X

Building their own clearing house came with added risks - it just seems no one saw GameStop rising 500% in a week 8/X

Letting customers continue to buy GameStop stock was like selling lottery tickets while knowing there could be problems with the drawing 9/X

Messaging to customers that this wasn't about "protection" could have come sooner

The SEC could've done something (anything) and *market wide* to protect the lopsided impact to protect the market's poorest investors 10/X

But running with a theory that hedge funds pressured them into anything before those facts exist is dangerous and endangers any real change 11/X

I'm just as angry about it as everyone else (even Mama Guz couldn't trade on Robinhood!) I'll keep chasing the truth.

https://t.co/CGhDIqjRk1

More from Trading

You May Also Like

@franciscodeasis https://t.co/OuQaBRFPu7

Unfortunately the "This work includes the identification of viral sequences in bat samples, and has resulted in the isolation of three bat SARS-related coronaviruses that are now used as reagents to test therapeutics and vaccines." were BEFORE the

chimeric infectious clone grants were there.https://t.co/DAArwFkz6v is in 2017, Rs4231.

https://t.co/UgXygDjYbW is in 2016, RsSHC014 and RsWIV16.

https://t.co/krO69CsJ94 is in 2013, RsWIV1. notice that this is before the beginning of the project

starting in 2016. Also remember that they told about only 3 isolates/live viruses. RsSHC014 is a live infectious clone that is just as alive as those other "Isolates".

P.D. somehow is able to use funds that he have yet recieved yet, and send results and sequences from late 2019 back in time into 2015,2013 and 2016!

https://t.co/4wC7k1Lh54 Ref 3: Why ALL your pangolin samples were PCR negative? to avoid deep sequencing and accidentally reveal Paguma Larvata and Oryctolagus Cuniculus?

Unfortunately the "This work includes the identification of viral sequences in bat samples, and has resulted in the isolation of three bat SARS-related coronaviruses that are now used as reagents to test therapeutics and vaccines." were BEFORE the

chimeric infectious clone grants were there.https://t.co/DAArwFkz6v is in 2017, Rs4231.

https://t.co/UgXygDjYbW is in 2016, RsSHC014 and RsWIV16.

https://t.co/krO69CsJ94 is in 2013, RsWIV1. notice that this is before the beginning of the project

starting in 2016. Also remember that they told about only 3 isolates/live viruses. RsSHC014 is a live infectious clone that is just as alive as those other "Isolates".

P.D. somehow is able to use funds that he have yet recieved yet, and send results and sequences from late 2019 back in time into 2015,2013 and 2016!

https://t.co/4wC7k1Lh54 Ref 3: Why ALL your pangolin samples were PCR negative? to avoid deep sequencing and accidentally reveal Paguma Larvata and Oryctolagus Cuniculus?

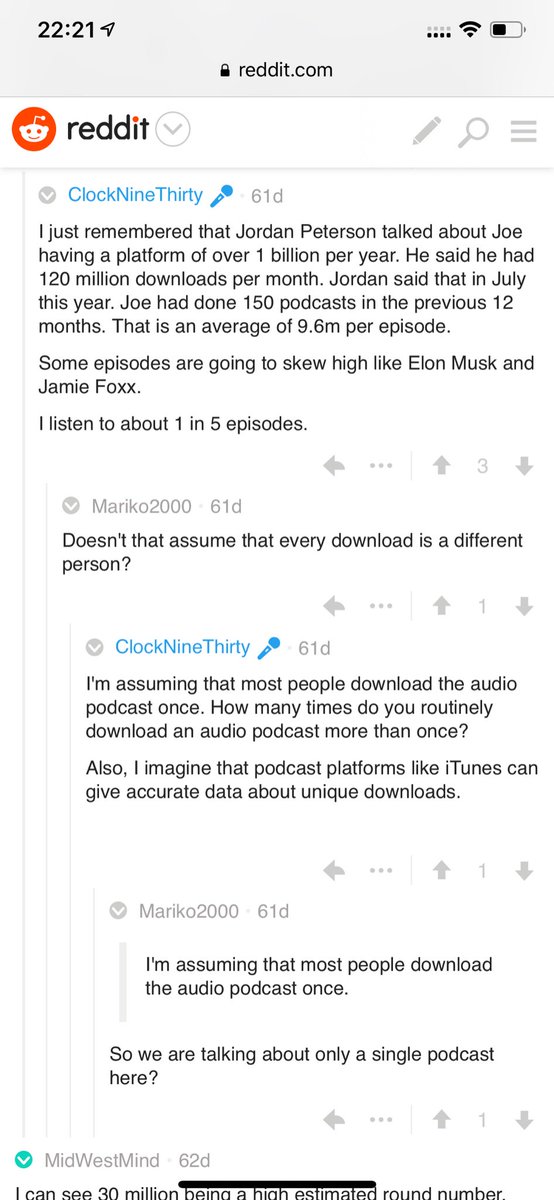

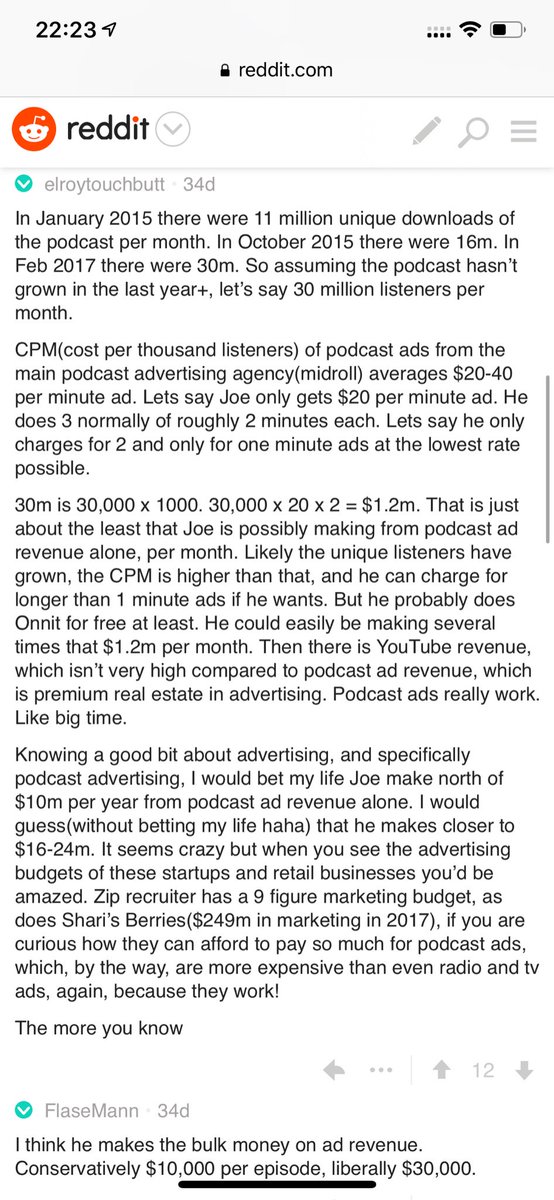

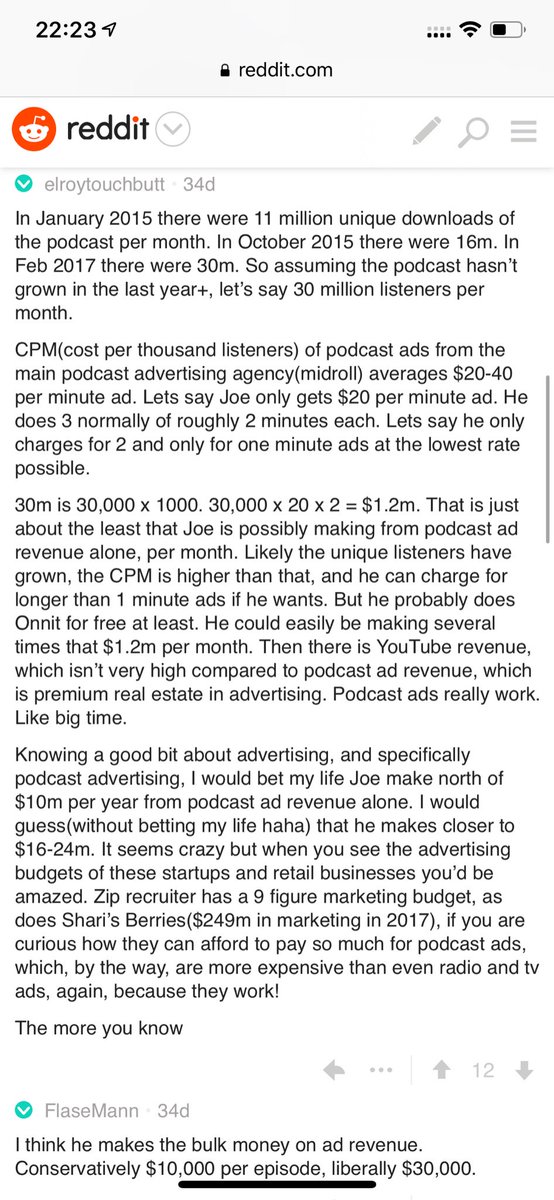

Joe Rogan's podcast is now is listened to 1.5+ billion times per year at around $50-100M/year revenue.

Independent and 100% owned by Joe, no networks, no middle men and a 100M+ people audience.

👏

https://t.co/RywAiBxA3s

Joe is the #1 / #2 podcast (depends per week) of all podcasts

120 million plays per month source https://t.co/k7L1LfDdcM

https://t.co/aGcYnVDpMu

Independent and 100% owned by Joe, no networks, no middle men and a 100M+ people audience.

👏

https://t.co/RywAiBxA3s

Joe is the #1 / #2 podcast (depends per week) of all podcasts

120 million plays per month source https://t.co/k7L1LfDdcM

https://t.co/aGcYnVDpMu

A brief analysis and comparison of the CSS for Twitter's PWA vs Twitter's legacy desktop website. The difference is dramatic and I'll touch on some reasons why.

Legacy site *downloads* ~630 KB CSS per theme and writing direction.

6,769 rules

9,252 selectors

16.7k declarations

3,370 unique declarations

44 media queries

36 unique colors

50 unique background colors

46 unique font sizes

39 unique z-indices

https://t.co/qyl4Bt1i5x

PWA *incrementally generates* ~30 KB CSS that handles all themes and writing directions.

735 rules

740 selectors

757 declarations

730 unique declarations

0 media queries

11 unique colors

32 unique background colors

15 unique font sizes

7 unique z-indices

https://t.co/w7oNG5KUkJ

The legacy site's CSS is what happens when hundreds of people directly write CSS over many years. Specificity wars, redundancy, a house of cards that can't be fixed. The result is extremely inefficient and error-prone styling that punishes users and developers.

The PWA's CSS is generated on-demand by a JS framework that manages styles and outputs "atomic CSS". The framework can enforce strict constraints and perform optimisations, which is why the CSS is so much smaller and safer. Style conflicts and unbounded CSS growth are avoided.

Legacy site *downloads* ~630 KB CSS per theme and writing direction.

6,769 rules

9,252 selectors

16.7k declarations

3,370 unique declarations

44 media queries

36 unique colors

50 unique background colors

46 unique font sizes

39 unique z-indices

https://t.co/qyl4Bt1i5x

PWA *incrementally generates* ~30 KB CSS that handles all themes and writing directions.

735 rules

740 selectors

757 declarations

730 unique declarations

0 media queries

11 unique colors

32 unique background colors

15 unique font sizes

7 unique z-indices

https://t.co/w7oNG5KUkJ

The legacy site's CSS is what happens when hundreds of people directly write CSS over many years. Specificity wars, redundancy, a house of cards that can't be fixed. The result is extremely inefficient and error-prone styling that punishes users and developers.

The PWA's CSS is generated on-demand by a JS framework that manages styles and outputs "atomic CSS". The framework can enforce strict constraints and perform optimisations, which is why the CSS is so much smaller and safer. Style conflicts and unbounded CSS growth are avoided.